- The dynamics of the Commercial Office Space Demand real estate market in India, especially the commercial real sector, have evolved tremendously over the last couple of years.

- The emergence of alternative real estate investment avenues, for example, fractional ownership and co-ownership of property, coupled with the rise of FOPs (Fractional Ownership Platforms) has breathed new life in the industry.

- As per JLL Research Group, gross leasing activity in India’s top 7 states was recorded at 12.7 mn sq ft in Q2 2023, building upon the momentum sustained in the last quarter, with gross leasing also up by 2 percent.

- Now coming to the question that’s on many investor’s minds: Will the current demand for office space continue on its upwards trajectory in 2024? With the current commercial real estate market booming in India, let’s look at what real estate trends hold for the future.

Demand For Commercial Office Space

Increase in Finished Commercial Properties

- As per CBRE, the number of commercial real estate projects in the country is expected to rise from 37% in 2022-23 to more than 40% in 2023-24.

- A lot of projects which had been delayed last year due to rising costs and other delays are in line to be finished by year end and 2024, with a number of big name developers behind them.

- Cities such as Chennai, Bangalore, and Delhi-NCR are expected to see the lion’s share of commercial project completions by prominent developers.

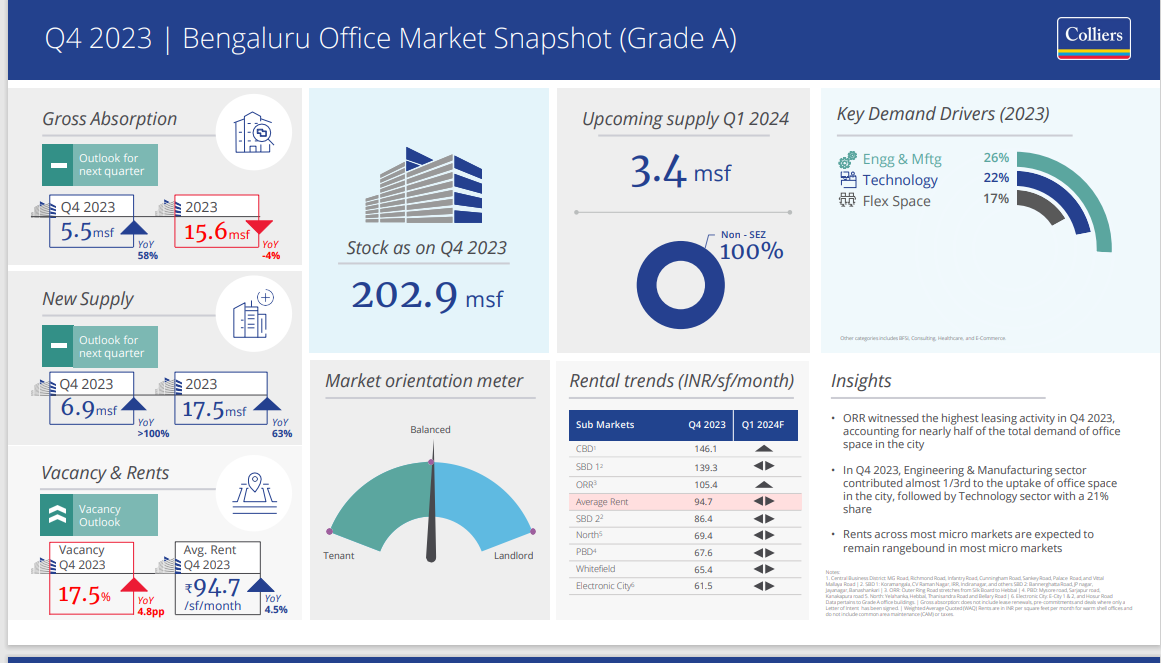

Bangalore Office Market Snapshot (Grade A)

