Often referred to as the ‘City of Dreams’, Mumbai is the financial and commercial heart of India, attracting millions of people every year with its promise of opportunity. With a burgeoning economy, rich history, diverse culture, and an increasing global presence, Mumbai’s real estate market remains a robust investment sector. However, understanding the nuances of the city’s land rates is a complex task, necessitating a thorough comprehension of the socio-economic factors that drive these rates. In this blog, we’re set to delve deeply into the analysis of Mumbai’s land rates, aiming to grasp the influential factors that have triggered shifts in these rates. Additionally, we’ll explore other investment avenues that might provide superior returns. So, let’s embark on this insightful journey!

A Snapshot of Mumbai’s Real Estate Market

Property prices in Mumbai are a reflection of the city’s standing as a top-tier global city. A unique mix of space crunch, robust demand, high living costs, and unparalleled opportunities drive the land rates in the city. Real estate in Mumbai is distributed across various categories – commercial, residential, retail, and hospitality, each with distinct price points and trends.

Residential Outlook

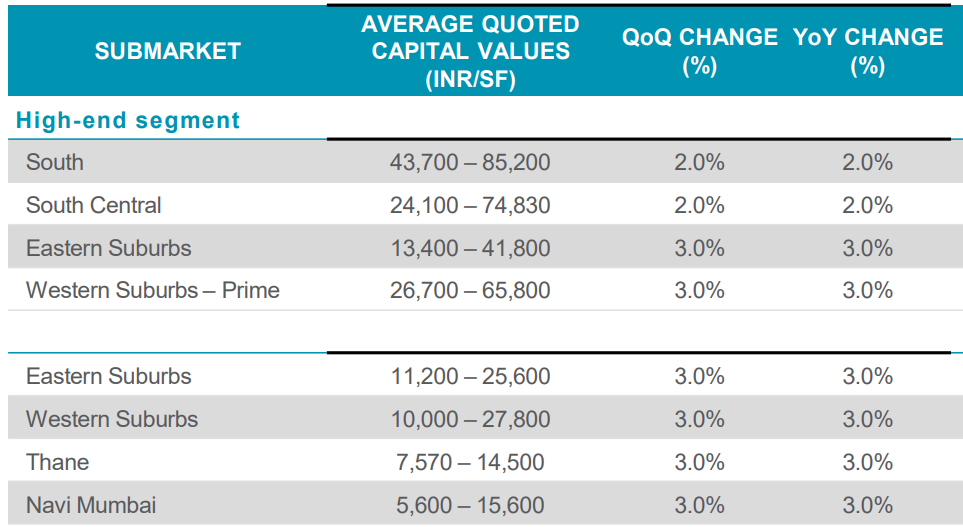

Mumbai’s diverse demography results in a broad spectrum of residential properties, from ultra-luxury apartments in South Mumbai’s prime locations such as Malabar Hill, Colaba, and Cuffe Parade to more modest yet upcoming localities like Thane, Mira-Bhayandar, and Navi Mumbai. As of 2023, the average price per square foot in premium locations can range anywhere between INR 40,000 to INR 1,00,000, while in peripheral areas, the rates can vary between INR 5,000 to INR 15,000 per square foot.

Source: Cushman & Wakefield Q3 2022

Commercial Outlook

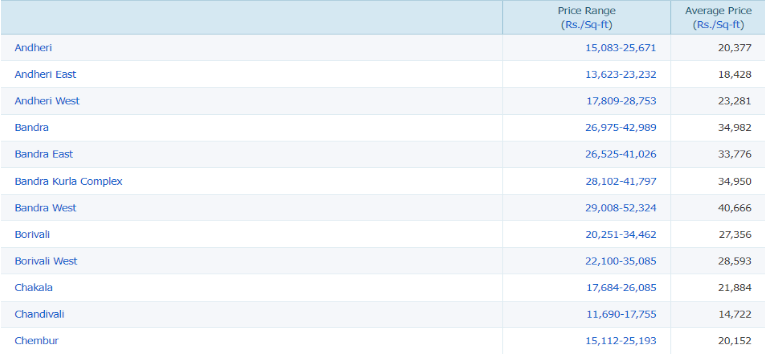

Commercial property prices, particularly in business districts such as Bandra Kurla Complex (BKC), Nariman Point, Andheri East, and Lower Parel, are relatively higher, with prices touching INR 30,000 to INR 50,000 per square foot. These areas host a plethora of multinational corporations, financial institutions, and start-ups, maintaining a steady demand for commercial spaces.

