There are numerous ways to make money in the Real Estate business. Isn’t it? However, real estate investors usually fall somewhere along the spectrum of risk and effort.

But, you should know both are unique investment strategies on their own. However, the answer is quite simple, like in real estate investing, if you are a flipper, you would take high risk and put forth a lot of effort while buying, renovating, or flipping. On the contrary, if you use the buy-and-hold strategy, you need to buy a rental property and then rent it for the long-term without much effort.

Still, the same question is raised whether you should go for Flipping Vs Renting Houses. So, it is pretty clear to have a detailed understanding of both the unique strategies. Together with comparing, you can know which method can meet your lifestyle and financial goals.

Flipping of Houses

Flipping of houses can be said as an active investment strategy for buying and selling real estate properties. Now, the question is ‘how to flip a house’? Mostly, you will find two ways to flip a property.

Ways to Flip a Property

Firstly, the investor can acquire the property under the market value due to financial distress and sell it when it is ripe. For this, you need to focus on distressed property and identify the homeowners who can no longer manage the properties. It also can be due to overleveraged and is likely to go in default.

Secondly, you can flip a property by approaching the Fixer-Upper Model, i.e., the stuff with structural, design, or condition issues requiring additional capital for the repairs and maintenance. In this way, you can increase the value of the property and later use it for sales.

Profitability Strategy of Flipping

To make a profit using the fix and flip strategy, it’s essential to buy undervalued property. For example, if you purchase and repair a distressed property using the 70% rule, you need to sell at the market value to earn a 30% profit on investment.

The strategy 70% rule dictates that you should not pay more than 70% of the after repair value (ARV), minus the repair costs. In simple words, ARV is the estimated value of the property after all repairs are completed.

For instance, if a property ARV is Rs 1,00,00 and repairs costs Rs 25,000, then 70% rule suggests that the most, the investor should pay is Rs 45,000, i.e. Rs (1,00,000 * 70%) = Rs 70,000 – Rs 25,000 = Rs 45000. Using this rule will leave aside 30% both for your profits, and other miscellaneous expenses like soft costs.

Renting out Houses

Renting out a property is a passive income strategy. For this, you need to invest in a property with reasonable accommodation, since you will be holding it for a while. It need not be a highly distressed price. You need to look for a property rented out on a monthly income to cover all your mortgage payment and ownership expenses.

Gradually, on receiving rent, you can pay the mortgage sum and build up your equity. At some time in the future, you can sell the house and make a good profit in addition to the rental income.

Profitability Strategy of Renting

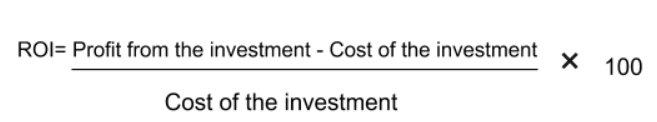

To make a profit on rental properties, you need to calculate ROI or Return on Investment. Through an ROI, you can measure the amount of return on an asset relating to the investment cost.

For instance, say you invested Rs 50,000 in the investment property, and the total profits you made from the investments sums up to Rs 70,000. Therefore, the ROI will be Rs ( 70,000 – 50,000) / Rs 50,000 = 40%

This is a sample rate to calculate your profit from rental property. Together with the Cap Rate, the cash-on-cash return can give accurate results on your rentals.

Flipping Vs Renting Houses Key Variations

Management

Both types of investment strategies require different types of work. When you flip a property, you continuously need to keep looking for properties to buy and sell. On the other hand, if you work on the rehab of stuff, you either always work on the construction or manage the people that do it for you.

On the other hand, if you are renting out a property, you need to deal with the day-to-day responsibilities like collecting rents, paying bills, and managing the tenants.

Cash Flow

When you flip a property, you can collect money much less frequently, but you get a lump-sum amount when you order. As the income from flipping comes on, creating equities.

On the other hand, renting out properties is quite similar to ‘get rich slowly.’ You indeed make good returns, but you will get on every next month. Further, your income from rentals is primarily from the ongoing cash flow.

Tax Incentive

Flipping, it is charged with tax at somewhat 25-43%. And you are not allowed to write off the depreciation of your asset owned.

In comparison to flipping, rental properties are usually taxed at 15%. Moreover, the rental property owners can write off the expenses such as repairs, maintenance, the cost of the property, and much more. You can take advantage of writing off the depreciation and save thousands of rupees in a year.

Investments Vs Speculation

As mentioned above, flipping includes speculation of the properties. It is more like a full-time job than an investment strategy. As you plan on flipping a house, you need to spend countless hours to put in new floors, windows, bathrooms, exterior, etc.

On the other hand, buying and holding a rental property is an investment strategy based on the underlying long-term capital gains and dividends.

Should you Flip or Rent a House?

Rental investment can be the best choice for an investor who is looking for :

- Having a slow but steady return on investment

- Want to pay less tax

- Want to take more time to invest

While flipping can be an alternative if the investors :

- Want to have a quick and more return on investment

- Have less time to invest

- Want to avoid the stress of managing a property

An Alternative to Real Estate Investment

However, both strategies represent different aspects, yet you can combine both the systems. You can approach the BRRR method, the Flipping + Renting model, with a unique twist.

Likewise, if you don’t have enough money to buy a rental property, you can decide to flip one or more houses to raise the required capital. As for flipping the houses means buying a cheap investment property that fits your budget. In this way, you can increase the wealth for renting out the property and enjoy the benefits of both renting and flipping houses.

Closure Interpretation

To sum up, flipping is not an investment; instead, it is speculation. Realistic speculation involves risky financial transactions with an expectation to earn a high return based on market fluctuations. Therefore, though flipping can make a lump sum of money in a short time, it can also backfire and can leave you with heavy losses.

On the other hand, buying and holding real estate is a long term investment. Though you might not earn immediately while owning a rental property, yet you can be assured of a consistent source of income over time.

Hence, after reviewing each real estate strategy, you should have understood that both approaches represent different investments. Now, the choice between both systems depends merely on your particular financial situation and goals.

However, renting houses is appropriate for investors looking at real estate as a core portion of their overall investment. Simultaneously, flipping of properties is better when real estate is used as an adjunct tactic.

Want to invest in the Real estate without the hassle of property management or worrying about earning high returns? Check out Assetmonk, a reputed real estate platform with high-growth properties with an expected IRR of 21%, a hassle-free investment process, and custom product solutions.

Flipping Vs Renting Houses FAQ’s:

What is an alternative to Flipping or Renting houses?

If you don’t have enough money to buy a rental property, you can decide to flip one or more houses to raise the required capital. Flipping the houses means buying a cheap investment property that fits your budget. In this way, you can increase the wealth for renting out the property and enjoy the benefits of both renting and flipping houses.

Write an opportunity to Rent a Property.

Buying a rental property can be a long term investment. Even if you don’t work, you would be receiving a monthly income. This would make your finance healthy and build your wealth for retirement.

Write one risk while flipping a house.

In flipping the property, you need to do lots of work, from finding the right property, dealing with contractors to seeing the potential purchaser. And as such, you might be stressed out and unable to crack a good deal.

What is the profitability strategy while flipping a house?

To make a profit using the fix and flip strategy, it’s essential to buy undervalued property. For example, if you purchase and repair a distressed property using the 70% rule, you need to sell at the market value to earn a 30% profit on investment.

Listen to the article

Listen to the article