For instance, if a borrower demands a massive quantity of money for a lender to supply or is outside the limits of the lender’s exposure of risk level, financing is aggregated from lenders via debt syndication.

Debt syndication merely facilitates the acquisition of a significant number of loans by enterprises. Generally, it gets done by accumulating varying sums from numerous lenders rather than just one. This structured product gets managed by a reputable syndicate business. Previously, large corporations employed debt syndication services.

Debt syndication meaning

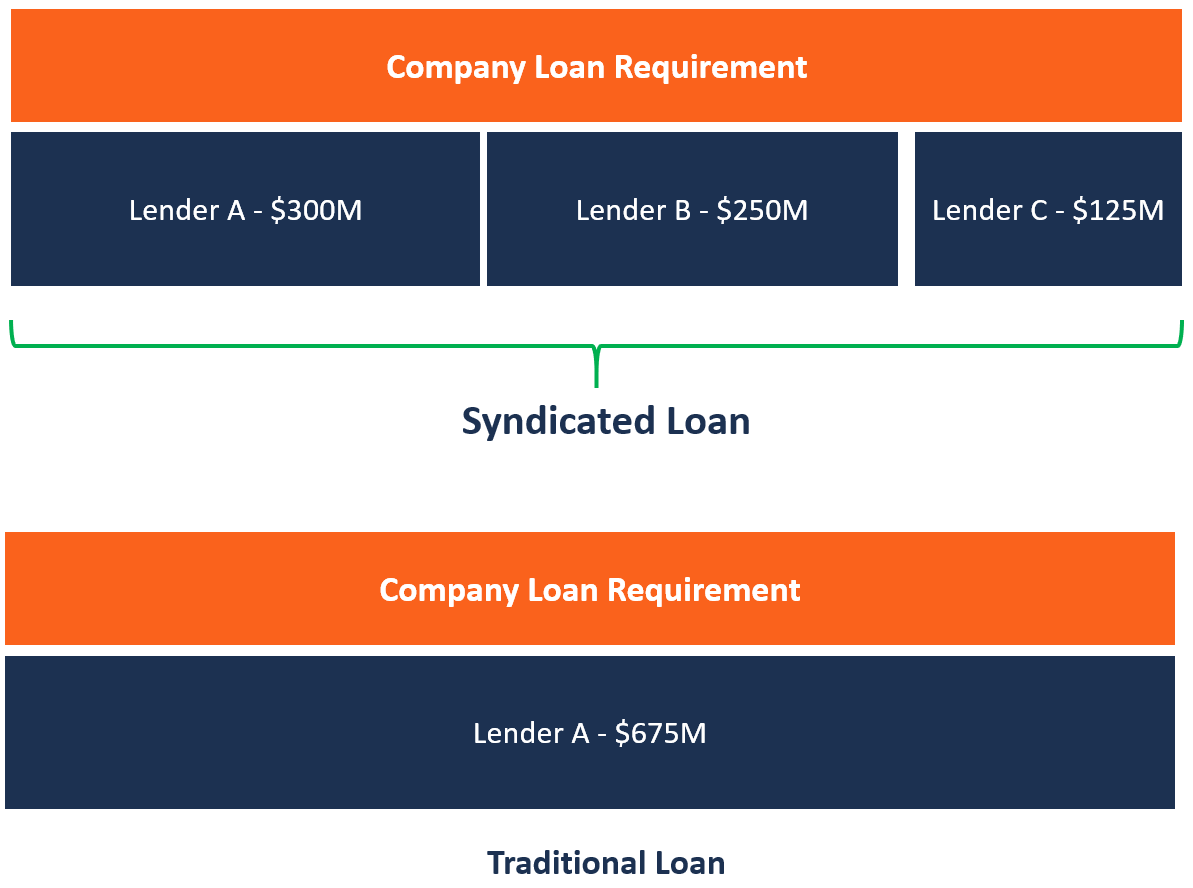

Debt syndication or syndicated loan is made available by a consortium of lenders that collaborate to give credit to a big borrower. Borrowers might be corporations, individual projects, or governments. Each syndicate lender provides a portion of the amount borrowed, and they all split the lending risk. One of the lenders serves as the manager (arranging bank), administering the loan on behalf of the syndicate’s other lenders. The syndicate might be a collection of several sorts of loans, each with repayment terms negotiated between the lenders and the borrower.

