With the fall in the number of foreign investments, the value of the Indian Rupee is proving to be unstable. NRIs are utilizing their money to keep an exit plan that is directly affecting the Indian Debt Market.

To combat this depression in the value of the Indian Rupee, the State and Central government of India has opened specific routes that allow NRIs to invest in certain Government Securities without any limit.

Using a Fully Accessible Route or FAR as a separate channel for this purpose, NRI investment in Government Securities has been greenlit since April 1, 2020.

The upper limit of Foreign Portfolio Investment has been increased from 9% to 15% for corporate bonds by the Central Bank.

Under the influence of the Fully Accessible Route, OCIs, FPIs, and NRIs are fully authorized to invest in Government Securities without any restriction of the upper limit.

Trends in Government Securities Market in India for NRI

NRIs have shown immense interest in investments in their homeland, especially as NRI real-estate investments. After the involvement of Government securities under the financial policy of 2019-20 as a ‘Fully accessible route’, NRIs were opened to new avenues of investments.

Government securities of GSec are securities that are issued by the State and Central Government of India. These are established to supply funding for different projects and/or to balance out any fiscal deposits.

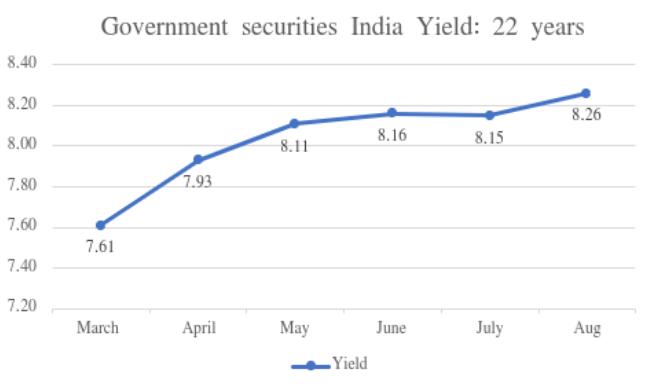

Source: ceicdata

These government securities have interest rates or coupon rates, which are either fixed or floating. These interest rates are to be paid on face value at regular periods.

Types of Government Securities for NRIs:

There are three types of Government Securities:

- Cash Management Bills: Cash Management Bills of CMB are State, and Central Government issued short term securities. The amount that is raised through CMBs can be utilized to meet cash deficits by the Indian Government for temporary cash flow. CMBs usually have short tenures lasting for a few days to a maximum of 3 months (91 days). The funds accumulated can also be used in the treasury of the Government as emergency funds.

- Government Dated Securities: These are more long term securities and can either have fixed or floating interest rates. These securities are issued to mobilize funds for the development and management of fiscal deficits.

- Treasury Bills: Treasury Bills are Government Securities that Non-Resident Indians or NRIs can use to get good returns. These are short term money market instruments that come in three tenures of 91 days, 182 days, and 365 days (1 year). These bills do not pay any interest, rather are issued at a discounted price. At the time of maturity, Treasury Bills are redeemed at face value by the investor.

- State Development Loans: SDLs or State Development Loans, as the name suggests, are issued solely by the State Government. Similar to that if Dated Government Securities and State Development Loans have repayment methods and long investment periods and are issued for the State activities. The only part where State Development Loans differ from Loans is that it is issued for the satisfaction of the State’s budgetary need only.

Benefits of NRI Investment in Government Securities

As an NRI, one can still take advantage of Indian Government Securities to get good returns:

- Risk Factor: The biggest benefit one can get from investing in Government Securities is that it is risk-free. With secure transactions, the returns are guaranteed to be safe and risk-free. This even applies to NRIs, who are eligible for investing.

- Diversification: By investing in Government Securities, an NRI can get a more diverse investment portfolio. Having such investments in one’s portfolio greatly reduces the overall risk factor of the entire portfolio.

- Tenure Period: As an NRI investing in Government Securities, one can enjoy a wide range of tenure periods. The tenure for such securities can range from as low as 91 days (3 months) to 41 years.

