EV Investments in India For Investors

- Exciting news for all of us watching India’s electric vehicle (EV) scene – there’s a fresh EV policy out, and it’s all geared up to supercharge India’s electric car game.

- Formulated for India’s thriving electric vehicle market, the new EV policy is here to boost the country’s growing electric car scene. Its objective is to attract big car makers from abroad, ramp up production at home, and move tech forward.

- According to the latest findings from Canalys, the Indian light vehicle sector saw a 26% growth in 2023, reaching 4.4 million units from 3.5 million units in the previous year. Electric vehicles held a 2.2% share of the total Indian market, with sales of 96,000 units in 2023 – a 92% increase from the prior year and aiming to hit 30% by 2030.

- The government’s intention with the introduction of this new EV policy in the first quarter of 2024 is to fast-track the adoption of electric vehicles and position India as a leading production hub for the global automotive industry.

- The policy is twofold: it seeks to entice foreign investment and enable newcomers like Tesla and VinFast to set up manufacturing operations within India. Its goals include promoting India as a prime location for electric vehicle production, enhancing the supporting supplier network, and positioning India as a key exponent in the global EV export market.

The Rise of India’s EV Market

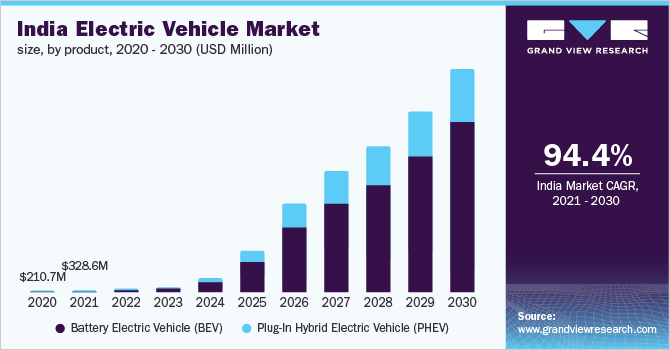

- The electric vehicle (EV) market in India is expected to experience a significant surge, expanding from USD 3.21 billion in 2022 to USD 113.99 billion by 2029.

- This growth represents a compound annual growth rate of 66.52 percent, as reported by Fortune Business Insights.

- Such an explosive increase showcases the sector’s capacity to revolutionize India’s automotive scene. The past few years have seen substantial growth within the industry, bolstered by the Government of India’s adoption of supportive policies and initiatives.

- Furthermore, a collaborative study by GameChanger Law Advisors and Speciale Invest indicates the Indian EV battery market is on a trajectory to expand from $16.77 billion in 2023 to a remarkable $27.70 billion by 2028.

- 2023 marked a significant achievement for India, with more than 1 million EVs sold in less than nine months, a pace surpassing the entire year of 2022.

- According to the Ministry of Road Transport and Highways, EV registrations made up 6.4% of total vehicle sales within the nation that year, with two-wheelers leading sales at 56%, closely followed by three-wheelers and passenger cars.

- Notably, 2022 was a landmark year, marking the first time EV sales in India exceeded a million units, largely driven by fleet operators who represented about 25% of all EV purchases.

- There’s a growing commitment among various automotive brands towards the electric vehicle sector. Both established automakers and new market entrants are eagerly participating in the EV movement, introducing an array of electric vehicles for the Indian consumer.

- Moreover, sectors such as automotive, power, and oil are promoting this transition to clean mobility together by significantly investing in the development of EV charging infrastructure nationwide. With thousands of charging stations already operational and plans for further expansion, the industry demonstrates a solid commitment to encouraging EV adoption nationwide..

- A recent analysis by the Confederation of Indian Industry (CII) highlighted the essential need for approximately 1.32 million charging stations in India by 2030 to accommodate the swiftly growing number of electric vehicles.

- To achieve an optimal ratio of one charger for every 40 EVs, it is estimated that India should aim to set up more than 400,000 charging stations each year, aiming for a total of 1.32 million stations by 2030.

Key players and startups in the Indian EV space

- In India, the electric vehicle (EV) industry is thriving with the emergence of innovative startups and recognized companies playing a vital role. Notable firms like Ola Electric, Ather Energy, Yulu, and Tata Motors are at the forefront of this EV revolution. Each has a unique approach, offering different electric vehicles and services to encourage more people to choose EVs.

- Ola Electric stands out with its electric scooters, while Ather Energy has gained attention for its high-quality scooters and extensive charging network. Yulu is making waves with its shared electric bike service that helps city residents get around more easily.

- Tata Motors, a trusted name in the automotive industry, is leading the way in electric cars and is planning to offer more EV models.

