It is lucrative for NRIs to invest in opportunities back home as they have certain rights and institutions through which they can create wealth and earn a high Return on Investment (ROI). One such option is a Certificate of Deposits. Although NRIs are not allowed to repatriate their returns, there is still an increase in the selection of CDs as a mode of investment.

As per statistics, NRIs have contributed approximately $1.49 billion to Indian deposits as savings, NCDs, and CDs. This is a peak investment trend up until today.

Investment in Certificate of Deposits (CDs) for NRI in India

Several NRIs aren’t aware of the fact that CDs can be issued by both Indian and Foreign Banks and by other financial institutions. Only scheduled commercial banks are permitted to issue CDs, and they should maintain funds with banks and financial institutions. They can issue CDs as a paper certificate in the form of a Usance Promissory Note, or they can issue it in the electronic form.

So, why has NRI CDs investment seen such a growth in India?

The first advantage is that NRI investments in CDs enable them to have access to the required bank accounts which are required for Real-estate Investments. CDs are a safe and secure investment but can offer short term gains. The same when re-invested in Commercial Real Estate and Residential Real estate, which is an upcoming and flourishing investment criterion in India, gives a much higher return on investment. The money is invested for a longer period and provides benefits to NRIs on rent and resale proceeds.

This also further creates wealth and boosts the economy of India as a substantial investment by NRIs in Real Estate signifies a thriving economy from all ends.

Why NRI Invest Should in Certificate of Deposit in India?

Investment in CDs is a popular choice among NRI investors because of the following benefits:

Safety and Security

Investments in CDs are not affected by the volatility in the market, and it assures a sum at maturity, just like in the case of traditional insurances. It is a sort of mid-term investment where NRIs can earn profits depending on the rate of interest, but the principal amount remains safe and secure.

High Rate of Interest

This is a lucrative benefit that attracts many NRIs to invest in CDs in India. The rate of interest can go as high as 7.8% as compared to the 4% offered by traditional savings accounts.

Flexibility

NRIs have the flexibility to choose from monthly or annual pay-outs or a lump sum withdrawal of CDs at maturity. He just needs to decide on the desired duration as per the set parameters of the banks.

Minimal Costs of Maintenance

All one has to pay is the investment that is made directly to the bank or financial institution without paying extra form fee or brokerage as in the case of other NRI investments. So, this is a rather transparent investment for NRIs with no hidden costs.

NRIs can invest in Indian Certificate of Deposits, but with some restrictions. They can subscribe only on a non-repatriable basis which means once bought; they cannot be transferred to another NRI in the secondary market. One can invest for Rs. 1 Lakh and in multiples of the same amount. The bids are also issued for CDs that have denominations of $1,000,000 or greater. This is where the NRI factor mainly kicks in.

Features of Certificate of Deposit

NRIs need to be aware of the features of CDs before investing in them.

- The minimum deposit in CDs is Rs. 1 lakh and multiples of it.

- Only Scheduled Commercial Banks (SCBs) and All-India Financial Institutions are eligible to issue a CD, and Cooperative Banks and RRBs are not authorized to issue a CD.

- SCBs issued CDs have a term period between 3 months and a year whereas CDs issued by financial institutions have a term period between 1 to 3 years.

- CDs cannot be publicly traded, NRIs cannot take a loan against CDs, and there is no lock-in required. Also, the CDs are fully taxable under the ITA.

How to Choose the Right Certificate of Deposit?

NRIs must consider the following before investing in a Certificate of Deposit:

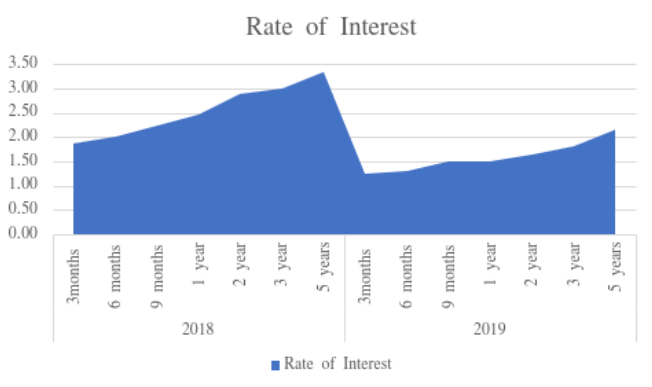

Source: moneycafe.com

- He should be aware of the tenure he would like to invest in the CD for, as it will be locked in for that time period. He must also consider the highest rate of interest and then lock the tenure of the CD.

