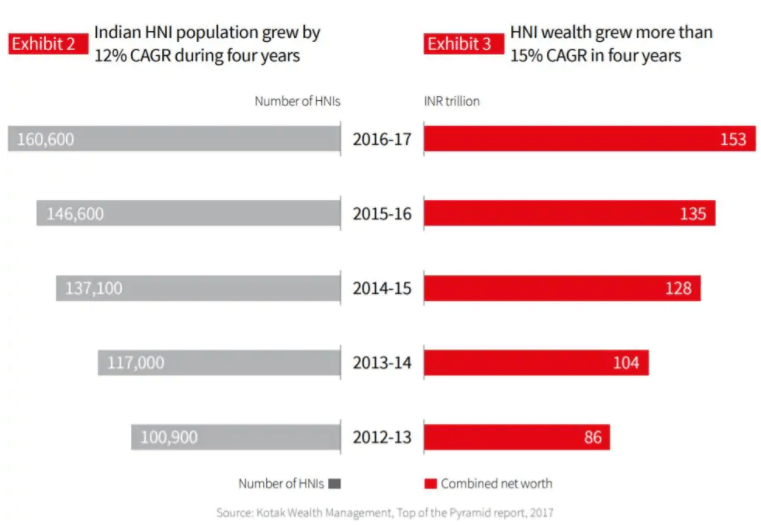

After the long and bearing financial crisis induced by the pandemic, we have finally started receiving some good news regarding the real estate sector. The High Net Worth Individuals (HNIs), widely defined as those individuals having an investible surplus of more than five crores, are gradually shifting and preferring the real estate market after the equities.

Who exactly are High Net Worth Individuals (HNI) in Indian Real Estate?

What comes to mind when you hear the term High Networth Individual (HNI)? It will most likely be a fleet of flashy cars, plush mansions, exotic foreign vacations, ivy league education, and so on. Right? That is all correct! When you have money, you can expect to live a privileged life. Is that it, though? No, not at all. It is difficult to become wealthy, and it is even more difficult to remain wealthy.

High Net Worth Individuals (HNIs) are widely defined as those individuals having an investing capacity of more than five crores. We can see a substantial shift in the market trends as these HNIs start shifting to the real estate market and equities for income generation and multiplication.

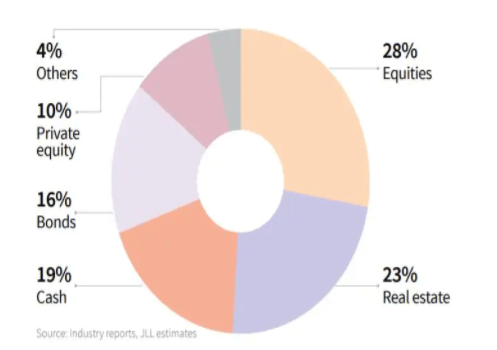

According to the JLL report’s data, this new trend has given the rise in the country’s interest rate scenarios, and this reallocation of the HNI portfolio is bound to lead to higher inflows towards the assets classes in real estate.

The report also states that in the year 2019, the wealth of the global HNIs stood at $74 trillion. And, about 26% of Indian HNIs have parked their wealth in Indian Real Estate.

Source: JLL Report

Typically, it is seen that Indian HNIs have a combined wealth of almost $ 1.5 trillion, which is 58% of India’s GDP. It is also estimated that there are more than 80,000 HNIs based out in Mumbai and Delhi alone, as per the JLL report.

Why are the HNIs heading towards having their corpus in Real Estate?

While most of the needs for the HNIs are pretty obvious, still a difference lies in the way they approach their investment strategies. Usually, seen HNIs are more aware of the financial markets and products offered. They are more likely to take higher risks, and their economic background seems typical and complicated. Also, they look for assets with wealth management facilitation and high liquidity.

Considering all of this, HNIs are investing more in equities, about 28%, and real estate, 23%, compared to other asset classes.