When a single borrower seeks a big loan ($1 million or more) that a single lender may be unable to supply, or when the loan is outside the limits of the lender’s risk exposure, loan syndication happens. Lenders will then establish a syndicate to distribute the risk and share the cash potential. Each lender’s responsibility gets restricted to their portion of the overall loan. The agreement for all syndicate participants gets incorporated in a single loan agreement.

Source: Corporate Finance Institute

Parties in Debt Syndication

Players in loan syndication may differ from one contract to the next. However, the following are the main participants.

Source: WallStreetMojo

-

A Lead Bank is also known as an Arrange Bank.

- The loan issuer, or borrower, negotiates the preliminary conditions and ultimately agrees on the form of the financing transaction with a designated arranging bank.

- The lead bank serves as a manager and is accountable to the borrower for coordinating money based on a specified term agreed upon by the loan parties.

- To engage in this syndication, the lead bank must identify additional banks as lending partners prepared to share risk.

- The lead bank is responsible for discussing agreement specifics and completing loan documents with participating institutions.

2. Underwriting Bank

- The unsubscribed sections of the needed loan may be underwritten by the lead bank. The loan may also be funded by a separate bank.

- Underwriting banks will accept the risk that will very certainly arise.

3. Participating Bank

- Participating banks are all banks that engage in loan syndication.

- Banks that participate will be charged fees for their involvement.

4. Bank Agent

- The agent bank’s role is to guarantee that loan syndication runs well.

- The agent bank works as a go-between for the borrower and the lender and has a contractual duty to both parties (borrower and lender).

- In some circumstances, the agency agreement imposes extra obligations on the agent bank.

- The main function of agent banks is to channel money from all participating banks to the borrower and to channel interest and principal amounts from the borrower to participating banks.

Debt syndication process

- The borrower initiates the loan syndication procedure. Borrowers contact a single lender or solicit competitive bids from numerous lenders at the initial or pre-mandate stage. Post this; the borrower finalizes the lead bank or arranging bank.

- Following the selection of the leading bank, the arranger creates a document called the Information Memorandum. Investment considerations, transaction terms, industry overview, executive summary, financial structure, list of terms & conditions, thorough evaluation, strengths and weaknesses, and risk mitigation are all included in this document.

- When the preceding phase gets done, the arranger extends invites to other institutions to join in the syndication. The confidentiality agreement gets agreed upon among the parties after the collaborating lenders of the syndication get established. Loan documentation is forwarded to banks for assessment and approval when the confidentiality agreement is signed.

- When the loan paperwork gets finished, the loan contract is signed, and the loan money gets disbursed.

- The final stage entails monitoring via an escrow account. The borrower’s revenue gets deposited into the escrow account. It is the agent’s responsibility to guarantee that loans are repaid and statutory dues are paid before making payments to any third party. The agent is also accountable for regularly managing the lending facility’s operations.

A Debt Syndication Example

Assume Company ABC wants to purchase a deserted airport and develop it into a massive development that includes a sports stadium, various apartment complexes, and a mall. A $2 billion debt is required to do this.

JPMorgan takes over the firm. The loan gets approved by the bank. However, because the amount is massive and beyond the bank’s tolerance for risk, it chooses to organize a lending syndicate.

JPMorgan serves as the primary agent, gathering participation from other institutions. It enlists the participation of Credit Suisse, Bank of America, Wells Fargo, and Citi in the loan. JPMorgan contributes $1 billion to the loan, with the remaining $1 billion split among the syndicate members. Bank of America loans $250 million, Credit Suisse lends $350 million, Citi lends $250 million, and Wells Fargo lends $150 million.

JPMorgan, as the primary bank, also organizes the loan’s terms, covenants, and other information. Following completion, Company ABC obtains a $2 billion loan from the lending syndicate.