Source: Colliers

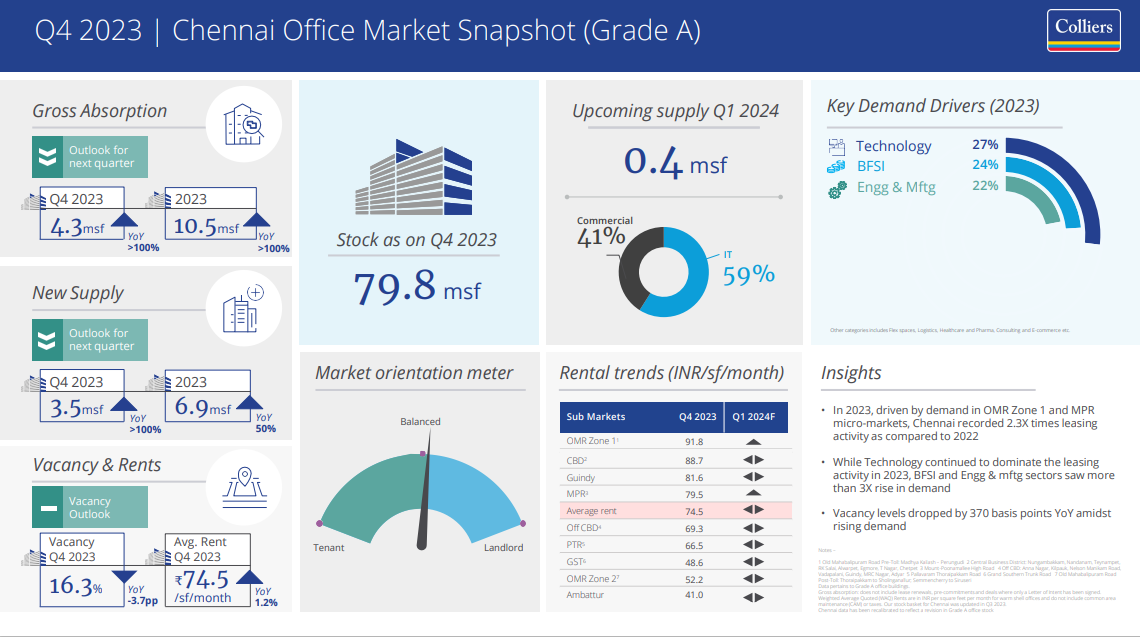

Chennai Office Market Snapshot (Grade A)

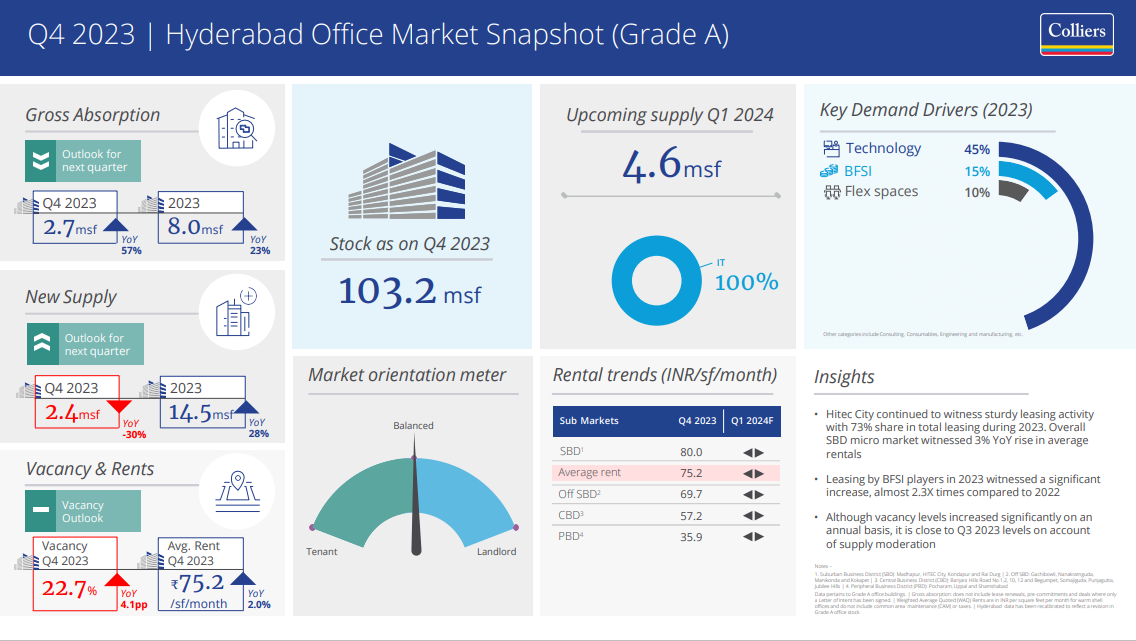

Hyderabad Office Market Snapshot (Grade A)

