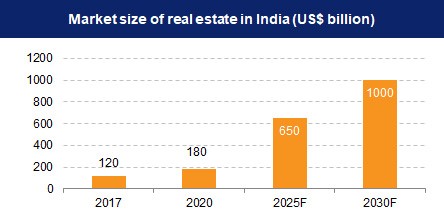

In 2017, the Indian real estate market was valued at over 120 billion dollars, and it is expected to reach one trillion dollars by 2030. These were estimations made before the coronavirus (COVID-19) pandemic was assessed.

The best industry in the world is real estate. Housing, retail, hospitality, and business are the four sub-sectors. The expansion of this industry is aided by the expansion of the business environment as well as the demand for office space and also urban and semi-urban lodging. In terms of direct, indirect, and induced impacts in all sectors of the economy, the construction sector ranks third among the 14 major industries.

After agriculture, the real estate business in India is the second-largest employer. This industry is also likely to attract greater non-resident Indian (NRI) investment in the medium and long term. NRIs are projected to choose Bengaluru above Ahmedabad, Pune, Chennai, Goa, Delhi, and Dehradun as property investment destinations.

Also Read: How To Analyze The Potential Of A Real Estate Investment Opportunity in India

Real Estate Market Size

From Rs. 12,000 crores (US$ 1.72 billion) in 2019, the real estate industry would rise to Rs. 65,000 crore (US$ 9.30 billion) by 2040. India’s real estate market is predicted to grow to US$ 1 trillion by 2030, up from US$ 200 billion in 2021, and contribute 13% of the country’s GDP by 2025. Retail, hotel, and commercial real estate are all seeing considerable growth, supplying India with much-needed infrastructure.

In only one year, approximately 1,700 acres of land were sold in India’s top seven cities. From 2017 to 21, foreign investments in commercial real estate totaled US$ 10.3 billion. Developers anticipate a surge in demand for office space in SEZs once the present SEZs legislation is replaced in February 2022.

According to ICRA, Indian companies are likely to raise more than Rs. 3.5 trillion (US$ 48 billion) via infrastructural and real estate investment trusts in 2022, compared to US$ 29 billion raised so far. From July to December 2020, the office market inside the top eight cities had 22.2 million square feet of sales, while new completions totaled 17.2 million square feet.

Sources: IBEF

In the second half of 2020, the Information Technology (IT/ITeS) sector dominated with a 41 percent share, followed by the BSFI and Manufacturing sectors with 16 percent each, and the Other Services and Co-working sectors with 17 percent and 10%, respectively.

In India, over 40 million square feet were delivered in 2021. In the next 2-3 years, the country is predicted to have a 40 percent market share. In 2022, India is estimated to produce 46 million square feet. According to Savills India, data center demand is estimated to grow by 15-18 million square feet by 2025. At 5.7 million square feet, the industrial sector will account for 24 percent of office space leasing in 2020.

Also Read: The Role Of Real Estate Investment In Portfolio Diversification

Between Pune, Chennai, and Delhi NCR, SMEs and electronic component manufacturers rented the most, followed by auto sector leasing in Chennai, Ahmedabad, and Pune. The 3PL, e-commerce, and retail industries each accounted for 34%, 26%, and 9% of office space rentals, respectively. The office category received 71 percent of total PE real estate investments in Q4 FY21, followed by retail (15 percent), residential (7 percent), and warehousing (7 percent).

In 2021, India’s gross lease volume in the top eight cities was 16.2, up 12.4 percent from the previous quarter. In the fourth quarter of 2021, India’s net absorption of the office market was 11.56 million square feet. This was an 86 percent increase from the previous quarter. A total of 55,907 new dwelling units were sold in India’s eight micro marketplaces between July and September 2021. (59 percent YoY growth).

New housing supply in the third quarter of 2021 (between July and September 2021) grew by 228 percent YoY across the top eight cities, compared to 19,865 units introduced in the third quarter of 2020.

The business sector is likely to see increased investment in 2021-22. For example, Chintels Group stated in October 2021 that it would spend Rs. 400 crore (US$ 53.47 million) in a new commercial complex in Gurugram that will span 9.28 lakh square feet. According to the Economic Times Housing Finance Summit, around three houses are created per 1,000 people every year, compared to the needed five dwellings per 1,000 inhabitants. The present housing deficit in cities is projected to exceed ten million units. By 2030, an extra 25 million units of affordable housing will be needed to accommodate the country’s urban population growth.