Source: MagicBricks

Comparison of Residential and commercial Yields

Here’s a comparison of residential and commercial yields of prominent places in Mumbai. Historically, residential property yields in Mumbai have been relatively lower than commercial yields, typically hovering around 2-4%. The high price of residential properties, coupled with relatively low rental rates, has resulted in these lower yield rates. The average yield on commercial properties in these areas varies between 7%-10% annually, depending on the location, the quality of the building, and the type of lease agreements. The Bandra Kurla Complex (BKC), for instance, has consistently offered returns on the higher end of this range due to its modern infrastructure, connectivity, and status as a business district.

| Area | Residential Yields (%) | Commercial Yields (%) |

| Bandra Kurla Complex (BKC) | 2-4% | 7-10% |

| Andheri East | 2-4% | 7-10% |

| Lower Parel | 2-4% | 7-10% |

| Mira Road | 3-5% | 6-8% |

| Thane | 3-5% | 6-8% |

| Navi Mumbai | 3-5% | 6-8% |

Underlying Factors Affecting Land Rates

Geographical Constraints

The city’s geographical constraint, primarily with the Arabian Sea on one side, restricts horizontal expansion. This leads to an upward growth of vertical residential and commercial spaces. As a result, land rates continue to escalate due to the premium attached to the limited available land.

Infrastructure Development

The progress in infrastructure significantly influences property prices. Upcoming projects like metro lines, monorail, flyovers, and expressways positively impact the land rates, leading to an appreciation in the surrounding areas.

Economic State, Interest Rates, and Government Policies

The overall state of the economy, prevailing interest rates, and government policies also significantly impact land rates. For instance, during the COVID-19 pandemic, there was a temporary slowdown in the real estate market due to decreased demand and economic uncertainty.

The Future of Land Rates in Mumbai

Forecasting the future of land rates in Mumbai requires an understanding of both present trends and potential changes on the horizon. Mumbai’s real estate market has always been dynamic, influenced by a plethora of socio-economic and regulatory factors. Looking forward, several factors could play a significant role in determining the trajectory of Mumbai’s land rates:

Urban Expansion

Given Mumbai’s geographical constraints, urban expansion is primarily directed towards the outskirts and peripheral areas of the city. This development may lead to the appreciation of land rates in previously underdeveloped regions.

Infrastructure Development

Mumbai is set to see extensive infrastructure development in the coming years, including metro projects, road expansion, and redevelopment projects. These developments could increase land rates in the affected areas, boosting overall property prices in the city.

Affordable Housing and Government Policies

The Government’s focus on affordable housing through various schemes may drive growth in the residential sector. Land rates in suburban and peripheral areas offering affordable housing could see a surge due to increased demand.

Adoption of Remote Work

The rising acceptance of remote and hybrid work models post the COVID-19 pandemic could affect both residential and commercial property prices. As businesses adopt more flexible working models, the demand for commercial spaces might see changes. At the same time, residential properties with additional space for home offices might see an increase in demand.

Real Estate Regulations

Changes in real estate regulations, such as amendments to the Real Estate (Regulation and Development) Act (RERA), or alterations in stamp duty, GST, etc., could also influence Mumbai’s land rates.

