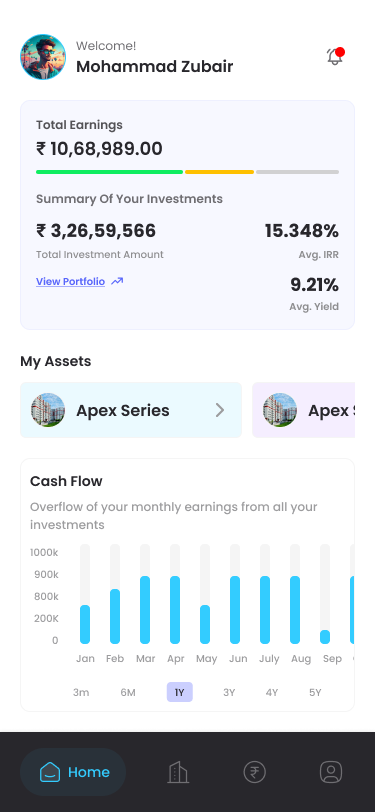

1 INVEST

In-demand categories, thoroughly vetted & made accessible with structured debt investments and fractional ownership

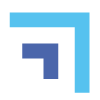

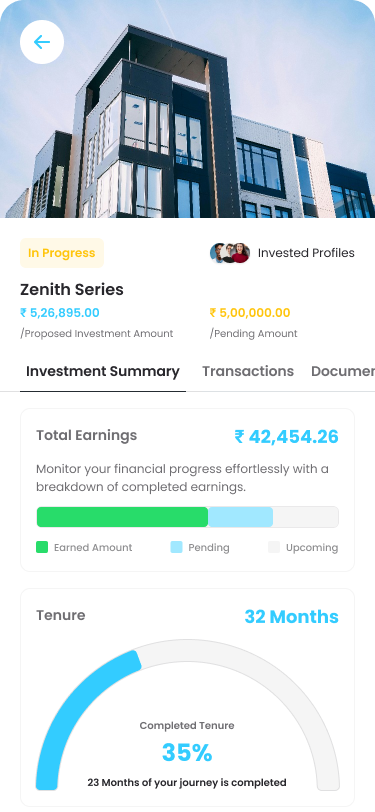

2 TRACK

Tech-enabled dashboard to be informed about every investment performance

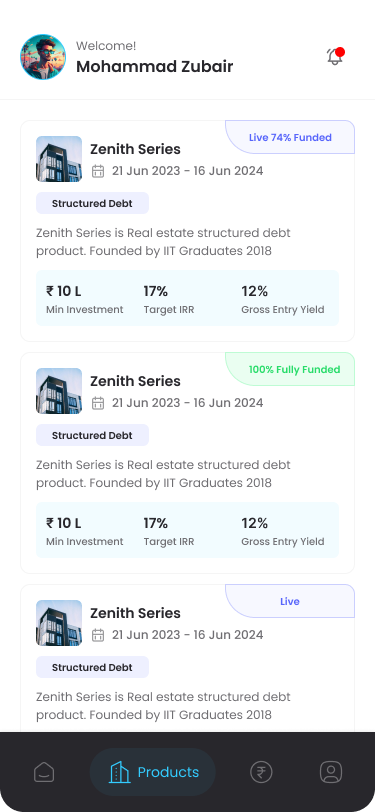

3 EARN

Industry-best returns of IRR 14% to 24%, directly flowing to your bank account

4 EXIT

Expert guidance to liquidate your investment at the most opportune time

Hyderabad International Airport

Hyderabad International Airport