- Invest 10 Lakhs Rupees For Monthly Income in India can be a strategic financial decision. This blog aims to provide an in-depth guide on investing 10 lakhs to get monthly income consistently.

- We will explore various investment options, their potential returns, and associated risks. We will also see the key factors to consider before making investment decisions.

- By understanding the available choices and conducting thorough research, you can make informed investment choices to meet your financial goals.

Investment Options for Investing 10 Lakhs to Get Monthly Income in India

Real estate Backed Fixed Income Products

Structured debt backed by real estate refers to investment products that offer fixed-income opportunities by utilizing real estate assets as collateral. These investment instruments provide investors with exposure to the real estate market without the need for direct property ownership or management.

Real estate-backed investments can offer attractive returns through interest payments and potential capital appreciation. However, it’s important to note that returns may fluctuate based on market conditions and the performance of the underlying assets. Generally, these investments via alternative investments have the potential to yield returns ranging from 12 percent to 18 percent.

Fixed Deposits (FDs)

Fixed deposits are a popular choice for risk-averse investors seeking a secure source of monthly income. Offered by banks and financial institutions, FDs provide a fixed interest rate for a specified term. While they offer capital protection, the returns might be lower compared to other investment avenues. Additionally, the interest income from FDs is taxable.

Are You Looking For Alternatives To Fixed Deposit

Post Office Monthly Income Scheme (POMIS)

The Post Office Monthly Income Scheme is a government-backed savings scheme that offers a regular monthly income to investors. With a lock-in period of five years, POMIS provides a fixed interest rate and is considered a relatively safe investment option. However, the interest income is taxable.

Debt Mutual Funds

Debt mutual funds are managed by professional fund managers and invest in fixed-income securities like government bonds, corporate bonds, and money market instruments. These funds aim to generate steady income with lower volatility compared to equity funds. The returns from debt mutual funds can vary depending on market conditions, and they are subject to taxation.

Dividend-Paying Stocks

Investing in dividend-paying stocks can provide an opportunity for monthly income through regular dividends distributed by companies. Look for stable companies with a history of consistent dividend payouts. While dividend income is generally tax-free for individual investors up to a certain limit, it is essential to keep track of tax regulations.

Real Estate Investment Trusts (REITs)

REITs are investment vehicles that allow investors to participate in the real estate market without directly owning properties. REITs invest in income-generating properties such as commercial buildings, apartments, and shopping malls, and they distribute a portion of the rental income as dividends to shareholders. REITs offer a potential source of monthly income with the added benefit of diversification. However, the income earned from REITs is taxable.

Systematic Withdrawal Plans (SWPs)

For investors with a diversified portfolio, Systematic Withdrawal Plans (SWPs) can be an effective strategy to generate a regular monthly income. SWPs allow investors to withdraw a predetermined amount from their mutual fund investments at regular intervals. This approach provides a consistent stream of income while keeping the remaining capital invested for potential growth.

Bonds and Fixed Income Instruments

Investing in bonds and fixed-income instruments can provide a regular income stream. Government bonds, corporate bonds, and fixed-income mutual funds are examples of investment vehicles that offer fixed-interest payments at regular intervals.

Assessing Investment Options of Investing 10 Lakhs to Get Monthly Income in India

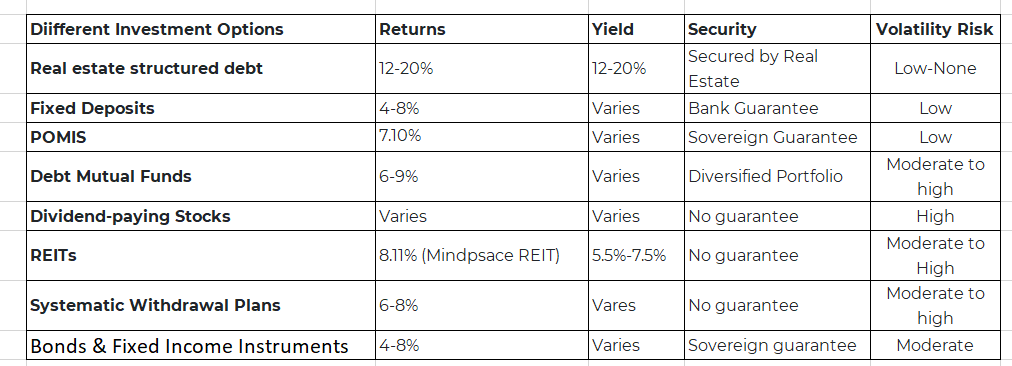

To gain a comprehensive understanding of the investment options mentioned above, let’s examine their risks, potential returns, and tax implications:

Comparison Table of Investment Options

As can be seen from the table above, structured debt real estate is the best investment option for investing 10 lakhs to get monthly income. Via alternative investment platforms like Assetmonk, you can get an assured IRR of 17 percent.

How to Invest Rs. 10 lakhs in Real Estate Structured Debt With Assetmonk

You can invest your hard-earned Rs. 10 lakhs into Assetmonk’s real estate structured debt. Both these are short-term investments for a period of 36 months only. They are also fixed-income investments.

