Even if you haven’t actively followed the news, you can’t have missed this year’s main issue and concern: record-high inflation. Investors have been keeping a keen eye on inflation for good reasons. Inflation soared first owing to supply chain concerns caused by the coronavirus outbreak and recently due to disruptions in energy markets caused by Ukraine’s invasion. Inflationary forces are becoming more established and pervasive. But, among all of this commotion, the persistent concern remains, if we cannot remove inflation, how can we protect ourselves from its effects? It is where real estate investing becomes crucial.

For the past two years, the economy has gotten affected by excessive inflation. In a growing country like this one, investors must deal with high inflation rates. Inflation is a slow, quiet killer that progressively erodes the purchasing power of money. Hence, the purchasing power of accumulated savings. Over time, inflation may destroy wealth.

To develop wealth, annual growth in cumulative savings must be greater than the inflation rate. If your cumulative savings increase at a slower rate than the rate of inflation, your saving corpus is declining since the value of the rupee today is lower than it was at the start of the year. Because of inflation, the rupee today buys fewer goods and services than it did a year ago. As a result, beating inflation is critical for every investment.

As the worth of savings decreases at an alarming rate, each year so does the need to invest. The rising cost of living limits the amount of money that can get saved. We all want to be able to live comfortably in the future, and because we live in an expensive culture, we are always looking for methods to enhance the money we invest. We are always seeking ways to increase our riches.

Maintaining a close eye on the market’s alternatives, real estate investing is a solid approach to safeguard its investors against inflation.

Inflation Meaning?

Inflation is the average increase in the prices of a group of products and services in a given economy over a specific period, generally measured in years. Simply, it is the gradual decline in the dollar’s purchasing power. Using an inflation rate of 1.8 percent, the $400 washing machine you purchased last year will cost you an extra $7.20 today. It may not appear to be much, but when you sum up all of your purchases throughout the year, including food, petrol, phone bills, massages, and so on, you’ll have a lot greater amount and higher cost for things over time. If a country has above-average inflation, the effects may get magnified. In Greece, for example, inflation has approached 5% in the last decade, meaning that the identical $400 washing machine would incur an additional $20.

It is critical to understand that inflation is not the same as appreciation. An appreciation rate in real estate is the growth in the value of a property over time. Value does not rise in respect to the currency when it rises in response to demand. You can have scenarios where a property gains more than the inflation rate, or where it depreciates in an inflationary economy.

India’s Inflation Rate Over the Last Ten Years

Inflation is a measure of a country’s economic health. The inflation rate is the percentage increase in prices, products, and services in an economy, impacting the cost and living circumstances. It manifests further as higher mortgage interest rates and diminished savings, plus influencing the level of benefits and state pensions obtained.

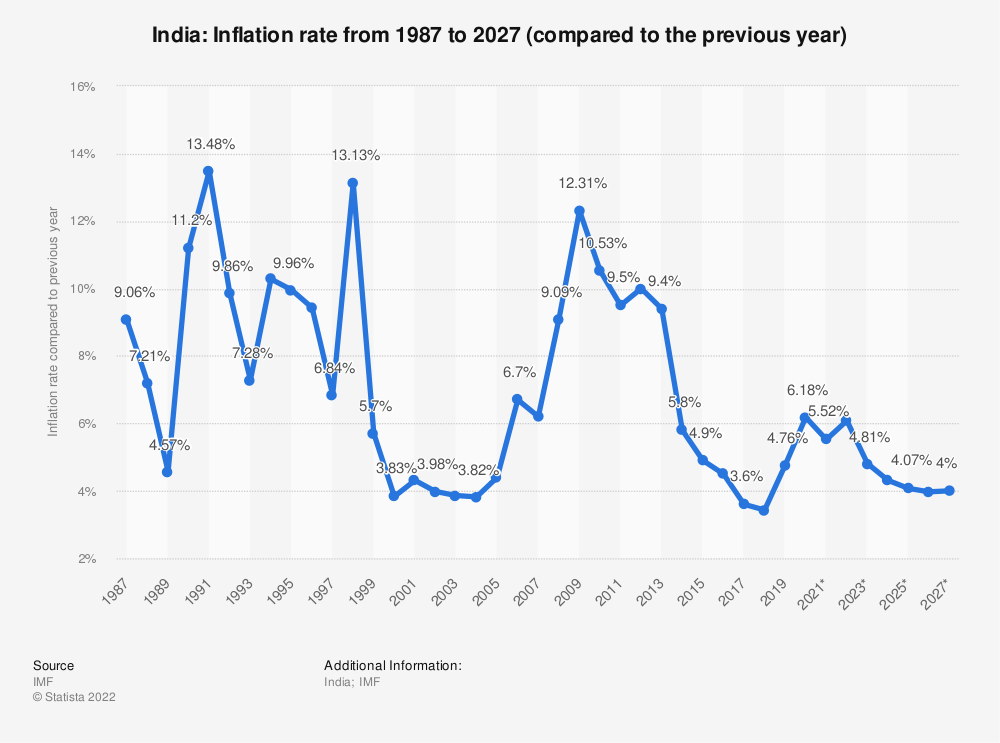

The figures below show India’s inflation rate from 1986 through 2020, with estimates until 2026. In 2020, India’s inflation rate was 6.18 percent higher than the previous year. For further information, look into the country’s economic growth.

