What Are Alternative Investment Funds (AIFs)

- An Alternative Investment Funds (AIF) refers to a privately pooled investment vehicle established or incorporated in India, gathering funds from sophisticated investors, both domestic and foreign. These funds are then invested according to a defined investment policy for the benefit of its investors. The minimum investment threshold for participating in any AIF in India is ₹1 crore.

- With a minimum ticket size of Rs. 1 crore, alternative investment funds are a category of pooled-in investment vehicles that gather capital from institutions and high-net-worth individuals, including Indian, international, and non-resident Indians. As their name implies, they offer an alternative to conventional investment options like bonds, mutual funds, and direct equity.

- The privately pooled money in best Alternative Investment Funds in India are invested in alternative asset classes including venture capital, private equity, hedge funds, infrastructure funds, etc. in accordance with a determined investment policy.

- This means that they offer a diverse range of projects, at every stage of development, long-term, high-risk finance.

- Compared to mutual funds, Alternative Investment Funds in India are currently an investment option that is growing more quickly in India. Many factors, including diversification of risk from traditional asset classes, the ability to generate higher returns than stocks and mutual funds, and low susceptibility to stock market volatility, have contributed to this. However, their emergence in India was driven by some fundamental factors.

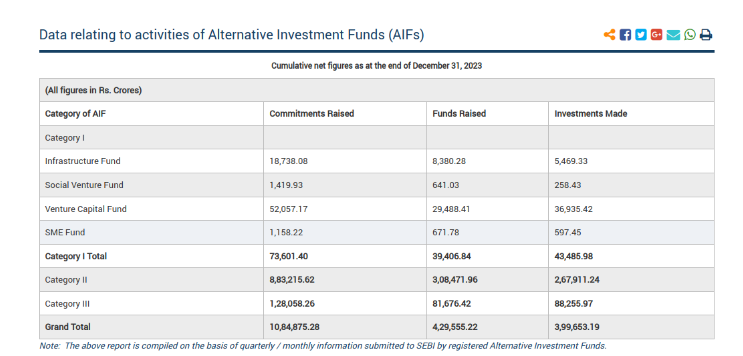

AIF Industry in India on the Rise

Source: https://www.sebi.gov.in/statistics/1392982252002.html

Alternative Investment Trends In India

- Other asset classes than traditional alternatives, like cash, stocks, and fixed deposits, are referred to as alternative investments. Via peer-to-peer lending, cryptocurrencies, commercial real estate, asset leasing, venture capital, and private equity, among other strategies, these alternatives provide investors with high returns and diversification.

- Like most emerging investment options, affluent individuals with higher net worth are among the first to embrace alternative investments.

- With the increasing digitization of retail investment practices and the growing trend of fractionalization, alternative investments are gradually finding their place in portfolios of various sizes.

Types & Categories of Alternative Investment Funds in India

As per classification made by SEBI, Alternative Investment Funds in India can be divided into three unique categories, which are defined as follows –

1. Category I AIF

- These funds invest in SMEs, start-ups, and new economically viable businesses with high growth potential, , or other sectors which are considered by government regulators as positive and beneficial either socially or economically.

- Because of this, it is anticipated that Cat I funds will have an impact on the economy, and the government might consider giving them incentives or concessions for serving that purpose.

- Venture Capital Fund (VCF)

New-age entrepreneurial firms that require large financing during their initial days can approach VCF. They can get through the financial hardship with the aid of VCF. High-growth start-ups are the focus of these funds. HNIs investing in VCFs adopt a high-risk, high-return strategy while allocating their resources.

- Angel Funds

These invest in budding start-ups and are called angel investors. They bring with them prior experience in business management. These funds make investments in new businesses that VCF does not fund. Each angel investor must contribute a minimum of Rs 25 lakh.

- Infrastructure Funds

This fund invests in infrastructure companies, i.e., those involved in railway construction, port construction, etc. Those who have high hopes for infrastructure development allocate their capital to these funds.

- Social Venture Funds

Funds investing in a socially responsible business are social venture funds. Although they are a type of charitable investment, they have the potential to provide investors with decent returns.

2. Category II AIF

- This category of Alternative Investment Funds includes debt funds and private equity funds. The category is created to offer a defensive investment alternative where diversified investment portfolios are built and managed by experienced fund managers to reduce the risk profile of investors.

- The debt funds that fall under this category invest in debt/debt securities of listed or unlisted investee companies as per the stated objectives of the fund.

