The real estate transactions have almost come to a standstill due to the pandemic countermeasures like social distancing and lockdown that were enforced across the nation and the globe at large. With the shutdown of the markets and the public restricted to the house, the real estate activities were stalled, which introduced falling trends in demand. This led to the property prices correcting across the major cities of the country. This adjoined with the decades’ low-interest rates made the cities more affordable.

The fall in property prices is sharp, ranging between 16% – 19%, according to the latest report by Knight Frank Research for the months between July and December 2020. Let us get to understand them further.

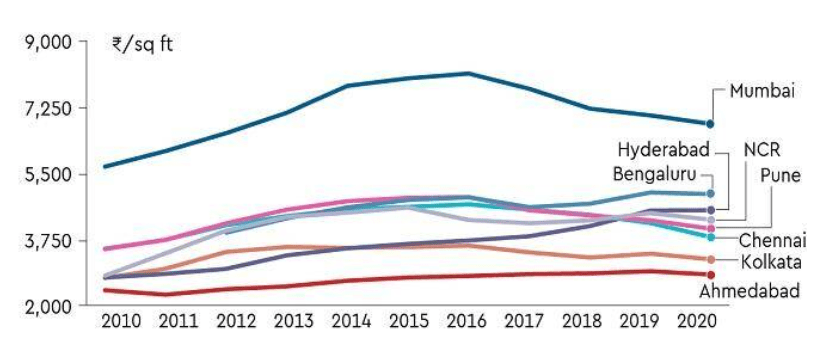

Price Correction across Various Cities

The report has provided the price correction percentage information of the major cities over four years, i.e., from 2016 to 2020, which are as follows.

Chennai has witnessed the steepest price correction of 19%, and Pune stands right behind with the correction percentage of 17%. Mumbai occupied the third position with a sharp fall of 16% but remained the most expensive city.

While these cities have seen a drop in prices, NCR has maintained the equilibrium with no correction. Among all the major cities, the ray of hope to the property owners is provided by Bengaluru as it experiences an increase of 2% in the property prices in these last four years.

Affordability Comparison of Various Cities

The price correction has been reflected in the affordability that has increased in almost all the country’s top eight cities.

Mumbai had seen affordability significantly increase from 100% in 2011 to 61% in 2020. This means that the average household needs to spend around 61% of the income on the EMIs, which was 100% earlier. While Delhi had seen a correction in its affordability from 64% in 2011 to 38% in 2020, Bengaluru has improved its affordability index from 53% to 28% over a decade. The most affordable city in the country is Ahmedabad with the affordability of 24%.

Source: Knight Frank Report

Residential Markets

The government policies like reduction in stamp duty, tenancy law, and the increase in the difference between circle rate and market value of the property have added to the rise in the residential properties’ sales in all the major cities.

The home loan interest rates are at the decade’s lowest adjoining the sentiment that sparked off the pent-up demand during the festive season. Experts say the trend of lower home loan rates is expected to continue for a year to get the market back on track.

The sales have increased by 60% in the July-December 2020 period compared to the first half of the year. The sales in the cities have been recorded at a massive figure of 94,997 units. The annual sales however declined by 37% in the year 2020 as compared to the previous year.

Of the residential sales in the second half of the year, 57% belonged to the category of over Rs.50 Lakh priced properties, while the affordable segment constituted only 47% of the sales. This justifies the increase in the transaction of the high-end category.

The new launches in 2020 have recorded a 34% slump, and the figure stood at 1,46,628 units. When the launches are split into the half-yearly period, the first half of 2020, i.e., from January to June, saw a 42% increase in the launches.

The unsold inventory has declined by 2% throughout 2020, attributed to the halt in the new launches.

Office Markets

The year started with a bang recording 96% of the quarterly average of the previous year. No sooner had the sales increased than the pandemic imposed lockdown has stalled the office market. The office market hence has a turbulent graph across the year. The fall in the office leasing activities in the second quarter of 2020 is attributed to economic inactivity. The leasing activities have covered 31% of the quarterly average of 2019 in the third quarter of 2020 due to the easing restrictions. There was a tremendous rise of 115% in the fourth quarter of the year 2020 that demonstrates the market’s comeback and the industries at large.

Among all the cities that experienced a fall in property prices, Bengaluru and Hyderabad have stood firm against the challenges. Hyderabad was resilient to the fall in property prices, and Bengaluru has witnessed an increase instead. The rental sector has remained stable in these cities, exhibiting the strength of the markets. Investments like office spaces, data centres, and warehouses have been trending lately. The developers have a strong reason to spearhead, and the investors have a strong cause to invest in these cities that stand firm against the falling trends.

What else could be a better investment than which stands strong against the drooping markets? Investing in real estate seems rewarding enough in strategic locations like Bengaluru and Hyderabad. Invest today through Assetmonk, an online platform that gets the best properties to you across the cities like Hyderabad, Chennai, and Bengaluru. Only the assets which have undergone thorough due diligence make it to our list. We present the products in Growth, Growth Plus, and Yield, one of their kind to suit every investor’s needs. Navigate to know more about the investment options!

Falling Trends in Property Prices FAQ’s:

How is Indian real estate in 2021 going to be?

The Indian Real Estate sector is exhibiting resilience to the falling market during tough times like pandemic, states a report from Knight Frank. So, it is expected to rise in the coming years.

What are the markets that remained positive despite challenges?

The prime office markets, residential and unique sectors like student housing and senior living have shown an excellent performance.

How did the Residential Market perform?

The residential market has seen a downtrend due to the stalling construction activities during the pandemic. Still, it seems to recover due to the pent-up demand and the government policies adjoining festive sentiment.

Is there a scope for Senior Living spaces?

Senior living spaces are the specially constructed housing units for elderly people who are aged above 55. Like medical support and engaging social activities, the infrastructure is the unique features of the living spaces. With the more senior living population in India growing with each year, these have gained prominence.

Listen to the article

Listen to the article