Commercial Property Investment Platform in India 2024

- Are you looking to unlock the secrets to successful commercial real estate investment? or How to invest in commercial real estate with little money? Look no further, In this comprehensive guide is here to show you the way.

- India’s commercial real estate sector has experienced a significant transformation over the past couple of decades.

- More and more investors are turning to commercial real estate investment in India due to the country’s stable economic growth and its booming commercial real estate scene, and the emergence of commercial real estate Investment platform in India and commercial real estate investment companies.

- Whether you’re a seasoned investor or just starting out, this guide will cover everything you need to know, from understanding market trends and analyzing potential risks to finding the right property and negotiating deals and finding the best commercial real estate investment opportunities.

India Commercial Real Estate Market

Trending Best Commercial Property Investments in India

How to Invest in commercial real estate in India

Recently, commercial real estate investments are gaining traction. This is due to 4 reasons:

- Potential for high returns

- Portfolio diversification for investors

- Regular passive income in the form of the rental amount

- Serves as a hedge against inflation

But, how can one start CRE investing and how to invest in commercial properties/ property? Here are a few strategies to get you going:

- Direct investment: You may buy a commercial property individually or as part of a group, and manage the property

- Real Estate Investment Trusts (REITs): You can purchase stock in a business that manages commercial real estate, trades on stock exchanges, and pays dividends to you.

- Real Estate Crowdfunding: With smaller sums of money, you can access commercial real estate, browse projects, invest in a property or portfolio, and pool money with other investors.

- Private Equity Funds: You may pool capital from high-net-worth individuals or institutional investors, invest in larger commercial real estate projects, and have a minimum investment requirement

- Real Estate Structured Debt: Structured debt backed by real estate refers to investment products that offer fixed-income opportunities by utilizing real estate assets as collateral. Investors can participate in the real estate market through these investment vehicles without managing or owning real estate directly. Real estate-backed investments can offer attractive returns through interest payments and potential capital appreciation.

Generally, these investments via alternative investments have the potential to yield returns ranging from 12 percent to 18 percent.

Before investing, research, speak with a financial advisor, and be aware of the possible risks and rewards before investing.

Are you still wondering how to invest in commercial real estate with little money? You can now invest in real estate structured debt with just 10 lakhs and earn guaranteed returns through CRE platforms like Assetmonk.

Assetmonk’s structured debts, backed by high-quality real estate assets, present additional investment opportunities. The investment products offer a guaranteed Internal Rate of Return (IRR) of 17% and are secured by assets. Additionally, it assures investors of a seamless exit option. These investment opportunities are carefully selected from India’s thriving private markets and are overseen by a trustee registered with SEBI.

Types of Commercial Real Estate Investment Opportunities

1. Office space

This CRE space is used to set up offices for multinational corporations, call centers, co-working, start-ups, etc.

In urban areas, office spaces are typically found in high-rise buildings and skyscrapers, some of which can have an area of several million square feet. Most suburban office buildings are smaller and can sometimes be found in office parks.

Based on the number of tenants, office buildings can be categorized into two types:

- Multi-tenanted

- Single-tenanted

Further, there are three classes of commercial office spaces:

Class A office space

These are prestigious buildings with rents higher than the typical for the area.

Class A office buildings are well-known in the market, feature excellent accessibility, and are equipped with modern technology. They also provide excellent services.

Class B office space

Class B office buildings compete for a diverse range of users and have rents comparable to the area average. Here, building finishes range from fair to good, and the systems are competent

Class C office space

Class C office buildings are competing with one another to attract tenants seeking usable space at less than average rent. Medical office buildings are one specific sub-sector within this market.

You may read more about these types in our blog: Smart Real Estate Investments: What Are Grade A, B, C In Commercial Properties

Co-Living Spaces

In recent years, Co-Living has become increasingly popular in India, transforming the traditional notions of housing and community living.

Coliving, a modern housing arrangement where individuals share living spaces and amenities while fostering a sense of community, has captured the attention of both urban millennials and investors alike.

Colliers’ latest report – Future of Co-living in India – concluded that India’s co-living market is expected to double by 2024, with 4,50,000 beds by the end of 2024 against the 2,10,000 beds as of 2021-end.

India’s coliving market is expected to grow at a rapid pace. Convenient, community-driven housing solutions will remain in demand as urbanisation and lifestyles change.

The sector’s ability to adapt to market trends, regulatory challenges, and consumer preferences will shape its trajectory.

2. Industrial space

Companies in the steel, automotive, and other industries that require large workshops and assembly lines for their operations search for industrial spaces.

Most industrial buildings are located outside of residential areas and house various tenants’ industrial operations.

There are four categories of industrial commercial properties:

Heavy manufacturing: These highly tailored structures house the equipment that manufacturers need to run and develop goods and services.

Light assembly: They are less personalized and can be used to assemble or store products.

Bulk warehouse: These buildings serve as distribution hubs and are typically large.

Flex industrial: These are a mix of office and industrial space.

3. Multifamily complexes

Properties known as multi-family complexes provide rental housing for several families or individuals within a single building. This type of residential real estate includes apartments, condos, co-ops, and townhomes.

Multi-family properties, like commercial office properties, are divided into three classes (Class A, Class B, and Class C) according to their amenities and quality. Since the property owner or management company receives rental income from these spaces, they are classified as commercial spaces. These properties can be located in urban or suburban areas.

The location and size of multi-family properties are used to further categorise them. Garden-style apartments are typically less than four stories high, mid-rise buildings are between five and seven stories, and high-rise buildings are seven or more stories high.

4. Retail spaces

A “retail space” is any property used to sell products or services to customers. These include everything from small one-story shops to large shopping centers and entertainment hubs. Retail space is more expensive than office space because it is frequently crowded.

In retail, long-term leases are typical, and they usually include anchor tenants—larger, more well-known businesses that draw customers to the site. Other tenants in the same facility may benefit from the increased foot traffic.

5. Mixed-use properties

In cities, mixed-use buildings are common. Smaller retail or dining spaces are located at the bottom of the building, while business or residential space occupies the upper portion.

6. Structured Debt Backed by Real Estate

Real estate-backed structured debts are financial instruments that derive their value and security from underlying real estate assets. These structured debts involve pooling funds from multiple investors, which are then used to provide loans or financing to real estate projects or borrowers. Generally, real estate assets like homes, buildings, or land are used as loan collateral.

