Since economic reforms took shape, Hyderabad deserves special mention among the regions that have grown with massive strides in India. It is hard to think of many other regions that have seen such massive inflows of high-skilled expats. This has contributed to the Hyderabad Dream, of which a natural consequence has been the rise of the Hyderabad Commercial Real Estate Sector in the city.

Hyderabad is one of the regions in India that has grown at a rapid pace since economic reforms were implemented. It’s difficult to think of many other regions that have seen such large inflows of highly skilled expats. As a result, the Hyderabad Commercial Real Estate Sector has grown as a result of the Hyderabad Dream.

In terms of gross office space demand, Hyderabad surpassed Bengaluru as India’s top CRE destination during the July-September quarter. Occupiers concentrated on large block deals, particularly in the BFSI and flexible workplace sectors. According to real estate experts, Hyderabad emerged as one of the most resilient cities following an average performance in the second quarter of 2021.

Also Read: Ultimate Guide for Hyderabad Real Estate Investment

Real Estate in Hyderabad: Prospects

Despite the significant downturns that this industry has faced in recent times in the country, Hyderabad is one of those places that recorded a growth in this sector. Property prices have even gone up quite steadily and rapidly bolstered by sound government policies to draw realtors. Hyderabad’s tremendous advantage over metropolitan cities like Delhi NCR and Mumbai is the relative balance in its property prices. This not only makes it a prime investment destination for big Multinational Giants but also for smaller companies.

While the Real Estate scene in Hyderabad had continued to be dominated primarily by the IT/ITeS sector, new investment channels are gradually picking up pace. Thus major explorations are being done in the areas of rental property, residential and retail real estate. A major ramification of this is that co-living players are slowly making inroads into the Real Estate environment in Hyderabad. It will not be long before they tap into its potential with all their might. Hyderabad had already surpassed Bengaluru to emerge as the no. 1 spot for office property in the first quarter of 2019. It won’t be long before new milestones are achieved.

Best Property Places in Hyderabad

Amongst the various places with excellent potential for the growth of real estate in the state, the most noteworthy ones are listed below with their features:

- Narsingi

- Tellapur

- Adibatla

- Pocharam

- Ghatkesar

Growth dynamics of commercial spaces in Hyderabad

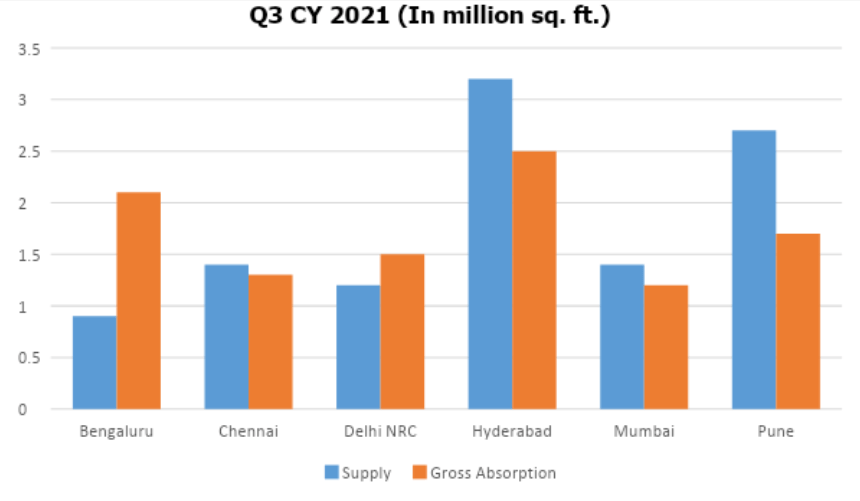

With 2.5 million square feet of leasing volume, Hyderabad surpassed Bengaluru for the first time (MSF). However, on a year-to-date (YTD) basis, India’s Silicon Valley remains the market leader. In the third quarter of 2021, the top six cities in India reported around 10.3 MSF of office gross absorption, the highest volume since the first quarter of 2020. Hyderabad, Bengaluru, and Pune, which are IT-ITeS-driven cities, accounted for 62 percent of gross absorption.