- To overcome any chances of future losses, it is recommended for the NRI to invest for a longer maturity term, especially for those CDs which are at the risk of declining interest rates.

- There could be CDs whose rate of interest could increase, so these should be for the short term and maintain their security and feasibility.

How to Calculate Profit of Investing in CD?

There are two main parameters considered by banks and financial institutions while issuing a Certificate of Deposit:

- Discount on Face Value or the Coupon Rate: The bank or financial institution can decide on the discount rate.

- CDs issued based on a Floating Rate: To ensure transparency, the procedure of calculating the floating rate is a market-based benchmark and objective. The rate of interest floats and varies from time to time.

- To calculate the income, the NRI must be aware of whether the CD is on a floating rate or whether it is based on a discount on face value.

Redemption of a Certificate of Deposit by NRIs

NRIs have the option to withdraw the CD with no loss in the secondary market. However, if he maintains the certificate of deposit till maturity, he technically becomes a “beneficiary holder”, and he would need to open a redemption account. Before the issue is open, the account needs to be opened with an authorized depository participant.

The NRI, now as the beneficiary holder, needs to submit DIS to his DP to transfer his CD holding to the redemption account at least two days before the maturity date of the CD. Only when the authorized issuer receives the CD in his redemption account, it starts with the steps of payment. If the DIS is delayed, so will be the redemption of the CD.

Investment in a certificate of deposit by NRIs is a secure and sturdy way to invest in short-term to medium-term investments. NRIs need to open a Demat account or a dematerialized account to hold dematerialized securities like a CD. Besides the normal bank accounts that NRIs require to open in India, he can open a Demat account with a few, convenient, and easy steps and be well on their way to procuring their first CD. Assetmonk also provides details regarding the trends and interest rates of CDs along with attractive deals for NRI investors. Head over to Assetmonk for more information.

Certificate of Deposit (CD) FAQ's:

A CD is a type of savings account that is usually issued by the commercial banks under the regulation of RBI. This restricts the access to the money that one invests but it does offer a much higher rate of interest than the regular savings accounts.

One major difference is that the CDs are quite freely negotiable whereas the FDs are not. Apart from this, there is no major difference between a fixed deposit & a certificate of deposit. More or less, they are the same. Fixed deposits are often referred to as Certificates of deposit or time deposits by some banks.

No, the CDs cannot be returned to the banks, as they are not permitted to cancel it and recall the CD before its maturity date. Banks would allow one to renew or terminate a CD account upon its maturity period.

The CD accounts are held by the consumers of average, which means that they include a relatively minimal risk and don’t lose the value as CD accounts are insured by the RBI. The total Insured sum varies from bank to bank and the account terms can also range from 7 days to ten years. This depends on the total amount of money that is deposited.

As long as one leaves the money in the CD for the entire term, one would not lose any money in a Certificate of Deposit. The other thing which makes CDs worth it from a risk standpoint is that these are insured by the RBI. Hence, in the event of the bank failing, one won’t lose whatever he/she invested in it.

Whether one should open a Certificate of Deposit right now or later primarily comes down to when does the individual expect to need the money. Though some banks waive off fines, it is better not to open a CD if one anticipates the need for funds before the CD tenure is finished. One is advised to go with a high-yielding savings account instead.

A jumbo certificate of deposit is simply a CD that needs a much higher minimum sum than that required by CDs. In return, these jumbo CD gives a much higher rate of interest.

Yes, and putting the savings into the online certificates of deposit (CDs) could be one of the ways to get a fairly high rate of interest than most of the other savings accounts. Purchasing a CD online would also provide one the advantage of the convenience of online banking.

These are simply as safe as the other CDs. The majority of the online banks provide RBI insurance similarly to other institutions. The primary difference between online and traditional banks is the branch access for customer supports.

Most of the Bank does provide an online portal for the purchase of their products. This depends on the bank, and one can use that to open a CD online. Of this is not available one can book a CD over the phone, email or in person at the nearest branch. Some banks do encourage online applications while others need one to visit their branch.