What are Trends?

Trends are a possibility to assess the real movement in the market, predict a transformational change in the product in picture, and identity patters that can impact significant factors like demand, supply, business profits, and customer services. Trends are insights into a variety of influences that can impact any nosiness.

CRE Trends: Why They Matter?

Commercial Real Estate trends help stakeholders understand the bigger picture and the dynamics of the existing market. To maintain the level of competition, excellence, proficiency, and leadership in Commercial Real Estate, it is imperative to comprehend the various trends that affect the market and are highly influential in decision making, planning, and profitability.

Commercial Real Estate Trends in India

Around a decade ago, Asia Pacific Real Estate or CRE trends in India were at full throttle, and there was a boom in the business despite the global financial crisis. But eventually, things took a downward trend, especially in the case of residential developers, when the banking sector pulled the plug as issued by the Government in lieu of the growing risk of credit that was rolling in the market. Real Estate lending took a toll, and even NBFCs were in dire straits, thus leaving Commercial Real Estate of the country without any financial support.

Challenges Faced by The Commercial Real Estate Sector in India

Globalized wars regarding increased volatility in currency.

- Lower yields and productivity and a shortage of properties that were worth investing in.

- Hike in the rate of interest and huge cost to avail of finance for CRE business.

- Understanding CRE trends and how to utilize them.

- Intense competition from Global buyers, especially from Asia.

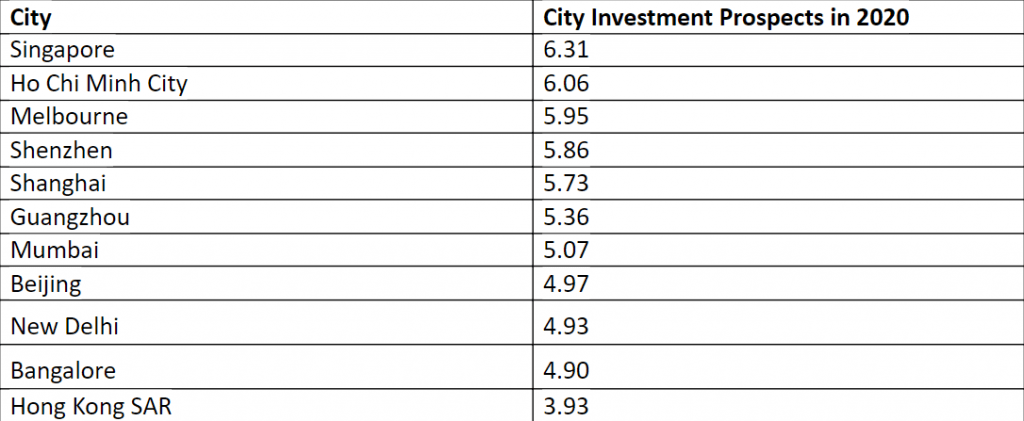

Below is a comparison of Indian cities and the prospects of city investment.

We have three Indian cities featuring in the list of Prospects in CRE Investments – Mumbai, New Delhi, and Bangalore. But the rate of prospect is much lower in competition to other global cities.

Why Should One Study CRE Trends?

Let us look at how the Commercial Real Estate stakeholders benefit by understanding the trends that drive evolution and help the relevant people involved in navigating the market successfully. These insights into the CRE Trends can enhance firms’ performance and leverage the industry’s successful working through proper research and scrutiny of these trends.

It helps to Create a Strategy

Trends in CRE that make owners proactive rather than depend on haphazard changes in the industry, which is unreliable. Information gathered from CRE trends can be useful in gathering relevant information to strategize the next move, proactively plan the action, and monitor and control the situation effectively instead of being blindsided by offhand and irrelevant market information. proper assessment and analysis of what worked for the real estate better and the reasons for its growth, identify its scope for improvements, and work on it to avoid hiccups that could evolve and respond accordingly and accurately. A proper strategy needs to be planned, implemented, and monitored after studying CRE trends thoroughly.

