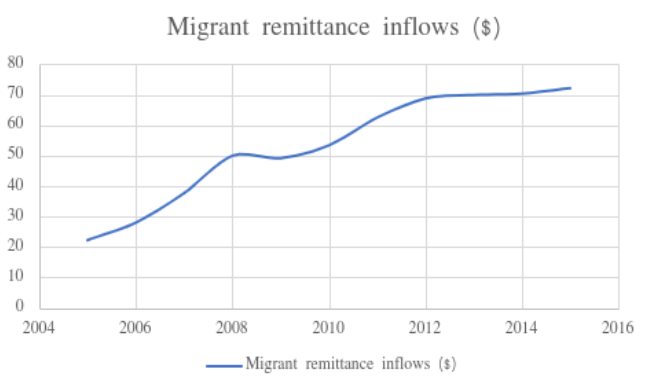

Source:https://factly.in/remittances-to-india-where-does-the-money-come-from-and-what-does-it-mean/

Source:https://factly.in/remittances-to-india-where-does-the-money-come-from-and-what-does-it-mean/

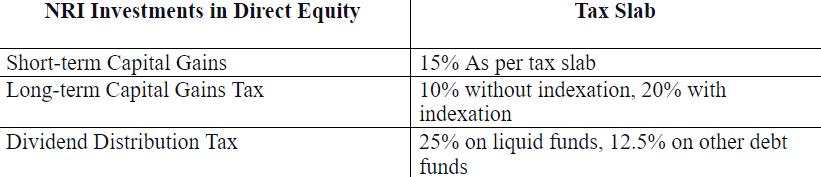

Tax liabilities of NRIs

Total NRI investment should not exceed 10% of the paid-up capital of a company. Taxation on NRI investments in Direct Equity from money invested in India is calculated in the following manner:Can NRI Invest in Direct Equity and other options like Real Estate in India?

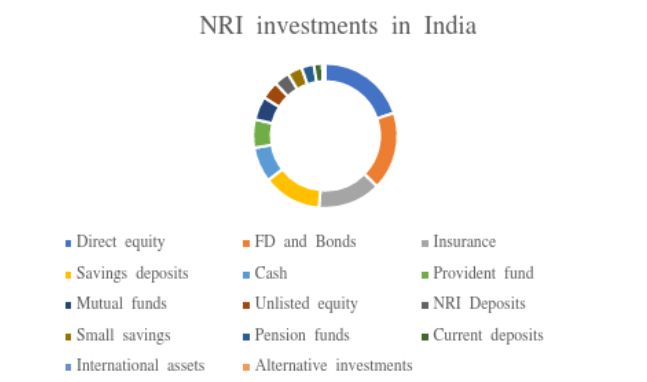

Source:https://www.winvesta.in/blog/how-diverse-is-indias-wealth/

Source:https://www.winvesta.in/blog/how-diverse-is-indias-wealth/

Equity Investments by NRIs

NRIs can invest in equity shares of both listed and unlisted companies, concerning sectoral restrictions, certain conditions, and other parameters.Features and Benefits of Direct Equity Investment

- An NRI can invest up to 5% of the paid-up value of the shares of the listed company through a recognized stock exchange in India on a repatriation basis.

- This can be increased to 10% for investments by all NRIs, and Overseas Citizens of India (OCIs) put together. (If more than one NRI/OCI).

- 10% can be increased to 24% special resolution passed by the company, which comes under ‘foreign portfolio investment’ as per the foreign exchange regulations. The proceeds can further by profitably invested in Real Estate for a higher return on investment.

- Investment in an unlisted company by an NRI on a repatriation basis is treated as ‘foreign direct investment’.

- NRIs can also purchase equity instruments without any limit either on the stock exchange or outside it, subject to certain sectoral restrictions, on a non-repatriation basis.

- Equity investments provide capital appreciation and recurring return in the form of dividends. The Dividend Distribution Tax (DDT) which was paid earlier has been abolished with effect from 1 April 2020. The same can be used for Real Estate investments which are booming in the NRI Investment category in India.

- NRIs are required to pay capital gains tax in India if shares are transferred. Listed shares held for more than 12 months are eligible for long-term capital gains tax at the rate of 10%.

- Shares held up to 12 months are short-term capital gains, taxed at 15%.

- Unlisted shares should be held for more than 24 months to qualify as long-term capital gains, at the rate of 10% tax on it.