Real estate-backed structured debts continue to be popular alternative investments, offering potential benefits to both borrowers and investors. With rising demand for residential, commercial, and industrial properties, the real estate market has demonstrated resilience and growth in recent years.

Structured debts backed by real estate have become a consistent source of investment opportunities due to this trend.

Investors are drawn to these instruments due to their potential for generating regular income through interest payments and the added security of collateralized assets. Additionally, the diversification that comes with owning a variety of real estate assets can lower risk and stabilise investment portfolios.

| Parameter | Residential Property | Office Spaces | Industry and Warehousing | Co-Living Spaces | Structured Debt Backed by Real Estate |

| Return | Low | Moderate | Moderate | Moderate | High |

| Yield % | 2-4% | 8-10% | 7-7.5% | 7-11% | 12-18% |

| Holding Period | Medium | Medium-Long term | Mid-Long term | Mid-Long term | Short-Medium term |

| Market Demand | Varies | Growing | Growing | Growing | Growing |

Best Cities for Commercial real estate Investment opportunities

Currently the CRE sector is experiencing a boom even during the economic slowdown and the real market in the country.

- Best commercial real estate investments opportunities include investments in office space, retail space, and floor space for the construction of huge malls, multiplexes, etc. Factors that influence the selection of right CRE investment are the location of the property, its infrastructural facilities, and the property trends in that area.

- Following are the best destinations for investment in CRE in India:

Chennai CRE Market:

- Chennai is one of the top 10 cities in India for commercial real estate investment in 2024

- Chennai is a desirable location for commercial real estate investment because of its strong industrial base and top-notch educational system.

- Promising returns can be found in sectors like Guindy and OMR. Chennai is more investor-friendly due to its reasonably stable market and low cost of living.

- The Chennai real estate market is expected to maintain its upward trend in 2024.

- The city has long been a popular place to invest in real estate, and current patterns suggest that this tendency will probably continue in the future.

Bangalore CRE Market:

- Popularly known as the Silicon Valley of India, Bengaluru is home to a flourishing IT sector that draws major international companies as well as new start-ups.

- The city is a great area to invest in because of its robust economy, high rental returns, rising housing demand, affordable pricing, excellent connections, and high quality of life.

Hyderabad CRE Market:

- Emerging as a next IT hub in the South of India, Hyderabad CRE market has also been experiencing high demand in rentals. Hyderabad is a popular destination for commercial real estate investment because of its growing economy, abundance of job opportunities, and reputation in the biotechnology and IT sectors.

- If you are looking to invest in the best commercial property investments opportunities, this can be the right place for you. Commercial office spaces, as well as residential properties, have been in high demand.

Pune CRE Market:

- Pune, the second-biggest city in Maharashtra, is known for being the cultural hub of the state. Being a booming city, it’s fast rising to the top of the real estate investment list.

- Pune is one of the most lucrative and practical cities to invest in residential real estate, according to the majority of investors.

Retail Investors’ Expanding Role in Commercial Real Estate

India’s real estate market is expected to expand significantly over the next several years.

A joint analysis from NAREDCO and EY projects that the nation’s real estate market will grow from $200 billion in 2021 to $1 trillion by 2030. By 2030, the industry will account for 18–20% of India’s GDP, thanks to a favorable demand-supply gap fueling its expansion.

Compared to fixed deposits and stocks, commercial real estate in India offers a clear advantage with a guaranteed and higher yield. The combination of rental income and property appreciation sets commercial real estate apart as a valuable investment choice for retail investors.

Unlike residential properties that yield around 2% in rental income, commercial properties can yield 8-9% or higher, along with appreciation, resulting in 15-16% overall returns, making it a lucrative option for retail investors.

The commercial real estate sector led the way as the real estate market continued to grow spectacularly in the first half of 2023, especially in the top seven cities in India. This upward trend indicates the industry’s status as an appealing investment opportunity for stakeholders.

Indian CRE is undergoing a significant transformation, and one of the key developments leading the way is Fractional ownership.

- Investing in CRE can be made more affordable for investors thanks to fractional ownership. Think of it as buying a piece of a larger property, like owning a share of a shopping mall or office building.

- A report by Knight Frank reveals that the market size of fractional ownership in India was USD 5.4 billion in 2020 and is projected to reach USD 8.9 billion by 2025, at a CAGR of 10.5%.

Fractional ownership provides:

- Diversification: Spread investments across various assets, reducing risks and creating a balanced portfolio.

- Access to Prime Properties: Open doors to Grade A commercial properties, previously limited to institutional investors.

- Benefits to NRI Investors: NRIs can invest in high-quality Indian assets while leveraging management companies’ expertise, which is particularly appealing to those seeking stable, income-generating assets in their home country.

Structured Debts in 2024: New Face of Fractional Ownership

- In 2024, Structured debts will be the new face of fractional ownership, transforming how investors engage in real estate ventures. Structured debts are cutting-edge financial products with distinctive advantages that appeal to institutional and private investors.

- This novel fractional ownership approach transforms the investment landscape by creating more inclusive and diverse opportunities.

- “Structured debts” refers to the process of creating debt securities that represent a portion of a real estate asset when talking about fractional ownership. Investors hold debt securities backed by the asset’s value and potential future cash flows rather than directly owning a physical portion of the property.

Should I Invest in Commercial Property?

Investments in commercial property is gaining popularity in the real estate segment of investment. Best commercial property investments opportunities in India is a lucrative option for savvy investors. Though commercial investment real estate has its own complexities by way of issues in liquidity, maintenance, transparency, and high prices.

For anyone who wants to invest in CRE and find themselves the best commercial property investments opportunities, a thorough consideration must be given to the risk-bearing capacity, the type of investment whether long-term or short-term, and the purpose of investment. For those considering stability, low risk with low returns, and buying a small space, investing in CRE is ruled out.

The potential buyers of CRE can be

Business owners in need of new or larger premises.

Investors who are looking forward to expanding their portfolio.

New investors to CRE who are interested in buying into a portfolio.

Emerging Trends in Commercial Real Estate

- The commercial real estate in India is experiencing rapid growth and expansion.

- According to Mordor Intelligence, Commercial Real Estate India is set to achieve a valuation of USD 67.08 billion in 2023. The commercial real estate growth in India will be 27.19% CAGR from 2023-2028.