Helps in Identify Opportunities

Trends in CRE help owners and players to identify and gauge the opportunities and prospects. There could be several openings and areas of growth that they can venture into, like expanding new segments of assets, driving efficacies by discovering various other geographic areas, and thriving markets, exploring innovative and updated technologically sound markets much more. It is highly recommended to take the existing and forecasted trends of the CRE market into consideration to assess the market niche that stands by the current strategy used. That seems profitable for the organization and all the partners and stakeholders of the firm.

Finally, to Drive Excellence and Efficiency

Keeping a tap on the latest market trends can solve many business and finance related problems and can offer multiple solutions to a myriad of blockages that a firm may face. Keeping track of emerging and innovating technologies can streamline the planning, strategizing, and controlling of the firm’s operations, thus providing value to investors and investment management solutions.

CRE Technology is a Basic Necessity

CRE Technology has greatly influenced the current trends of growth in the industry and is a basic necessity for investors. Its transition from just being a luxury has delved into the fact that today without the use of the latest and conventional meals of technology, it is hard to cope with the fast churning of the real estate business. CRE based technology has greatly benefitted the industry to save valuable time that now can be invested in value-add services. It has become the driving force for back-office efficiencies.

It has immensely helped sponsors and investors to get the maximum output thus increasing their expectations and promising them a better tomorrow. More than 80% of investors are keen on working and investing in modernized firms that have prioritized and emphasized on the emerging world of technology. Predictive analytics has been a turning point in technology and has enhanced the market to a new level. The inculcation of predictive analysis, business intelligence, and analysis of CRE trends can harness insights and help mold investment decisions to lucrative business deals and high growth in the CRE business.

Commercial Real estate trends are futuristic and highly advantageous, keeping the future in perspective. They provide easy access to visualized data and vital information on a real-time basis and on smartphones, which were never the case in the conventional way of running CREs.

These trends are the new normal, and professionals in the CRE industry thrive on adopting and using technology to make data-driven and profitable decisions and keep a steady pace with the investors’ evolving markets and demands. A strong market, together with the boom in technology and the increased interest and expectations of investors, can change the market game altogether and create a well-established background for the CRE Industry.

CRE Trends FAQs:

CREs or Commercial Real Estates are generally grouped under the following groups:

- Office buildings

- Retail workshops and markets

- Industrial Godowns, warehouses, storage centres, manufacturing units and wholesaling departments

- Multifamily units

- Special Purpose properties which are used for commercial purposes.

As far as the trending and insights go, anyone with the following traits and characteristic towards CRE can invest in it:

- He should have the ability to think and think long term ready to take bigger risks

- He should be an expert relationship manager as he would have to deal with multi-level hierarchical employees and would himself be answerable to many. So, he should great leadership qualities along with PR skills.

- He should be able to execute his diligence thus enhancing the profitability and value-added properties of the CRE.

An investor must take the take following into consideration in lieu of following CRE Trends before investing in a property:

- Location of the CRE

- Demand and Supply

- Market rent compared to in-place rent

- Interiors

- Tenant details

- Fitout rent compared to base rent

- Lease structure

- Security deposits

- Diversification

Indirect investing can be done through:-

- Mortgage Bonds

- Real exchange company stocks

- REITS – Real Estate Investment trusts

- Mortgage Backed securities

- ETFs or Real Estate sector focused mutual funds

CRE Trends are an imperative factor to consider due to the following:

- Home prices and home sales in the current market and the desired one

- New construction and the latest deals that have been incorporated

- Property inventory – a crucial asset to take into account

- Mortgage rates – Another significant point to consider and to research before investing in CREs. The current trends followed by existing CRE champions rule and control the factors set and thus need to be implemented accordingly

- Flipping activity

- Foreclosures

A credit score is a mandatory soft tool to decide the credibility and the ability of the loan seeker to repay it without any issues. A minimum of 800 credit score is required toa acquire a CRE loan as per the latest trends and insights. There are a multitude of ways through which the credit score can be maintained like:

- One must always Pay his bills on time every month and to set up reminders and automatic payment procedure toa void delay

- Try to Pay down the debt

- Whatever amount of credit is availed, one must aim for credit utilisation of only 30%

- It is recommended to no to close unused credit cards unless no annual fees are being paid for it

- Regular review of the credit report and one must always dispute in case of any discrepancies.

Listen to the article

Listen to the article