India being a lucrative source of investment, has been an area of interest for all international clients. NRIs top this list because of their emotional connection to the country and sometimes due to the significant investment return. According to a UN survey, a massive population of Non-residents in India is about 16 million.

Hence, out of which many of them search for profitable options of investment in countries like India. Most of these NRIs usually give in on their plans seeing the dirty marketing gimmicks of their sellers. Those who choose to stay in this game of investment are either aware of how to continue with the process without any external help or have researched their goals and risks in the long run. During recent years, NRIs have shown a great deal of investment in the real estate sector.

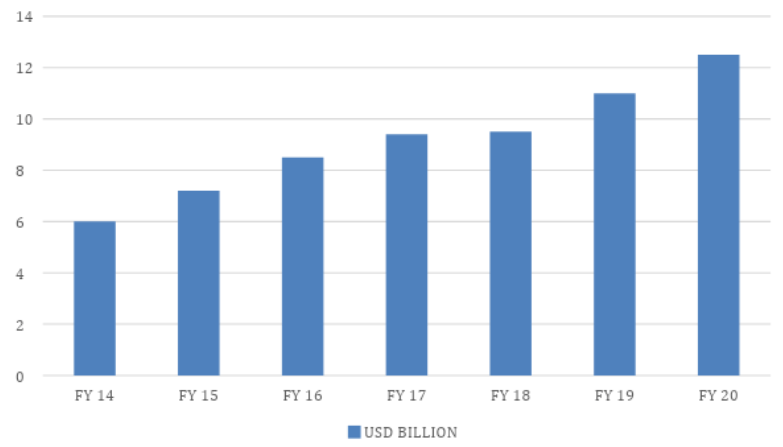

The graph below displays the real estate investment by NRIs in USD Billion in every financial year starting from 2014:

Source: https://www.quora.com/What-is-the-NRI-investment-in-real-estate-India

Trends in NRI Investment in India Residential Real Estate

NRI Real estate investment is a heating topic that brings a lot of attention towards it but isn’t considered a viable option because of the monotonous procedures and mainly because of the systems’ lack of knowledge. To make this investment process easy, here is a detailed version from the basics to advanced stages of all the documents you will require throughout the process:

What are KYC documents?

Know Your Customer or KYC is a set of documents required by various businesses to have their customers’ information they are dealing with. And, KYC documents are generally official government-issued IDs.

Types of KYC Documents

Proof of Identity (POI)

Proof of Identity must include a picture of the applicant. Various IDs are allowed to be used as proof of identity. These are acceptable and are determined on a jurisdictional basis.

Some commonly accepted Proofs of Identity documents are:

- Passports

- Aadhaar Card

- Driving License

- Voter ID card

Proof of Address (POA)

The Proof of Address (POA) KYC document is one of the fundamental requirements for KYC checks. Officially issued documents that have the person’s name and current address on them are essential for these kinds of documents. The only thing to be kept in mind while submitting these Proofs of Address documents is that they must be issued within three months.

Like Proof of Identification documents, various documents that can be used for Proof of Address purposes are acceptable and determined on a jurisdictional basis.

The reason behind most documents being dated within three months is to show that the address is current. Some commonly accepted Proof of Address documents are:

- Utility bills like Telephone Bills, Gas bill, or Electricity bill

- Bank Account Statement or Passbook

- Proof of residence issued by a Notary Public or a Government Authority

- Identity card or document has an address specified on it issued by a Central or State Government.

- Maintenance bills issued by official companies

KYC Documents for NRI Investment in India

Real-estate investment by Non-Residents of India come under FEMA- Foreign Exchange Management Act, and to make this process simpler government of India issued a list of a few necessary documents required to buy a property in India, which are as follows:

Indian Passport or Person of Indian Origin (PIO) Card or Overseas Citizen of India (OCI) Card:

Non-residents of India need an Indian passport to invest in real estate in India or require a Person of Indian Origin Card (PIO) or Overseas Citizen of India (OCI) card. Conditions for providing the respective cards are as follows:

- If you are an individual who is not a citizen of countries like Pakistan, Bangladesh, Sri Lanka, Afghanistan, China, Iran, Nepal, or Bhutan but has held an Indian passport at some point.