Source: Financial express

Source: Financial express

Experts believe that cities, not countries, are driving Asia’s growth. Over the period 2022-24, Bengaluru and Hyderabad are expected to be Asia’s fastest and third fastest-growing cities, respectively. While Bengaluru has always been the CRE bright spot, Hyderabad has shown tremendous potential and has grown by leaps and bounds in the last decade.

Also Read: Investing in Hyderabad Real Estate-A Boon or Bane?

Hyderabad’s CRE growth story has been aided by a renewed and planned emphasis on the city’s infrastructure, the availability of talent, lower costs, a proactive state government, and favorable state policies.

To maintain its real estate momentum, the state intends to implement several integrated projects throughout the city. In recent years, technology behemoths such as Apple, Google, Facebook, and Amazon have entered this market, resulting in tremendous economic growth.

The BFSI and flexible workplace sectors accounted for the majority of leasing demand in the Hyderabad market, accounting for 66 percent of total demand. The micro-market saw the most leasing traction, accounting for 53% of total demand, while Hitec City contributed 40%. With 10.8 MSF, the region saw the highest supply since Q2 2020, with Hyderabad and Pune contributing the most, at 29 and 25 percent, respectively.

According to industry experts, despite the ongoing pandemic, Hyderabad has demonstrated resilience and is poised for a growth recovery shortly. According to them, while vacancy levels showed an upward trend in the previous quarter, they do not expect a further increase in the vacancy number by the end of 2021 because the majority of the new upcoming supply is already pre-committed.

Also Read: Residential Property Investment in Hyderabad

Experts have also noted that the vacancy may put some pressure on rentals in the short term; however, we are seeing a surge in inquiries for upcoming Grade A projects from occupiers assessing their real estate strategy.

Despite the significant downturns that this industry has experienced in the country in recent years, Hyderabad is one of the places that has seen growth in this sector. Property prices have even risen steadily and rapidly, aided by sound government policies aimed at attracting realtors. The relative balance of property prices in Hyderabad gives it a significant advantage over metropolitan cities such as Delhi NCR and Mumbai. This makes it a popular investment destination not only for large multinational corporations but also for smaller businesses.

While the IT/ITeS sector has continued to dominate the Hyderabad real estate scene, new investment channels are gradually gaining traction. As a result, significant research is being conducted in the areas of rental property, residential real estate, and retail real estate. One significant implication of this is that co-living players are gradually making inroads into the Hyderabad real estate market. It won’t be long before they fully realize its full potential. In the first quarter of 2019, Hyderabad had already surpassed Bengaluru to take the top spot for office property. It won’t be long before new benchmarks are reached. Assetmonk is a WealthTech platform offering real estate investment opportunities with an IRR upto 21% in cities such as Bangalore, Hyderabad and Chennai.

Hyderabad CRE FAQs:

Q1. How do we determine the value of CRE investment?

The value of CRE investments are determined by the demand for building projects in an area that is measured by the kinds of residents, facilities of livelihood, accessibility, etc. And by renovation measures.

Q2. What makes Hyderabad a good destination for CRE?

Industrialization and commercial growth through investments in the Services Sector and steady investment in infrastructure make Hyderabad a liveable city. This naturally shoots up the demand for CRE investment.

Q3. What is the USP of Hyderabad in CRE sector?

Hyderabad is an emerging CRE market and remains one where the absorption of projects is the norm. This is unlike other metropolitan areas in the country. The affordability and range of housing catering to various income groups make it a convenient emerging market with massive potential.

Q4. What is the current scenario of CRE in Hyderabad?

At present, Hyderabad offers a range of properties, most of which offer employees a chance to live in the proximity of their workplace in the IT and allied sectors. More investments and government incentives are to follow in the long run.

Q5. What are the prospects of Hyderabad in CRE market?

To reiterate a point made earlier, Hyderabad does not face saturation problems like the Chennai and Mumbai markets. This, coupled with government will and investment potential in commercial areas, makes it one of the most sound places for CRE investment.

Listen to the article

Listen to the article