Source:JLL Report

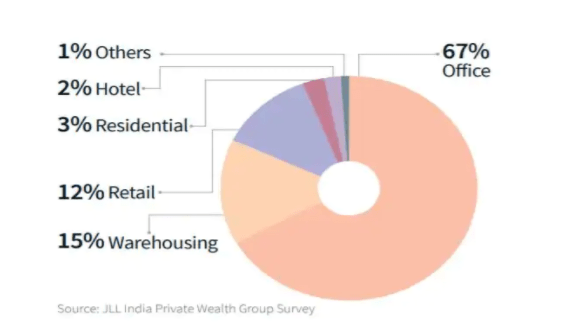

The report further states that with the new emerging trend of investing in the real estate sector, more than residential property, office spaces have gained higher demand over the last decade.

Source: JLL Report

Why is Office Space the Most Preferred by the HNIs?

Going by the current market trends, we can see that office spaces are emerging as the most preferred segment for HNI investors, accounting for 67% of the total investment in real estate.

The country’s office sector has witnessed growth over the last four years, with the average annual net absorptions crossing about 30 million sq ft, leading to steady rentals and capital appreciation until the onset of a pandemic. This segment is also expected to recover the fastest due to robust fundamentals, as per the report.

The number of HNIs in India is seen growing at a steady pace with time, and they continue to allocate more of their capital into Commercial Real Estate investments with a focus more on the office space. This is basically because office space investment tends to offer a stable cash flow and capital appreciation, thereby providing attractive HNIs.

The number of HNIs and family offices in India has been steadily increasing, and they are continuing to invest more capital in commercial real estate, with a focus on office space. Office space investments provide consistent annual cash flow and capital appreciation, resulting in attractive returns for HNIs.

Further, Real Estate, which plays the dual role of a contributor and a deficiency of growth, makes office space the most preferred asset class in the HNIs portfolio due to its tangible nature, stable income, steady returns, and collateral value attached.

Additionally, the nature of investments within the real estate has seen a transition with a higher allocation towards commercial office space and in publicly traded Real Estate Investment Trust (REITs). It helps the investors reimagine the deployment strategies.

As per the report, warehousing space is also expected to have an additional demand because of the e-commerce, FMCG, and PHARMA sectors’ recent activities. Delhi, NCR, remains the top city in the warehousing space, followed by Mumbai and Bengaluru in India. In 2019, the warehousing space absorption accounted for more than 20 million sq ft. of absorption.

Is Real Estate the Best Alternative to HNIs?

Besides providing a stable income over time, and capital appreciation of the assets, real estate can be looked at as an ideal investment for the HNIs also due to the following main aspects, including:

Real Estate provides Long-Term Financial Security

When you invest in real estate, you can ensure a stable cash income for a long duration. Thus, investment in real estate enables you to gain a financial reward for an extended period.

Also, investors’ primary aim is to be financially dependent on themselves and have long-term financial security. And, this can be achieved by investing in real estate.

Real Estate allows you to claim Tax-benefits

Being able to claim tax benefits also makes real estate investments one of the attractive and lucrative investments.

For example, the self-employment tax in India is not levied on rental income. Further, investing in real estate allows you to claim some tax deductions that are eligible, including property taxes, professional fees, travel expenses, repairs and maintenance charges, etc.

Also, yearly you can deduct the depreciation cost from your gross income. Thus, living you more space for the profits by lowering the amount of tax paid on the net income.

Real Estate is Usually Less Sensitive to Volatility

Further, on comparing, the real estate’s relative low correlation to stock market movements make it a more reliable choice for the investors. This is so because the stock markets and alternative assets like crypto trading usually move down rapidly during a recession.

Simultaneously, one of the significant hallmarks of investing in Real Estate is its slower-to-move nature. Though the real estate market is not entirely volatile, it tends to move much more slowly than other investments. Looking into this, Real Estate can be a good option, indeed.

Real Estate is Improvable

One of the most unique and attractive features of Real Estate is that it is improvable. Because Real Estate is a tangible asset made of wood, brick, concrete, and glass; hence, you can improve the value of any property with some ‘elbow grease’ and ‘sweat equity.’ Whether the repair the structure by yourself or hire some specialist, still the principal remains the same. And, in this way, you can make your real estate worth more than before.

Real Estate Coincides with Retirement

When the real estate is purchased, the cash flow is lower, and the principal reduction on the mortgage is also less. However, with time, the mortgage is paid down or paid off, and the cash flow increases.