- Dynamic new companies like Altigreen, Blusmart, Battery Smart, and Evage also support the EV market, each bringing new ideas and technologies to the market. Altigreen is making electric three-wheelers to carry goods and passengers. Blusmart is a ride-sharing service that uses electric cars. Battery Smart is changing the game with battery-swapping tech, making it quicker to “refuel” electric vehicles. Lastly, Evage is working on electric vehicles for businesses, which could transform the delivery and logistics industry.

Through the active efforts of these key industry players and newcomers, India’s EV sector is moving steadily towards a cleaner, electric-driven future. These companies’ commitment and innovative spirit are shaping India’s EV landscape and establishing the country as a significant participant in the global EV movement.

Government Initiatives

- The rise in the popularity and adoption of electric vehicles (EVs) in India can be attributed to several critical elements, such as supportive policies from the government at both national and state levels, a strong commitment from the industry, and increasing acceptance among the public for EVs.

- Initiatives like the FAME India scheme, the Production-Linked Incentive (PLI) scheme for the Auto and Auto Components sector, and the PLI scheme for Advanced Chemistry Cell (ACC) battery manufacturing have been pivotal in promoting domestic production and encouraging the use of EVs.

- The Indian government is also considering a plan to convert all its vehicles to electric in the coming years, underscoring its commitment to sustainable transport.

- On the state level, there’s a noticeable eagerness to support the EV industry and adopt electric vehicles more widely. The Delhi government, for example, has ambitious plans to electrify 80 percent of its public buses by 2025, indicating a significant shift towards electric mobility.

- This goal would require the city to expand its fleet of electric buses from 800 to a remarkable total of 8,000, marking a major step forward in integrating environmentally friendly transportation solutions.

What are the key features of the new Indian EV policy?

- The revised regulation requires car manufacturers to invest at least US$500 million in India over three years as part of their commitment to set up local electric vehicle (EV) manufacturing units using at least 25% of parts produced within the country. If a car company meets these requirements, it can bring in up to 8,000 EVs each year and pay less import tax — 15% less — if the cars are worth more than US$35,000 each.

- This initiative complements the Indian government’s “Atmanirbhar Bharat,” or self-reliant India campaign, which aims to boost self-sufficiency and technological progression.

- A central aspect of the policy is the focus on increasing Domestic Value Addition (DVA) to at least 50% within the next five years. This stipulation aims to cut down the dependency on imported components, foster employment opportunities, and encourage innovation in technology within India’s own EV industry.

- The policy also holds companies accountable by requiring them to secure their investment commitments through bank guarantees. If a company does not follow the rules about investment or using Indian parts, the government will claim the money from the bank guarantee. This rule is there to make sure companies are clear and honest in their work.

What are the opportunities and challenges with the new Indian EV policy?

Under the updated policy, automakers are obligated to make a minimum investment of US$500 million in India within three years to establish local electric vehicle (EV) production facilities, incorporating no less than 25% of components that are sourced locally.

Automakers fulfilling these conditions will be permitted to import a maximum of 8,000 EVs annually, enjoying a 15% reduction in import duties for vehicles that have a minimum price of US$35,000.

This measure supports the goals of the “Atmanirbhar Bharat” or self-reliant India initiative, which seeks to enhance the country’s independence and advance technologically.

The policy significantly emphasizes the need to increase Domestic Value Addition (DVA) to a minimum of 50% over five years. This requirement reduces reliance on foreign parts, creates jobs, and stimulates technological innovation in India’s EV sector. Companies are also mandated to back up their investment commitments with bank guarantees.

The government will enforce these guarantees if a company fails to meet the investment or local sourcing requirements, ensuring transparency and integrity in business practices.

India’s recent introduction of a fresh electric vehicle (EV) policy marks a turning point, especially for international car manufacturers seeking to broaden their presence in new markets.

This policy could pave the way for global brands like Tesla to enter the market and may encourage participation from companies such as VinFast, Jaguar Land Rover, and Foxconn in India’s ambitious automotive plans. Tesla, with its robust global expansion strategy and prowess in shaping EV production networks, stands out as a particularly well-suited candidate for India’s market.

This new EV framework in India presents a range of growing benefits, positioning Tesla to carve out a significant foothold in the nation. Tesla can start by building the systems and networks it needs and grab the attention of people who want to try new things even before it makes cars in India.

By moving fast and investing early in the Indian market, Tesla can be a step ahead of others. This early lead can help Tesla win loyal customers and grab a big slice of the market as more people start buying electric cars.

EV Investments for Passive Income Investors

- The concept of generating income in your sleep while adventuring across the globe or engaging in what you love is irresistibly appealing. This is what passive income offers: the chance to make a continuous flow of money with minimal effort after setting things up.

