What is National Pension Scheme (NPS)?

The National Pension Scheme or NPS is a scheme that has been implemented and sponsored by the Government of India. Those who are subscribed under this scheme can make systematic savings contributions. These contributions are to be paid during the work-life of the subscriber in a pension account at regular intervals.

The investment scheme has gained popularity because it provides a tax exemption going as much as Rs.50,000 that is way more than other investments.

National Pension Scheme (NPS) India For NRI Investors

NRIs have shown interest in NPS as an investment option as it provides a good savings resource without a lot of maintenance requirements as the sum of investment is Rs.6000/year.

Under an NRI NPS investment, subscribers can take out/withdraw a certain part of the corpus as a lump-sum amount. This lump-sum can then be used by the subscriber to purchase an annuity.

This annuity acts as a form of regular income after the subscriber has reached the age of 60 and has retired from his or her work life.

How to Apply for an NPS as an NRI?

As a Non- Residential Indian, one can apply for a National Pension Scheme through the following steps:

- Step 1: Download the NRI- NPS form from the NPS trust website or the website of the Pension Fund Regulatory and Development Authority or the PFRDA. Several banks also allow people and NRIs to apply for an NPS from their branches.

- Step 2: The required information must be provided as asked by the application form. Along with that, all necessary documents must also be provided along with the NPS application form.

- Step 3: Banks have an NRI branch which is, in general, the authorized branch for KYC and similar transactions. An NRI can submit their filled out NRI-NPS form to one of these branches.

- Step 4: After submitting, the bank will proceed to verify the application and bank details. Upon getting the verification approved, the form is sent to the Central Recordkeeping Agency or the CRA.

- Step 5: The CRA digitizes the form and issues a new Permanent Retirement Account Number for the Pension Fund.

- Step 5: The CRA sends the PRAN information to the NRI applicant via mail/SMS. After the activation of the PRAN, the BRI can then proceed to make real estate and other investments online.

The Profits of NRI Investment in NPS

As a Non-Residential Indian, the biggest advantage one can get from applying for the National Pension Scheme is getting a mix of all corporate, government, and equity bonds as investment options.

NRI has the option to choose to have an active or passive mix while selecting the investment opportunity. The active mix will allow the NRI to choose how and where to invest in opportunities like real estate. The passive mix will automatically invest on behalf of the NRI.

By making a regular contribution during their working life, NRIs can accumulate a Pension Fund. This fund is used to invest in real estate opportunities. The corpus gained from this investment can be utilized by the NRI as a pension.

Upon retirement, NRIs can withdraw 60% as a lump-sum while the rest 40% is paid monthly as an annuity.

Growth of Corpus from NPS for both NRIs and Indian citizens:

Eligibility for NRIs:

- Any NRI can apply for an NPS as long as he or she is between the ages of 18 and 60 years.

- The applicant must have abided by the KYC norms for a minimum of 9 months.

- Overseas Citizens of India or OCIs and Persons of Indian Origin or PIOs are not specified under the definition of a Non-Resident Indian. Thus, OCIs and PIOs are not eligible for the National Pension Scheme.

National Pension Scheme Benefits

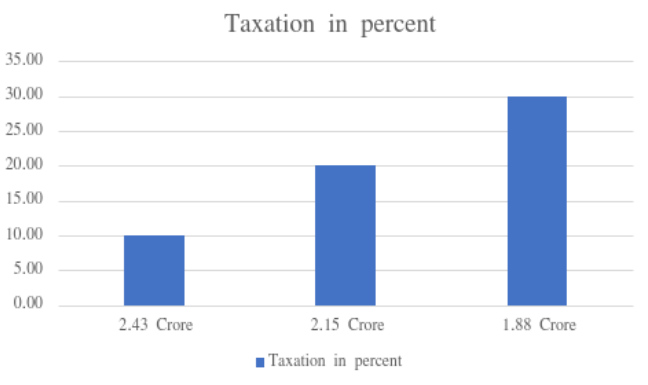

- Tax benefits: Those who avail of the National Pension Scheme; upon making contributions can avail of tax benefits under section 80C of the Income Tax Act. Over 60% of the withdrawable amount can be claimed tax-free.

- As an NRI one can claim up to Rs.1.5 Lakh under section 80C and section 80CCD (IB) can get tax breaks up to Rs.50000.

The amount of equity after taxation can be seen in the following:

- 2 Types of Accounts: Subscribers of the NPS have the flexibility to choose between a Tier- I account and a Tier- II account. Tire- I accounts are default accounts that are meant for post-retirement saving and limit withdrawals till the subscriber has retired/ reached the age of 60.