In some respects, real estate can be seen as a forced saving program that yields a more significant amount as time goes leading to a perfect investment plan for Retirement, as it increases the cash flow over the road.

Real Estate has a low Tax-rate

Suppose the investment is sold after a year. In that case, the gain is subjected to the capital gains tax rate. Depending upon the investor tax bracket, it is usually charged between 15%-20%, which is relatively less than one’s tax bracket.

Thus, looking into this real estate can yield a high net worth compared to other asset classes. Also, the high appreciation in their investment often leads the HNIs in abundance, and so, they can keep the funds locked in an investment for a longer duration.

Further, HNIs real estate investment options are attractive, including residential or commercial properties, which also have the potential to generate attractive returns. It would mostly yield more stable returns and would help increase the value of their investment over multiple folds over time.

A Suggestive Approach to Family Offices: Real Estate becoming a Billionaire Investment

Usually, a family office is a privately owned business that manages an affluent family’s financial services and assets for building and distributing the wealth successfully throughout the upcoming generations.

However, many get confused on how family offices should invest and where? As the sole purpose of investing lies to sustain long-term prosperity and wealth.

But now, family businesses no longer need to wait and decide which one will be worthwhile. Real estate investment can be looked at as a proven investment plan looking into extreme market volatility. Family offices can now increase their investments by investing in stable assets such as real estate and earning growth in purchases over time.

Also, given the comparatively low association with the capital market, real estate investments for the family offices can be ideal. It is most suitable for the diversification of their equity, debt, and other alternative portfolios.

Furthermore, it is seen that the wealthy family often has an objective to preserve value rather than aiming for attractive returns. Hence, family offices have a crucial role in safeguarding a good legacy for their clients’ future generations.

And, in such scenarios, Real Estate can help the family offices to achieve the desired preservation of the value on the property.

The Closing Note

Backed by the growing realm influence of real estate on the Indian market, and vice versa, it is an undisputed fact that real estates are one of the best investment options and strategies for HNI investors and family offices. Also, besides being the basic principle of investment, it remains the same irrespective of the sector.

As you begin your investment journey in the Indian market, you need to be mindful of the dynamic environment and the changing policies, increasing interest rates, and the market fluctuations that make an indispensable part for an investor in choosing the right property. It is also important to ensure that your investments yield the expected returns you desire for.

Ready to get started with investing in Indian Real Estate?

Assetmonk is a Wealthtech platform specializing in fractional ownership of commercial real estate assets. As an online investment platform, we offer high growth opportunities to our valued investors. Carefully chosen assets after extensive due diligence and asset curation process are listed on the Assetmonk website. Click here to know more.

High Net Worth Individuals (HWNI) FAQ:

Why are HNIs heading towards Real Estate investment with time?

Usually, it is seen HNIs are aware of the financial markets and products offered. They are more likely to take higher risks, and their economic background seems typical and complicated. Also, they look for assets with wealth management facilitation and high liquidity. And, real Estate does fit all their financial goals of investments.

Thus, with the passages of time, most of the HNIs are shifting towards real estate investments.

Why do the HNIs more prefer office Spaces for building their portfolios?

The number of HNIs in India is seen growing at a steady pace with time, and they continue to allocate more of their capital into commercial real estate investments with a focus more on the office space. This is because the office space investments offer a stable cash flow and capital appreciation, thereby providing attractive returns to HNIs.

Further, real estate, which plays the dual role of a contributor and a deficiency of growth, makes office space the most preferred asset class in the HNIs portfolio due to its tangible nature and the collateral value attached to the asset.

How Real Estate can be a worthwhile investment for HNIs.

Real Estate can be a worthwhile investment, especially for the HNIs. It provides long-term financial security, has a low tax rate, is usually less sensitive to volatility, etc.

How can Real Estate be an ideal investment for Family Offices?

Usually, a family office is a privately owned business that manages the financial services to build and distribute the wealth successfully throughout the upcoming generations. Real estate investment can be looked at as a proven investment plan looking into extreme market volatility. It is most suitable for the diversification of their equity, debt, and other alternative portfolios.

Listen to the article

Listen to the article