Have you been thinking of investing in Indian office spaces in 2022 but are unsure? Commercial office space in India has achieved a rapid recovery in 2022. The office space investment remained stable in the second half of 2020, before ramping up growth in 2021. The improving mood has boosted investor confidence, and the trend gets projected to continue in 2022.

India is regarded as one of the world’s fastest-growing office space markets, owing to increased demand for office leases, the emergence of flexible office spaces, and the expansion of startups and technology firms.

While virus outbreak work from home (WFH) initially lowered office space demand, the accelerated speed of vaccination last year resulted in a relaxation of restrictions and a swift economic rebound, which boosted investor confidence. Thus, 2021 saw a remarkable resurgence in occupier optimism, with pan-India office space absorption reaching 2016–18 levels.

With India predicted to increase at an average of 8% this year, the office space category gets expected to rise in 2022. As organizations embrace hybrid work, co-working office space, which has emerged as the trending option for most occupiers, is predicted to grow at 20–30 percent in seat occupancy.

The Indian commercial real estate sector appears to have a bright future, having exhibited tremendous endurance in the face of the pandemic. Even in the work-from-home environment, office leasing in the top eight cities surged by more than 2.5 times between July and September 2021, per a Knight Frank India analysis. Renting transactions in metro areas returned to 83 percent of quarterly norms in 2019, a year when office space sales were at an all-time high. The ITeS/IT sector remained the primary demand generator during the study period. The non-IT industries also gained ground. In 2022, coworking space is also predicted to increase. It will prosper in these unpredictable times because of its adaptability. It is anticipated that demand would grow in 2022.

Do not miss Will the Hybrid work culture impact the Indian office space market in 2022?

Commercial Real Estate Recovery

| Cities | Office Leasing in Jul-Sep 2021 | Office Lease in Jul-Sep 2020 |

| Mumbai | 1.2 mn sq ft | 1 mn sq ft |

| Delhi NCR | 2 mn sq ft | 0.9 mn sq ft |

| Bangalore | 4.3 mn sq ft | 1.1 mn sq ft |

| Pune | 1 mn sq ft | 0.2 mn sq ft |

| Ahmedabad | 0.3 mn sq ft | 0.1 mn sq ft |

| Chennai | 1.6 mn sq ft | 0.7 mn sq ft |

| Kolkata | 0.1 mn sq ft | 0.2 mn sq ft |

Source: Knight Frank Report

Why should you invest in India office space in 2022?

The Indian real estate industry is seeing a number of spectacular developments, which are driving the commercial realty office segment. Consider the following high-priced transactions: Byju’s, a fast-growing ed-tech startup, has rented a prime 5,701 sq ft office space in Mumbai’s Andheri East for a hefty Rs 13.9 lakh per month. Apple India extended their lease for five years on September 8, 2021, for 15,925 square feet across three floors at Mumbai’s Bandra-Kurla Complex (BKC). HDFC has extended its lease for an entire office building on Dr. Annie Besant Road in Worli, Mumbai, for three years at a jaw-dropping monthly rate of Rs. 1.45 crore. Furthermore, there are other new initiatives in the works. Is it a smart time to invest in commercial office property, given all of these recent developments?

- Increasing demand: According to Anarock’s research, working from home will not become the new normal in India. The rising family sizes, smaller residences, unstable internet connections, and susceptible digital platforms have made most individuals choose to return to work. Around 16,000 new firms have been established, according to the Central Registration Centre since the lockdown. In addition to start-ups, global corporations are looking to India as a center for Data Center Offices and huge commercial premises, particularly in Tier 1 cities.

- Demand from the IT industry has increased: During the study period, over 8,100 digital enterprises got launched across metro areas, per Nasscom. In India, these firms produced around 600,000 employees.

- REITs actively sought additional office space: Embassy REIT financed by Blackstone now has a 42.4 million square foot portfolio spread over 12 offices in several locations. Mindspace Business Parks REIT (with investors such as GIC, Capital Group, and Fidelity) has a portfolio of 30.2 million sq ft. Brookfield is the third prominent name on the list, with 14 million sq ft spread across many Indian cities.

- Rising demand from other industries: The increased office space sparked interest from the banking, BFSI, manufacturing, and consultancy industries. For example, Noida and Gurgaon alone have over 8.5 million square feet of commercial space under construction. Net absorption in metro cities was 15.05 million sq ft in Q3 2021, almost 8% more than the absorption level reported at the same time in 2020.

- Growth of startups: According to Colliers India and CRE Matrix, India’s fast-developing start-up economy will be one of the leading office space occupiers in the future years. It will lead to the lease of 29 million square feet between 2022 and 2024. Despite COVID, office leasing activity by startups gets predicted to climb by 1.3 times from 2019-2021 to 2022-2024, according to the research titled ‘Startups Scaleup.’ In 2019-2020, Indian entrepreneurs rented 22.4 million square feet of office space. Bengaluru is the leading startup hotspot, with a 34% lease share in 2019-21, with Koramangala, HSR, and Indiranagar being popular startup locales. A well-developed ecosystem, technological skills, and an entrepreneurial culture are significant reasons drawing businesses to this location. In terms of leasing by startups, Delhi-NCR is one of the fastest-growing marketplaces, with a three-fold rise in leasing by startups year over year throughout 2021.