What Effect Does Debt Syndication Have on the Borrower?

Borrowers are not affected differently by loan syndication than other forms of loans. In most cases, the borrower requests a loan at a single bank. If accepted, this institution contacts others to create a syndicate, allowing them to split the risk among themselves. After the loan is issued, the borrower executes a single document that lists each syndicate member and their commitment to the loan. Payments get sent regularly to the lead bank, which distributes them among syndicate members.

The Perks of Debt Syndication

The loan syndication procedure has several advantages, which get stated below:

- Less time and effort are required: The borrower is not obligated to meet with all syndicate lenders to negotiate loan conditions. Rather, the borrower must meet with the arranging bank to negotiate and agree on the loan conditions. The arranger then undertakes the more involved job of forming the syndicate, bringing in other lenders, and discussing loan conditions with them to decide how much credit each lender will commit.

- Loan term diversification: Because a syndicated loan is funded by numerous lenders, it can be structured in a variety of loan and security types. The various loan kinds provide different sorts of interest, such as fixed or fluctuating interest rates, making the borrower more flexible. Furthermore, borrowing in many currencies shields the borrower from currency risks caused by external factors such as government laws, inflation, and regulations.

- A large sum: Borrowers can use loan syndication to borrow substantial sums to fund capital-intensive projects. A major firm or government can get a significant loan to finance large equipment leases, mergers, and financing transactions in the petrochemical, telecommunications, energy, transportation, and mining industries. Because a solo lender cannot acquire cash to finance such projects, putting together numerous lenders to offer funding makes it possible to complete such projects.

- A solid reputation: The involvement of many lenders in financing a borrower’s project reinforces the borrower’s positive market image. Borrowers who have effectively paid syndicated loans in the past have a favorable reputation among lenders, making it simpler for them to get credit from financial institutions in the foreseeable.

- Reliable Management – The lead bank oversees the syndication process and ensures that it gets carried out in the most efficient manner possible. As a result, money gets professionally managed within a set time frame. The agent is also in charge of ensuring that the procedure gets carried out correctly and gets completed.

- Competitive Interest Rates – Because numerous lenders are participating, the borrower receives the best market rate available among the lenders. The lead bank ensures that the borrower’s loan gets delivered at the most competitive rates possible.

Several lenders contribute varying portions of a loan in loan syndication. Every lender is accountable for their portion of the loan. As a result of pooling a large loan across many lenders, each lender has less risk. As a result, loan syndication benefits banks or financial organizations.

Have you recently considered investing in real estate? Assetmonk, a famous GrowthTech platform in India, offers its clients Grade-A commercial real estate holdings at low prices, with a yearly IRR of up to 21% assured. It motivates investors to vary their holdings. You may also get advice from our asset and property specialists.

FAQ’S

Q1. What is the Eligibility for Debt Syndication in India?

The following are the most frequent qualifying requirements for obtaining a debt syndication loan. However, qualifying conditions may apply depending on the lending financial institutions or banks.

- The total amount necessary must be substantial. Other borrowing alternatives are available for smaller amounts of money.

- Your organization must have a solid credit score and a decent market reputation.

- Your company must have a solid financial and operational foundation.

- Businesses must fulfill the banking institution’s minimum operation term.

- Your company must fulfill the syndicate agent’s minimum turnover requirement.

Related Articles

As The Era of WFH Draws To a Close, Commercial Real Estate is Making a Strong Comeback

As The Era of WFH Draws To a Close, Commercial Real Estate is Making a Strong Comeback As per analysts, the resurgence in commercial office space markets will persist, with most employees projected to operate in a hybrid model. Thus, it entails significant time devoted to the office. Share on facebook Share on twitter Share on linkedin According to analysts, the resurgence in commercial space markets will continue, with most employees projected to operate in a hybrid model. Thus, it entails significant time devoted to the office. Also, read 5 Reasons To Invest In Office Spaces As Real Estate Investments In 2022. According to one poll, 70% of the workforce are considering a remote or a hybrid model of work. It means 70% of the remaining workforce will be present on-site at the office one, three, or five days a week. Also, read Will the Hybrid work culture impact the Indian office space market in 2022? Not unexpectedly, the increase…

How To Prepare Your Investment Portfolio For The Upcoming Recession?

