Table of Contents

- CoWorking spaces are transforming the way we think about modern workspaces. They offer flexible and accessible solutions for businesses of all sizes and are reshaping the traditional real estate landscape.

- Coworking spaces have grown remarkably quickly since they were first established. The Indian market for flexible space was estimated to be worth 47 million square feet as of H1 2022, and by the end of 2025, it is expected to have grown to over 80 million square feet.

- We predict that co working spaces will have a significant impact on the commercial real estate market in 2024, bringing with them new opportunities for major players in the market.

What Is a Coworking Spaces?

Coworking is the arrangement in which several workers from different companies share an office space. This allows cost savings and convenience as they use common infrastructures such as equipment, utilities, refreshments, and a lot more.

- A growing number of people prefer to work remotely while traveling in order to avoid social isolation, loneliness, and a lack of professional contacts. Remote work is also becoming more flexible and popular.

- There’s a solution for that: the co working space.

- Coworking space is an environment that’s designed to accommodate people from different companies who come to do work. Coworking space is characterized by shared facilities, services, and tools.

- It’s different from a typical office workspace because the people in a co working environment generally aren’t working for the same company.

India Coworking Office Space Market

Benefits of CoWorking Spaces

- Coworking has become the newest thing among budding business owners everywhere. Coworking office space is a popular concept in most developed countries, and entrepreneurs and visionaries in India have recognised its ingenuity.

- 84% of professionals that are working from coworking spaces admitted that they feel motivated when working in a coworking environment. No wonder, the demand for co working is expected to rise by 160% by 2024.

A few Benefits of CoWorking Spaces are:

1. Flexibility:

Coworking solutions let you pay for just the space you use, whether you’re a freelancer looking for a place to work for the day or an established team looking for an office. This kind of flexibility is essential to growing companies.

2. Productivity:

A great workspace is one that can adapt to your different levels of focus and collaboration throughout the workday, from the hectic morning meetings to the focused period at 3 p.m. Coworking spaces are a fusion of workspaces designed to accommodate various workers and their work preferences.

Coworking spaces are designed to maximize productivity, offering more variety than a regular office and more structure than working from home. The proper workspace promotes advancement on all fronts, which is facilitated by intentionally designed spaces with natural light, and inspiring corners.

3. Networking:

Meeting people you might not have otherwise had the opportunity to connect with is one of the most well-known advantages of coworking. While working with new people every day contributes to this in part, other workspaces have community-building features as well.

Monthly networking events are an easy way to find fresh collaborators and exercise your networking know-how, while educational workshops and meetshelp you turn those introductions into lasting relationships—and possibly new business contacts.

4. Collaboration:

CoWorking spaces provide more design options than a traditional office. Between convenient hot desks, expansive lounges, glass-walled private offices, and conference rooms, there’s plenty of space for collaboration when teams get together. Privacy and productivity are possible, too, with bookable meeting rooms and quiet phone booths.

5. Cost-effectiveness:

Because CoWorking spaces typically offer a variety of membership options catered to your budget, they are frequently more affordable than traditional office spaces. Small and medium-sized teams can rent private offices, while larger businesses can take advantage of managed offices.

Solopreneurs can reserve day passes or select assigned desks. The spaces come with a host of premium amenities and resources that can benefit your business.

How Does Coworking Space work?

- While every coworking space is a little different, it’s a general conception that co working spaces allow professionals to share office space in some capacity.

- Similar to other shared spaces, co working spaces operate. Consider a shared flat as an example. The kitchen, common areas, and bathrooms are shared by all of the residents.

- In contrast to a traditional office, which is occupied by staff members of a single business or organisation, a co working space welcomes individuals from a wide range of industries, professions, companies, and social backgrounds.

Types of Coworking Spaces are Available?

Coworking spaces are available in a variety of sizes. While looking into places, there are a lot of factors to take into account. Community, amenities, and workspace environment are all factors that vary from space to space.

Open Workspaces

Open workspaces are usually synonymous with the term coworking since traditionally that is where coworking first started. In these kinds of workspaces, employees from various companies share common areas while occupying dedicated or hot desks.

Private Workspaces

Private workspace is the exact opposite of open workspaces.These private areas can be designed as offices or even as specially constructed suites meant for big groups of people. Members of the same company may share the designated space or a number of locations that the company leases or rents.

Industry Specific

Making connections with people who have similar experiences and interests would be fantastic, wouldn’t it? That’s exactly why vertical-specific spaces were built. Members who operate in the same industry are catered to in these areas.

For instance, coworking spaces designed specifically for creative professions exist. Artists, videographers, and graphic designers can all work together in one workspace. Keep in mind that these industry-specific spaces can offer a combination of both private and open workspaces.

Venture/Incubators

- Incubators or venture capital spaces are among some of the most selective coworking environments. These workspaces aim to fund and attract businesses by giving them the assistance they require to expand. Traditionally, venture firms have given equity in the companies they accept into their programmes in exchange for lower rent or capital.

- In addition to the different kinds of workspaces that are available, there are aesthetic considerations. Corporate and formal coworking spaces can be found alongside funky and laid-back ones.