- Private Equity Funds

A private equity fund invests in unlisted private companies. It is challenging for unlisted businesses to raise capital through the issuance of debt and equity instruments. These funds typically have a lock-in period of 4 to 7 years.

- Debt Funds

The debt securities of unlisted companies are the fund’s principal investment vehicle. Usually, such companies follow good corporate governance models and have high growth potential. For cautious investors, they represent a risky option due to their low credit rating. Loans cannot be made with the money that debt funds have accumulated, according to SEBI regulations.

- Fund of Funds

Such funds invest in other Alternative Investment Funds. They do not have an investment portfolio but focus on investing in different Alternative Investment Funds

3. Category III AIF

- Cat III Alternative Investment Funds apply complex trading strategies such as arbitrage, margin, futures, and derivatives to generate returns.

- Under this category, funds that trade for short-term profits, such as hedge funds, private investment in public equity (PIPE) funds, and others that purchase publicly traded stock at a discount to market value, are eligible to be registered as AIFs.

- Private Investment in Public Equity Fund (PIPE)

Shares of publicly traded corporations are purchased by PIPEs.. They acquire shares at a discounted price. Investment through PIPE is more convenient than going for a secondary issue owing to less paperwork and administration.

- Hedge Funds

Hedge funds pool money from accredited investors and institutions. These funds make investments in local and foreign debt and equity markets.

To provide returns for investors, they take an aggressive approach to investing. Hedge funds can be pricey, though, because fund managers may charge 2% or more for asset management. They can also levy 20% of the returns generated as their fees.

Who Can Invest in an AIF?

Investors looking to diversify their portfolio have the option to invest in AIFs. To be eligible, individuals must meet the following criteria:

- Resident Indians, NRIs, and foreign nationals are allowed to invest in these funds.

- The minimum investment required for investors is Rs. 1 crore, while directors, employees, and fund managers must invest a minimum amount of Rs. 25 lakh.

- AIFs have a minimum lock-in period of three years.

- The number of investors allowed in each scheme is limited to 1000, except for angel funds, where the maximum number of investors is 49.

Benefits of Investing in an Alternate Investment Funds (AIF)

Here are some of the benefits of investing in best Alternative Investment Funds

High Return Potential

AIFs typically offer greater potential returns than other types of investments. The massive pooled amount gives the fund managers enough room to prepare flexible strategies for maximizing returns.

Diversification

These funds give an investment portfolio the much-needed diversification. They act as a cushion at the time of financial crisis or market volatility.

Low Volatility

AIFs are not directly related to stock markets. These funds have lower volatility, especially when compared to conventional equity investments. Therefore, it might be appropriate for investors who are risk averse and seek stability.

Potential of Alternative Investment Funds in India

- The popularity of AIFs is definitely rising in India. Alternative (AIF) sector has committed a total of Rs 6.4 lakh crore as of March 31, 2022. This represents a substantial increase of seven times over the previous five years. It is likely to grow further in the coming years.

- The government must recognize the AIF industry’s expectations in order for it to grow further. These expectations include adopting strong global best practices, supporting on-shore fund management, and unleashing the domestic capital pool through additional sectoral and regulatory support.

- By carefully assessing and implementing AIFs, investors can increase the returns and diversification of their portfolios.

- Until recently, only ultra-HNIs and high net worth individuals had access to alternative investments because of their high cost, high risk, lack of regulation, and liquidity. However, now the general public can invest in these asset classes, starting with small investments spread across different properties with the help of platforms like Assetmonk.

- An Alternative Investment Funds lowers the risk profile of real estate as an asset class and provides a defensive investment option with knowledgeable investment managers overseeing a broad investment portfolio.

- Most importantly, the funds will be used in developing stalled and delayed projects – a pain point of the real estate sector.

- The sector is expected to grow at an optimistic rate through 2024, which will support the expansion of AIFs in India. The property markets in top cities are likely to remain stable and thrive due to an increase in institutional investments and stakeholder confidence.

How to Invest In AIFs?

The process of investing in Alternative Investment Funds (AIFs) varies greatly depending on the specific type chosen. It can range from requiring significant capital and extensive research to simply making a few clicks. Here are the top alternative investment options in India.

Top Alternative Investments in India

Numerous investment vehicles that provide access to a range of alternative investments can be found in India’s dynamic economic environment. As mentioned below, these vehicles offer access to assets in various segments that are ideal for diversifying an investment portfolio.

Commercial Real Estate

- Commercial real estate is an alternative investment asset that offers predictable, fixed-income returns generating multiple income streams. Shops, offices, warehouses, and other commercial properties are secure investments that provide long-term capital growth and consistent rental income.

