Table of Contents

Latest Update on Fractional Ownership

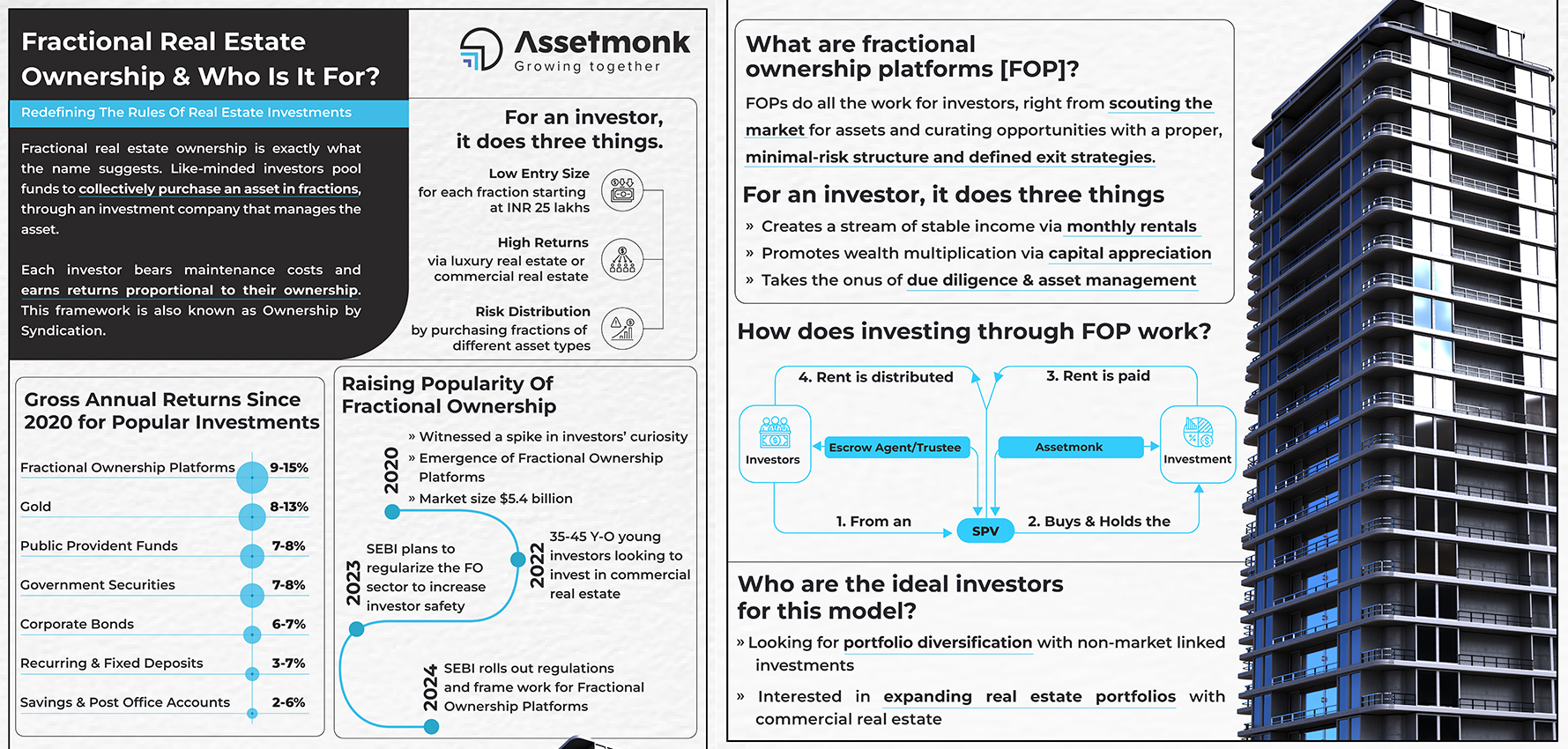

SEBI to oversee and regulate Online Platforms offering Fractional Ownership in Real Estate.

Click Here to know more about SEBI To Regularize Fractional Ownership

What is Fractional Property Investment?

- Fractional ownership commercial real estate is the ownership of a part of a commercial property.

- Fractional real estate investing gets achieved by a group of investors with pooled funds.

- With its potential for high returns, ease of tracking, and diversification benefits, this investment model is rapidly gaining popularity.