- The market is expected to expand further, reaching an impressive USD 223.25 billion by the year 2028 due to commercial investments being the top choice of savvy investors.

Commercial Real Estate Trends in Office Spaces

The Indian commercial real estate sector is experiencing a surge in office space availability, particularly in cities like Bengaluru.

Grade-A office properties have shown undeniable potential, delivering excellent returns. This was made clear in 2022 when the demand for office space increased by an unprecedented 50%, emphasizing the strong market growth in this segment.

- Office Leasing on the Rise: One trend that’s impossible to ignore is the growth of office leasing. In the second quarter of 2023, office space leased in India increased by 12% over the previous quarter to a total of 13.9 million square feet despite challenges posed by the global economy.

The cities of Bangalore, Chennai, and Pune were responsible for 59% of all office leasing activities during those three months.

- According to Colliers, Commercial spaces offer investors an average yield of 6-10%.

In Q3 2023, office leasing surged by 17% Q-o-Q and 33% Y-o-Y, hitting 15.8 million sq. ft. Mumbai, Bangalore, and Hyderabad dominated, driving 60% of the transaction boom.

SOURCE: CBRE

- Due to their strong ecosystem, favored by major corporations, prominent micro-markets in the six main cities, such as BKC, Andheri (Mumbai), and Whitefield (Bengaluru), are expected to experience continued growth.

- Office Flex spaces continue to perform well in 2024, as occupiers prefer dynamic working arrangements for their portfolios.

- Bengaluru and Delhi-NCR are the most preferred locations for flex players for their expansion.

Commercial Real Estate Trends in Industrial Spaces

- The 2023 budget introduced incentives to promote the manufacturing of batteries for Electric Vehicles (EVs). This move is expected to drive significant growth in battery manufacturing in 2024.

- As a result, there will likely be a notable demand for land in the coming years to establish factories for battery manufacturing.

- The main objective of the DESH Bill is to create development hubs that promote WTO-compliant domestic manufacturing. These hubs offer enticing incentives, making them attractive to diverse companies looking to operate in emerging regions. Consequently, there is an anticipated increase in demand for industrial spaces near these hubs as more companies express interest in establishing their operations in these strategic locations.

- The growing emphasis on the ‘China plus one’ strategy will encourage global companies to relocate some of their manufacturing to India, creating an ideal opportunity for real estate investors to explore industrial spaces.

Commercial Real Estate Trends in Warehousing

- The increasing demand for rapid deliveries and the emergence of quick commerce (q-commerce) players has led to a greater need for storage facilities, particularly for in-city small fulfillment centers, as they move closer to end-users.

- Industrial and warehousing demand in India’s top five commercial cities dropped to 6.2 million square feet in the third quarter (Q3) or the July-September period of 2023.

SOURCE: Colliers India

Commercial Real Estate Trends in Retail

- Approximately 10 million sq. ft of new commercial space is expected to be completed and become operational. Additionally, 25 new malls are set to enter the market in prominent cities like Delhi-NCR, Mumbai, Pune, Bangalore, Hyderabad, and Kolkata.

- There is a strong demand for high-quality shopping malls.

- Robust growth was witnessed in leasing and supply addition in Q3 2023 in the sector; the overall space take-up is likely to strengthen further on the back of incoming supply and the ongoing festive season.

SOURCE: CBRE

Why Invest in Commercial Real Estate Investment

- Commercial real estate investment in India is attractive due to its potential for high returns and diversification benefits.

- The real estate market has historically been the asset class that created the most wealth for investors.

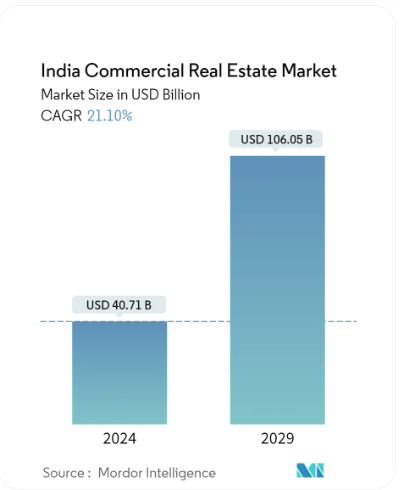

- India’s commercial real estate (CRE) market is currently valued at USD 33.62 billion and is expected to grow to USD 87.57 billion.

- The growth is anticipated to continue at a remarkable CAGR of 21.1% during 2023 – 2028.

- However, institutional investors and individuals with ultra-high net worth have been the only ones able to access this asset class, particularly in commercial real estate investing, due to the requirement for specialized investment knowledge and significant capital investment.

- However, commercial real estate investment companies like Assetmonk are democratizing commercial real estate.

- Assetmonk, being a new-age alternative investment platform, is looking to change this and drive the transformation in the real estate investment landscape by making the asset class more accessible to ordinary investors with a significantly lower investment threshold.

- We have democratized access to commercial real estate investments, making it more affordable and feasible for retail investors to participate in investing in commercial real estate development

Why Investors Looking At CRE Investments In India?

- India is quickly emerging as a popular destination for commercial real estate (CRE) investment. With a booming economy and population, a growing middle class, and inspired infrastructure investments, investors worldwide are turning to India to secure their investment portfolios.

- India’s Commercial Real Estate (CRE) sector has played a vital role in India’s growth story, leading to significant development in office infrastructure, IT hubs, and knowledge parks.

- This industry offers many options, such as office buildings, retail stores, warehouses, and industrial properties. It has the potential to create wealth through property appreciation over time in addition to a steady stream of income through rent.

- Overall, investors from across the globe are increasingly turning to India to secure their investment portfolio, as the country offers a range of benefits to investors who prioritize low-risk and high returns. The introduction of government initiatives, such as REITs and FDI, has further attracted investors to the Indian CRE market, who are keen to take advantage of the country’s long-term economic growth and benefit from the development of infrastructure projects by investing in commercial real estate development. There is also an emergence of a lot of commercial property investment companies in india.

Smart Building Systems for Sustainability

- Smart building systems are becoming a big deal, with a global market value expected to reach over $500 billion by 2032.

- To create more eco-friendly and efficient buildings, they employ smart technology.

- These systems use machine learning and artificial intelligence to forecast and optimise energy use depending on occupancy and weather. Moreover, intelligent systems track the functioning of buildings and use real-time analysis to spot possible problems.