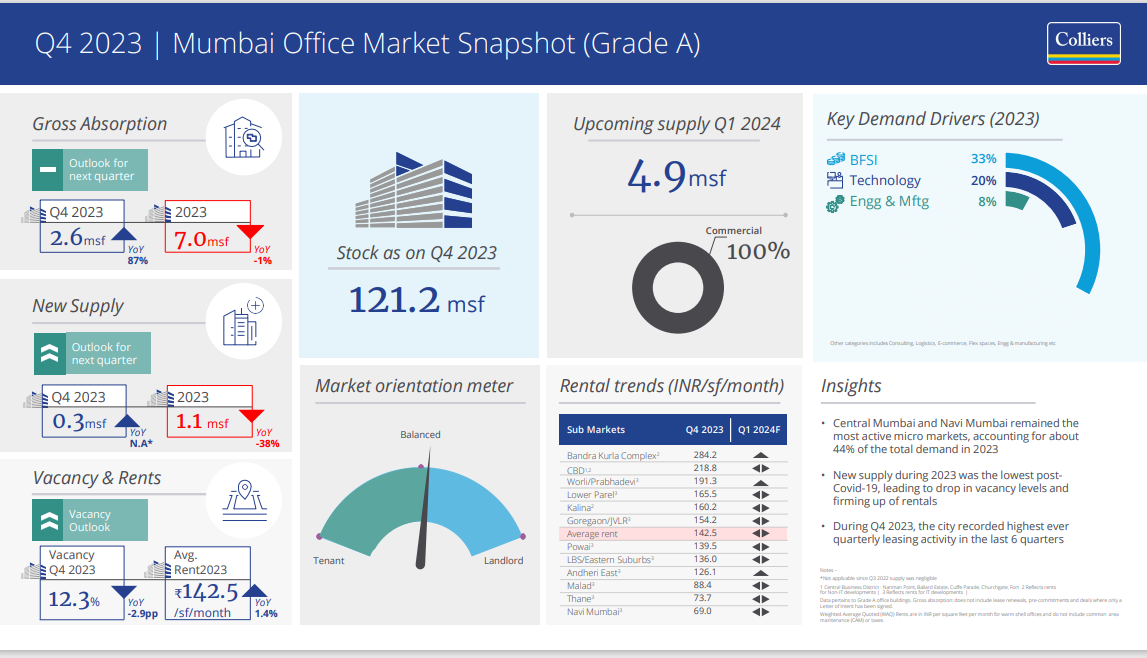

Mumbai Office Market Snapshot (Grade A)

Pune Office Market Snapshot (Grade A)

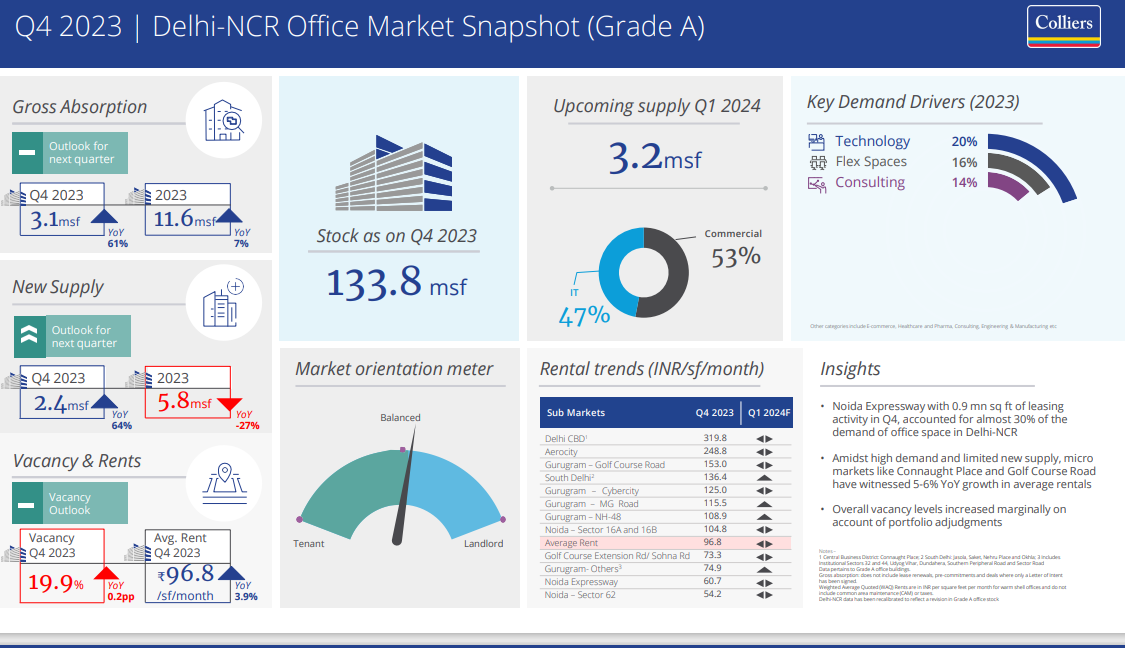

Delhi-NCR Office Market Snapshot (Grade A)

Global Economic Outlook

- While the international landscape has seen economic growth slowdowns affect office markets and the commercial office space worldwide, the Indian real estate sector has laudably managed to hold its own.

