Asset Management vs Wealth Management

Earning money may seem difficult, but that is not always the case in spending it. Keeping control over the income ensures financial stability in the long run. The financial sector today offers several ways to invest and use our money. Thus, it has become difficult to manage our finance effectively without professional financial advisors’ advice.

The concept of asset management and wealth management has become quite popular in recent times. The concepts may sound familiar, but certain differences need to be understood.

What is Asset Management?

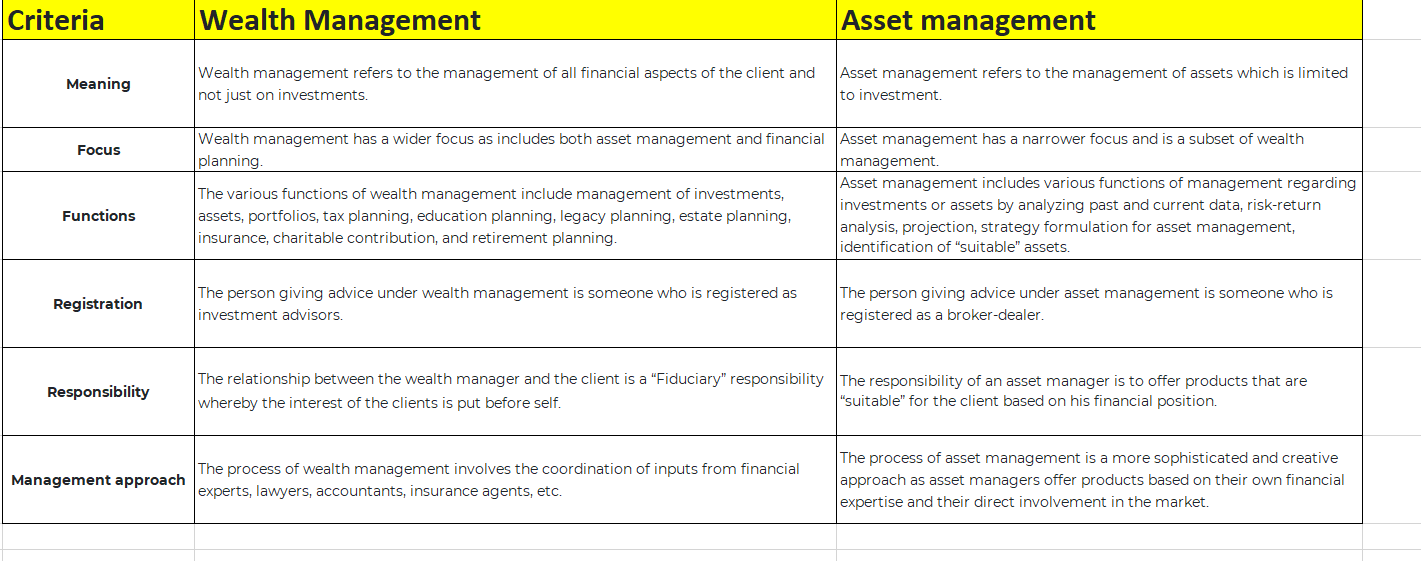

- The simple meaning of asset management is the process of managing your assets. Even though the concept of asset stretches along all forms of assets and financial holdings, the term asset under asset management is focused on your investments like stocks, bonds, mutual funds, ETFs, real estate investments, etc., which grow your wealth and prepare for the future.

- The concept of asset management is a subset of wealth management. The asset management activities have been carried out by conducting risk-return analysis, making projections, and identifying suitable asset classes for the clients.

- The main goal of asset management is to ensure that you invest in the best possible asset class to maximize your profit margin.

- An asset manager helps his client by determining the best-suited investment based on their financial situation. The investment is planned byways of asset allocation in different asset classes.

- The asset managers earn a percentage of assets under the management. It is a less complicated approach than the wealth management approach, but it is a less comprehensive method.

What is Wealth Management?

- Individuals with a high net worth may require additional services than those provided by standard financial consultants. Those with millions, if not billions, of wealth, may have complex portfolios, difficult tax circumstances, and other requirements that ordinary investors are unlikely to have. And that is where wealth management and wealth managers come in. Wealth management is the most sophisticated type of financial adviser service.

- The concept of wealth management can be described as examining the financial situation of an individual or his family. The main objective of wealth management is to maximize long-term wealth.

- This also includes all kinds of financial planning, tax planning, and retirement planning.

- The financial advisors can also help you with education planning, legacy planning, insurance, and even charitable giving.

- Wealth management is also the consulting process of addressing affluent customers’ requirements and desires by delivering suitable financial goods and services. Coordination of a team of professionals to satisfy the demands and desires of rich customers is what wealth management includes.

Some of the services provided by wealth managers include:

- Tax planning

- Education planning

- Legacy planning

- Estate planning

- Insurance

- Charitable giving

- Retirement planning

The wealth management process can be carried out with several experts apart from financial advisors, which includes accountants and lawyers. They can be brought in to understand the different aspects and angles of wealth management.

A lawyer also plays a vital role in understanding wealth management as it includes aspects such as estate planning in which the passing of the wealth legally takes place.

The main focus of asset management may be to grow the money of the investor. On the other hand, the main focus of wealth management is the client’s overall financial situation and recommends steps that could be taken to ensure that their wealth is protected in the long run.

The wealth managers are often paid through a percentage of the wealth they help manage or through a flat or hourly fee.

What is An Asset Management Company?

The asset management company is a firm that carries out the investments by dividing your funds into stocks, bonds, real estate, master limited partnerships, and more.

They also have plans for high-net-worth individuals as they manage funds and provides pension plans.

They also help smaller investors with investments such as mutual funds, index funds, or exchange-traded funds, which can be managed using a single centralized portfolio. Asset management companies are also referred to as money managers or money management firms that offer public mutual funds or exchange-traded funds (ETFs). They are also called investment companies or mutual fund companies.

Don’t miss A Step By Step Guide To Choose A Modern Asset Management Company.

Difference Between Asset Management vs Wealth Management

Bottom Line

The question of wealth management and asset management often depends on the kind of service you need. The concept of wealth management is a process of managing the financial life and portfolio of an individual.

In contrast, asset management is a concept of choosing the best way to make investments after considering your financial position. Some financial advisors provide both assets and wealth management services, making it easier and cost-efficient.

Concern regarding real estate investments? Assetmonk is an online platform offering different real estate investment opportunities. Assetmonk also offers you the best investing options after considering your financial position.

Asset management and Wealth Management FAQs:

Asset management is the process of managing your assets. All kinds of assets are not included under the head of asset management as it includes only investments. Thus asset management can be described as the process of managing your investments and determining the best option to invest in after considering your financial position.

What are the types of asset management?

The different asset management types include Digital Asset Management (DAM), Fixed Asset Management, IT Asset Management (ITAM), Enterprise Asset Management, Financial Asset Management, and Infrastructure Asset Management.

Wealth management is the process of managing all the financial transactions of an individual. It is a broad concept and includes tax planning, education planning, legacy planning, estate planning, insurance, charitable giving, retirement planning, etc.

Why is wealth management important?

Wealth management is important as it helps you decide what you want from your future and how your financial abilities can help you attain your objectives. The key goal of wealth management is to plan to attain your goal irrespective of whether it is a one-year plan, five-year plan, or ten-year plan.

How does wealth management make money?

The wealth managers are often paid through a percentage of the wealth they help manage or through a flat or hourly fee.

Listen to the article

Listen to the article