India is quickly catching up to this phenomenon, with many developers already harnessing the power of smart building systems for sustainability.

| Category | Expected Gross Yield Range |

| Grade- A Warehouses | 6-8.5% |

| Grade A Office Assets | 8-9% |

| Co-living spaces | 6-7% |

| Retail (Minimum guaranteed rental revenue) | 8-10% |

| Residential | 2-2.5% |

| Fractional Commercial Real Estate | 7-10% |

| Commercial Structured Debts | Assured IRR 17% |

Is Buying a Commercial Property a Good Investment?

Here are the pros and cons of investing in CRE to help you understand commercial property investing better.

| Category | Pros | Category | Cons |

| Stable source of high rental income | The average commercial property rental yield in India ranges from 8-11% vs residential properties, which yield a rental income between 1-2%, i.e., 4 times lesser yield. | High ticket size | Commercial real estate is usually valued between Rs. 25 and 30 cr, and the minimum investment in CRE is typically beyond the reach of a retail investor. But now that fractional ownership is available, you can begin investing with as little as Rs. 25 Lacs. |

| Long-term commitments | CREs are leased to tenants for a long period of time. These leases may range from 3-9 years or more, as businesses rarely want to shift their operations from one place to another in a short span | Complex asset management | Since corporate entities, not private individuals, occupy CREs, seamless end-to-end asset management is necessary. Retail investors usually lack professional expertise in managing complex commercial assets. |

| Appreciation value | When compared to other property kinds, CRE offers exceptional long-term appreciation. What’s more, if you invest in a premium commercial property through fractional ownership or REITs, it may provide higher returns with a significantly lower and more affordable investment. | Difficult Entry | Because of complex legalities, extensive research required, and limited market opportunities, investing in this type of asset can be challenging for a naive retail investor. |

| Free from market fluctuations | Income from traditional investment options tends to become positive or negative depending on fluctuations in the financial markets. However, because it is unrelated to fluctuations in the stock or bond markets, investing in commercial real estate is unaffected by the performance of any other source of capital. | Selection of property | Research and market knowledge are necessary to choose the ideal property and location. Because of this, investing in commercial real estate may be very challenging for an individual investor who lacks other resources and market expertise. |

| Tangible Asset | Real estate is considered a more physical and tangible asset because you can see it and touch it. A property’s size, location, condition, appearance, and many other aspects that could be important to its profitability can all be learned more about by visiting it with an investor. Whereas, stocks, bonds, mutual funds, etc., may not look appealing to such investors because you can’t see them. | Not Easy to Sell or Find a Tenant | A commercial property may pose a problem of non-availability of a good buyer or a tenant. Selling may take a longer time. considering the size of the commercial property. |

| Tax Benefits | CRE investing can have its share of tax benefits by reducing or eliminating some capital gains. For tax purposes, a depreciation in the value of buildings over time can help reduce the yearly taxable income. An investor is depreciating his property for tax purposes while appreciating the same for investment. Thus making it a unique feature of CRE investing. | No Tax Benefits | There are no tax benefits on commercial investment properties based on a loan as against a home loan thereby increasing the overall cost of borrowing. |

Commercial Vs Residential Property: Which is Better to Invest?

| Category | Commercial Property | Residential Property |

| Buying Process | As it’s a huge property, buying a CRE is a lengthy process and hence many formalities are involved | The process of buying a residential property is comparatively easier |

| Period of Lease | CREs are leased to tenants for a long period of time. These leases may range from 3-9 years or more, as businesses rarely want to shift their operations from one place to another in a short span | Residential properties are leased for a shorter span of time, as here individuals/families may want to shift to another place within as less as 6 months due to a variety of reasons |

| Contract for Rent/Lease | CRE lease/rent contracts are in-depth and complex, as they are created for a long tenure | Residential property lease/rent contracts are comparatively simpler as they are created for short tenures |

| Rental Yield | Rental yield for a CRE may range from 8-11% of the capital invested | Rental yield for residential property may range from 1.5-3.5% of the capital invested |

| Income Stability | Due to the longer lease period, they generate regular rental income for owners for a long time period | As tenants shift to another place in short intervals, rental income for owners is less stable |

| Loan for Buying Property | A loan for buying a commercial property can be given to an individual or a business | A loan for buying a residential property can only be given to an individual |

| Leasing Process | The tenant and owner both are involved equally in the process of leasing | Residential legislation supports tenants over the owners, hence it is tough to evict the tenants |

Even though certain factors like the buying process and getting a loan are easier for residential property owners; the rental yield, income stability, and leasing process for CRE make it a preferred option for investment.

Commercial Real Estate vs Other Asset Classes

The following are the ways in which the returns on commercial real estate differ from those of other asset classes:

Commercial Real Estate vs Stocks & Equity Mutual Funds

| Investment | Commercial Real Estate | Stocks & Equity Mutual Funds |

| Overview | Offers fixed returns with direct asset ownership | Provides potential for capital appreciation with ownership in companies |

| Tangible Assets | Yes | No |

| Potential for Cash Flow | Yes, through rental income from tenants | No direct cash flow, but potential for dividends and capital gains from stock market |

| Long-Term Investment | Yes, typically requires a long-term commitment to realize potential appreciation | Can be short-term or long-term, depending on investment strategy and market conditions |

| Maintenance and Management | Investors need to consider property maintenance, management fees, insurance, taxes, vacancies, and tenant turnover | Not directly responsible for management, as equity mutual funds are professionally managed by fund managers |

| Volatility | Relatively stable and less volatile compared to the stock market | High volatility with prices fluctuating significantly in short periods, leading to potential gains or losses |

| Diversification | Adds diversification to an investment portfolio by including a different asset class | Adds diversification by investing in a diverse portfolio of stocks across different industries and sectors |

| Liquidity | Relatively low liquidity, as it may take time to sell or liquidate a property | High liquidity, as stocks and equity mutual funds can be easily bought or sold on stock exchanges |

| Potential for Profits | Fixed returns from rental income and potential property appreciation | Potential for higher returns through stock price growth, dividends, and overall stock market performance |