Source: Statista

As shown in the graph above, a record inflation rate of around 13.48 percent occurred in 1991. It reached a low of 3.6 percent in 2018, only two years before the pandemic.

Although it surged again and nearly doubled to 6.18 percent in 2021, inflation gets expected to decline in the future years.

While we may blame the country’s developing stage, high unemployment, and poverty rates for such elevated inflation in the pre-2000 era, the inflation from 2008 and 2012 can get linked to an Asia-wide increase in oil and commodity prices, which hit India. The government, meanwhile, fueled the fire of inflation at the time by raising gasoline prices to cut subsidies, which cost nearly 3% of GDP.

But, with India’s GDP (Gross Domestic Product) continuously increasing in recent years, the country’s economy is currently operating well, resulting in a reduction in national debt.

Inflation Protection Through Real Estate Investing

Between the peaks and troughs of Covid19 and the Russia-Ukraine war, inflation has returned to the forefront. Inflation in India has risen by 7% in the last two months. With growing living expenses and customers carefully weighing investment returns, investors are faced with a basic question: What does inflation mean for property investment?

- In India, inflation has been rising rapidly, but one thing has outpaced inflation: real estate. Even if we must invest a large quantity of cash in the beginning, the revenues from real estate provide a gigantic amount of return to the investor. The fundamental reason inflation does not affect real estate is that it gets determined by geographical region rather than the actual market.

- The real estate industry has four subsectors: housing, hotel, retail, and commercial. Investing in the housing sector can help you develop your original investment into something substantial down the road since property values rise even when inflation escalates. The capacity to vary the price of a commodity daily allows the hospitality business to retain profit margins despite escalating prices, rendering hotel investments a risk-adjusted hedge against inflation. Investing in commercial real estate mitigates risks and benefits from inflationary safeguards. As the cost of materials and labor pay rises, supply becomes limited, causing rental rates and property values to rise. Real estate is an internationally recognized industry that is rapidly expanding. The rise of real estate gets inextricably linked to the need for space and accommodation.

- Even if inflation rises, it is possible to predict that the total rise in the value of your real estate will beat your anticipations. Also, inflation is a natural component of the economy, and a wise investor will hedge his stakes on outperforming assets regardless of inflationary pressure. The Indian real estate industry gets predicted to grow at a CAGR of 9.60% between 2022 and 2027, per research “India Real Estate Market: Industry Trends, Share, Size, Growth, Opportunity, and Forecast 2022-2027.” India has a latent demand for inexpensive homes, which would massively increase the demand. Furthermore, the government is investing heavily in rail, road, and aviation infrastructure, which will help to stimulate the broader real estate market in India.

- In India, real estate is a safe investment vehicle, and also no degree of doubt generated by inflation can even marginally reduce its value. As a result, it is seen today as the most realistic alternative when contrasted with other investment possibilities. Furthermore, the owner can control the return on their investment. Not to mention the tax advantages that come with ownership of the real estate. Also, historically, the returns on real estate have exceeded those on other asset types.

- Inflationary eras get typically characterized by high mortgage rates, greater costs of materials, and growing costs of debt. No doubt, these factors can briefly slow down but not stop development. India’s market may yet bet against all odds and profit from its current undervaluation. As a result, the V-shaped recovery projected for the start of 2022 will almost certainly materialize.

- This optimism arises from the fact that real estate in India is becoming more technologically savvy at every level, lowering operational costs. Machine learning, analytics, and AI are being used to solve issues before they occur. Foreign investors hold high esteem for India’s real estate sector, and with government measures, this investment will only grow. Inflation is lagging far behind potential in this race.

The question should not be if but when. When should you start investing in real estate? And the answer is now. The appreciation of your business property rates will compensate you for the consequences of inflation. In your daily routine, it may look so, but years of owning and maintaining that asset can only help you in the long run. Real estate has always been seen as a hedge against inflation. As the purchase value of money falls, real estate offers security.

Rather than lazy equity, investors may invest in properties with high cash flow. Right now, the advantages of real estate investing exceed the disadvantages. In addition, during periods of high inflation, real estate owners will include rent increases in their leasing contracts, known as escalation clauses. The provisions are directly connected to inflation. You can also have a larger number than regular escalation clauses under normal circumstances. In conclusion, real estate is an effective inflation hedge, and most investors will concur that real estate is resistant to negative inflation effects.

If you are interested in investing in real estate, Assetmonk is here to help you. Assetmonk recommends that clients diversify their investments. As a result, you can seek advice from our asset and property specialists. Assetmonk provides commercial real estate investment opportunities via fractional ownership and crowdfunding. It also offers residential real estate packages, such as co-living and senior housing, that are highly regarded and chosen projects.

Listen to the article

Listen to the article