Initiatives of Government

The Indian government, in collaboration with state governments, has taken several steps to promote growth in the industry. Real estate businesses should take advantage of the Smart City Project, which aims to develop 100 smart cities. Other notable government efforts are listed below:

The RBI declared in October 2021 that the benchmark interest rate would remain at 4%, providing a significant boost to the country’s real estate sector. Low house loan interest rates are predicted to fuel housing demand and boost sales by 35-40% during the holiday season of 2021. Tax deductions on interest on housing loans up to Rs. 1.5 lakh (US$ 2069.89) and tax holidays for affordable housing developments have been extended till the end of fiscal 2021-22, according to the Union Budget 2021-22.

Also Read: A Simple Guide To Start Real Estate Investments Online

Income tax relief measures for real estate developers, as well as homebuyers for primary purchase/sale of housing units of value (up to Rs. 2 crores (US$ 271,450.60) from November 12, 2020, to June 30, 2021), were included in the Atmanirbhar Bharat 3.0 package announcement was made by Finance Minister Mrs. Nirmala Sitharaman in November 2020. The government has established an Affordable Housing Fund (AHF) at the National Housing Bank (NHB) with an initial capital of Rs 10,000 crore (US$ 1.43 billion) to use priority sector lending shortfalls of banks and financial institutions for HFC microfinance.

India had legally sanctioned 425 SEZs as of January 31, 2021, with 265 of them currently functioning. The IT/BPM industry is home to the majority of special economic zones (SEZs). The Union Cabinet has authorized the establishment of an Rs. 25,000 crore (US$ 3.58 billion) alternative investment fund to resuscitate over 1,600 delayed housing projects throughout the nation (AIF).

Road Ahead

The Securities and Exchange Board of India (SEBI) has approved the Real Estate Investment Trust (REIT) platform, allowing all types of investors to participate in the Indian real estate market. In the next years, it will offer a market potential worth Rs. 1.25 trillion (US$ 19.65 billion) in India. Indian real estate developers have altered gears and embraced new difficulties in response to an increasingly well-informed consumer base and the globalization factor. The transition from family-owned to professionally managed firms has been the most noticeable change.

To address the increased need for managing various projects across cities, real estate developers are investing in centralized systems for sourcing materials and organizing the workforce, as well as recruiting experienced specialists in project management, architecture, and engineering.

The residential sector is set to expand dramatically, with the federal government intending to build 20 million affordable dwellings in metropolitan areas across the country by 2022 under the Union Ministry of Housing and Urban Affairs’ ambitious Pradhan Mantri Awas Yojana (PMAY) scheme. The need for commercial and retail office space will rise as the number of dwelling units in metropolitan regions grows.

The present housing deficit in cities is projected to exceed ten million units. By 2030, an extra 25 million units of affordable housing will be needed to accommodate the country’s urban population growth.

Increased transparency is being encouraged by the rising influx of FDI into Indian real estate. To get investment, developers have updated their accounting and management systems to fulfill due diligence requirements. With US$ 8 billion in capital infusion by FY22, Indian real estate is likely to attract a significant amount of FDI in the following two years.

Assetmonk is a rapidly growing Indian wealth technology platform. In Bangalore, Hyderabad, and Chennai, it provides excellent real estate investment options. The high quality of our services and goods is frequently mentioned by our investors. To learn more, come see us.

FAQ’S On Real Estate Growth Till 2030

1. What is the annual growth rate for a property?

House prices in India fell 0.9 percent YoY in December 2021, following a 5.0 percent YoY gain in the previous quarter. Year-over-year growth data is provided from March 2011 to December 2021, with just an average growth rate of 5.5 percent.

2. What is the real estate future in India?

Mortgage rates will rise slightly but remain historically low, house sales will hit a 16-year high, and pricing and rent increases will be much lower than in 2021. Many people will be concerned about affordability since housing prices should continue to climb, albeit at a slower rate than in 2021.

3. Why next 5 years are crucial for the Indian real estate industry?

The residential real estate units are delivered to the customers within the agreed-upon time range. Builders and developers have been more accountable and transparent. In the next years, real estate players will be required to follow the law and make investing simpler.

Related Articles

How Stable Is The Indian Economy For Real Estate Investments?

This blog gives you an idea on the stability of Indian economy in real estate sector. With wide range of metrics from trusted sources we gathered the information and make this post available.

