Investments are key to the creation of capital assets. Whether it is a business or for an individual, making timely investments goes a long way in financial stability.

Fixed deposit is important from the point of view of NRI Investment in India as they help the NRIs to establish a capital source in India that can be used primarily as real-estate investments. Just in recent times, NRIs have poured an estimated $2 billion as NRE deposits in India.

The recent year has also seen a spike in the NRI real-estate business along with an increase in the NRI deposits in India. As per the reports of CNN, bank FDs have been popularized as a safe option for NRI real-estate investments offering a return rate of 5%-7%.

A pivotal reason behind it is that an FD provides the investor or in this case the NRI an assurance of returns. This is not the case with other investments such as stocks where a fluctuation in the market can cause a decline in the investment yield.

Fixed Deposit for NRI Investment in India

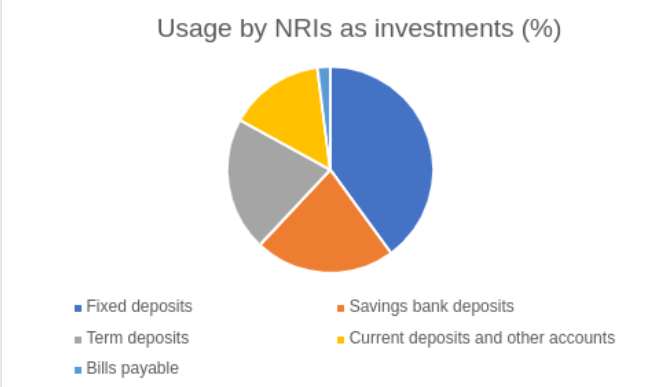

Source: http://www.msrblog.com/business/economics/assignment-on-deposit-and-investment-analysis-of-nbl.html

When it comes to NRI real-estate investments, fixed deposits are considered a smart option owing to their better performance in terms of returns and interest rates. As a result, more NRI investors are drawn towards using fixed deposits as a means of increasing the capital and then utilizing it for the purchase of real-estate.

Aside from being beneficial for the NRIs, fixed deposits are also fruitful for the Indian economy. How? It is because the investments in fixed deposits that are made by the NRI investors serve as an inward remittance for the economy. These NRI deposits are among the major contributors to the economy as these deposits add to the pool of foreign exchange. An estimated 25% of the total foreign reserves available in India are made by the NRI fixed deposits.

Instead of wasting their revenues in a savings account that does not enable flexible withdrawals, NRIs often prefer a smarter form of investment. This comes in the form of a fixed deposit. The boost of the real-estate business in India has brought many NRI investors. A fixed deposit serves as a key weapon in this investment.

Benefits of NRI Investing in Fixed Deposit

Fixed deposits are advantageous to both NRIs and regular investors. The NRI should invest in a fixed deposit due to the following benefits:

- Fixed deposits provide a convenient and regular cash flow to the investor. This is useful from the NRI perspective because it allows the NRIs to maintain a healthy stack of capital in the country without any hassle.

- The higher interest rates offered under a fixed deposit are attractive to the NRIs that are on the hunt to diversify their investment profile.

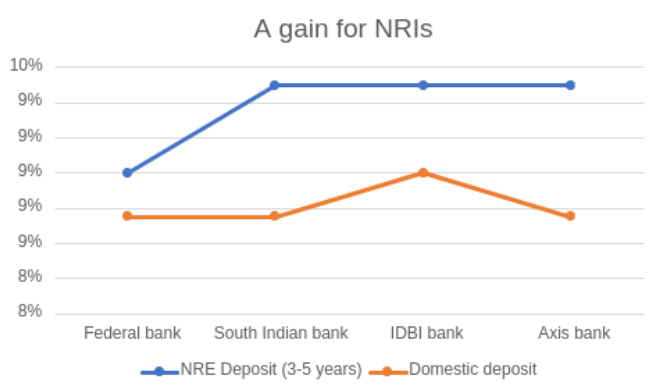

As is clear from the chart above, there is a trend of higher interest rates ranging from 9% to 9.5% for a tenure of 3-5 years compared to 8.75% to 9% interest rates offered by the normal domestic deposits.

- Fixed deposits are risk-free investments. The investors have assured a healthy return without the risk of decline or crash of stocks.

- Fixed deposits are not affected by the fluctuations that may occur in the market. Some of the other investments like mutual funds are prone to such changes in market trends creating an atmosphere of uncertainty for the investor.

- The NRI FDs are eligible for tax exemptions in India. The returns on FDs are tax-free.

- FDs provide a much flexible period of investment (up to 5 years) for NRIs.

- It is easier to apply for business or real-estate loans using FDs.