- Fractional ownership India, specifically within real estate investment, has gained significant popularity in the Real estate market making it a lucrative investment option for the savvy investors.

How Does Fractional Ownership Work?

- Let us understand this with an example. A group of investors are managing a commercial property worth Rs 30 crore. They invite retail investors to invest a minimum of Rs 25 lakhs and earn fixed returns in proportion to their investment.

Trending Fractional Ownership Properties for Sale

Stay up to date with the top-performing Fractional commercial properties to invest better!

- Assetmonk, an alternative investment platform, for example, offers a fractional ownership model where investments are secured and starts as low as 25 lakhs.

- Fractional ownership investment not only opens up new channels for investors, but it also lowers the cost of investment and reduces risk.

Why is Fractional Property Ownership Gaining Popularity in India

- According to a report by Knight Frank, the market size of fractional ownership in India was USD 5.4 billion in 2020 and is projected to reach USD 8.9 billion by 2025, growing at a CAGR of 10.5%.

- According to a recent TruBoard Partners report, while the concept of fractional ownership of real estate is still in its early stages in India, it is expected to grow in the next few years aided by tech-driven platforms.

- Estimates suggest that the fractional ownership market in India jumped from Rs 1,500 crore in 2019 to Rs 4,000 crore in 2023.

Source: TruBoard Partners

Growth of Fractional Real Estate Property Investment

Types of Fractional Ownership Real Estate

- Although fractional ownership real estate india is a relatively new idea, It has already become very popular among investors looking for a more adaptable real estate investment strategy.

- Due to the high cost of real estate and the scarcity of financing options for small investors in India, fractional ownership is especially appealing.

- The most popular kinds of fractional real estate investing India are as follows:

- Joint Development Agreements (JDAs)

- Real Estate Investment Trusts (REITs)

- Fractional Ownership Platforms

- Co-living and Co-working Spaces

- Vacation Properties

Joint Development Agreements (JDAs)

- In the real estate industry in India, it is common for fractional ownership to happen through a Joint Development Agreement (JDA).

- A JDA is a contract between the landowner and developer that specifies their joint efforts in developing the land and dividing the proceeds from the sale.

- Investors can participate in a JDA by contributing money to the project and receiving a share of the profits based upon their investment.

Real Estate Investment Trusts (REITs)

- Real Estate Investment Trusts (REITs) are the second most popular type of fractional property investment India.

- REITs are publicly traded businesses that own and manage a portfolio of real estate assets that make money. Investors can buy shares in a REIT and receive dividends based upon the income from the properties the REIT owns.

Fractional Ownership Platforms in India

- Fractional ownership real estate companies, also known as real estate crowdfunding platforms, are becoming more popular in India.

- Fractional ownership real estate companies in India allow investors to browse different properties and invest any size investment they choose. After investing, each investor owns a share of the property and receives rental income.

Co-living and Co-working Spaces

- Co-living and co-working spaces are becoming common in India, especially in major cities like Delhi and Mumbai.

- A single entity usually owns and operates these spaces. However, investors can buy shares in the entity and receive a portion of the revenue generated by the space.

Vacation Properties

- In India, fractional ownership of vacation homes like beach houses or mountain lodges is also on the rise. Investors can purchase a share of the property and use it for a specified period each year. In the remaining time, the property can be rented out to generate income.

- Property industry executives said the holiday home industry is worth around $2 billion in India, and its size is expected to surge to $10 billion in the next few years.

Benefits of Fractional Property Investment India

For Indian investors, fractional ownership in real estate or fractional real estate investing India has several advantages.

Diversification

- One of the primary advantages of real estate fractional ownership or fractional real estate investing is that it allows investors to diversify their investment portfolios.

- Real estate is a top asset class for high-net-worth individuals (HNIs) in India, making up around 40% of their portfolios, as per a PwC India report.

- Fractional property investment India offers a more affordable and easier way for investors to diversify and reduce risk.

High Returns

- Real estate has historically been a high-yielding investment, and Fractional ownership in real estate lets investors earn high returns without investing a lot of money.

- According to a Knight Frank India report, investors can expect rental yields of 6-8% on fractional ownership in real estate.

Passive Income

- Real estate fractional ownership or fractional real estate can also provide passive income. Investors can earn rental income on their property ownership stake, which can provide a consistent stream of income over time.

