- If you’ve been keeping a close eye on alternative investments in the real estate space, you must have heard about fractional ownership of real estate by now. You’d also be well aware that fractional ownership of commercial real estate is gaining traction in the realty alternative investment space.

- As per data from global real estate consultant Knight Frank, the market for fractional ownership of properties in India is expected to reach $9.8 billion in 2025, from $5.4 billion in 2020. This is an increase of 65%, with an annualised rate of 10.5% (!).

- And based on a Mordor Intelligence report, the fractional ownership market for commercial real estate is expected to bounce from USD 5.4 billion to USD 8.9 billion come 2025.

- Understanding the concept of fractional ownership is one thing. There are certain other aspects that might be a tad confusing for investors looking to venture in the fractional ownership space, such as the concept of Special Purpose Vehicles (SPV), or how taxation works for fractional ownership investments.

- In this article, we’ll take a look at SPVs in fractional ownership of real estate, and how they play a pivotal role in the fractional ownership model.

Special Purpose Vehicles in Fractional Ownership

Fractional ownership of real estate is an investment model in which multiple investors come together to split the cost of acquisition of real estate. The real estate could be commercial real estate, or even luxury holiday homes or residential properties.

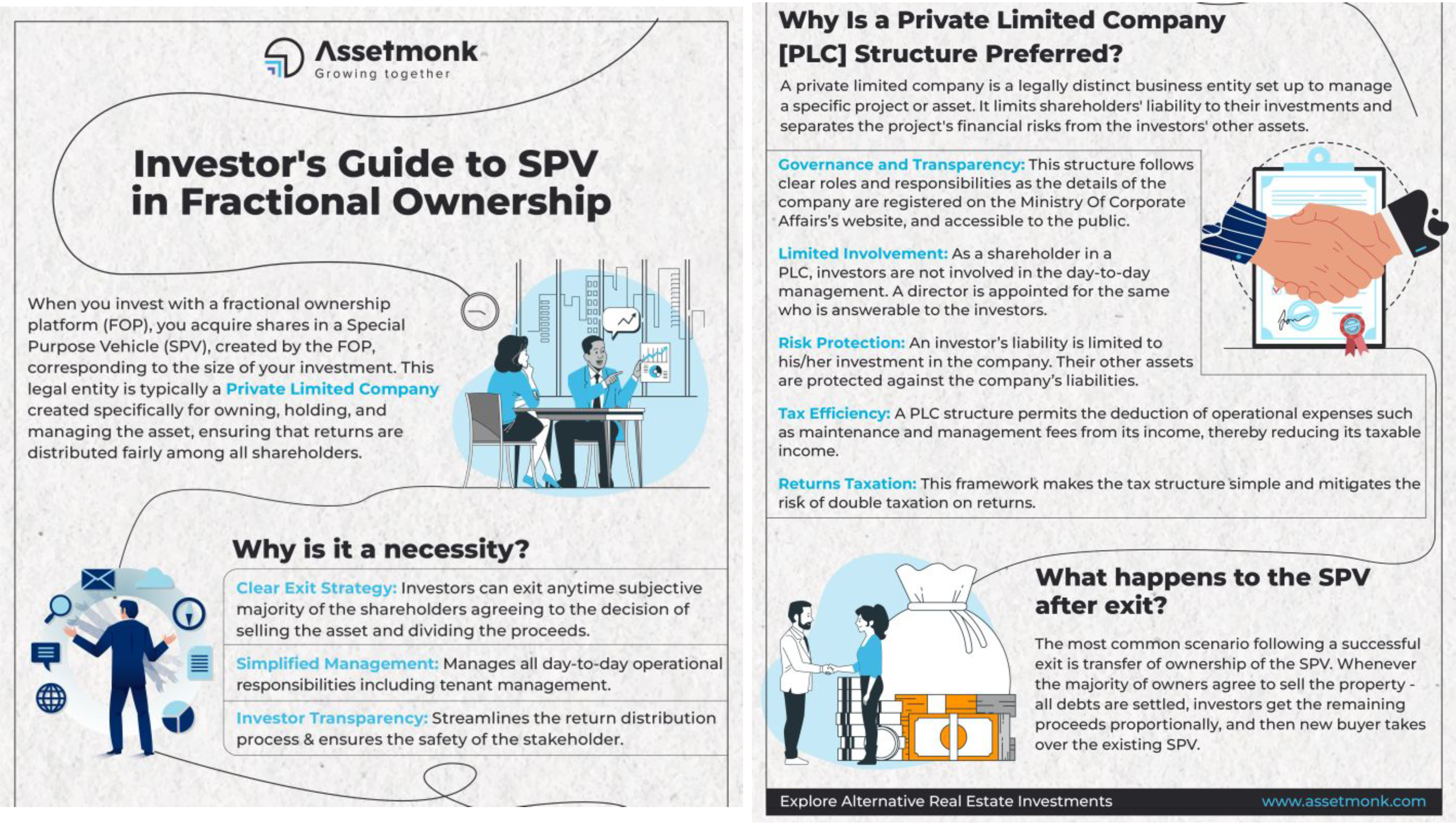

In this model, the acquisition of the property is done through fractional ownership platforms (such as Assetmonk), and the investors invest in a security issued by a Special Purpose Vehicle (SPV). This SPV is used to purchase the real estate asset.

SPVs, or Special Purpose Vehicles are distinct legal entities. They are created for a specific purpose, often investment or to or to isolate financial risk. In the context of alternative investment in real estate, SPVs in fractional ownership serve as the vehicle through which multiple investors pool in their resources to collectively acquire and manage commercial properties.

Key Advantages of SPVs:

Limited liability, tax efficiency, and streamlined management structures – these are what SPVs provide to investors. SPVs offer a unique level of protection and transparency; they achieve this by segregating assets and liabilities from other business ventures – a feature that traditional investment models may lack.

SPVs in Fractional Ownership: Briefly Explained

If that seemed a little complicated, here’s an simpler explanation in the form of an analogy.

Consider the investors who are investing in fractional ownership to be guests at a grand buffet in a large banquet hall.

Investing in fractional ownership models through a Special Purpose Vehicle is like attending a grand banquet, where the SPV is the head chef who has orchestrated the entire buffet which the guests are there to eat, and the Fractional Ownership Platform (FOP) is the host of the party, the one who has invited the investors to gather and indulge in this banquet of real estate opportunities.

How SPVs Are Beneficial for Investors

Active Management