Shift In Investors Preference To Real Estate Backed Alternative Investments

| The market for asset-backed products has experienced significant growth in recent years, exemplified by the record-high issuance of NCDs in India, reaching Rs. 2.2 lakh crore during 2020-21. This surge in popularity demonstrates the increasing demand for structured investment options ~ EconomicTimes |

Real Estate-backed Structured debt products are a type of asset-backed Investments that use real estate as collateral. These financial instruments allow investors to gain exposure to real estate investments without needing to directly buy or manage them while generating a stable source of income for them. Plus, through investments in such products investors can earn stable and higher returns from 16-18%. Implying their fixed income nature, these products offer various investment opportunities that include fixed assured returns, portfolio diversification, higher yields, capital preservation, predictable cash flows, exposure to real estate market growth, professional management, and liquidity all at once.

Key Takeaways

- Mumbai’s real estate market, due to its high demand, limited supply, and unique geographical constraints, remains a robust and promising investment sector in 2023.

- The average price per square foot in premium locations of Mumbai can range between INR 40,000 to INR 1,00,000, and in peripheral areas, the rates can vary between INR 5,000 to INR 15,000 per square foot.

- Commercial property prices in business districts such as Bandra Kurla Complex (BKC), Nariman Point, Andheri East, and Lower Parel can reach INR 30,000 to INR 50,000 per square foot.

- Residential property yields in Mumbai are generally lower than commercial yields, with average commercial property yields varying between 7%-10% annually, depending on the location, the quality of the building, and the type of lease agreements.

- Several factors influence land rates in Mumbai: the city’s geographical constraints, infrastructure development, economic state, interest rates, and government policies.

- Mumbai’s real estate market future will likely be impacted by urban expansion, infrastructure development, affordable housing and government policies, the adoption of remote work, and changes in real estate regulations.

- There is a growing preference for real estate-backed structured debt products, which provide stable returns from 16-18% and offer various investment opportunities like portfolio diversification, capital preservation, predictable cash flows, and exposure to real estate market growth.

- Assetmonk offers real estate-backed alternative investment options with an assured IRR of 17%, asset-backed security, and an equally assured exit option, sourced from India’s growing private markets and monitored by a SEBI-registered trustee.

Bottom Line

Mumbai’s land rates are a dynamic entity, shaped by multiple factors ranging from geographical limitations to socio-economic developments. Given the city’s ever-growing appeal and the continuous development of infrastructure, real estate in Mumbai is likely to remain a promising investment avenue. At Assetmonk, we’re staying ahead of the curve by offering our investors the best real estate-backed alternative investment options available. With an assured IRR of 17%, asset-backed security, and an equally assured exit option, our investment products are sourced from India’s growing private markets and monitored by a SEBI-registered trustee. With just a minimum investment of 10 lakhs, investors can enjoy stress-free investing and high returns.

FAQs

Q1.What drives land rates in Mumbai?

Land rates in Mumbai are influenced by a variety of factors, including geographical constraints, infrastructure development, economic conditions, interest rates, and government policies.

Q2.How does the geographical constraint of Mumbai impact its land rates?

Mumbai’s geographical location, with the Arabian Sea on one side, restricts horizontal expansion. This has led to a vertical growth of residential and commercial spaces, resulting in escalating land rates due to the premium on limited available land.

Q3.What is the impact of infrastructure development on land rates in Mumbai?

Infrastructure development like new metro lines, flyovers, and expressways can significantly increase the land rates in the affected areas.

Q4.What are the future prospects for land rates in Mumbai?

Future land rates in Mumbai will likely be influenced by factors such as urban expansion, further infrastructure development, government policies around affordable housing, adoption of remote work, and changes in real estate regulations.

Q5.What is the average price per square foot for residential properties in prime locations in Mumbai?

As of 2023, the average price per square foot in prime locations can range anywhere between INR 40,000 to INR 1,00,000.

Q6.What is the difference between residential and commercial yields in Mumbai?

Historically, residential property yields in Mumbai have been relatively lower than commercial yields, typically hovering around 2-4%. The average yield on commercial properties varies between 7%-10% annually, depending on the location and the type of lease agreements.