Access to NewAge Alternative Investment Platforms

- In India, several new-age alternative investment platforms, such as Assetmonk, provide fractional ownership of real estate.

- These platforms facilitate real estate investment by providing a user-friendly platform, transparent pricing, and hassle-free property management.

Fractional Ownership vs Traditional Real Estate Investment

| Parameters | Fractional Ownership | Traditional Real Estate Investment |

| Capital Required | Lower | Higher |

| Ownership Structure | Shared Ownership | Full Ownership |

| Rental Income | Shared | Sole |

| Property Management | Shared | Sole |

| Diversification | Easier | More Challenging |

| Flexibility | Higher | Lower |

| Liquidity | Lower | Higher |

| Potential for Return | High | High |

Understanding Timeshare

A timeshare is a type of vacation ownership where individuals purchase the rights to use a property, typically located within a hotel or resort, for a specific period each year.

But, it’s important to know that timeshare owners don’t actually own a part of the property. The developer or owner(s) of the building(s) still own the property. Instead, Timeshare ownership grants individuals the right to use the accommodation unit during their designated time period.

Fractional Ownership Vs Timeshare

| Aspect | Fractional Ownership | Timeshare |

|---|---|---|

| Ownership Structure | Owners purchase a fraction of the property. | Owners purchase the right to use the property. |

| Time Period | Typically divided by weeks or months. | Typically divided into one or more weeks. |

| Upfront Costs | Higher upfront costs due to purchasing a share of the property. | Lower upfront costs, often just purchasing the right to use. |

| Ongoing Expenses | Owners may share maintenance and other expenses. | Owners pay maintenance fees and other ongoing costs. |

| Flexibility | More flexibility in using the property, often allowing for trading or exchange programs. | Limited flexibility, usually restricted to designated time periods. |

| Investment Potential | Potential for property appreciation. | Limited investment potential. |

| Long-Term Commitment | Typically involves a higher level of commitment due to ownership share. | Offers flexibility for occasional vacation use without long-term commitment. |

Fractional Ownership Vs REITs

| Comparison Points | Fractional Ownership | REITs |

| Type of Property | Fractional Ownership has no constraints on the type of property. Thus, investment can be done in both under construction as well as fully constructed properties. | According to SEBI guidelines, 80% of the investment should be in developed and income-generating properties. The rest can be invested in under-construction properties. |

| Choice of property | Fractional Ownership offers complete control to investors in choosing the property | REITs offer no control as the management decides in choosing the property after due diligence. |

| Lock-in period | Fractional Ownership does not have any lock-in period. Investors can sell their stake in the property anytime. | REITs generally come with a constraint of market value fluctuations of the company. Investors can profit only when they sell at higher prices. |

| Earnings Distribution | The rental earnings from the property are distributed through SPVs at regular intervals. | The earnings by the REITs are distributed to the investors in the form of dividends with a payout ratio of 90%. |

| Ownership | Part-ownership in the property is acquired. | No ownership of the property is acquired. |

| Transferability | The ownership of property is freely transferable. | No transferability due to no ownership of property. |

| Diversification of Portfolio | Investors can diversify their portfolios as per their will. | Investors’ money is invested in a set portfolio created by the company. |

| Entry Cost | The entry cost can be comparatively higher than REITs | The entry cost is low as the company’s shares are listed on the stock exchange. |

| Valuation Requirements | Requires continuous valuations at frequent intervals. | Requires complete valuation for at least twice a year. |

Fractional Ownership Investment Option for NRIs

- Non-resident Indian (NRI) investors are attracted to fractional commercial real estate because of the professionally managed environment and the potential for rental income.

- A survey by NRI-focused fintech company SBNRI Technologies Private Ltd found that about 52 percent of NRIs consider investing in Commercial Real Estate (CRE) to diversify their portfolio in the Indian real estate market. This shows that NRIs prefer CRE over other asset classes, such as residential properties.

- NRI investors can benefit from the expertise of management companies like Assetmonk by investing in high-quality assets in India through fractional ownership.

- This is appealing to NRIs who want stable and income-generating assets in their home country. NRIs can invest through their NRO accounts.

Guide to Investing in Fractional Ownership Commercial real estate

Diversifying your financial portfolio and investing in fractional commercial real estate can enhance it.