- Selecting a location that embodies the culture of your business is crucial. Additionally, coworking spaces offer on-demand spaces where you can book a meeting room, virtual package in addition to your plan.

Who uses CoWorking spaces?

- A wide range of working professionals are drawn to coworking because of its many advantages. Some people are used to working outside of the typical office setting, such as consultants and freelancers. For others, such as new remote workers and startups, coworking provides a useful link between their familiarity and this new way of working.

- Here are examples of professionals using coworking today:

- Freelancers: Those who work for themselves without a fixed location are known as freelancers. Coworking provides them with social opportunities to grow their professional networks and helps break up the monotony of working from home.

- Business travelers: When away from home and the office, business travellers frequently use coworking spaces as a place to complete their work. They see it as the ideal fusion of a business setting and easily accessible lodging.

- Remote workers: It could be challenging for staff members who visit the office just once or twice a week to adjust. They can work wherever and whenever they want, with the unstructured convenience of coworking alongside the familiarity of a traditional workplace.

- Startups: Funding for office space or building leases isn’t always available to startups. They might also require room to meet in person for collaboration. Coworking offers the much-needed physical space for planning and execution while keeping costs low and under control.

- Small businesses: Growing small businesses, particularly those in the service industry, may find the cost of commercial real estate to be prohibitively high. In order to minimize expenses without dispersing their workforce too far from a central location, they resort to coworking.

- Consultants: Consultants carry out their work outside the normal purview of the workplace. A workspace that supports their professional and adaptable needs is necessary for consultants, whether they are working on proposals, meeting clients, or traveling. Coworking is that space.

- As more of the workforce finds itself working remotely, the coworking scene will become even more diverse. Like the professionals mentioned above, gig workers and specialized professionals already embrace coworking.

- The natural alignment of benefits and workforce trends makes coworking an appealing proposition for just about anyone.

The Growing Appeal of CoWorking

- The widespread accessibility of coworking makes it easy for anyone to try. A well-managed coworking space might have a varied group of regular customers who draw in new members as a result of their interactions.

- Coworking is becoming more and more popular as more people decide to work remotely rather than in an office. A coworking space will be valuable to anyone who can work remotely.

- Coworking spaces are gaining popularity among businesses in India, with demand doubling in the past four years. In Q1 2023, coworking spaces represented a 27% share of the net absorption of 8.2 million sq. ft. across the top seven cities, a significant increase from 14% in Q1 2019.

- The places with the highest demand for such coworking spaces in India are metro cities like NCR-Delhi, Mumbai, Bangalore, and Hyderabad.

Challenges Faced by the Indian Coworking Market

- The Indian co working space is expanding quickly, but there are still a number of challenges that need to be addressed. Some of the major challenges include:

- High Real Estate Costs: The high real estate costs in India are a major challenge for the growth of the coworking market. It is challenging for companies that provide coworking spaces to offer reasonably priced and adaptable office spaces due to the high costs of commercial real estate.

- Lack of Awareness: There is still a lack of awareness about the benefits of coworking spaces among small businesses and freelancers. This lack of awareness is hindering the growth of the Indian coworking market.

- Competition from Traditional Office Spaces: While many small businesses and freelancers still prefer traditional office spaces, the Indian coworking market is up against fierce competition from these establishments.

Opportunities in the Indian CoWorking Market

Despite the challenges, the Indian coworking market presents several growth opportunities, such as:

Growing Demand for Flexible Office Spaces: The growing demand for flexible office spaces is a major opportunity for the growth of the Indian coworking market. There is a growing demand for affordable and adaptable office spaces due to the rise in freelancers and startups.

Expansion into Tier-2 Cities: Tier-1 cities are not the only ones seeing growth in the Indian co working space market. There is a significant opportunity for co working space providers to expand into tier-2 cities and tap into the growing demand for flexible office spaces.

Growing Demand for Virtual Offices: The growing demand for virtual offices is another opportunity for the growth of the Indian coworking market. The need for virtual office services, like virtual phone numbers and virtual mailing addresses, is increasing as more and more businesses operate online.

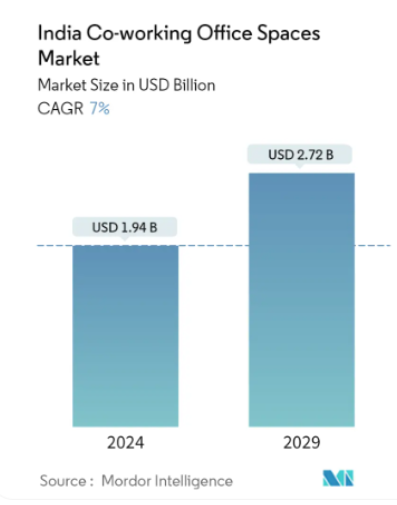

- According to Statista, the co working market is expected to grow by two billion $worldwide.

- Co working spaces in India are projected to grow at 16 per cent CAGR between 2021 to 2026. In Q1 2023, coworking spaces represented a 27 per cent share of the net absorption of 8.2 million sq. ft.