Invest in Commercial Real Estate vs Gold

| Investment | Commercial Real Estate | Gold |

| Overview | Offers stable investment with price appreciation, tax benefits, and passive income | Highly volatile commodity with rapid price fluctuations, requiring protected storage |

| Tangible Assets | Yes | Yes |

| Potential for Cash Flow | Yes, through rental income | No direct cash flow, primarily valued based on market sentiment |

| Long-Term Investment | Yes | Yes |

| Maintenance and Management | Investors need to consider property maintenance, management fees, insurance, and taxes | No maintenance or management required, but requires protected storage |

| Volatility | Relatively stable | Highly volatile with rapid price fluctuations |

| Diversification | Adds diversification to an investment portfolio | Adds diversification, especially as a hedge against inflation and during times of economic uncertainty |

| Liquidity | Relatively low liquidity, may take time to sell or liquidate a property | High liquidity, can be easily bought or sold |

| Potential for Profits | Potential for price appreciation, tax benefits, and passive income |

Invest in commercial real estate Vs Bonds

| Investment | Commercial Real Estate | Bonds (AAA-rated) |

| Overview | Offers a stable source of passive income | Low credit risk due to AAA-rating |

| Tangible Assets | Considered a tangible asset with intrinsic value | Not a tangible asset |

| Potential for Cash Flow | Potential for long-term rental income | Fixed income through periodic interest payments |

| Long-Term Investment | Potential for long-term capital appreciation | Generally considered a long-term investment |

| Maintenance and Management | Requires ongoing maintenance and management | No maintenance or management responsibilities |

| Volatility | Can be more volatile due to market fluctuations | Lower volatility compared to commercial real estate |

| Diversification | Can provide diversification in a portfolio | Can provide diversification in a portfolio |

| Liquidity | More illiquid with high transaction costs | More liquid with easier buying and selling |

| Potential for Profits | Potential for profits through capital appreciation and rental income | Potential for profits through periodic interest payments and return of principal at maturity |

The following is a tabular representation that compares these assets based on return, liquidity, risk, volatility, and ticket size:

| Parameters | Commercial Real Estate | Stocks & Equity Mutual Funds | Gold | Residential Real Estate | Bonds |

| Returns | High | High | Moderate | Moderate | Moderate |

| Liquidity | Low | High | High | Low | Moderate |

| Risk | Low | High | Moderate | Low | Moderate |

| Volatility | Low | High | Moderate | Low | Low |

| Ticket Size | High | Varies | Varies | High | Varies |

How to Get Started in Commercial Real Estate Investing?

Though CRE investing is attractive, there are some common hiccups, mistakes, and risks involved.

Therefore, it is important to know how to get started and what you should look out for before investing in CRE, especially for first-timers.

Step 1: Do Your Market Research

Start by doing some research to understand the commercial real estate market. Examine the state of the economy and the policies of the government that impact the market.

Also, Examine the population growth, employment prospects, and any recent advancements.

Take a look at the available properties and the demand for commercial spaces. This will help you find the right location and property type for your investment.

Step 2: Evaluate Properties Wisely

When you find potential properties, don’t just go by looks. Consider the value and potential in the long run. Think about the location – is it in a good area with easy access to amenities? Consider the type of businesses that would want to rent there. Properties in busy areas with high demand usually offer better chances for growth.

Get the property thoroughly inspected to avoid surprises later on. It’s important to know if any repairs are needed or if you’ll have to spend extra money on upgrades.

Step 3: Understand Your Financing Options

Investing in commercial real estate can require a lot of money, so you might need to get a loan. Look into various financing options, such as real estate investment trusts (REITs), bank loans, and non-banking financial institutions. Verify that you are aware of the loan’s conditions, interest rates, and repayment schedule.

Having a good credit history and manageable debts will help you get better financing terms.

Step 4: Build a Diverse Portfolio

Don’t put all your money into just one property. It is advisable to diversify your investments across a range of cities, property types, and sizes (e.g., office or retail spaces).This is called diversification, and it helps lower the risks.

Each property type has its own pros and cons. Diversifying your portfolio will make your investments more stable, even if some parts of the market aren’t doing well.

Step 5: Start Investing!

If you plan carefully, investing in commercial real estate in India can be a rewarding experience. Do your research on the market, carefully consider properties, find reliable commercial property investment company india, be aware of your financing options, and assemble a diverse portfolio. Take your time, seek expert advice, and stay informed about the market.

Maximizing ROI: Bonus Tips for a Flourishing Commercial Real Estate Venture

Financial Ineptness:

It is always advisable to keep track of your capital as well as your expenses to have an idea of the amount of cash that you can invest.

Realistic Goals:

Every investor has a different set of goals. These goals should be realistic in nature, considering all the factors, and should have a realistic deadline.

Knowledge of Risks:

Create a perfect strategy that determines your risk bearing attitude.

Exercise Due Diligence:

A prospective buyer can always conduct thorough research on CRE regarding the actual investment opportunity, availability of finance, property inspection, documents, tax returns, profit and loss statements from the previous owner, survey reports, feasibility study, etc.

Best Time to Invest in Commercial Real Estate?

Are you considering investment in commercial real estate online but not sure when is the best time to do so? Or want to know the best commercial real estate investments opportunities? You’re in luck, then! We have all the answers you need right here.

Understanding Cycle of the Real Estate Market

Market volatility rarely affects commercial real estate. When thinking about long-term investments, that is a very advantageous factor.

It also implies that you cannot forecast your gains by observing the behavior of the market, unlike in the stock market.

The reason to stay in commercial real estate investing is capital appreciation, not rent returns, which are the driving force behind entry.

Understand the different markets of Real Estate

Commercial real estate comes in a variety of forms, and each has its own market cycle. Since some types of properties are more stable than others, it’s important to know how long you plan to invest in them. It is important to think carefully about the kind of real estate you invest in because every kind has unique qualities that affect the kind of return you can expect.

Real estate is a long-term investment, although there are also short-term options (such as renting).

Understand what it takes to be a Successful Investor

You should be aware that the real estate sector offers a wide range of opportunities. It is quite convenient to invest in commercial real estate using a reliable commercial real estate Investment platform India like Assetmonk, so you need to consider this option before investing.

To succeed in the commercial real estate industry, you need to understand what it takes for your business to grow and succeed. Not only do you need to know the market but also know how it works as well as possible.

Keep your Cash Invested when you can

The best way to get the most out of your money is to stay invested in commercial real estate. There are alternative options, such as fractional ownership, that can offer secure and consistent returns if you’re worried about the market. And if you need money, you can easily sell it due to its amazing liquidity.

