Recently, Maharashtra has been in the news for slashing the stamp duty rates to boost the real estate sector that has seen a slight halt in the pandemic’s aftermath.

Wondering what stamp duty is and how would the stamp duty cut spur the demand? To understand it better, let us first know about stamp duty before getting to the benefits of reducing it.

Stamp duty is one of the sources of government revenue. It is paid to the government during the transaction of property transfer. Buyers generally have to pay the stamp duty at the time of execution of a document by affixing non-judicial stamps to the document in favor of the Inspector General of Registration and Stamps.

What is Stamp Duty?

Stamp duty is a tax levied on the transaction of property. When the property owner changes, i.e., if a seller finds a buyer for his property, on changing the property’s hands from seller to buyer, the tax is levied. It is usually calculated as a percentage of the transaction value.

The stamp duty changes across the states of India. Let’s sneak into Telangana’s charges.

Telangana Stamp Duty & Registration Charges

The registration and Stamp duty in Telangana is generally collected at 6% of the property value, including Stamp duty, transfer duty, registration fee, and a user charge.

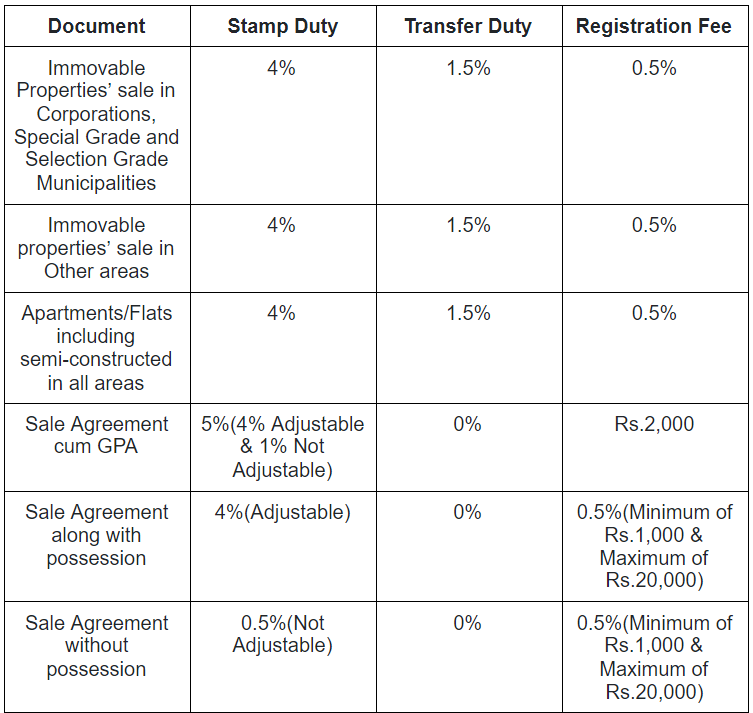

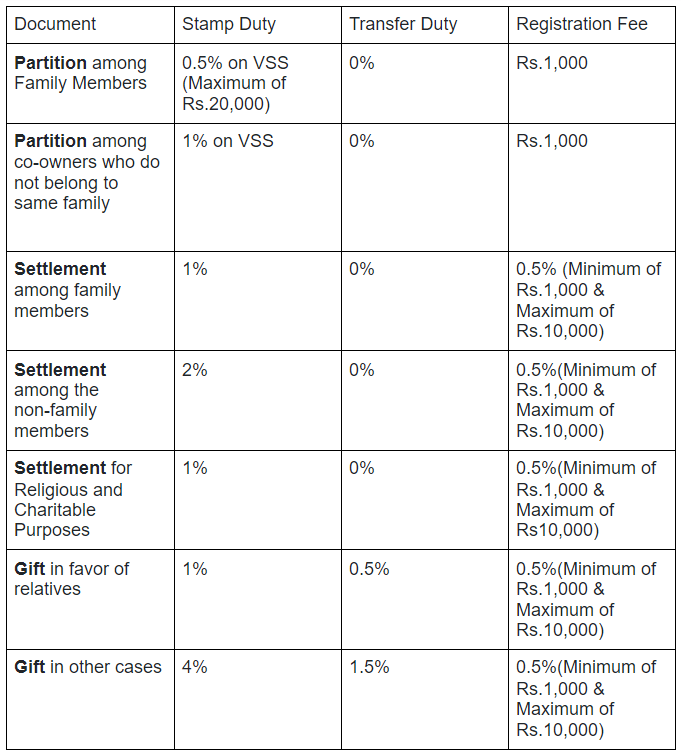

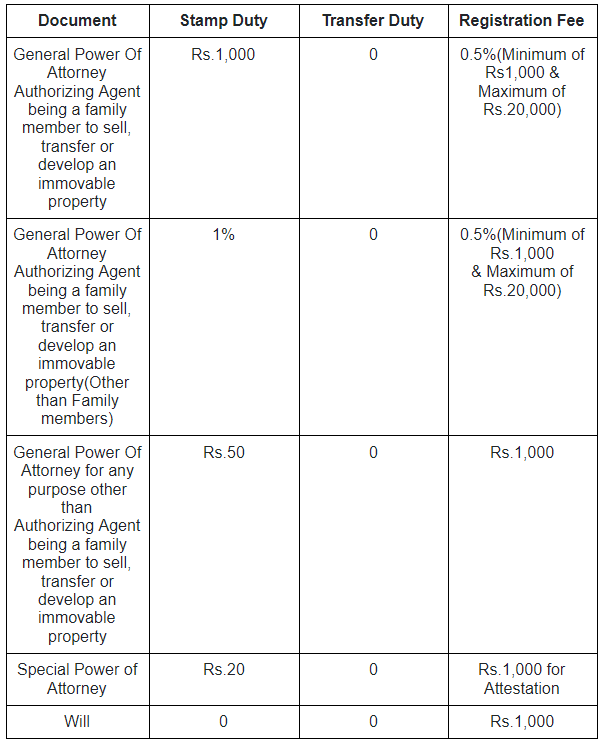

The following tables give the stamp duty payable calculated as the percentage on the market value or the consideration amount, whichever is higher. The stamp duty is payable on the immovable property, partition of property, gift, settlement, power attorney, and will. Let us consider them one by one and know the charges.

Stamp Duty on Immovable property

The following table gives insights into the stamp duty levied on immovable property.

Source: http://registration.telangana.gov.in/

