“A strong economy causes an increase in the demand for housing; the increased demand for housing drives real-estate prices and rentals through the roof. ”

– William Baldwin

Have you been thinking of investing in the real estate sector in India? But are unsure? For an investor, a country’s economy tells if investing in that country is safe. Be it Foreign Direct Investments, the stability of the economies of the countries in question is paramount. A few indications that an investor evaluates before investing are GDP, stock markets, the Consumer Price Index, consumer spending, and unemployment rates. So, if countries perform well in these measures, the entire future of the country’s economy makes it a secure investment for an investor’s money. Following the same rationale, when India’s economy is expanding, it is a compelling motive to invest in the real estate of the economy in India.

The purpose is to offer property purchasers across India a better clarity and sense of direction regarding the key developments in India’s economy.

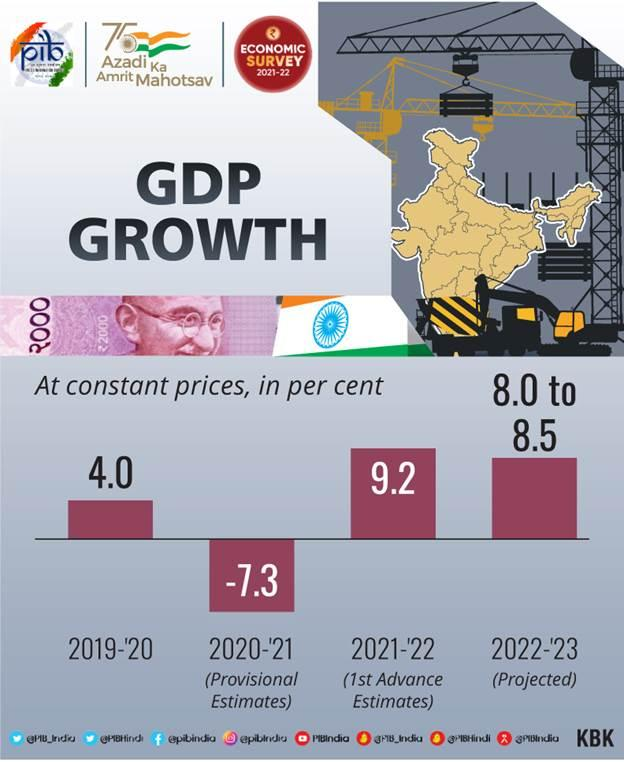

Source: Press Information Bureau

Because of all the right reasons, a house buyer in India may securely invest in the residential and commercial real estate market in India. India’s economic indicators check all the boxes, indicating that India is secure to invest. India is a thriving city for investment from all areas!

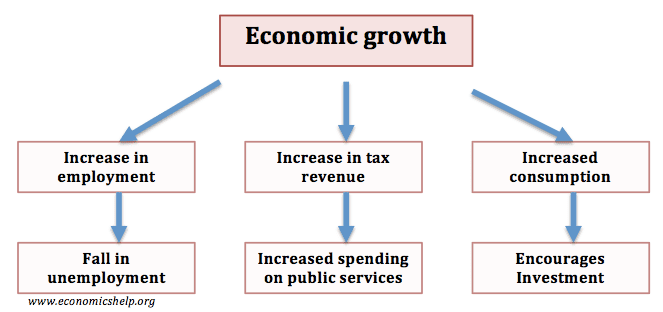

Source: Economics help

Trends in India’s economy

- India is one of the fastest emerging economies globally.

- India gets anticipated to be among the top three economic powers over the coming 10 to 15 years.

- Indians take enormous pride in their country’s vibrant democracy and alliances.

Indicators of Macroeconomic Stability In India’s Economy

GDP:

- From 2021 to 2022, India’s GDP is INR 232.15 trn or $ 3.12 trn.

- India is third in the world in terms of unicorn production. What exactly does a unicorn mean? A unicorn company is worth more than $1 billion.

- Approximately 83 unicorns originating in India have a total of USD 277.77 bn.

- India is anticipated to get 100 unicorns by 2025. More existence of Indian unicorns means more employment in India.

- Per the Nasscom-Zinnov research titled ‘Indian Tech Start-up,’ Indian unicorns would generate about 1 lac direct employment.

Source: Press Information Bureau

Which sector contributes most to the GDP of India? The services sector is the largest GDP contribution in India. In 2020-21, the services sector’s Gross Value Added (GVA) at current prices gets anticipated to be 96.54 lakh crore INR. The services sector generates 53.89 percent of India’s total GVA of 179.15 lakh billion Indian rupees.

Which state contributes most to GDP in India? Among the states and UTs, Maharashtra has the maximum GSDP in India. Maharashtra provides 13.88 percent of GDP to India in FY 2018-19. It gets followed by Tamil Nadu contributing 8.59 percent and Uttar Pradesh contributing 8.35 percent.