Follow these basic steps to invest in fractional real estate ownership:

Step 1: Select a Platform for Fractional Ownership

- choose a reliable fractional ownership platform to invest with. Choose fractional ownership real estate companies in India that have a proven track record of performance.

- They should be transparent and honest about their costs and investment prospects. They should also offer a diverse range of investment options.

- There are many professional real estate investment platforms like Assetmonk. It is a good option since they offer a user friendly interface and a wide range of investment choices.

Step 2: Look into Investment Opportunities

- The next step is to investigate the available investment opportunities. Seek assets that match your investing goals, risk tolerance, and time horizon.

- Fractional ownership real estate companies give detailed information about each investment opportunity including financial predictions. You will also know property specifications, and expected returns.

Step 3: Examine Your Investment

- Ahead of making an investment, it is critical to research the investment. Examine the platform’s property data, financial estimates, and any other pertinent information.

- Look for possible hazards and weigh them against the potential rewards. If you have any queries or problems, contact the platform’s customer service staff.

Step 4: Make a financial investment

- It’s time to make your investment. But, only after you’ve located an investment opportunity that satisfies your criteria. These platforms enable you to invest online, making the transaction quick and easy.

- You can invest with INR 25 lakhs in premium properties. So, fractional ownership is a viable investment option for an array of investors.

Step 5: Keep an Eye on Your Investment

- It is critical to check your investment once you have made it. Keep an eye out for any property-related developments or news. Also, you must examine your returns on a regular basis.

- Fractional ownership real estate companies provide regular updates and extensive data. These will keep you informed about the success of your investment.

Fractional ownership real estate companies in India like Assetmonk provide hassle free management and maintenance of your commercial property investments, freeing up your time while giving enticing high returns.

Fractional investment real estate India is made possible by such Fractional ownership real estate companies in India starting at just 25 lakhs.

Factors to Consider while investing fractional ownership commercial real estate Investment

Fractional real estate ownership is a new investment instrument. So, investors should consider a few key points before investing.

- Detailed research plus background checks: Investors must conduct extensive research on the firm. Investors must investigate major investors’ backgrounds and financial standing. A stable team must support the facilitator.

- Legality: Investors should confirm the facilitator can serve as a fractional investment facilitator. Because this investment is so large, the likelihood of fraud increases.

Also read Curious About Fractional Property Ownership? Here Are The Essential Legal Facts.

- Tech environment: Investors should opt for a tech-enabled fractional investment firm. If so, your investments can get tracked online. Investors are more likely to proceed if they have easy exit alternatives and no hidden terms.

- Seek the Best Deal: Experienced investors get skilled at negotiating. It is a ‘great to have’ ability. Try to get the biggest discounts possible, as huge projects have a lot of price flexibility.

How to Get Started with Fractional Real Estate Investing India

- Fractional ownership India or fractional real estate investing India is the hottest trend in the Real estate sector. The real estate sector is becoming democratized as a result of fractional ownership.

- A retail investor can now invest in a former pricey but very profitable real estate. So if you’ve ever dreamt of owning a piece of prime commercial real estate but thought it was beyond your reach, think again.

- As co-ownership of real estate has started gaining traction, the market regulator — Securities and Exchange Board of India (SEBI) — is considering a regulatory framework for fractional ownership India.

- Read along to find out how you can start investing in fractional ownership commercial real estate in India.

Second home Fractional Ownership: A New Trend in India’s Real Estate

- Second homes are accommodations that people own or partly own, but they are not their main residence. In the past, people used them for vacations or to get away from city life.

- However, the purpose of acquiring second homes may have changed with the seismic lifestyle changes brought on due to the pandemic.

- Getting a second home is not just a luxury anymore. It’s a smart move that can make your life better and give you the chance to make money. As city life gets busier, more people want to take breaks and relax.

- This has made the demand for vacation homes in peaceful areas go up a lot. So, investors are thinking about buying vacation properties.

A growing work-from-home, or rather, work-from-anywhere culture, is also fuelling the demand within the market for second homes in India.

Conclusion:

Fractional ownership real estate Investment India is relatively a new idea in the Industry. But, it has created a novel potential for individual investors. Fractional commercial real estate offers investors access to high-end homes, flexibility, and diversity that may have been otherwise out of reach for individual investors.