Buy and Hold, not Flip

For long-term investors who lack the time to continuously monitor their investment portfolio, the buy and hold strategy is a great option. This can be profitable if the purchase price is financially secure. But, given how risky flipping investments can be, most people would prefer not to risk their savings on them. Therefore, you can always opt for alternative investment methods like fractional ownership.

CRE Due Diligence and Things to Consider

Due diligence is a process of doing thorough research before buying the property. It is a process where the investor investigates in detail, checks, and verifies any important information relating to the property before giving it consideration.

Due diligence process can be categorised into five steps followed by the investor in any order to investing in commercial real estate development. Its important to do proper due diligence before investment in commercial real estate online. Let us have a look at them

Operational Due Diligence:

This step is taken to ensure that the investor has the best team available to execute his business plan. It involves hiring professionals, selecting an appropriate property manager, going into the details of the existing management of the property, investigating the lease terms, going through the local market competence, and the types of tenants and their affinity with each other.

Financial Due Diligence:

It requires to investigate property’s finances by looking into the details of the property’s cash flow, ensuring that it matches with the seller’s representation of income and expenditure and helps in determining the sustainability of the property’s rent. Several audits also go into it.

Legal Due Diligence:

It is a step taken to ensure the validity of entitlements and obligations as regards the owners as well as to investigate details like title transfer which includes a survey of the property to collect the latest possible information of the site and breach of any access rights to the site or any other complication.

Physical Due Diligence:

Appointment of a certified engineer and an appraiser is done to visit and physically inspect the property. The engineer will inspect the property’s current physical condition, need for any repairs or renovations, and so on. The appraiser will at the same time review historical operations of the property and take up the calculation of current rent roll analysing the fundamentals of the market.

Environmental Due Diligence:

A geologist identifies any potential environmental issues, the property’s historical use, any environmental contamination in the past or any future contamination, state of the site and the underlying soil, the groundwater and soil testing and the actual condition of the land at the time of ownership prior to the acquisition of the property.

Why is Commercial Real Estate So Expensive?

Commercial properties are expensive in comparison to residential properties.

There are many factors which one can consider proving the expensiveness of investments in commercial property.

Commercial real estate is more expensive than residential real estate due to a number of factors, including limited availability, desirable locations, competitive rental yields, strong tenant demand, development expenses, income potential, market dynamics, and higher operating costs. These elements contribute to the higher prices of commercial properties.

How to Make Money in Commercial Real Estate?

The most common way for investors to make money from investments in commercial property is by getting others to occupy your property and then charging them a fee over a specific period.

Commercial properties such as shopping centers, hotels, parking lots, and apartment buildings can use this income model.

However, this is one of the many ways investors can make money through properties. Other ways include:

- Selling the properties for a higher price than it was bought

- Taking advantage of the tax-related benefits available to investors

- Offering exceptional services to tenants for a premium.

Buying, Holding, and Selling

This traditional way of acquiring wealth from investments in commercial property is one tried-and-tested method on this list. Purchasing and managing commercial real estate is based on a fundamental idea that is arguably among the oldest: the appreciation of landed properties.

All you need to do to turn a profit with this strategy is purchase commercial real estate, hold onto it for a while—typically years—and then sell it when its value has grown.

Although this is a tried-and-true approach, it can take some time because many properties don’t appreciate much until after a few years. It will often require investors to be extremely patient.

Occupancy Charges

This is one of the most common ways to gain from commercial real property and applies to most commercial property types.

All you need to do is purchase commercial real estate, such as shopping malls, hotels, parking lots, office buildings, and apartments, and arrange for tenants to occupy it.

You then charge these people for occupying the property over some time. The time frame you choose will vary slightly depending on the particular kind of property. For instance, you would charge per night for a hotel. You could charge by the hour or by the day for a parking lot. You could establish a monthly rent for apartment buildings.

For office buildings, you can lease out floors to businesses or even multiple businesses depending on the needs of the business, as some businesses do not require as much space as others. Depending on your preferences, you might think about either managing the property yourself or employing a management company.

Additional Services

Investors can make a lot of money from commercial properties by offering additional services to tenants or customers, like hotels, and charging a fee for those services. You can be the owner of an office building’s parking lot or require that your tenants use another service you offer.

Value Addition and Flipping

Investors can also make gains from flipping commercial properties. This approach to building wealth through commercial real estate is comparable to the buying, holding, and selling strategy. However, instead of waiting for the property to appreciate on its own, investors increase the value of the property themselves.

Usually, this is accomplished by finding properties that are undervalued, fixing them up as needed, and then reselling them for a profit. This method will require investors to be proficient in identifying the right kind of buildings and making the right kind of renovations.

How The Digital Gateway is Enabling CRE Investment?

Innovative Tech-driven Digital CRE platforms have disrupted the status quo by enabling fractional ownership in curated CRE assets across India and investment in commercial real estate online. However, choosing the right CRE platform requires vigilance and careful evaluation:

- Reputation and Credibility: Prioritise CRE platforms with a proven track record. Check for ratings, reviews, and any honors or recognitions that the platform may have gained from users. Take into account the platform’s exit history as well; these are cases when investors have successfully sold their holdings, demonstrating a realised return on investment.

- Transparency: Select platforms/ commercial property investment company india offering comprehensive information about the properties, such as their location, tenant information, valuation reports, due diligence documents, and more. A transparent platform often indicates reliability.

- Fees and Charges: There will be a cost structure for each platform. It’s critical to comprehend all associated fees, including transaction, management, and hidden costs. Always ensure that the fee structure is aligned with your returns.

- Complaint Readdressal: Ensure that the platform has a strong and effective mechanism in place to handle complaints and grievances from investors. A swift and effective redressal mechanism can be an indicator of the platform’s commitment to its users and its overall credibility.

This addition helps potential investors understand the importance of choosing platforms that value user feedback and have systems in place to address concerns.

Why Choose Assetmonk for Commercial Real Estate Investment

Investment Risk Mitigation:

Certain key actions can help an investor weather a variety of market conditions while achieving his long-term objectives. They are as follows:

Asset Allocation:

An appropriate asset allocation means the way in which the investment portfolio is trying to meet a specific objective. Try to know about its possible risks, rewards, and the investment time frame.

Portfolio Diversification:

Portfolio diversification involves selecting a variety of investments to reduce the risk of investment. A variety of investments should be selected from the major class of assets for example, stocks, bonds, cash equivalents, and so on.