Do not miss that Indian Startups Are Expected To Lease Around 29 Million Square Feet Of Office Space In 2022-2024.

But what has propelled the office space growth in 2022?

- High-performance and increased hiring by the IT and ITeS industries.

- The economy is rapidly rebounding, and many businesses are reopening their doors.

- Corporates are making proactive office space selections while working toward long-term expansion ambitions.

- Enhanced amenities, technology advancement, and health and safety elements are increasingly available in offices.

- Co-working facilities are rapidly expanding in India’s major cities.

- More organizations are searching for Flexi spaces for workers in Tier-1 and Tier-2 locations, fueling the expansion of Hub and Spoke models.

- Reverse migration to Tier 2 and Tier 3 cities, and the necessity for office infrastructure in rising markets are driving commercial real estate expansion in these areas.

- With the help of many government programs, infrastructure in smaller cities has grown significantly.

- Workspaces now provide voice control, little surface exposure, automatic attendance, and touch-free accessibility, which has increased investor trust in the post-pandemic environment.

Indian commercial property will continue to attract more investment, with REITs and skyrocketing demand for office space from a rapidly improving economy. The new updates for the commercial sector in the Union Budget 2022-23 have made investment possibilities potentially emerge. The revision of the Special Economic Zone (SEZ) Act, tax breaks, and infrastructure development are intended to spur commercial expansion and, as a result, investment.

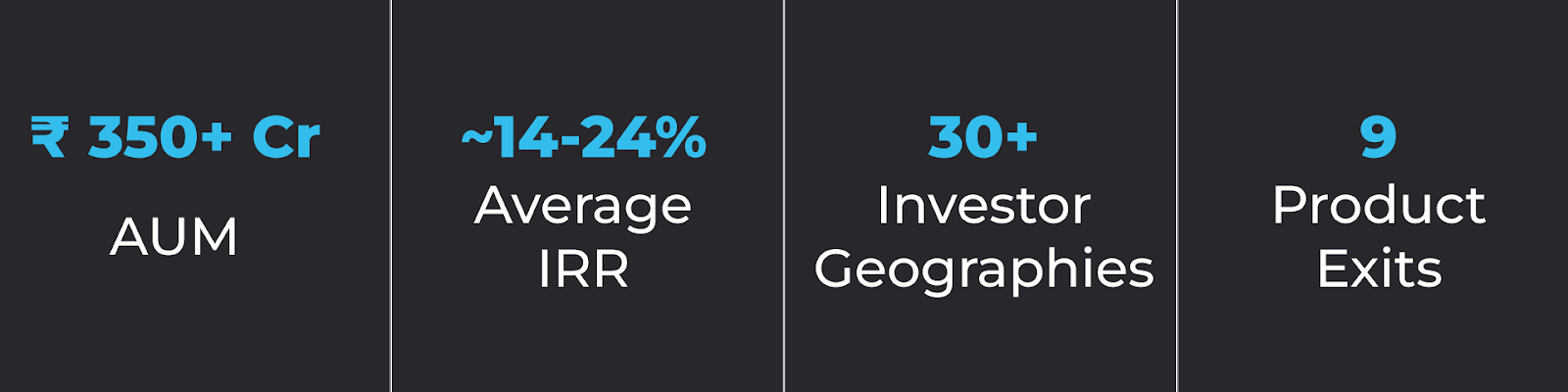

Do you want to start investing in office buildings in India? Assetmonk is India’s fastest-growing wealth tech platform that offers investment options in commercial real estate. After comprehensive due diligence, we provide investment opportunities in upcoming markets. The IRRs range from 14 to 21 percent. Assetmonk also provides fractional ownership and real estate crowdfunding of commercial office space opportunities to investors.

Reasons To Invest In Office Spaces

FAQ’S

Q1. Is Investing In Commercial Office Space A Good Idea?

The Indian real estate industry is seeing a number of spectacular developments, which are driving the commercial realty office segment. Consider the following high-priced transactions: Byju’s, a fast-growing ed-tech startup, has rented a prime 5,701 sq ft office space in Mumbai’s Andheri East for a hefty Rs 13.9 lakh per month. Apple India extended their lease for five years on September 8, 2021, for 15,925 square feet across three floors at Mumbai’s Bandra-Kurla Complex (BKC). HDFC has extended its lease for an entire office building on Dr. Annie Besant Road in Worli, Mumbai, for three years at a jaw-dropping monthly rate of Rs. 1.45 crore. Furthermore, there are other new initiatives in the works. Is it not a good time to invest in commercial office property, given all of these recent developments?

Q2. How do I invest in corporate office space?

. There are many ways you can invest in corporate office space. The following are some ways you can invest in corporate office space.

- REITs

- Fractional Ownership

- Real estate crowdfunding

- REIGs

Listen to the article

Listen to the article