The taxation for NRI investors revolves around ITA’s NRI Taxation Section. NRIs’ global income is taxable under a scenario where the NRI has resided in the country for 182 days or 6 months. They are also required to pay an advance tax sum if their liability exceeds Rs.10,000. Keeping these things in mind, there has been a growth in NRI investors in the country. Naturally, this has had an impact on the post-tax returns as well.

Income Tax Regulations for NRIs Investing in India

Currently, India has a double taxation avoidance agreement with more than 95 countries. An NRI is liable to pay tax on India’s amount of capital, and an NRI can claim a tax credit on taxes paid in India.

Tax Benefits for NRI in India:

The Income-Tax Act allows certain tax deductions under Section 80TTA, and 80C and NRIs can use this to waive off their tax burden while Section 24 will enable NRIs to claim the exemptions on the interest that is paid on property loans. NRIs can do only two types of deductions; Interest on Borrowed Capital and Net Annual Value which is the standard deduction.

Under section 80C, NRIs can claim tax benefits on the payment of the principal amount. They can also claim deductions on investments made in the return of the income. Also, NRIs must ensure that the revenue should be for the year the property investment was made. There is no minimum limit, and the maximum tax saving limit is up to ₹1.5 lakh. Immovable property held for more than 24 months is treated as a long-term capital asset and gets the indexation benefit with taxation at 20%.

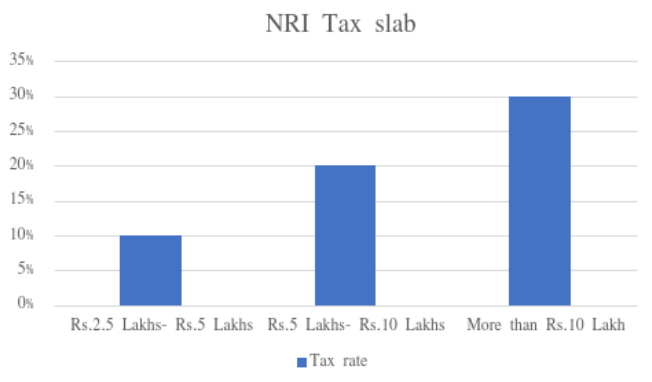

Tax liabilities for NRI

Source: File Income Tax Online

In case an NRI has decided to diversify the portfolio and invest from abroad. It is also crucial to understand their effect on tax liability along with knowledge of all the investment options and their risks or benefits.

Initially, the NRI should open an NRE account in India; he/she can get assured that he/she will not have to pay any taxes in India. An NRE account is tax-free in case a person qualifies as an NRI. There is no income tax on interest if earned on an NRE account and no application of any wealth or gift tax.

In case of an NRO account, the tax must be paid according to the income tax slab applicable. Further, the interest income earned should get reported under ‘income from other sources’. As long as the NRI continues to pay taxes on the income acquired abroad, any money transferred to India in the NRO account will not be taxable, whether they are NRE fixed deposits earnings or even earnings on the interest.

India is a rapidly growing country, and investing here can be rewarding in various ways. It is a smart opportunity for investment and helps increase the country’s foreign exchange pool.

Suppose an NRI has funds lying static in his saving accounts. In that case, he can choose an efficient and suitable investment option based on financial goals, funds availability, return expectations, and risk appetite to expand the wealth. Currently, around 25% of India’s total foreign exchange reserves are because of remittances by NRIs, which is a key factor for the country’s overall economic development and growth.

NRI Investments with High Post-Tax Returns:

Below is a list of the top 3 most safe, reliant, and best investment options available in India for non-residents of India (NRIs). A capital gain can be long term or short term. You can easily claim capital gain on income taxes. Capital gained over the short term is taxed as ordinary income, and it depends on the tax bracket. A long-term capital depends on your marital status, overall income, and other factors.

Real Estate

Real estate in India is growing faster than ever, and this industry holds significant prospects in sectors like commercial, hospitality, housing, manufacturing, wholesale, and retail. There are primarily three ways to opt for investment in real estate, some of which are residential properties, commercial properties, and Real Estate Mutual Funds.