- An individual would need a PIO card if you are not a citizen of India, but your forefathers were citizens of India. In simpler words, if you as an individual hold the passport of a foreign country, you need a PIO card.

- An individual who isn’t a citizen of India at this moment but had the opportunity to become an Indian citizen before or after partition (or a child of such a person) would require an Overseas Citizen of India (OCI) card as proof. A person can apply for these cards in the Indian embassy or in the country in which they reside. It is necessary to provide the parent’s birth certificate as proof that the respective person is an Overseas Citizen of India or a Person of Indian Origin.

PAN Card:

Non-Residents of India need a Permanent Account Number (PAN) Card as:

- They will be expected to file income tax returns if they rent out the property in the future.

- Moreover, in the future, if the property is sold, the gains in the capital which arise from the sale would be subject to Capital gains tax. Capital gains would be included in the total income when the taxation is done.

Power of Attorney:

If the Non-Resident of India wishes to invest in real estate but does not visit India too often, the individual would find it much easier to:

- Get registration of property

- Execution process of the sale

- Possession and other methods to be done

If you give a Special Power of Attorney to someone who resides in the city where you are buying the property, the process is made easier.

Attestation:

Non-Residents of India (NRI) or Persons of Indian Origin (POI) can get the above-listed documents attested by the:

- Respective authorities of overseas branches of scheduled commercial banks which are registered in India

- Public notaries

- Court magistrate or judge

- The Indian embassy

Points to Note:

- If the POI, POA, or any other specified documents are in any foreign language, they must be translated into English before these are submitted.

- If the NRI appoints a Power of Attorney (PoA) for making investments in India, the Power of Attorney and the NRI both must be KYC compliant.

Hence, if these sets of documents are sent for preparation before executing the real estate investment plan, there would be no further unwanted delay in proceeding with the deals.

KYC Documents for NRI FAQ's:

Yes, KYC can be done online and there are 2 methods to do so. The first Option is the Aadhaar OTP and Aadhaar based Biometric KYC. The Aadhaar OTP will allow one to get the KYC done easily in few minutes and on the other hand in Aadhaar-based Biometric KYC, the individual has to apply for the KYC online, after that an executive from KRA would visit the given address (home/office) for the biometric verification.

KYC Documents Includes Passport, Voter’s Identity Card, PAN Card, Driving Licence, NREGA Card, Aadhaar Letter, or Card.

An overseas citizen of India Scheme was introduced in 2005 by the Government of India, under this, the overseas citizenship of India (OCI) could be granted dual citizenship. But, If the individual had ever been a citizen of Bangladesh or Pakistan, then he/she would not be eligible for the Overseas Citizen of India Scheme.

NRIs would be allowed to invest in immovable properties. It will serve as a phenomenal long term investment option with stable & steady growth. NRIs can buy both residential as well as commercial properties but they won’t be allowed to purchase any kind of agricultural lands, plantations, or farmhouses. However, this rule would be void in case the individual gets the ownership of the agricultural land through the process of inheritance or as a gift.

Any funds received in India through the normal banking channels by the means of inward remittance from certain places outside India or by the debit to NRE, FCNR, or NRO account. Such payments will not be allowed to be made through the traveler’s cheque, foreign currency notes, or by any other modes except for the ones which are specifically mentioned above.

To do KYC from home, one needs to go to the respective KYC, and then select the “Aadhar verification at the doorstep” option from the drop-down menu from the options window. On very the next screen, one would be asked to fill in the address where the individual wishes the KYC to be done.

This has to be done in INR and could be made out of the funds received in India through the normal banking channels through the way of inward remittance from anywhere outside India or by debiting the funds to the NRE, FCNR, or NRO account.

Any Immovable property that is going to be acquired must be under all the provisions of foreign exchange laws, which are in action at the moment of acquisition by the provisions of certain regulations.

The foreign currency equivalent, as on the time of payment of the sum paid where any payment that is made, should be from the funds held in the Non-Resident External account before the acquisition of the property.

If the payment was done through an NRO account, one can repatriate the total amount which is subjected to the overall upper limit. And in the case of the residential property, repatriation of sale proceeds would be restricted to a maximum of 2 such properties.