A lot of the day to day responsibilities of property management are delegated by investing through an FOP. Through SPVs, investors can collaborate with experienced asset managers to optimize property performance, enhance tenant satisfaction, and drive revenue growth.

Capital Appreciation

One of the primary drivers of returns in real estate investment is capital appreciation. Capital appreciation is how the value of your property increases over time. By investing in high-growth markets and emerging sectors, investors can capitalize on appreciation potential and unlock significant value through SPVs.

Distribution Reinvestment

The rental income you generate through your commercial property investment is distributed through SPVs. SPVs distribute dividends to investors based on their proportional ownership.

Fractional Ownership: Breaking Barriers of Real Estate Investment

In late 2023, the Securities & Exchange Board of India (SEBI) approved amendments to its REITS (Real Estate Investment Trusts) Regulations, 2014 to create a regulatory framework for fractional ownership. In doing so, it gave acceptance to fractional ownership models of investing in real estate.

SEBI extended its ambit to Small and Medium REITS (SM REITs) with an asset value of at least Rs 50 crore.

Traditionally, a large amount of capital and experience were needed to invest in commercial real estate, making it out of reach for many ordinary investors. But fractional ownership, which enables people to buy shares in valuable real estate for a small portion of the asking price, democratises real estate investing.

Most fractional ownership platforms offer reduced entry thresholds, and Assetmonk offers a minimum entry ticket of Rs 25 lakhs, and access to premium commercial real estate assets. INR. This approach enables investors to diversify their portfolios and access premium real estate assets without the burden of sole ownership.

Bottom Line

Fractional ownership has changed how the world looks at real estate investments. It is a paradigm shift, providing ease of access and potential for global growth through technological advancements. It’s a cornerstone of the modern diversified investment portfolio.

As the real estate sector in India grows, platforms that prioritise transparency, due diligence, and an overall good experience for investors will come to the front.

At Assetmonk, we’ve embraced our role in shaping the future of fractional ownership in commercial real estate in India.

Fractional ownership of commercial real estate is all set to become a mainstream investment avenue. Investors who embrace this model stand to benefit from a more flexible and rewarding real estate investment experience in the years to come.

Assetmonk’s web based investment platform facilitates access to these opportunities. We also contribute to the evolution of the real estate sector, and are ready to guide investors in their fractional ownership journey.

Read More

SEBI Approves Framework for Fractional Ownership Assets

Fractional Ownership In Commercial Real Estate

Source Links For Data Provided:

https://www.financialexpress.com/money/fractional-ownership-is-unlocking-new-opportunities-for-investors-in-real-estate-3286278/

https://www.knightfrank.com/siteassets/subscribe/the-wealth-report-2022.pdf

Listen to the article

Listen to the article