- Cash Requirements: GSecs can easily be used as collateral to borrow funds in the repo market. These securities can also be sold at a moment’s notice on the secondary market to meet sudden cash needs.

- Settlement: The way trading in Government Securities are settled in a Delivery vs. Payment system. This is a safe and risk-free method of settlement that ensures the proper transfer of securities from the seller. At the same time, it also ensures the transfer of funds by the NRI buyer.

How to Invest in Government Securities as an NRI

When dealing with Government Securities and their investment, it is important to know all the variables that go into investing in GSec. Following are the requirements and processes of getting a Government Security investment as an NRI:

- Bank Account: As an NRI, to invest in Government Securities, one should either have a Non-Resident External bank account for Repatriable basis or a Non-Resident Ordinary bank account for Non-Repatriable basis.

- Minimum amount: To apply for a Government Security to invest in, the minimum amount needed is Rs.10000. After that, all payments must be made in multiples of Rs.10000 followings through.

- Application: To invest in the GSec, one needs to apply for the same through the authorized dealer bank. This bank should also apply to the Reserve Bank of India and notify them about the investment through the GSec.

- Payment: After applying, the NRI must make the payment. This can be done by issuing a cheque or banker’s pay order drawn in favor of the RBI. The payment can also be done using their Non-Resident External bank account or Non-Resident Ordinary account.

- Format: Government Securities can be helpful in a Demat and physical format.

- Interest payments: The interest payment that is to be received is usually processed on a half-yearly basis. As instructed by the NRI, this interest amount will be paid and credited to their NRE or NRO bank account.

With NRIs getting full access to invest in Government Securities, the value of the Indian Rupee is expected to face an appreciation. Furthermore, the NRIs can receive good returns on their investments while mitigating the risk of their entire investment portfolio. They can also visit Assetmonk for knowledge about G-sec and apply for some investments at great deals.

Government Securities FAQ's:

Treasury bills won’t suddenly make one gain tremendous wealth but they are a good way to add some stable and conservative investments to one’s portfolio. In case of plenty of cash is entangled in much riskier bets like mutual funds or stocks, these T-bills could balance the risks out without requiring a longer commitment.

It is quite true that if one invests in a Treasury bond at the face value, then the individual is assured to gain interest along the way and also get the principal back if the bond is held until its maturity. But with some investments in the Treasuries which typically do not involve holding securities to the maturity, in these cases, one might lose money.

Yes, they can prove to be a good investment option as these are the debt securities backed by the government. In long-term investment options, these Treasury bonds (also termed as T-bonds) are often considered to be typically risk-free, as well as among the safest investments available.

Any Non-resident of Indian (NRI) is not allowed to invest in any post office schemes by the government. This means that they cannot invest in Investment modes such as the Public Provident Fund, the National Savings Certificates, or the Monthly Income Plans and some other time deposits which are offered by the post office.

Yes, Government bonds are typically considered low-risk investment options because the chances of a government defaulting under its own loan payment tend to be fairly low. But certain defaults might still happen, and a riskier type of bond would usually be available at a lower price than other bonds that includes a much lower risk factor and a similar rate of interest.

Yes, this is another similar method for the state government to collect short term funds under the regulation of ‘Ways & Means Advances’ (WMA). Under the WMA, RBI gives temporary loan options to the center as well as the state governments as a banker to the government.

No, the State government cannot issue Treasury bills. Treasury Bills could only be issued by the central government of India. The State governments do not issue any kind of treasury bills. Interest on these treasury bills, issued by the Central Government is governed by certain market forces.

State Development Loans (SDLs) are mostly considered to be a low-risk option as the securities carry pre-stated sovereign guarantees and are governed by the Government of India.

Advantages of investing in SDLs (State Development Loans) or other Government Securities include lower risk when compared to other assets like debts or equities, as the rate of returns is assured by the government. Although there are few market-related risks, simply holding on to the bonds until their maturity, might nullify the overall risks.

Yes, government securities are typically considered to be the safest investment option around the globe. Treasury securities of all tenures and amounts provide a similar assured source of income and they hold their overall value in almost every economic environment.