Building wealth has been one of the topmost priorities of many millennials. The deadly virus just helped strengthen the priority of passive wealth in lockdowns. The restrictions imposed by the Covid pandemic forced a majority of people to stop their occupation or work remotely. With few sources of income, people were left to ponder on their financial stability in such trying times. The toughest lesson taught by nature is ‘DON’T SOLELY RELY ON YOUR OCCUPATION’. The creation of a passive income portfolio is the need of the times. And for that, investors must employ their knowledge and time to build a sustainable portfolio to cover their financial needs in uncertain times.

To build a passive income portfolio, investors must simply follow the below 8 steps and create a financial plan that suits their requirements.

1) Know your finances

The upfront task for building a great passive income portfolio is to analyze your current financial position. One of the efficient ways to financial planning is to know what is your major source of income. Along with that, assess your short-term as well as long-term assets and liabilities. This will put forward a true picture of your financial position. From this analysis, you can introspect which expenditures are eating up your active income and whether they can be cut down. The money can then be redirected towards profitable passive investments which can compound over the long term.

2) Set your Objectives

Any kind of investment holds an underlying objective that can be fulfilled in the future. Some quick instances of it could be an investment for retirement, children’s education, buying a house, dream vacation, and many more. It is important to know the reason behind an investment for further understanding the time horizon and the minimum maturity amount required. Moreover, investment objectives help investors to use their money carefully and not make impulsive purchases.

3) Determine your Risk Capacity

Defining your risk capacity becomes mandatory for each investment objective. Based on the risk, the right asset allocation can be done with constructive steps to mitigate the risk. Generally, for short-term investments, the risk is higher. In the long-term, the market volatility is less and hence the risk can be contained. The risk-taking appetite is generally classified into

- High Risk

- Moderate Risk

- Low Risk

According to the investors’ preferences, the risk can be diversified for protecting the portfolio.

4) Conduct thoughtful Asset Allocation

The most important aspect of portfolio planning is Asset Allocation. There are tons of passive investment options available. However, making the right choices at the start will prove to be impactful in the long run. To choose the best options, one must take complete knowledge about the passive investment options.

The key things to check before buying an investment are:

- Liquidity

- Investment Type

- Expected Returns

- Risks

- Lock-in Period

- Investment Tenure

- Taxability.

With a due understanding of these concepts, the investors must align their investment objectives to choose the best suitable option.

5) Direct your Earnings to Investments

Most salaried people get a fixed sum of money at the start of every month. From this, they can direct a certain percentage towards their passive investments. A Savings/Investment ratio can be formulated to dedicate solely to their allocated passive assets. An ideal investment ratio could be 40 percent of your income. However, for people with high financial responsibility, even a 10 to 20 percent savings ratio is a good starter. Furthermore, any extra earnings through overtime or bonuses can also be allocated towards the passive investments.

6) Check your taxes

To become a better investor is to master the art of taxation. To simply put it, knowing the nuisances of taxation rules will help you to better allocate your investments and save taxes lawfully. Take complete advantage of the deductions available and make sure you reveal all your incomes to avoid any penalty. Also, file your taxes within time to avoid any late penalties. In this manner, your passive income portfolio will be optimized and lesser taxes will indirectly end up creating more investments.

7) Create an emergency fund

This step is as important as making a perfect portfolio. An emergency fund is typically a fund that will cover at least 6 months of your expenses without any income sources. The need for having an emergency fund grew more essential with the onset of the pandemic when people’s income went for a toss and their expenses grew tremendously for health and daily survival. Thus, it is recommended to create an emergency fund that can cover any health or financial emergency in the future. Furthermore, it is highly recommended to buy health insurance and term life insurance to cover your health.

8) Monitor and Evaluate your Portfolio

Managing a portfolio is a recurring task. The asset allocation must be altered from time to time to eliminate non-performing assets. Timely evaluation of the investment options can be done through financial analysis by investors themselves or through asset management firms. The factors for evaluation could be the geopolitical scenario, economic condition, demand and supply of underlying asset or company, trade relations, and so on. If the said factors possess the capability of permanently disrupting the investment’s projections, then exiting the investment would be a wise decision. However, if the effect is temporary then the investment can be held according to the risk preferences and minimization of loss.

To put it in a nutshell, wealth creation is a continuous effort of putting your hard-earned money into the right investment options and letting it grow. Passive sources of income make it the topmost priority of successful investors in the world. The reason why most retail investors are not able to scale up their wealth is that they lack a concrete ‘financial plan’. Financial Planning is of utmost importance to build a well-formulated passive income portfolio. With strict adherence to the above 8 techniques, even non-finance investors can easily build a sustainable passive income portfolio for themselves.

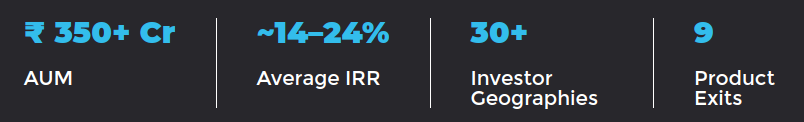

Assetmonk is a smart real estate investment provider with major market penetration in Hyderabad, Bangalore, and Chennai. We at Assetmonk, offer multiple real estate investment options through Growth, Growth Plus, and Yield models with a maximum IIRR of 21% per annum. To get started with your real estate journey, visit our website today!

8 Simple Techniques To Build Your Passive Income Portfolio FAQ’s:

How do I create a passive income portfolio?

Creating and maintaining a passive income portfolio is a continuous process. By following the 8 techniques mentioned in the article, one can easily build a sustainable passive income portfolio.

How do I start building passive income?

To start building a passive income portfolio, analyse your investment goals along with other factors like Liquidity, Investment Type, Expected Returns, Risks, Lock-in Period, Investment Tenure and Taxability.

How can I make passive income 2021?

The popular streams of passive income investment are Real estate rentals, Mutual funds, Direct stocks, ETFs, Provident Fund and so on.

Listen to the article

Listen to the article