Stamp Duty on Partition of Property, Gift, and Settlement

Source : http://registration.telangana.gov.in/

Stamp Duty on Power of Attorney and Will

Source: http://registration.telangana.gov.in/

What Will Happen if You Do Not Pay Stamp Duty?

Stamp duty is a type of tax, as stated earlier and hence demands payment. Under any circumstances, if the stamp duty is evaded, i.e., not paid, the transaction would be considered null and void. The property’s transaction remains unrecognized, and the property would be immediately confiscated, and corresponding persons would be penalized accordingly.

Stamp Duty Refund Procedure

The refund on the non-judicial stamp papers that are not used or spoilt can be availed through the challan system. This is permissible under the provision of the Indian Stamp Act, 1899. However, the non-judicial stamp papers are available up to Rs.100 only, of which you can request for refund.

Any reduction in stamp duty reduces the burden on the buyer. For instance, if the buyer wants to sell a property worth Rs.1 Crore and the stamp duty stands at 4%, the buyer has to pay an amount of Rs.4 Lakhs as stamp duty to the state government. As insisted by the builders of Telangana, if the stamp duty is reduced to 50%. The buyer has to pay Rs 2 Lakhs. It would boost the demand as it would reduce the overall cost of the property at large

Telangana Stamp Duty FAQ's:

Stamp duty is a tax levied on the property during its transfer from the seller to the buyer.

No. The stamp duty changes from state to state as land and property are the subjects of the state.

The general registration and stamp duty charges stand at 6% in Telangana.

If the stamp duty is reduced, the property’s overall cost from the buyer’s side reduces. Hence the buyers would show an inclination towards the purchase of properties, which stimulates the market demand.