Investing in property is a popular option among NRIs. In the last few years, NRIs have been playing an important role in the real estate market. But buying the property is not enough. There are many costs associated with the maintenance of those properties. Hence, it is considered better to rent out such stuff. It makes the maintenance of such properties easy and ensures a steady flow of income that could further help in fulfilling other financial goals. For NRIs, there are two major aspects related to rental income. The first one is regarding the laws for rental income that also includes tax consequences. The second one is related to the investment process for channelizing the income for a fixed financial goal.

NRI Income Tax Slab Rates & Guide to Renting Out Property in India

Channel through which NRIs can Receive Rent:

The first question that comes to one’s mind is how an NRI will receive rent while staying in another country. The tenant can transfer the rent through NRO or Non-Resident Ordinary account. According to the regulations made by the Indian government, NRO funds up to $1 million can be sent in a given financial year. Or it can be directly transferred to that foreign bank in which the NRI has an account. For example, if the NRI stays in London, and the flat is in New Delhi, the tenant can directly transfer the money to the NRI’s UK bank account.

But before sending the money, the tenant needs to submit a Form 15CA through an online channel to India’s Income Tax Department. Form 15CB needs to be submitted in some specific cases, but in this case, the form needs to be signed by a registered Chartered Accountant. The form certifies that all the details of the particular transaction are correct, including TDS, DTAA if any, and the purpose and nature of the remittance. The tenant himself can submit form 15CA. Once the forms are submitted to the banks, remittance is available.

Tax Rate:

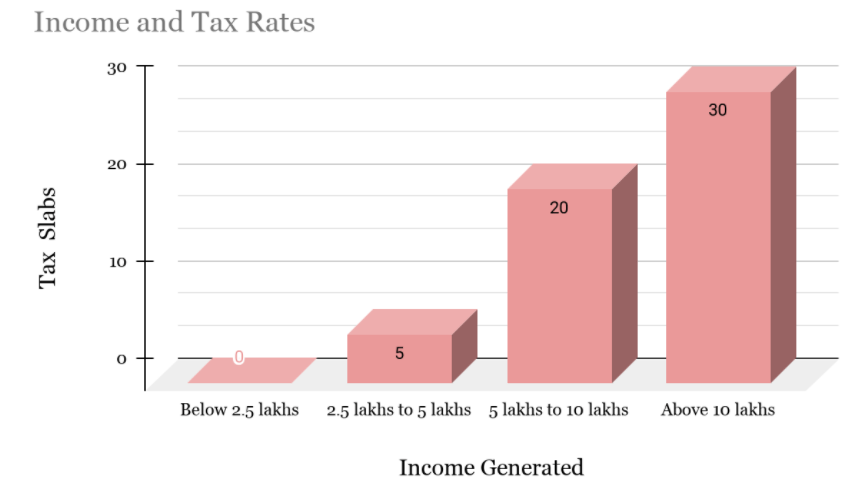

Another important factor for renting out the property by NRIs is the government’s tax payable. The tax paid is dependent on the marginal income tax rates, which are applicable for NRIs since the income is earned in India. The rate is calculated by computing the income generated from the property according to the tax laws, which further needs to be added to income generated from capital gains and other sources that determine the NRI’s Income Tax Slab Rate. Below is a chart which shows the tax rate and income earned. Here the tax rates are in percentages.

Source– NRI’s Rental Income in India

This graph shows that for upto 2.5 lakhs income, there is no tax. As the income grows from 2.5 lakhs to 5 lakhs, a 5% tax is charged. For income between 5 lakhs and 10 lakhs, there is a 20% tax. For income above 10 lakhs, there is a tax rate of 30%.

TDS Rates:

A TDS rate of 31.2% must be deducted by the tenant before paying the rent monthly. For this, the tenant must obtain a Tax Deduction and Collection Account Number or TAN and deposit the same to the government and a copy of TDS certificate to the NRI. If the TDS amount is deducted more than the tax liability, a tax refund is paid while filing ITR. But suppose one wants to skip the refund process. In that case, the person can apply for a certificate for deducting TDS at a lower rate by the Jurisdictional Assessing Officer of the IT department. Once this certificate is given to the NRI, the tenant will deduct the TDS at a lower rate and deposit it on NRI’s PAN.

