The EV revolution in India is coming sooner than you think. In 2023, the total EV sales reached 1.53 million, approximately 1.5x increase from 1.02 million in 2022. This cements Indian consumers’ willingness to adopt EVs and gives an optimistic nod to the Indian government’s plan of drastically reducing emissions by 2030 through non-ICE [petrol/diesel] vehicles.

GOI’s EV adoption target: 30% among private cars & 70% among commercial fleets.

India’s Auto Market In Focus

- Third-largest automobile market in the world

- GDP contribution: 35% to manufacturing, 8% of total exports, and 7% of the country’s total.

- Largest producer of three-wheelers

- Second-largest manufacturer of two-wheelers and buses

- Fourth largest producer of passenger cars

Being one of India’s biggest industries, there is now a spotlight on manufacturers to shift consumer demand towards greener options. Globally, there are now approximately 40 million electric cars on the roads with China leading the new car registrations as of 2023 [60%] followed by Europe [25%] and the United States [10%]. Now, India, Japan, Mexico, and UAE have a minimal contribution but as the country with the largest population, there’s progressive pressure on India to hit the mark.

Prominent manufacturers like Tata Motors and Mahindra & Mahindra have begun producing EVs in different price ranges but the greater need of the hour that needs to go hand-in-hand with manufacturing is changing the way consumers perceive electric vehicles.

According to a report by Mordor Intelligence, the market share of the EV industry is also bound to grow by 26.05% annually, from an estimated USD 34.8 billion in 2024 to USD 110.74 billion by 2029. A steep yet remarkable target to achieve, this growth depends on making consumers more confident about the shift by reducing range anxiety.

What Is Range Anxiety – A Roadblock In EV Adoption?

Range anxiety is the fear that the electric vehicle will not have sufficient charge to complete a long-haul drive, typically on highways. This is one of the greatest barriers to complete EV adoption in India. Early manufacturers released electric vehicles that had poor real-world mileage of approximately 300 km per charge. This tainted the reputation of electric vehicles among enthusiasts who don’t limit driving to just city limits.

Is there a solution to EV range anxiety?

Yes, expanding the public charging infrastructure.

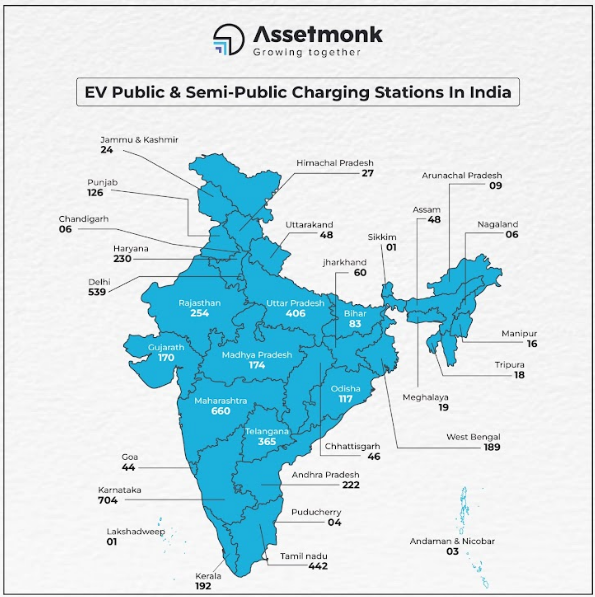

- Total current public & semi-public charging stations – 5,234

- Required public & semi-public charging stations – 39 lakh

- Current public charging station to EV ratio – 1:135

- Required public charging station to EV ratio – 1:20

The government has recognized this gap in the EV industry’s backbone, public charging, and is incentivizing private players to enter the sector and build fast charging stations while sanctioning the construction of 2,877 EV charging stations along with 1,576 stations spread across 16 highways and 9 expressways under the FAME act. Private companies entering the industry to reduce the gap are bound to have high revenues as the usage grows with increasing EV sales.

Can Retail Investors Capitalize On The Growing EV Sector?

For the early mover advantage, people are not just looking for better EV cars to purchase but also for EV investments. As a result, EV manufacturers, clean energy, and battery tech stocks are getting popular as those avenues are easily accessible to investors who are already well-versed in the markets. However, investing in this sunrise industry can also mean looking beyond volatile equities.

Alternative investments give retail investors access to investments in unique industries and one of them, now, is EV. As private companies are preparing to set up public charging stations, this is opening avenues for investors to participate in structured investment options with the assurance of investment security and fixed, higher returns, great for portfolio diversification since they are non-market linked and act as a hedge against inflation.

Open Opportunity: A Fixed Income, Alternative Investment.

Right now, Assetmonk has curated a fixed-income product from the EV public charging sector for a minimum ticket size of INR 5 lakhs and a 12% fixed yield. The funds will help a promising company set up public charging stations with fast chargers across Southern highways touching 18 cities including Bengaluru, Chennai, Vizag, Hyderabad, Vijayawada, and Tirupati which will also give investors a revenue-sharing upside.

Wrapping Up: Now Is The Right Time To Invest In EV

The Indian EV Industry is certainly on a growth spree. To cement its spot as a 100% EV-reliant country, active measures are being taken to improve the underdeveloped public charging infrastructure, opening opportunities for retail investors to diversify their portfolios with structured investments from this sector.

From an investor’s point of view –

- The government is showing unwavering support to private players entering the public charging space with incentives.

- Skyrocketing consumer demand for EVs, observed from 1.5x sales growth in 2023, is a green flag indicating high utilization and revenues for the public charging companies.

- Increasing investment options, not just from traditional avenues but alternative fixed-income investments opens a bigger playing field for investors looking at portfolio diversification.

Are you ready to get started with your investment in the EV charging sector?

Listen to the article

Listen to the article