Employment:

- India expects to increase its pace of job growth by producing 9 mill. non-farm employment from 2023 and 2030. According to the McKinsey Global Institute, this will boost India’s economic growth and productivity.

- If India’s rate of net employment increases 1.5 percent annually between 2023-2030, the country will be on track to attain 8 percent to 8.5 percent GDP growth throughout this time.

Forex Reserves:

- According to the Depart. of Economic Affairs, the foreign exchange reserves of India would reach USD 634.287 bln. by the close of Jan. 2022. It is a reasonable reserve to keep.

Source: Press Information Bureau

The India Economy Indicators’ Recent Development Trends

- India’s economic situation has improved after the pandemic.

- Investments in numerous industries of the economy have grown.

- In November 2021, the private equity and venture capital or PE-VC industry witnessed investments totaling USD 6.8 bln. over 102 transactions. It is 42% more than in November 2020.

- April 2021 to December 2021 saw Indian exports at USD 299.74 bln. It is about a 50 percent rise from last year in the same period.

- In December 2021, India’s Manufacturing Purchasing Managers’ Index or PMI was 56.4. It is good enough. But, what exactly is the PMI Index? The Purchasing Managers’ Index monitors the manufacturing sector’s economic health. It is also gets based on five primary indicators: levels of inventory, new orders, output, deliveries from suppliers, and employment situation.

- In Jan 2022, the collection of GST revenues amounted to INR 1.38 trn. (USD 18.42 bn.). It is a 15 percent increment over the previous year’s collection.

- April 2000-June 2021 saw FDI equity inflows to India totaling USD 547.2 bn. It is a very positive trend.

- The IIP or Index of Industrial Production in India was 128.5 in November 2021, up from 126.7 in Nov 2020. Now, what exactly is IIP? The IIP evaluates the performance of India’s economy’s industrial sectors. Every month, the Central Statistical Organization (CSO) calculates and publishes it.

- The CFPI or Consumer Food Price Index – What exactly is CFPI? The Consumer Food Price Index or CFPI measures the changes in the retail prices of food products eaten by the general public. The CSO’s CFPI provides the food price levels differ for urban, rural, and entire India. Combined inflation stood at 2.9 percent from (April-December) 2021 to 2022, falling from 9.1 percent the past year. These are positive tendencies.

- CPI or Consumer Price Index – Combined inflation in the first nine months of 2021 to 2022 stood at 5.20 percent (April to December). In 2020-21, this figure was lesser than 6.6 percent.

- In 2021, FPIs or foreign portfolio investors invested INR.50,009 crores (USD 6.68 bn). Another positive indication!

- Wheat purchase in Rabi 2021 to 2022 and paddy procurement in Kharif 2021 to 2022 will comprise (1) 1208 lac metric tonnes of paddy and wheat from 163 lac farmers plus (2) direct payments of 2.37 lac cr. to farmers’ accounts.

Source: Press Information Bureau

In conclusion, the overall macroeconomic stability indicators are hopeful and imply that India’s Economy is well equipped to face the difficulties of 2022-23. One of the reasons for this is India’s Economy’s quick response plan. The indicators of India’s economy assist us in extrapolating the trend to the India Real Estate industry, particularly with a strong belief and propensity to invest in India.

House purchasers, particularly in India, may invest in the residential and commercial real estate market in India with confidence because all indicators of the economy at the national level are going in the correct direction.

Do you want to start investing in real estate in India as well? Please reach out to Assetmonk. Assetmonk is India’s fastest-growing wealthtech platform for real estate investing. It also makes NRI real estate investments easier by listing high-yielding opportunities in upcoming markets after thorough due diligence and risk analysis.

FAQ’S On Stability of The Indian Economy

Q1. How much does real estate contribute to India’s economy?

The Indian real estate industry is one of the country’s major. The real estate sector’s contribution to India’s GDP is predicted to be between 6.5 and 7%, and the sector is expected to provide millions of employment.

Q2. What is the growth rate of real estate in India?

The real estate growth rate in India will rise to Rs. 65,000 crore (US$ 9.30 billion) by 2040, up from Rs. 12,000 crore (US$ 1.72 billion) in 2019. The Indian real estate sector is predicted to be worth $1 trillion by 2030, up from $200 billion in 2021, and to contribute 13% of the country’s GDP by 2025.

Q3. What is the future of the real estate market in India?

The Indian real estate sector is predicted to be worth $1 trillion by 2030, up from $200 billion in 2021, and to contribute 13% of the country’s GDP by 2025. Retail, hotel, and commercial real estate are also expanding rapidly, supplying far infrastructure for India’s expanding requirements.