- The NRI investors can utilize their FD funds anytime and break them into little packets of capital for better use.

How to Open NRI Fixed Deposit Account in India?

Fixed deposits are highly profitable investment options for NRIs in India. There are two ways in which the NRIs can open a fixed deposit bank account:

- By creating an NRE account

- By creating an NRO account

- By creating an FCNR account

- Fixed deposits using an NRE account: A Non-resident External account enables the NRIs to save their income earned outside of India in the form of Indian currency. A fixed deposit made in the form of an NRE account is profitable because the returns from the NRE account are free from tax impositions and that includes both principal amounts as well the interest. It is also of use for those NRI investors who wish to save their earnings made outside of India and keep them in India.

Minimum deposit amount: Rs.80,000

FD tenure: 1-5 years

- Fixed deposits using an NRO account: Another type of bank account that functions for NRIs are a Non-resident Ordinary account. Under such type of bank account, NRIs can save the earnings that they have made here and kept them in India as a national currency. Such accounts are useful because they save NRIs from the hassle of currency exchange. These bank accounts also allow investors to make fixed deposits however, the returns earned from the fixed deposit using an NRO account do not provide tax exemptions. NRO bank accounts are mainly used by NRIs to keep their money in India as Indian currency.

Minimum deposit amount: Rs.80,000

FD tenure: 1-5 years

- Fixed deposits using FCNR account: A fixed deposit made in an FCNR account allows the NRI to keep their earnings made abroad in their original currencies in India. Such investors can utilize the funds anywhere in the world.

Minimum deposit amount: $2000

FD tenure: 1-5 years

Steps to open a fixed deposits bank account:

NRIs can open a fixed deposit account by using their NRO or NRE accounts. In case the NRIs do not possess an NRO/NRE, they can do so online by:

- Visiting the official website of the authority where they wish to create the account. In India, NRO/NRE or other accounts are offered by banks and NBFCs.

- The investor should complete the application form and provide the credential required.

It is simple to apply for an FD using the NRO/NRE bank accounts by simply putting a request to the concerned authority.

Documents Required For Opening a Fixed Deposit Account

The main documents required from NRI investors to open a fixed deposit are:

- Passport: NRI’s passport is used as proof of the candidate’s age, name, DOB, residential address, photograph, and signature.

- Work permit or Visa: The NRI is required to present his/her visa documents as proof of residence, employment, and work permit.

Fixed deposits are a smart way for NRIs to expand their real-estate investments without dealing with a lot of investment risks. Such investment strategies are becoming popular and increasing the scope of real-estate in India. Get the best offers on fixed deposit investments at Assetmonk. For further details visit the website today!

Fixed Deposit FAQ's:

The NRE deposits could only be made out of the money gained out of India. NRE fixed deposits are commonly foreign currency accounts that are freely repatriable. Unlike other accounts such as FCNR deposits that are denominated in Pounds/ Euro /dollars / Canadian dollar, the NRE is still denominated in INR only.

To get an idea of the period in which one’s FD amount would get doubled, the individual should divide 72 with the highest rate. For instance, if the maximum rate on the fixed deposit is 7.5%, then the number of years in which the FD is expected to doubled is 72/7.5= 9.6. Hence, it would take approximately 10 years for the FD to be twice its original sum.

Yes, one can get a monthly interest mode of payment, if one does choose these periodic payouts, and selects the monthly tenure. When an individual invests any sum in FDs, one gains the interest on the principal amount, which could be obtained periodically.

Yes, according to the Securities & Exchange Board of India (SEBI) when any NRI wants to invest in India, the PAN card is required. Once the individual invests, he/she would have taxable wealth gain in India and this needs to be noted down as per the PAN. Therefore, a PAN card is also mandatory for the NRI FDs.

In most cases could invest in Fixed deposits for a minimum tenure of 7 days. This minimum tenure offered for an FD is subjected to variations from banks to banks.

One can choose a maximum tenure of 10 years. One might choose any period for which the individual wishes to keep the FD as per his/her requirement. One must also note that this maximum tenure offered for an FD is subjected to variations from banks to banks.

Yes, any fixed deposits, can be withdrawn as a premature withdrawal, before the time of maturity. Incase the FD is closed prematurely, before finishing a minimum of 7 days from the date of the reservation, the company is however not liable to pay out any interest. This minimum period might vary in different banks.

Yes, closing a Fixed Deposit (FD) is very simple, and could be done online or by visiting the nearest branch of the bank. One can close an FD before the maturity or after the maturity. Mostly, the process of closing an FD by going to a branch is fairly similar.

Withdrawing the fixed deposit before the maturity date is called breaking an FD. When one breaks the FD, one would be expecting a lower interest rate and might also need to pay a fine for this premature withdrawal.