How To Earn Passive Income From Real Estate Without Owning Any Property

There are methods to generate money in real estate without putting in a lot of effort. There are many ways to earn completely passive income from real estate.

5 Reasons To Invest In Office Spaces As Real Estate Investments In 2022

There are many ways present in real estate investments. Out of them office space investment is one of the best as it generates passive income every month. Here we are explaining the reasons to invest in office space in the year 2022.

Should Indians Invest In REITs With A Long Term Or Short Term Plan?

The dilemma is whether you should invest in REITs for capital appreciation or regular income. In India, the options are restricted – we know that worldwide, REITs meet both goals. This blog clearly explains whether Indians need to invest in REITs or not.

Exploring REITs? Here Are The 3 REITs Listed In India & How To Invest

Most would not have gone for REITs investing a decade or so. But, REITs have grown in appeal among institutional and ordinary investors, especially with the positive prospects surrounding future office space expansion.

Real Estate Crowdfunding: What is it And How It Works?

Real estate crowdfunding is often used to increase and diversify one’s financial holdings while maintaining an overall balanced portfolio of financial investments, including stocks, bonds, and other equity holdings, rather than as a major means of generating wealth.

Dividend Income or Passive Income From Real Estate – What’s Worth It?

This article mainly explains about the dividend and passive income that is generated from real estate investments. Read more to know about which type of income is best from investing in real estate properties.

Real Estate Investing – How Much Will The Sector Grow Till 2030?

There is no doubt that the real estate sector is growing like anything in India. After Covid 19 situation the industry is experiencing an increase in demand for many commercial and residential buildings. This blog gives us a clear idea of what real estate industry growth is going to be till 2030.

How To Calculate Yield For All Types Of Real Estate Investments In India

Rental yield may be measured in two ways: gross rental return and net rental return. The gross rental yield is the yearly rental revenue derived from the property valuation, excluding expenditures for property upkeep and taxes. It’s just the amount of money you make in rent each year.

Is Office Space Still A Worthy Real Estate Investment In The Work From Home World?

The market appears to be improving, with lease activity picking up in the top seven cities in 2021. Many offices already have opened, and many more are expected to start soon. As a result, this is an excellent moment to invest in commercial real estate.

What Drives The Price Of A Commercial Asset in Real Estate Investment?

A main real estate market driver is a primary force that positively impacts the market. If a market driver is available, there is a good chance that favorable market or industry trends will emerge. Values may rise, and demand may increase.

FEMA Regulations For NRI Real Estate Investments in 2022

This blog gives us a brief idea about the FEMA regulations that are required for NRI real estate investments in 2022.

What Is The Minimum Amount For Real Estate Investment Online In India

Nowadays small investors are coming forward to make profits with a minimum amount of investment in Indian real estate online. This blog gives them a clear idea of the various methods present in real estate investments.

How To Create A Tax-Smart Portfolio With NRI Real Estate Investments

These are the numerous investment opportunities available to NRIs in India. This article helps the NRIs to understand the different methods where they can be able to create tax-smart portfolio with their investments.

India Among The Top Flexible and Cost Efficient Office Locations in the World: Report

The rise of India as a startup powerhouse has also boosted the demand for flexible spaces. They’ve reimagined their products and repositioned themselves to be more relevant in today’s changing environment.

What Makes Real Estate Investment In India The Most Profitable Investments For NRIs?

There are different types of real estate investments present in India which can make NRI investments profitable within a short span of time. This blog gives you clear info on how the investments are being Profitable for NRIs.

JLL reports India real estate garnered $943 million in investments worth in Q1 2022

JLL India has reported that the Indian real estate sector has attracted investments of worth $943 million in Q1 2022 which is 41 percent more compared to the previous quarter.

10 Real Estate Investing Terms To Understand Before Talking To An Agent

Real estate investing may be expensive. However, if you do it correctly, you might earn a sizeable chunk of passive income from rental as the property appreciates. That is why it is critical to comprehend the main terminology of real estate investment.

RBI Rules & Permissions For NRI Investments In India Real Estate

The RBI provides guidelines from time to time outlining the legislation and granting broad authority to NRIs to acquire certain immovable assets in India without needing additional approval from the RBI.

Navigating Marketing Volatility In Real Estate Investment Via Fractional Ownership

Financial markets enjoyed a wild journey in 2022, with sharp ups and downs in stock and cryptocurrency valuations. While real estate with fractional ownership has always been a solid basis in every good portfolio

Listen to the article

Listen to the article