Related Articles

Real Estate Crowdfunding: What is it And How It Works?

Real estate crowdfunding is often used to increase and diversify one’s financial holdings while maintaining an overall balanced portfolio of financial investments, including stocks, bonds, and other equity holdings, rather than as a major means of generating wealth.

Dividend Income or Passive Income From Real Estate – What’s Worth It?

This article mainly explains about the dividend and passive income that is generated from real estate investments. Read more to know about which type of income is best from investing in real estate properties.

Real Estate Investing – How Much Will The Sector Grow Till 2030?

There is no doubt that the real estate sector is growing like anything in India. After Covid 19 situation the industry is experiencing an increase in demand for many commercial and residential buildings. This blog gives us a clear idea of what real estate industry growth is going to be till 2030.

How To Calculate Yield For All Types Of Real Estate Investments In India

Rental yield may be measured in two ways: gross rental return and net rental return. The gross rental yield is the yearly rental revenue derived from the property valuation, excluding expenditures for property upkeep and taxes. It’s just the amount of money you make in rent each year.

Is Office Space Still A Worthy Real Estate Investment In The Work From Home World?

The market appears to be improving, with lease activity picking up in the top seven cities in 2021. Many offices already have opened, and many more are expected to start soon. As a result, this is an excellent moment to invest in commercial real estate.

What Drives The Price Of A Commercial Asset in Real Estate Investment?

A main real estate market driver is a primary force that positively impacts the market. If a market driver is available, there is a good chance that favorable market or industry trends will emerge. Values may rise, and demand may increase.

FEMA Regulations For NRI Real Estate Investments in 2022

This blog gives us a brief idea about the FEMA regulations that are required for NRI real estate investments in 2022.

What Is The Minimum Amount For Real Estate Investment Online In India

Nowadays small investors are coming forward to make profits with a minimum amount of investment in Indian real estate online. This blog gives them a clear idea of the various methods present in real estate investments.

How To Create A Tax-Smart Portfolio With NRI Real Estate Investments

These are the numerous investment opportunities available to NRIs in India. This article helps the NRIs to understand the different methods where they can be able to create tax-smart portfolio with their investments.

India Among The Top Flexible and Cost Efficient Office Locations in the World: Report

The rise of India as a startup powerhouse has also boosted the demand for flexible spaces. They’ve reimagined their products and repositioned themselves to be more relevant in today’s changing environment.

What Makes Real Estate Investment In India The Most Profitable Investments For NRIs?

There are different types of real estate investments present in India which can make NRI investments profitable within a short span of time. This blog gives you clear info on how the investments are being Profitable for NRIs.

JLL reports India real estate garnered $943 million in investments worth in Q1 2022

JLL India has reported that the Indian real estate sector has attracted investments of worth $943 million in Q1 2022 which is 41 percent more compared to the previous quarter.

10 Real Estate Investing Terms To Understand Before Talking To An Agent

Real estate investing may be expensive. However, if you do it correctly, you might earn a sizeable chunk of passive income from rental as the property appreciates. That is why it is critical to comprehend the main terminology of real estate investment.

RBI Rules & Permissions For NRI Investments In India Real Estate

The RBI provides guidelines from time to time outlining the legislation and granting broad authority to NRIs to acquire certain immovable assets in India without needing additional approval from the RBI.

Navigating Marketing Volatility In Real Estate Investment Via Fractional Ownership

Financial markets enjoyed a wild journey in 2022, with sharp ups and downs in stock and cryptocurrency valuations. While real estate with fractional ownership has always been a solid basis in every good portfolio

The Right Way To Measure The Performance Of A Real Estate Investment

This article gives an overview of real estate performance measurement. Property valuation is more difficult than other types of asset appraisal because it lacks specific published values.

Over 2.5 Fold Jump in Office Leasing For Delhi-NCR During The First Quarter: Report

With this report we can clearly observe a 2.5 fold jump in leasing office spaces in Delhi NCR region with in the first Quarter of 2022.

Institutional Investments To Touch $1.1 Billion In The First Quarter of 2022: Report

Institutional investments in Indian property investment reached 1.1 billion in Q1 2022, more than doubling from the same period last year.

As Property Prices Rise In India, The Real Estate Industry Needs Fractional Ownership Now More Than Ever

Across the country, prices are likely to rise by 10-15%. According to our poll, 65 percent of developers believe that prices would increase by 10%. The impact would be the greatest on the inexpensive housing market.

RBI Rules To Sell Property For NRI Investment In Real Estate

NRIs can transfer or sell commercial or residential properties in India that they have invested and bought or inherited to an Indian resident, PIO, or NRI. They must go through the RBI Rules.

Listen to the article

Listen to the article