A recession gets distinguished from a contracting economy. People are spending less money on non-essentials and more on necessities. Companies may postpone recruiting or laying off staff to improve their bottom lines.

Debentures Or Bonds: What’s The Difference & What’s Better?

Both bonds and debentures are common alternatives on the market; let’s talk about some of the key distinctions between the two.

Is Commercial Real Estate Truly Recession-Proof? Let’s Find Out!

During a recession, commercial real estate prices nearly always see some kind of drop. As a result, investors should anticipate more appealing purchasing opportunities in a bear market than they would in a booming economy.

What Is Debt Syndication & What Are Its Benefits?

Many companies in the Indian market today might benefit from additional financing options to obtain the financial leverage needed to expand operations. Due to India’s less established debt market than its stock market, businesses in the Indian market have long struggled with a lack of funding choices.

Real Estate Debentures 101: Pros & Cons For Investors

These debentures are a type of secured financing. For example, if the debenture is for 10 crores, the collateral will be worth 2-3 times that amount.

Commercial Real Estate Q1 and Q2 Growth and Trends

In the Indian real estate sector, progress is anticipated to be facilitated by factors like governance, sustainability, and the environment.

Do You Qualify As An Accredited Investor? These Are The Pros & Cons in India

In order to become an accredited investor in India, an investor or corporate entity with a Demat account must apply to the depositories or the stock exchange for accreditation.

Indian Real Estate Q1 Growth and Trends

This article explains the growth metrics of the real estate sector in India that are observed in the first quarter of the year 2022.

Who Are Accredited Investors & What Are Accredited Investments?

To become accredited investors, corporations and trusts (excluding family trusts) must have a net worth of at least 50 crores.

Hiking Home Loan Rates And Its Impact On The Indian Real Estate Market

According to analysts, even if the increase in house loan interest rates was minor, it would function as a psychological barrier for purchasers at a time when the real estate market was just beginning to perk up.

The Luxury Real Estate Market Will Expand in 2022: Contributing Factors?

The luxury real estate market has fared extraordinarily well in recent years, without a doubt. Premium condominiums, luxury housing, and villa developments are selling like hotcakes in India.

New Trends and Factors That Are Influencing The Value Of Rental Income Properties

From property location to interest rate and infrastructure there are many factors that influence the value of rental income properties. Check out this blog for more details on the new factors and trends.

6 Statistics That Prove Why NRIs Should Invest In Indian Real Estate

This blog explains the statistics that proves the necessity of NRI real estate investments in India. Jump into this blog to read more.

How Much Can You Earn From Rental Income Properties In These Indian Cities 2022

Rental income from a property is considered passive income. We need to make sure the investment we make has to generate maximum income. This blog tells us about the top Indian cities that are selected by many investors in order to generate highest levels of rental income in India.

How Stable Is The Indian Economy For Real Estate Investments?

This blog gives you an idea on the stability of Indian economy in real estate sector. With wide range of metrics from trusted sources we gathered the information and make this post available.

How To Earn Passive Income From Real Estate Without Owning Any Property

There are methods to generate money in real estate without putting in a lot of effort. There are many ways to earn completely passive income from real estate.

5 Reasons To Invest In Office Spaces As Real Estate Investments In 2022

There are many ways present in real estate investments. Out of them office space investment is one of the best as it generates passive income every month. Here we are explaining the reasons to invest in office space in the year 2022.

Should Indians Invest In REITs With A Long Term Or Short Term Plan?

The dilemma is whether you should invest in REITs for capital appreciation or regular income. In India, the options are restricted – we know that worldwide, REITs meet both goals. This blog clearly explains whether Indians need to invest in REITs or not.

Exploring REITs? Here Are The 3 REITs Listed In India & How To Invest

Most would not have gone for REITs investing a decade or so. But, REITs have grown in appeal among institutional and ordinary investors, especially with the positive prospects surrounding future office space expansion.

Listen to the article

Listen to the article