- India is currently one of the fastest growing economies globally, with the Reserve Bank of India predicting a continued hot streak with a 6.5% growth forecasted for financial year 2024, despite some global hiccups.

- As per a Knight Frank Indian real estate report on Quarter 3, this growth is evidenced through the spades of activity taking place in the Indian office space, with the country showing resilience and continuing to thrive despite global challenges being faced by commercial office markets.

- The area transacted in Q3 has shown a Year on year growth of 17%, with Mumbai accounting for about 20% of the total commercial real estate area transacted on during this period.

Office Space in 2024: The Sky Is The Limit?

A new report by JLL has turned heads in the commercial real estate investment space, suggesting that not only are office markets expected to grow, but with the possibility in a few years that demand for office space might exceed the supply.

Growing Optimism

- There are a number of reasons for this view, that will make investors sit up and take notice. A large number of companies have issued back to office mandates, as well as numerous government offices and partially state owned corporations.

- When this happens, opportunities for companies to downsize take a backseat. Other reasons include a large number of commercial real estate being converted into residential properties, and a slowdown in the construction of new large commercial office spaces.

- As per JLL’s Q3 report, due to these limitations in supply of high end commercial office spaces, rental rates all over will increase, and landlords of non high-end commercial spaces will also begin to see spillover demand.

What Does This Mean for Investors In Real Estate?

- The growth of alternative real estate investments has completely reshaped the Indian real estate landscape, giving it a new dimension.

- Fractional ownership and co ownership especially, have paved new pathways for small investors to invest in lucrative commercial properties once accessible only to larger ventures. This will definitely impact the demand for commercial office spaces in a positive way.

Benefits Of Alternative Investment In Office Spaces

- The benefits of fractional ownership have not gone unnoticed in the market. The rise of FOPs (Fractional Ownership Platforms) such as Assetmonk, has been unprecedented, due to their flexibility, higher rental returns, and low entry barriers.

- These FOPs offer joint ownership of high end commercial properties (such as a trophy office space in, let’s say, Bangalore) to a number of investors, who pool in their resources and share both the costs, and returns.

- This is exactly what the modern investor is looking for: Diversification of their investment portfolio, mitigation of risk due to there being a number of stakeholders in the property, and greater liquidity.

Assetmonk: Leading the Line in Alternative Real Estate Investment

- As we’ve mentioned before, commercial real estate is steadily growing in India, and the demand for flexible office spaces is only going to go upwards from here.

- This demand is complemented with the increasing adoption of hybrid work models and the need for companies to develop collaborative work environments and office spaces.

- Thus, in the current real estate dynamics in India, Assetmonk stands out as a trailblazer in the alternative real estate investment space. Specialising in fractional and co-ownership of high end commercial properties, Assetmonk gives real estate investors the chance to jointly own high value properties with confirmed high IRR (internal rate of return).

Commercial Real Estate Investment: We find trophy commercial properties with strong rental returns and development potential so you don’t have to. By owning fractional shares in these properties, investors can access prestigious office spaces and earn profits from rental income and capital growth.

High IRR On Fractional Ownership Investments: We are dedicated to providing our investors with guaranteed value. Our investors are always certain of high IRR on their fractional ownership assets, which we provide through our meticulous research, careful property selection and management, and close attention to market trends and developments.

Read More

What is Fractional Ownership in India

Empowering Investors: SEBI To Regularize Fractional Ownership

Commercial Office Space FAQs

Q1. How has remote work impacted offices globally?

Remote work has led to the demand for more flexible workspaces attuned to the hybrid work model. While remote work is here to stay, most companies prefer flexible office spaces for shared collaboration and increased productivity.

Q2. How is the Indian office market performing right now?

While the rest of the world has been edging back to normal post a global economic slowdown, the Indian office market has shown remarkable strength and resilience, with a year on year growth in leasing activity despite global challenges.

Q3. How has India’s commercial real estate sector evolved in recent years?

With the introduction of alternative investment routes such as fractional ownership and co-ownership, as well as the rise of Fractional Ownership Platforms (FOPs), the market has undergone a tremendous shift.

Q4. What factors are fueling the post-pandemic demand for office space?

The adoption of hybrid work arrangements, the value of a coherent business culture, and the requirement for shared physical locations for collaboration and innovation all contribute to long-term demand.

Q5. Do you anticipate an increase in finished commercial properties in India?

Yes. As per CBRE, the number of commercial real estate projects will increase from 37% in 2022-23 to above 40% in 2023-24.

Listen to the article

Listen to the article