Long-term Tenants:

Treat tenants as stakeholders and keep them happy to grow the investment business and offer long-term leases for a steady income over a long period of time.

Prime Location:

Location plays an especially important role as it leads to earning returns on investment and for earning out of its sale.

Need for Efficient Commercial Real Estate Property Management:

Commercial real estate Investment platform India perform a variety of tasks for their clients, including analysis of the portfolio, forecast of the market, advice for investment, implementing investing strategies, and analysis of performance. Thus, Such CRE Platform are solely responsible for facilitating the management of the real estate properties. At Assetmonk we assist our investors with

- Prioritizing their protection and benefits in every aspect

- Providing relevant and detailed information on various choices of investment

- Provide a smooth and transparent investment process for the asset matching investment objective

- We look out for options and take steps to maximize the net ROIs

- With the help of a dashboard document vault and tools for better monitoring, we track the growth of investment for our investors

- Our assessment team supports the asset cycle of our investors from start to finish

For our stakeholders, we, at Assetmonk take the following care:

- We process every transaction and dealings with full integrity

- Our processes and tools are transparent throughout the system

- We exercise empathy towards our stakeholder while achieving their rightful objectives

- We try to achieve excellence in every pursuit of ours and strive hard not to settle for anything less than the best.

Higher Returns:

At Assetmonk, an investor gets access to some of the trendiest sectors of CRE like Co-living, residential and commercial real estates. A thorough due diligence is exercised to make a list of meticulously curated high growth potential assets, investigation of all the potential assets for our investors and to cover the prime areas of major Metropolitan cities covered in our list of assets. We, at Assetmonk, offer assets with high capital appreciation as well as regular rentals.

Product Flexibility/ Custom Products:

We, at Assetmonk, offer product solutions which are customised as per the investor’s needs. Every investor has a different objective to invest. Therefore, we offer different products, various locations, selection of tenure or preferences to risk.

Our Offerings( Investment products, Strategy for investment)

Every Investor invest in CRE with a motive and objective of his own. We, at Assetmonk offer a variety of products as a solution to their investment apprehensions.

Following are the different CRE Modules which are offered for CRE investment at Assetmonk:

Growth Module:

This is designed for investors who want a long-term investment value. This module is an early stage investment option in which investor benefits by low investment price and high return.

Growth Plus Module:

This is prepared specially for investors looking to generate income through short term investment products. These investors generate rental income by a collection of ownership of properties

Yield Module:

This is designed for those investors who are attracted towards seeking regular passive income. It is a long-term product which is offered with good capital appreciation as well as a steady rental income.

Types of Commercial Real Estate Offered

Assetmonk offers a variety of residential and mixed residentials real estate investment options in CRE including

- office,

- industrial

- Multi-family (including co-living and senior housing)

- and retail real estate

Properties

We have residential and mixed residential properties at Bangalore, Hyderabad and Chennai which include all the three modules of investment categories.

They are highly appealing and an investor would find it irresistible to go through our website for any further details

Future predictions in Real Estate Investment in India

As we gear up for 2024, the landscape of real estate investment in India is undergoing fascinating transformations.

To stay ahead in the game, it’s crucial to understand the trends that will influence the market in the upcoming year.

1. Office Spaces

Source: Dezerv

Another trend that would be impacting the commercial real estate sector is the demand for modern office spaces. Businesses are searching for office spaces that are tailored to their unique requirements as a result of evolving workplace cultures and increased competition for talent.

According to a report by Knight Frank India, the demand for Grade A office space in India is expected to exceed 100 million sq. ft. by 2025.

- Rise of Co-living and Co-working Spaces:

The sharing economy is revolutionizing the real estate game, and it’s time to jump on board! Co-living and co-working spaces are becoming increasingly popular among millennials and professionals, which presents a plethora of opportunities for savvy investors.

Co-working spaces have gained popularity among startups, freelancers, and small businesses due to their flexibility and cost-effectiveness.

The rise of the coworking sector has indirectly benefited the real estate market in the country. One of the reasons why more people are buying real estate these days is coworking spaces.

The dynamics of India’s commercial real estate market have been altered by coworking spaces, the leasing market too has seen an upswing.

Because coworking spaces are becoming more and more popular, real estate investors are making sure to include them in their portfolios.

According to Mordor Intelligence, the India co-working office space market is expected to grow at a rate of more than 7% over the next several years, and it is already estimated to be worth an astounding USD 1.78 billion this year.

2. Growth of Tier II and Tier III cities

The development of Tier II and Tier III cities is another trend influencing the commercial real estate market in India. Businesses are looking into opportunities in smaller cities due to the rising cost of living and traffic in major cities.

Commercial development in Tier 2 and Tier 3 cities has been accelerated by the rising costs of commercial real estate in metropolitan areas. This growth has also been aided by the rise in entrepreneurial endeavors and the need for spaces that are affordable.

According to a report by JLL India, Tier II and Tier III cities are expected to account for 45% of office space demand in India by 2025.

Overall, Tier 2 and Tier 3 cities offer substantial opportunities for commercial real estate development, making them attractive destinations for businesses and investors.

3. Emerging Technologies in the Indian Real Estate Sector

With the introduction of cutting-edge technologies, the Indian real estate industry is going through a digital revolution that is changing the way developers, investors, and homebuyers interact with the real estate market.

- Proptech Revolution: The proptech ecosystem in India is experiencing a boom, with numerous startups emerging with innovative solutions. Fintrackr’s analysis shows that between January 2021 and March 2023, over 29 real estate startups raised an impressive $345 million, which added up to an astounding $2.4 billion in total funding.

- And while it may seem like this technology is only relevant to industry experts, CRE platform such as Assetmonk can provide you with all the information you need quickly if you’re looking to invest in a commercial Grade A property.

Commercial real estate platforms like Assetmonk that facilitate seamless digital transactions, make commercial property discovery easier, and even provide immersive virtual property tours are responsible for this amazing growth.

Banking on the strength of technology, Assetmonk has been a top player in the proptech industry. Assetmonk is striving to provide smart real estate investment options for the specific needs of investors. To know more about the opportunities, you can reach out to us on Assetmonk’s website.

- Augmented Reality (AR) and Virtual Reality (VR): Virtual reality (VR) and augmented reality (AR) are two new technologies that are completely changing how people view real estate.