Real estate is also a moderately-liquid investment. Because of the low risk, they are quite popular while the return received is relatively high as the value of real estate property keeps increasing.

Investing in commercial spaces such as shops or offices can help you generate high returns but make sure that you research the properties thoroughly and do not make decisions in the blink of an eye.

Gold

Gold investment can be made in various formats such as gold ETFs, gold bars, gold mutual funds, gold deposit schemes, etc. Gold ETFs are transparent in the pricing and can easily be bought and sold like any other company stock.

If you are willing to invest in gold and is a conservative investor with a low-risk appetite, you can go for Gold Exchange Traded Funds or Gold ETFs. These instruments functioned as a mix of gold and stock investments and traded on the NSE (National Stock Exchange).

ETFs

Exchange-Traded Funds (ETFs) are marketable securities that track stock elements and mirror an underlying index. As an NRI, you can invest in this with a low transaction fee structure and minimum portfolio management to gain exposure to Indian equities. ETFs are liquid investments, and they have become one of India’s best ways of investment for NRIs.

Exchange-Traded Funds are a cost-effective and efficient way for you to quickly invest in the Indian stock market as you get access to a portfolio of Indian stocks. They mirror indexes such as the Sensex and Nifty 50.

Further, ETFs can help you diversify across various sectors and companies efficiently as compared to direct investment in individual companies.

NRIs can enjoy a good deal of tax benefits while investing in India. Certain investments also allow a DTAA( Double Tax Avoidance Agreement) to prevent NRIs against double taxation. On top of that, some people consider depreciation as the most potent tax benefit, particularly for NRIs looking to invest in real estate. A depreciation expense is the largest tax deduction available to real estate investors and improves their cash flow by reducing certain tax liabilities.

It is essential to gather knowledge about rules and regulations associated with taxation on investment returns. NRIs can file their ITR before 31st July every year. The individuals can also visit Assetmonk to know about NRI investments and real estate properties in detail.

Tax Benefits for NRI FAQ's:

Debt funds and short-term Wealth gains are taxed at a rate of 30%. Holding onto the fund for more than 3 years would result in a 20% tax. The LTCG on certain non-listed funds would be taxable at the rate of 10% without any kind of indexation under the terms and conditions.

An NRI would be entitled to subscribe to the corporate deposits as well as PSU bonds issued in India. But the issuer shall specifically turn on the ‘NRI Window’. The Tax-free bonds in the Public issue would be open for NRIs to subscribe to both the repatriable & non-repatriable types.

One of the best ways for NRIs to avoid paying high TDS will be to open a Non-Resident Ordinary Rupee Account, FCNR – Foreign Currency Non-Resident Account, and a Non-Resident External Account (NRE).

Any kind of interest which are credited to an NRI individual, irrespective of the net amount, would be the total amount; post TDS deducted sum. This means that NRIs interest income from the NRO account will have to be the source of income, in such cases, one can avail of income tax refund under the Section 80DDB, 80DD, and 80U

Interest earned on the NRO account would taxable at the 30% plus applicable as well as the surcharge, Incase they are applicable. If the total interest exceeds 5 million INR during a financial year, then an additional 10% surcharge would also be included.

Yes, a friend can deposit money in an NRO Account, after authorization. One’s friend might deposit money in an NRO account in the form of gifts from a resident or NRE/NRO account holder is allowed in NRO Account.

According to the regulatory guidelines, the applicable total tax has to be deducted at the source for the total profits acquired in a certain transaction. Tax laws would be subjected to alterations from time to time by the governing body.

To do that one needs to provide a declaration certificate mentioning changes in the tax status. The individual also needs to attach a Cancelled cheque leaf of the NRI bank account as well as the current bank account.

In the events where the tax deducted at a source is more than that of actual tax, which is the liability of the NRI, then a refund could be claimed by an NRI, but only after filling a return along with all the interests.

Any funds originating in the form of a foreign currency can be deposited in NRE as well as NRO accounts. However, any withdrawals made could only be done in the form of INR from the NRE as well as the NRO accounts.