- India’s electric vehicle (EV) movement is more than just a shift towards cleaner alternatives; it’s a transformative wave across the automobile sector. Supported by encouraging government policies, this transition opens up lucrative opportunities for investors interested in generating passive income.

- For those looking to invest, the allure of passive income represents a golden chance to generate passive earnings. India’s EV market is just starting to grow and offers many ways to invest, such as in start-up company stocks, eco-friendly bonds, and EV infrastructure projects.

- With a variety of investment choices available, investors can pick what suits their risk level, how long they want to invest, and the profits they hope to make.

EV Charging Stations: A Source of Steady Passive Income

- EV charging stations represent a great investment option if you are looking to establish a source of indirect income. Once they’re up and running, these installations require little effort to manage and oversee.

- Companies can earn by setting a fee for every use of the charging service, thereby ensuring a consistent income.

- The investment includes the station setup cost and operational expenses for each use. Nevertheless, your charging fees can exceed your costs, resulting in passive earnings with each usage. After recovering the initial setup costs, the subsequent income from charging services could provide a passive revenue stream that might last many years.

- A notable development is that some regions, such as Illinois, are now introducing utility programs that subsidize the installation expenses of EV chargers. This assistance can accelerate the return on investment, thereby bringing forward the stage at which passive income starts to flow into the business.

- Assetmonk, understanding the pivotal role of these charging stations in the EV landscape, is positioned to introduce a valuable investment opportunity to the market. By being part of this green initiative, investors can contribute to a cleaner environment while benefiting from the financial rewards of the expanding EV infrastructure.

- Assetmonk’s offerings in this sphere aim to lower the barrier to entry for investors seeking to invest in this crucial and profitable infrastructure, tapping into the growing need for public charging facilities.

Bottom Line

The electric vehicle (EV) boom in India isn’t just showing off its local strength; it’s making waves around the world, too. India’s EV scene is growing fast, and with big goals and active companies, it’s leading the charge in the global shift to electric.

This move isn’t just about new technology; it’s about making the air cleaner by cutting down on pollution and choosing greener ways to get around.

As India moves towards a future powered by electricity, it’s not just cutting down its own pollution but is also setting an example for other countries, showing them a way forward into a cleaner, electric-powered world.

Assetmonk is a new-age alternative realty investment platform focusing on structured quality deals from real estate, one of the most profitable asset classes once only accessible to the 1%. You can invest in asset-backed investment products and earn assured IRR.

FAQs

1. What is the role of government policies in promoting EV investments in India?

Answer: Government policies play a crucial role in promoting electric vehicle (EV) investments in India. By implementing supportive regulations, tax incentives, and subsidies, the government makes investing in the EV sector more attractive to businesses and investors. These policies aim to lower the cost of EV production, increase demand for electric vehicles, and support the development of EV charging infrastructure.

2. How do FAME India schemes encourage EV investments?

Answer: The FAME India (Faster Adoption and Manufacture of Electric Vehicles) schemes are a series of programs designed to boost EV adoption. They offer incentives on electric and hybrid vehicles to reduce their purchase price. For investors, this increases the attractiveness of the EV market by stimulating demand. The schemes also support the development of charging infrastructure, making investments in this area more promising.

3. Are there specific tax benefits for EV investors in India?

Answer: Yes, the Indian government provides various tax benefits to encourage investments in the EV sector. These include lower GST rates on EVs compared to traditional vehicles, income tax deductions on interest paid on loans to purchase electric vehicles, and customs duty exemptions for certain EV components. Such incentives lower investment costs and boost the sector’s profitability.

4. How do government policies support the development of EV charging infrastructure?

Answer: The government supports EV charging infrastructure development through capital subsidies up to 100% in certain cases for the first set of charging stations, guidelines for charging infrastructure, and policies that allow private companies to set up charging stations. This reduces the entry barrier for investors interested in developing charging solutions and ensures a growing market as the EV adoption rate increases.

5. Can foreign investors benefit from India’s policies on EV investments?

Answer: Yes, foreign investors can benefit from India’s welcoming stance on EV investments. The government’s policy initiatives apply equally to domestic and international investors, aiming to attract foreign capital into the sector. Furthermore, special investment regions and tax incentives designed to attract foreign direct investment create an inviting environment for overseas players to participate in India’s EV growth story.

6. What future policies can investors expect that may further boost EV investments in India?

Answer: Investors can look forward to more supportive measures as India aims to lead in the global EV transition. Future policies may include further incentives for EV manufacturing, enhanced subsidies for consumers and infrastructure development, more rigorous emission norms to phase out ICE vehicles, and larger initiatives for battery manufacturing and recycling within the country. Keeping an eye on policy updates is crucial for investors to capitalize on new opportunities.

Listen to the article

Listen to the article