Investments form an integral part of life to ensure safe and sound financial health. As an investor, your prime motive is to invest in an asset that elevates your resources vested with it. While there are various investment opportunities like stocks and deposits with financial institutions, real estate has always shone through with a broad range of investment options to cater to the investors’ goals.

Amidst all the investment options that real estate provides, the investors are exposed to the benefits and the implications equally. Not to frighten you, but as a word of caution, any ignorance in making a choice of investment might end you up with an expensive mistake. Real estate always gets to the grips of the issues of investors. To make you a calculated and an informed investor, real estate metrics are here for you!

To define, real estate metrics are the parameters that help you understand the property performance over a period of time. There are various metrics that use specific data to analyze and present you with the estimations of the property returns. Let us waste no further time and delve into the Real Estate Metrics and the surrounding mysteries.

Real Estate Metrics for Property Estimation Returns

-

Cash on Cash Return (CCR)

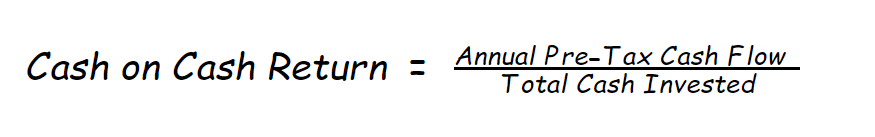

Cash on Cash Return, as its name suggests, is a metric that indicates the earnings in cash with respect to the cash invested during that year. Cash-on-Cash is also called cash yield on property investment.

Where,

Annual Pre-tax Cash Flow = (GSR + OI) – (V + OE + AMP)

GSR = Gross Scheduled Rent

OI = Other Income

V = Vacancy

OE = Operating Expenses

AMP = Annual Mortage Payments

Cash on Cash Calculation and Interpretation

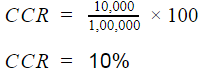

It is generally used to understand the cash flow from the commercial properties and is calculated as follows.

For example, if you have acquired property A by investing in the form of a cash down payment of Rs. 90,000 on the mortgage and incurred renovation costs of Rs.10,000. This totals your cash investment on Property A to Rs.1,00,000 during the first year. Property A during the same year attracts a rent of Rs.20,000 annually along with the other income like parking. Consider the vacancy during that year and other expenses like repairs and Annual mortgage payments have incurred a cost of Rs.10,000. Now, the cash on cash return from the property is calculated as,

Annual Pre-Tax Cash Flow = (20,000)-(10,000)

= 10,000

The Real Estate experts agree that an 8-12% cash on cash return is a profitable investment. The CCR primarily indicates the returns in cash for the cash invested. Also, it lets you compare the returns on two or more investments.

It is not the figures of the returns, but the returns with respect to your investment that makes an asset profitable. For instance, if you earn Rs.20,000 on an investment of Rs.40,000, your returns are around 50%. On the other hand, if you earn Rs,30,000 on an investment of Rs.90,000, then you earn 30%. Though the second investment generates higher income, the returns are comparatively less profitable than the first investment. If you do not calculate CCR, you might overlook the returns from your investment perspective.

-

Net Operating Income

Net Operating Income is another real estate metric that is used to understand the income generated from the asset. In simple words, it is the income obtained after deducting the operating costs.

Mathematically,

Gross Operating Income is the total income generated from the property (i.e., through potential rental income and income from other sources like parking) taking into account the vacancy and credit losses.

Operating expenses are the costs incurred on running and maintaining the property.

NOI Calculation and Interpretation

It is time to try your hands on calculating NOI. Imagine that you own a property that generates an annual rental income of Rs.5,00,000 and income from other complementary services like parking is Rs.20,000 per annum. Due to unforeseen circumstances, your property incurred a vacancy loss of Rs.50,000 during that year. Also, the operating expenses like maintenance, insurance, property taxes have summed up to Rs.1,00,000. Then the NOI on the property is calculated using the formulae mentioned above.

Gross Operating Income = 5,00,000 + 20,000 – 50,000

= 4,70,000

NOI = Gross Operating Income – Operating expenses

= 4,70,000 – 1,00,000

= Rs. 3,70,000

The NOI gives you a realistic approach to property investment. Through the figures of NOI, you get to know what to expect from the property. NOI gives an accurate estimate as compared to other metrics like Cap rate, as NOI considers the vacancy losses which are neglected in the Cap rate calculations.

This metric helps you analyze the flow of cash. A positive NOI indicates profits while a negative NOI indicates losses. If you do not calculate NOI, as an investor you may continue to bear the losses and retain the property that produces a negative NOI. Hence, you become an informed investor by knowing the metrics like NOI.

-

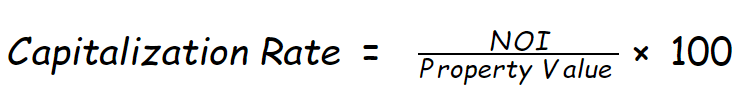

Capitalization Rate

Capitalization Rate also referred to as Cap Rate is the real estate parameter that tells you about the property’s income-generating potential. It is used to measure the profitability of the asset. It relates the rental income of the property to the property value as shown in the equation below.