Tier-II is a type of non-retirement plan offered to Tier-I account holders. This independent account offers no restrictions in withdrawing from the Pension Fund hand pried fast transfers from the Tier-I account.

- Expert Management: During the working period of the NPS subscribers, the corpus is invested to generate returns. This corpus if not actively allocated by the subscriber is handled by a professional expert. The expert is a manager that is personally hired by the Pension Regulatory and Development Authority. This fund manager is responsible for looking after the real estate investment and similar other investment that is made on behalf of the subscriber.

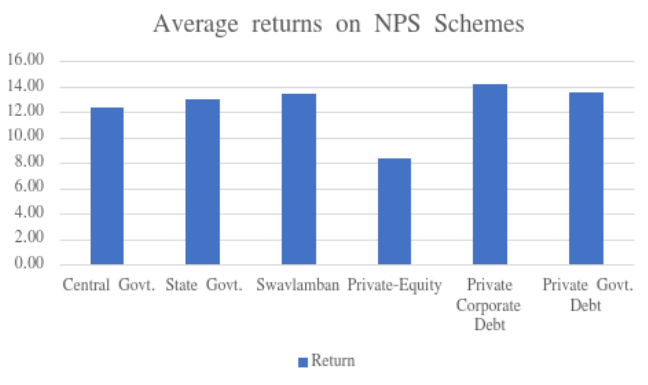

- Returns: The National Pension Scheme is a policy that utilizes money from the general public and channels it into the investment of a wide range of securities like bonds, bills, and shares. This makes the returns generated by this scheme to be linked with the market. With the options for passive and active portfolio allocation, subscribers who choose the active allocation of their corpus can gain up to 50% of exposure in terms of equity.

NRI Investment in India Real Estate

As NRIs can opt for passive investment for their pension fund; one of the common investment options is real estate. Real estate investment is made passively by Real Estate Investment Trusts (REITs). The real estate investment for NRI care is also done by private equity pools.

The long term investment can take place for commercial real estate like:

- Office buildings

- Retail complexes

- Apartments

- Industrial parks

The goal of this is to generate a portfolio that considers market inflation with equity appreciation to create higher returns.

An NRI can become a subscriber as long as there is no change in their citizenship and they have a valid PAN card and bank account.

National Pension Scheme (NPS) FAQ's:

National Pension System (NPS) Account could be opened online easily if an NRI has a PAN card, a bank account, and satisfies other conditions of the NPS. It also provides tax breaks of up to 1.5 lakh INR under Sec 80C and 50,000 INR under Sec 80CCD (IB).

Apart from prevailing the tax benefits, the National Pension System is also a very low-cost investment option, the fund management charges are around 0.01%, and it is considered to be a fairly low-risk option for Investment. Investing in a low-risk option like NPS would allow an individual to diversify their risk profile.

When a comparison is done between the Public Provident Fund and the National Pension System, NPS proved to be the higher return vehicle for a portion of what one invests goes towards the equity trading, this ensures higher returns. The PPF on the flip side is all about constant returns and there are no chances for any added frills.

Yes, both can be opened, the recruiter might also make NPS available for the individual along with the PF, and one may open both NPS & PPF while opening the salary account. But confusion arises, when it comes to choosing either NPS or PPF, as to which would give better income tax exemption.

To invest in NPS, NRIs would have to go through the KYC process, and the good news is that non-resident Indians would eligible to invest in the National Pension Scheme just like any other resident Indian. All the prevailing tax benefits on NPS would also be available for the NRIs.

If a National Pension Scheme holder dies before reaching the age of 60 the total accumulated pension sum would be paid to the nominee, beneficiary, or the legal heir of the policyholder. The NPS (National Pension System) will allow the individuals to build a retirement corpus by creating a pension account where contributions by the plan holder would be collected.

The appeal should be in a written format, duly signed by the complainant/ his authorized representative in the form as already specified by the regulations & supported by the documents. One thing to note is the fact that the complainant’s representative cannot be a legal practitioner.

After an Annuity is bought, the option to cancel or reinvestment with any other Annuity Service Provider/ in other Annuity option will not be allowed unless it is within the time limit which is pre-specified by the ASP (Annuity Service Provider); the free look period which is provided by the Annuity contract/ IRDA.

No, opening more than one NPS accounts for an individual will not allow under the NPS. However, an Individual will be entitled to the option to have one account in the NPS and another one in the Atal Pension Yojna.

No, the NPS account could only be opened in an individual capacity and one would not be allowed to open nor operate it jointly, for, or on behalf of the joint family.