The fixed-income nature of these products implies that they are committed to returning a fixed amount to investors regularly, akin to receiving scheduled interest payments on a loan. They also carry just moderate risk. And guess what? Get an assured IRR of 17 percent.

Assetmonk is committed to providing investors with top-notch alternative investment opportunities backed by real estate. The investment products offer a guaranteed Internal Rate of Return (IRR) of 17% and are secured by assets. Additionally, it assures investors of a seamless exit option.

These investment opportunities are carefully selected from India’s thriving private markets and are overseen by a trustee registered with SEBI.

With a minimum investment of just 10 lakhs, investors can enjoy the benefits of stress-free investing and attractive high returns. This is an exceptional chance to capitalize on India’s economic growth and be part of its success story. Don’t miss out on this exciting development that allows you to ride the wave of economic prosperity in India.

How can Invest 10 lakhs with Assetmonk Benefit You?

Assetmonk’s real estate-backed structured debts can be an attractive investment opportunity for retail investors due to several reasons:

- Diversification: Investing in real estate-backed structured debt allows retail investors to diversify their portfolios by adding exposure to the real estate market, which may not be closely correlated with the performance of traditional asset classes like stocks and bonds.

- Higher yields: Real estate-backed structured debt products, such as Asset Backed Securities (ABS) often provide higher yields with an assured IRR of 17 percent.

- Capital preservation: Some structured debt products offer capital protection features, meaning that investors may be protected from significant losses in case the underlying real estate assets underperform. This makes them an attractive option for risk-averse investors seeking income and capital preservation.

- Predictable cash flows: Real estate-backed structured debt products typically provide regular and predictable cash flows in the form of interest payments from the underlying mortgages or loans, making them suitable for income-seeking investors. The IRR generated from the investment is also assured for investors.

- Exposure to real estate market growth: By investing in real estate-backed structured debt, retail investors can indirectly participate in the growth of the real estate market and benefit from potential increases in property values.

- Professional management: Structured debt products are managed by experienced professionals who carefully analyze the underlying assets and structure the products to optimize risk and return for investors.

- Liquidity: These real estate-backed structured debt products, such as ABS, MBS, or CMBS, are traded in the secondary market, providing investors with a certain level of liquidity.

Considerations Before Investing 10 Lakhs to Get Monthly Income in India

Before investing 10 lakhs to get monthly income in India, it is crucial to consider the following factors:

Risk Tolerance

Evaluate your risk tolerance and choose investments that align with your comfort level. Investments with higher potential returns may carry greater risks.

Diversification

Diversify your portfolio across different asset classes to mitigate risk. Consider allocating your investment across multiple options to balance potential returns and income stability.

Time Horizon

Determine your investment time horizon, as it can influence your choice of investment options. Investments with longer lock-in periods may provide higher returns but limit liquidity.

Tax Implications

Understand the tax implications associated with the chosen investment options. Consider the impact of taxation on the monthly income generated.

Bottom Line

Investing 10 lakhs to get monthly income in India requires careful consideration and understanding of various investment options. Fixed deposits, Post Office Monthly Income Scheme, debt mutual funds, dividend-paying stocks, REITs, and systematic withdrawal plans offer avenues for consistent income. Each option comes with its risks, returns, and tax implications, and it is crucial to align your investments with your financial goals and risk tolerance.

Before making any investment decisions, conduct thorough research, assess your investment objectives, and consult with a financial advisor if needed. Diversifying your investments, staying updated with market trends, and reviewing your portfolio periodically is key to maintaining a successful income-generating investment strategy.

Assetmonk, an emerging and fast-growing alternative investment platform in India, focuses on delivering outstanding investment opportunities supported by real estate assets. With a significant presence in Mumbai, investors have the opportunity to explore a wide range of carefully selected, high-yielding projects sourced from the thriving private markets in the country. By investing a minimum of Rs. 10 lakhs in our structured debt offerings in commercial real estate, investors can confidently secure a guaranteed Internal Rate of Return (IRR) of 17 percent.

Reference Links

- A Comprehensive Guide On Fixed Income Investments.

- Structured Debt Backed by Real Estate vs. Debt Mutual Funds: Exploring Risk and Yield Potential.

- Structured Debt Backed by Real Estate vs Public Provident Fund.

FAQs

Q1. How to invest 12 lakhs for monthly income?

A. The best way to invest Rs 12 lakhs for monthly income is structured debt real estate. Structured debt backed by real estate refers to investment products that offer fixed-income opportunities by utilizing real estate assets as collateral. Real estate-backed investments can offer attractive returns through interest payments and potential capital appreciation. Generally, these investments have the potential to yield returns ranging from 12 percent to 18 percent.

Q2. Which investment will give me monthly income?

A. Commercial real estate structured debts will give you monthly income. You only need to invest with just Rs. 10 lacs and get an assured iRR of 17 percent via Assetmonk.

Q3. How to invest 15 lakhs for monthly income?

A. Fixed deposits, Post Office Monthly Income Scheme, debt mutual funds, dividend-paying stocks, REITs, and systematic withdrawal plans offer avenues for 15 lakhs with consistent income.

Q4. Can I invest money and get monthly income?

A. Yes, you can invest money and get monthly income. In fact, the best way to invest and get monthly income is via real estate. You can get real estate monthly income via rental income.

Listen to the article

Listen to the article