Coworking Space Investment

Owing to the increase in demand in India, co-working is now one of the fastest-growing markets. This segment has also leaped the commercial real estate sector, and it has occupied more than 12-13% of CRE investments in India, as per reports suggested by FICCI. The scenario being such in India, it is already at its peak of growth in countries like the US, UK, Australia, etc.

With this history of high growth rate in the past and looking at the way it is booming, it proves that this trend is for sure going to take us by storm in the future.

This phase, thus, is the right time for the investors to march into this field.

Reason for the Escalating Demand for Coworking Space as an Investment

The main reason why co-working is gaining importance as an investment option is that it saves a lot on the investor’s part. Real estate costs can be 9 to 12% of the operation’s cost for an established corporate and even more for a startup. But with shared work spaces, they can save around 20 to 25% of the total real estate costs, and that is a lot of money for the big companies to count upon.

How do investments in coworking spaces work?

- Investors can invest in co-working spaces in several ways.

- Directly invest, i.e. invest in a building to further develop into co-working space

- Through REITs investment

- Through online platforms

- Establish a partnership with another investor

- Then they lease or rent their spaces to startups or established companies.

- Finally, investors get to enjoy the enormous cash flow that the co-working spaces generate.

Key Considerations if You Want to Invest in Coworking Spaces

There are a few things that you need to consider before you directly barge into the investment.

Location

Location is of prime importance in co-working, just like any other real estate investment. The first step in selecting a co-working space is to find out the place that’s high in demand. The location should be easily commutable, a bit close to market places like those of suburbs or any prime urban areas.

Create Your Financial Model

Once you are done with the selection of the location, the next step is to calculate the costs and finalize the budget plans by making some assumptions and approximations. You will have to reconsider additional costs such as building codes and city permits, all things that can quickly add up to other charges.

Building codes will vary from state to state, so you must do careful research beforehand to ensure the co-working space complies with all building and fire safety codes. Code of Construction and Housing (CCH) sets standards for such co-working spaces, and they all must be built accordingly.

Co-working Space Design and Attractive Amenities

Space must be designed in quite an innovative way with good architecture so that it will make the workers there feel very much at ease and alive, unlike what the professional workspace makes them think.

Although it does not apply to everyone, many employees in co-working spaces are involved in technology or startup companies. Therefore, it becomes essential that you provide technology that is up to date and reliable for them to conduct their business. Additional amenities like lounges, recreational spaces, spaces for entertainment, etc. have the potential to lure new clients and tenants to your co-working space.

Good Partnership

If you want to invest in an existing co-working business and not start a new one, you need to establish a good working relationship with the co-existing owner of the space. This partnership will come with a massive set of expectations, responsibilities, and even complications, but establishing a positive dynamic with the existing management team will certainly help you bring overall success.

After reflecting on the points mentioned above, you can proceed with the funding for making a successful co-working space investment.

Bottom Line

CoWorking is the now and the future. From entrepreneurs to large corporations, it caters to everyone. People now place a high value on work-life balance, and co working spaces, with all of their advantages, can help them do just that.

The Indian coworking market is experiencing rapid growth, driven by the increasing number of startups and freelancers in tier-1 and tier-2 cities. The places with the highest demand for such coworking spaces in India are metro cities like NCR-Delhi, Mumbai, Bangalore, and Hyderabad.

The market offers tremendous growth potential due to factors like the rising demand for flexible office spaces, expansion into tier-2 cities, and virtual office services, even in spite of challenges like high real estate costs and low awareness.

The Indian coworking market is poised for continued growth in the coming years, and coworking space providers are well-positioned to tap into this growing demand.

Coworking spaces are becoming more and more popular, it is likely that this trend will continue to shape the future of work in India

Assetmonk, a rapidly expanding and promising alternative investment platform in India, is dedicated to providing exceptional investment prospects backed by real estate assets. With its upcoming project AM whitefield in Bangalore, Investors can invest with just 25 lakhs and can earn an enticing expected IRR of 16.07%.

Whitefield being one of the major destinations for real estate investments as it is home to several IT parks and companies, Investors can now enjoy the perks of fractional investment and owning a share of Grade A Office space in India’s silicon valley through Assetmonk. Reach out to us today!

CoWorking spaces FAQ’s

Q1- What are the advantages and disadvantages of coworking space?

A. Coworking spaces’ dynamic environments support the development of new business concepts and teamwork. They are also very cost-effective. However, coworking spaces can present a number of technological challenges and distractions, so they may not be ideal for everyone.

Q2- Is coworking space a good business idea for startups?

A. Most startups don’t have the financial resources to create individual workstations with shelves and cabinets. Sharing the same space with like-minded individuals helps in fostering new business ideas and a sense of community that is essential in startups.

Q3. Do coworking spaces offer a trial period?

A. If you are confused about whether coworking is ideal for you and its services meet your expectations, you don’t have to worry. Many coworking solutions offer a trial period of at least 1 day. If you are unsure of the space, you should try the space before you rent it.

Listen to the article

Listen to the article