Loss on the Property:

If the rental income in a particular year is less than the interest paid, the NRI can report a loss from the property. According to the current tax regulations, NRIs can show losses up to Rs 2 lakhs in a particular financial year and carry forward the remaining in the next year. The loss can be shown up to 8 years from the year the first tax is paid.

Deemed Rent:

As per the rules of the government, if a person has two or more properties, one will be considered as self-possessed and other will be considered as rented. There are some conditions associated with deemed rent which are mentioned below:-

- If an NRI has two properties and one is rented, the tax is paid on the rented property while there will be no tax on the self-possessed.

- If an NRI has two properties and both are given on rent, then there will be tax liabilities for only one property.

- If an NRI has two properties and neither is given on rent, the NRI will have to pay tax liabilities on one of them since only one property is treated as self-possessed. The property can be chosen as per the NRIs wish.

- If an NRI has one property and rented, then only tax will be paid on that property. There is no tax on self-possessed property.

Double Taxation:

If the residing country of NRI is in a DTAA with India, there will be no double tax charged. Generally, taxes are charged by the country in which the property is situated.

NRI Investment and Associated Costs:

Associated Costs:

Before renting out any property, the NRI must calculate the maintenance and repairs done on the property. Further, the full TDS might not be paid to the NRI. To know the exact rental income, one must deduct the actual tax liability and repair & maintenance costs.

Investment:

One can reinvest the rental income to either invest in mutual funds or redirect the money towards home loan or buying a new property. NRIs can also use this income as retirement corpus.

Hence one can see that while renting out properties is a great way to earn income. But there are some laws in the country which need to be followed by NRIs, especially the taxation laws. Also, rental incomes help in generating funds for different financial goals of NRIs.

NRI Rental Income FAQ's:

An effective way to reduce the tax liability on rent generating real estate is by owning it jointly. If a property is co-owned and the ownership which is shared, is ascertainable, then the total income should be taxable for both the partners by the ratio of their ownership as given in the Property Title Deed.

No, Rental Income is not considered as earned income. It is so, because of the source of the wealth gain. Instead, rental incomes are considered as passive income with certain exceptions from time to time.

Incase one owes tax on the rent one will have to tell HMRC about that rental income which one hasn’t declared through voluntary disclosure. Furthermore, if one fails to disclose that too and are investigated, the HMRC is allowed to charge penalties of up to 100% of the liabilities that are still unpaid, or up to 200% for certain offshore related income.

One can maximize the returns by using the following steps on how to reduce the tax on investment properties. Firstly one must know what he/she can claim and properly understand the key differences between repairs, capital improvements, and maintenance. Secondly one shouldn’t forget to scrap when renovating the investment property. Thirdly, Prepay for the expenses. And, lastly one should claim for the vacant land as well (if any).

One of the most common types of earned income is employment income & self-employment income. The total rental income would be the gross rental income excluding certain deductions like the property tax, mortgage interest, insurance, and maintenance. The total rental losses, when expenses exceed the income threshold, the earned income is reduced when calculating the RRSP room.

There are no such legal requirements to have a particular bank account for the rental income. It is perfectly allowed to use one’s bank account & seeing as one is renting out one property, this practice won’t pose much of an issue. One is advised to get aware of the best deals available on business bank accounts as well.

Yes, one should have a separate bank account for every rental property. If one only has a single bank account for all the rental properties, it’s way harder to have track of all the income as well as expenses.

Owning a rental property is considered a business if one does it to gain a profit and work at that regularly & continuously.

In case the property remains empty during the full or partial part of the last year, even after one does the best effort to let it out, one can claim a deduction as vacancy allowance under section 23(1c) of the Income-Tax tax Act. One will not have to pay any taxes on notional rent for the part for which the property remained vacant.

Unrealized rent is a condition when a tenant defaults on the prevailing payment of the rent, for certain income tax purposes. The I-T department defines it as the total amount of rent that the owner cannot realize, & this could be equal to the sum of the rent payable.