Direct Equity Investment

An NRI investor can invest in the Indian stock through the Portfolio Investment Scheme (PIS). For this, the NRI must have an NRE or NRO bank account and Demat and trading account to deal in the equity market in India. Furthermore, the same accounts will be extremely helpful for NRI investments in Real Estate, which follow after earning a good ROI from Direct Equity.NRI Investment in Real Estate through Direct Equity

The Indian real estate investment is booming, and the ROI is sky-rocketing. NRIs invest in direct equity and aim at earning a potential return and profit and re-investing the same in Real Estate, which gives higher, long-term, and better returns. NRIs and OCIs (Overseas Citizen of India) investing in Real Estate – whether commercial or residential and letting them out for rent is fetching them a great return. NRI Investment has been a favorable option due to the increasing prices of both commercial and residential properties in India. Features of Real Estate investments through Direct Equity are:- NRIs are not allowed to invest in Agricultural land, farmhouse, and plantations in India unless they have been gifted to them or inherited by NRIs. This makes for an exception through which even investments in Direct Equity will be powerless.

- All financial transactions regarding their investments must be done through bank transfer from their NRO, NRE, or FCNR accounts as cash transactions are blocked for NRIs. This is applicable for both, Direct Equity and through this, investments in Real Estate in India.

- These are long term investments made by NRIs.

- NRIs can procure real estate by direct purchase or by a gift/inheritance from a relative. These can be evolved from the margins earned by Direct Equity investments.

- There is no restriction on the number of immovable properties that NRIs and OCIs can invest in. So, the higher the Return on Investment (ROI) on Direct Equity, the better would be the real asset investment ratio.

- Investment by the spouse of NRI/OCI is permitted in a joint name in only one immovable property. It is plausible in the case of Direct Equity on the same grounds.

- Repatriation of rental income can be done freely without restriction. In case of a sale, repatriation of up to $1 million per financial year out of the sale proceeds can be done, as per the foreign regulations. Any excess would require approval from the Reserve Bank of India (RBI). Also, the sale proceeds are restricted to not more than two such properties. For more properties, again approval of RBI is required.

NRI Investment in Real Estate using Direct Equity Investment- A Profitable Affair

India is a developing economy and has a lot of options for investing and securing the future for its citizens as well as NRIs who live abroad, especially the Real Estate business which is at a constant high in India. This gives an equal opportunity to NRIs and OCIs to invest in various financial sectors in India like Commercial Real Estate and Residential Real estate, create wealth for themselves, and in return, work towards the upliftment of the economy of India. The investors can know more about the NRI real-estate investments and the available property offers with the help of Assetmonk.Direct Equity FAQ's:

Yes, an NRI can invest in any fixed property in India, except for agricultural lands, plantations, or a farmhouse. Any Investment done in real estate by way of any purchase should be necessarily done through regular banking channels.

If a resident buys property from an NRI, that individual must deduct TDS at 20% in case the real estate has been held for more than 2 years and at 30% if the real estate is being sold within 2 years. Any deductions would include the TDS plus certain surcharges.

Yes, NRIs might buy property in India without any Aadhar card. As per the rule under 114C, an NRI doesn’t need to have an Aadhar card for transactions of property in India.

REITs are Real Estate Investment Trusts and they have the potential for long-term capital appreciation as the baseline value of their underlying assets expands. Real estate values tend to incrementally grow over time and these REITs could use multiple strategies to create further value. All these, combined with fairly high dividends, concludes that REITs could indeed be a good form of Investment.

The Publicly-traded REITs offer the investors a mode to include property in an investment portfolio and also earn a high dividend. These REITs are a little bit safer than their non-exchange modes, but there would always be risks, that could emerge to the surface from time to time. REITs further allow access to investing in real estate without any burden of direct ownership.

REITs can help to make one’s portfolio recession-proof. Investing in real estate investment trusts during times of recession could make the stock market dips easier, this might help bear for certain investors hedging against such volatility.

No, being an NRI one could purchase shares in the market on any repatriable or non-repatriable frequency and the money could be paid through a regular NRE SB or NRO SB Account.

Equity REITs own as well as operate multiple income-producing properties. Mortgage REITs (mREITs) gives financing for income-generating options by buying a mortgage which is backed by securities and stable earnings from the interest on these investments. Second is the Public Non-Listed REITs which are called ‘PNLRs’ and are registered with SEC.

An NRI can open multiple Demat accounts with the same name, but with different brokers. Only 1 demat account would be allowed per the depository participant or stockbroker). One thing to note is, according to the prevailing RBI guidelines, an NRI should maintain 2 separate accounts for the repatriable and the non-repatriable investments options.

Yes, an NRI is required to have a PINS account to invest in Gold ETFs. NRIs could purchase Gold ETFs in India, provided that they are doing so through the exchange.