Cap rate calculation is simple and easy if you know the NOI of the property. Let us consider an example and analyze what the cap rate conveys.

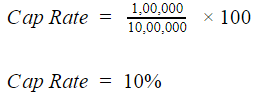

Cap Rate Calculation and Interpretation

If you buy a property worth Rs.10,00,000 which generates a net operating income of Rs.1,00,000, then,

Cap rate expresses the percentage of the income earned as profit from your investment. You can use the cap rate to compare two similar properties and understand the profitability. As the cap rate is expressed in percentage, you can directly understand the potential of the asset by looking at the figures. The higher the cap rate, the higher would be your returns.

The cap rate can also be used to understand the opportunities of the market. For instance, if your property’s cap rate decreases with your net operating income remaining constant, it means your property value has gone up. You can grab this opportunity to sell the property and earn lucrative returns. Watch out! You might miss out on the opportunity if you miss out on this metric.

While cap rate is a direct and quick comparison metric, it should not be the sole parameter on which you rely upon. Because the cap rate does not consider the mortgage payments and future cash flows. Let us get to another metric that you can pair up with Cap rate to understand your investment performance better.

-

Internal Rate of Return

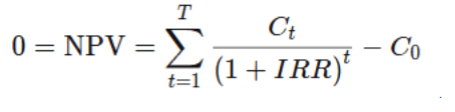

The Internal Rate of Return is the real estate gauge that tells you about the average annual returns that you can expect from the property over time. It is expressed in percentage. Mathematically,

Where,

NPV = Net Present Value

Ct = Net cash flow during the time period ‘t’

C0 = Total initial investment costs

IRR = Internal Rate of Return

While calculating the IRR, you consider the concept of NPV, i.e., Net Present Value which indicates the present value of the cash inflows. In simple words, the Rupee that you have earned today has comparatively less worth tomorrow, i.e., the purchasing capacity of the currency is subsequently reduced with time. The NPV concept calculates the present value of the future cash flows.

Now, in calculating the IRR, NPV is however equated to zero. Proceed with the above formula to obtain the IRR.

When you invest in a property, you earn profits over a period of time through regular rentals or when the property is sold out. The cash flow is hence distributed over a time period and the value of the cash proceeds is relatively not equal as explained in the NPV concept. IRR lets you understand the cash flows adjusted to the present value.

IRR is the tool that you can choose to understand the cash flows but it is a point worth noting that it does not consider the potential losses caused due to vacancies or the maintenance and repairs costs. This might over-estimate your returns.

-

Return On Investment

Return On Investment is the real estate factor that gauges the profits earned through the investment after deducting costs. It gives an accurate approach as the costs are involved.

The formula for ROI is as shown below.

![]()

ROI Calculation and Interpretation

Consider a property worth Rs.1,00,000 that is sold for Rs.1,50,000. If you incur a renovation and remodeling cost of Rs.30,000, your earnings are then reduced to Rs.1,20,000.

ROI is a real estate parameter that lets you compare the efficiency of the investments. If you have two properties at your discretion, you can choose the property which has a higher ROI, as higher ROI brings in higher returns.

As every coin has two sides, so does ROI. It has few limitations as it does not consider the time period during which your income is calculated. A property with higher ROI for a longer duration might not be a wise choice. Also, ROI does not consider the vacancy losses incurred. This might lead to inaccurate returns under any unforeseen circumstances like prolonged vacancies. Nevertheless, ROI can still make you a calculated investor if you combine other tools like Cap rate that take the limitations into their stride and evaluate your property performance.

What is good ROI in Real Estate?

The following table gives the ROI range that you can expect from your property as per the real estate experts.

| Type of Property | ROI |

| Rental Property | 8-10% |

| Commercial Property | 6-10% |

| REITs | 15% |

Bottom Line

On a concluding note, the metrics help you track the performance of the property throughout the investment period. If you see your metrics falling, you can adopt a few techniques to correct or sell the property altogether. The metrics make you realize your investment goals and dreams. On a word of caution, you have to know the procedure to calculate the metrics and arrive at an accurate figure.

There are online calculators to help you attain a precise estimate. Also, there are online platforms that help you bag properties with the best returns. Assetmonk is an online platform that lists out properties with an IRR of up to 21%. The properties undergo thorough due diligence before making it to our list. The highly curated assets are at strategic locations like Hyderabad, Bengaluru, and Chennai.

Real Estate Metrics FAQ’s:

Real estate metrics are the performance measuring or indicating parameters that can be used by the investors to understand the asset performance before and throughout the property investment and maintaining process.

What are examples of Real Estate metrics?

Cap rate, Internal Rate of Return, Net Operating Income, Return on Investment are few examples of real estate metrics.

The cap rate, also referred to as capitalization rate is the ratio of NOI to the property value. The profits earned is expressed as the percentage of the generated income. It indicates the income generation potential of the asset.

What is ROI and what is good ROI?

ROI is the Return on Investment that indicates your earnings after deducting the costs. A good ROI varies for different types of real estate properties like residential, commercial. But as per real estate experts, any ROI that ranges between 8-10% is a good investment and above 10% is a great investment.

Listen to the article

Listen to the article