Apart from NRIs and HNIs, small investors can also reap the benefits of investment in properties with high return potential. Investors must conduct a detailed investigation of the facilitator.

The growing demand for commercial real estate and office spaces will give rise to leasing opportunities. The growth in fractional ownership India opportunities is closely related to the increase in commercial real estate demand.

Assetmonk is one of the most innovative alternative investment platforms. You may invest in alternative investment options such as real estate on a budget. We make alternative assets, such as real estate, more accessible. Reach out to us right away!

FRACTIONAL OWNERSHIP FAQs

Q1. Is fractional ownership legal in India?

A. It is, indeed, legal. However, there is currently no specific legal structure in India that governs commercial real estate fractional ownership.

Q2. Can you sell fractional ownership?

A. One significant advantage of fractional ownership is the ability to resell. If the price or value of your fractional property rises throughout your ownership tenure, you can sell your fractional portion for a profit.

Q3. What is the difference between REITs and fractional ownership?

A. Because fractional ownership allows for liquidity, you can sell your share any time you want. REITs cannot be transferred or sold at the discretion of the investor.

Q4. Why invest in fractional ownership?

A. You should invest in fractional ownership because you can invest in Grade-A commercial properties with just Rs. 25 lacs.

Q5. Do you make money with fractional ownership?

A. If the ownership agreement allows it, a fractionally owned property can be rented out as a short-term or long-term rental. Depending on the terms of the agreement, all owners may be entitled to a portion of the rental income.

Q6. Is fractional ownership a good investment?

A. Yes, fractional ownership is a good option for investing in CRE compared to timeshares. As the market value for CRE keeps increasing, your share value keeps growing as well. With fractional ownership real estate India, Investors get access to high-end homes, flexibility, and diversity that may have been otherwise out of reach for individual investors.

Q7. Can NRIs invest in commercial real estate through fractional ownership?

A. Yes, like residents, NRIs (Non-Resident Indians) can also invest in CRE in India. An NRI investor needs to have an NRO/ NRE account to invest in commercial real estate in India.

Latest News About Fractional Ownership

64% of HNI investors prefer Fractional Ownership Model to invest in commercial real estate

As many as 60% investors and 64% of high net worth individuals prefer the fractional ownership model to invest in commercial real estate (CRE) and have expressed increased confidence in the framework following regulatory support from SEBI, a survey by WiseX, a neo-realty investment platform shows.

Source : Hindustan Times24 April 2024

How to leverage debt to invest in commercial realty

Representing innovation and connectivity, the commercial real estate (CRE) market is influencing urban ecosystems and most investors are eager to capitalise on opportunities it presents.

Source : Deccan Herald15 April 2024

Diversified investing — How Fractional Ownership can Safeguard Your Portfolio

Fractional ownership of commercial properties can emerge as an attractive option for investors seeking both security and favourable returns which enables investors to purchase a small portion of a real estate asset.

Source : CNBC Tv20 March 2024

Fractional Ownership Puts Luxury Getaways And Holiday Homes Within Reach

The thought of owning a holiday home in the lap of nature is quite appealing, but the hassle of actually purchasing the home generally puts people off the track. The legal complexities, logistical and financial aspects, zoning laws, upkeep and maintenance, etc, overwhelm and often defer potential buyers.

Source : Times Property20 March 2024

Under these amendments, SM REITs can pool funds from Rs 50 crore, involving a minimum of 200 investors, for acquiring and managing real estate assets.

Source : Hindustan Times10 March 2024

Fractional ownership platforms facilitate the pooling of investors’ funds and acquisition of real estate assets by utilising special-purpose vehicles (SPV) that issue securities to these investors. These SPVs are legal entities such as a Limited Liability Partnership (LLP) or a private limited company.

Source : Financial Express 05 JAN 2024

SEBI Approves Framework for Fractional Ownership Assets

The Securities and Exchange Board of India-SEBI sat down this week to discuss a proposal that plans to bring fractional ownership within its purview.

27 Nov 2023

Empowering Investors: SEBI To Regularize Fractional Ownership Platforms for Investor Protection

Discover how the regulation of fractional ownership platforms is empowering investors in the real estate market.

15 May 2023

Listen to the article

Listen to the article