- In the CRE sector, AR/VR makes it possible to showcase properties in a more engaging and compelling way

- According to a report by Knight Frank India, 70% of the developers in India have started using virtual site visits, while 50% of them have adopted digital marketing to promote their properties.

Homebuyers can take virtual tours of commercial properties from the comfort of their homes, saving time and reducing the need for physical site visits.

Commercial Real estate investing will be transformed in the future by utilising VR’s seamless integration and immersive experiences, which will change how buyers see, assess, and make decisions about properties.

- Digital marketing to gain exposure: Using social media and online marketing can effectively connect with potential clients and grow a commercial real estate business.

A commercial real estate website can get more exposure and leads by featuring blogs and weekly articles about online strategies, top-performing investments like multifamily properties, and macro market trends.

4. Built To Rent: A Growing Demand in India

In the ever-changing real estate investment landscape of India in 2024, the “Built to Rent” (BTR) sector is one trend that is rapidly gaining traction. As urbanization surges and lifestyles evolve, BTR properties have become an attractive option for both investors and tenants.

5. Sustainable Development in the Indian Real Estate Market

Sustainability is no longer an option; it’s a mandate in the Indian real estate market for 2024. There is increasing pressure to build eco-friendly and efficient structures as urbanisation grows.

Green buildings are becoming more and more popular in the commercial real estate industry as a result of the growing emphasis on sustainability and the environment. According to a report by Cushman & Wakefield, the demand for green buildings in India is expected to increase by 10-12% per annum.

- Green Building Certifications: In 2021, India ranked 3rd globally for LEED-certified green buildings, emphasizing the industry’s commitment to sustainability.

- Renewable Energy Integration: Solar panels and wind turbines are increasingly being incorporated into real estate projects, reducing energy costs and carbon footprints.

6. Real Estate Investment Trusts (REITs) in India

REITs continue to reshape the Indian real estate investment landscape in 2024. REITs provide an avenue for investors to invest in real estate without the hassles of property ownership.

Embassy Office Parks REIT, Mindspace Business Parks REIT, and Brookfield India Real Estate Trust are the three office-backed REITs. The first REIT in India to be backed by retail assets is Nexus Select Trust.

- Diversification: REITs allow investors to diversify their portfolios without the hassle of property management. They offer a mix of commercial properties, including office spaces, malls, and warehouses.

- High Yields: REITs provide attractive yields, often surpassing traditional investment options, making them an appealing choice for income-oriented investors.

- Transparency and Regulation: Strict SEBI regulations ensure transparency, investor protection, and efficient management of REITs.

FAQs

Q1. How to invest in commercial real estate?

A. In order to invest in commercial real estate in India, one needs to do thorough research and analysis of the market, choose a suitable property, and arrange for financing. Some suggested ways to invest in commercial real estate include buying a property outright, investing in a Real Estate Investment Trust (REIT), or investing through alternative investment platforms like Assetmonk.

Q2. how to get started in commercial real estate investing?

A. To get started in commercial real estate investing in India, it is advisable to follow these steps: doing your market research, evaluating the commercial properties wisely, understanding your financing options, building a diverse portfolio, and Start investing!

Q3. Should I invest in commercial real estate?

A. Investments in commercial property is gaining popularity in the real estate segment and it is a lucrative option for savvy investors like you. If you’re looking to expand your portfolio and earn high returns then CRE investing is for you.

Q4. Why invest in commercial real estate?

A. Investing in commercial real estate has the potential to yield higher returns on investment than other asset classes. Furthermore, The commercial real estate market is booming in India, making it an attractive investment option.

Q5. How to analyze commercial real estate investment?

A. You must investigate possible comparables, check up on leases and market trends, decide on your investment strategy and management, assess the risks and expenses associated with building and renovating, and secure loan terms before you can evaluate a commercial real estate investment. You can determine whether or not the investment makes sense for you after you’ve gathered all of this information.

Q6. How to get into commercial real estate investing?

A. You can get into commercial real estate investment by investing in commercial properties. You can start your journey by investing just 10lakhs in real estate structured debt offered by Assetmonk. There re other investment avenues too like Office spaces, fractional ownership, REITs, etc.

Q7. How to invest in commercial real estate in India?

A. One of the most popular investment avenues in India today is commercial real estate, which you can now invest in through alternative investment platforms. An investor’s portfolio is diversified by alternative CRE investments, which also serve as a hedge against downturns in the traditional real estate market. For alternative CRE investments, the internal rate of return (IRR) generally ranges between 12% and 17%. You can start investing through commercial real estate platforms like Assetmonk.

Q8. How to start investing in commercial real estate?

A. Regardless of the approach you take, investing in commercial real estate is something you will never regret. One of the best decisions you will ever make is buying real estate. You can start investing by identifying a suitable property and completing your due diligence, negotiating the terms of the purchase or lease agreement.

Q9. Is commercial real estate a good investment?

A. Investing in commercial real estate can be a great way to diversify your investment portfolio and create long-term wealth. Investing in commercial property has many advantages, including tax benefits, a high rental yield, and a high potential for appreciation.

Q10. What is commercial real estate investing?

A. The term “commercial real estate” describes real estate that is used expressly for commercial or revenue-generating activities. It is unlike residential real estate in that it can yield both capital appreciation and rental income for investors. It is a popular investment class which offers growth potential, passive income, and steady returns.

If it makes sense to invest in Commercial Real Estate, then don’t wait, let us help you!

Latest News About CRE

Real Estate Investment: Unlocking opportunities in commercial realty development

Navigating the complexities of commercial real estate investment requires a comprehensive understanding of market dynamics, financial modelling techniques, regulatory landscapes, and sustainability practices.

Source : Financial Express

06 MAR 2024

Does Investment In Commercial Real Estate Give Better ROI Than Residential?

Commercial real estate in India plays a crucial role in the country’s economic landscape, encompassing a diverse range of properties designed for business and commercial activities. From office spaces and retail outlets to industrial complexes and logistics facilities, the sector contributes significantly to economic growth, job creation, and urban development.

Source : Times Property

13 FEB 2024

Private capital leading growth factor for commercial real estate in APAC

Private capital is expected to remain a driving force in the Asia-Pacific commercial real estate market, according to global property advisory Knight Frank in its ‘New Horizon Outlook 2024 Part 1: Asia-Pacific Tomorrow’ report.

Source : Hindu Business Line

06 DEC 2023