- However, Investing in real estate is cumbersome and requires a large initial investment and excessive due diligence. As an alternative, fractional real estate allows investors to own some of such assets while enjoying all the benefits.

- Learn how fractional real estate and new-age investment discovery platforms transform the investment landscape.

Hedge Funds

- Hedge funds are a subset of non-traditional investment funds that raise money from investors to trade highly risky equities and domestic and international debt. These funds can utilize diverse investment tactics, such as short selling, leveraging, and derivatives.

- Hedge funds are subject to less restrictive regulations than mutual funds and other types of investment funds, which allows them to be more maneuvering investment strategies and produce higher returns.

Private Equity And Venture Capital

Growth in venture capital (VC) and private equity (PE) investments has been fueled by India’s thriving startup ecosystem. Venture capital (VC) and private equity (PE) funds provide funding to start-ups or rapidly expanding businesses in return for ownership stakes. Significant returns are promised by these investments, particularly when start-ups flourish or successfully exit. For instance, in the last 13 years, private equity funds in India have raised close to $100 billion.

Peer-to-Peer Lending

- One of the most popular alternative investment funds in India is peer-to-peer lending. It entails using online platforms to enable direct connections between lenders and borrowers.

- With this lending model, loans can be obtained by both individuals and small businesses without the need for traditional financial intermediaries. In line with this model, investors place money on lending platforms in order to earn interest on loan repayments from borrowers.

- P2P lending has less limitations on who can borrow than traditional financial institutions, which have strict guidelines on who can borrow money and at what rate. The only downside for people who fail credit checks is being hit with high-interest rates on loans.

Can an AIF Raise Any Amount of Funds From the Investor?

While an Alternate Investment Fund (AIF) has the flexibility to raise funds from various sophisticated investors, including Indian, foreign, and non-resident Indian investors, there are certain limitations on the amount of funds that can be raised. The Securities and Exchange Board of India (SEBI) has set regulations regarding the maximum funds an AIF in India can raise from investors.

For Category 1 AIF, Category 2 AIF, and Category 3 AIF, the minimum investment amount for an investor is 1 crore. However, for angel investors, the minimum investment is INR 25 lakhs.

Potential Risks And Challenges Of Alternative Investments

Like most forms of investment, alternative investments also have challenges and risks:

Lack Of Liquidity: The illiquidity of alternative investments is one of the key drawbacks that investors need to be aware of. Alternative investments don’t have the same liquidity as conventional investments because they have longer lock-in periods and fewer options for liquidation. For instance, venture capital, private equity funds, and some hedge funds tend to have longer lock-in periods, which might make it challenging to access invested capital.

Regulatory Challenges: Some alternative investments, such as cryptos, operate in regulatory gray areas. Investors may be exposed to risks and uncertainties due to the shifting regulatory environment. Therefore, the viability and profitability of these alternative investments may be impacted by changes in regulations or the introduction of new compliance requirements.

Alternative Investment Fund (AIF) Taxation

The taxation policy for Alternative Investment Funds (AIFs) varies according to their respective categories. Category I and Category II AIFs are granted pass-through status, meaning that any income earned by the AIF (excluding business income) is exempt from taxes.

However, the investors are liable to pay taxes on the gains acquired through such investments. It is noteworthy that even though the AIF makes the investments, the gains will be taxed as if the investor has invested personally.

In contrast, Category III AIFs are not granted pass-through status, and the income earned by these funds is taxable in the hands of the fund. However, the type of fund, such as a company, LLP, or trust, determine the taxation policy. In this category, the investors are not required to pay any taxes on the gains.

Conclusion

The alternative investment space in India is growing fast, and as a result, it presents savvy investors with massive investment opportunities. Depending on one’s investment strategy and risk tolerance, there are a variety of options to take into account, ranging from Real estate to cryptocurrencies.

It’s important to remember that these products and vehicles come with certain risks in addition to offering investors high returns and diversification. Therefore, before making an investment in these products, investors should do extensive research and consult with experts.

If you are looking to invest in alternative investments, sign up today on Assetmonk for insights on investment opportunities in India. Assetmonk distinguishes itself as an outstanding alternative investment platform in India, presenting a diverse range of alternative investment options for savvy investors.

alternative investment funds in India with a primary focus on real estate structured debt among their notable investment offerings. With a guaranteed Internal Rate of Return (IRR) of 17.1 percent, this product currently offers investors a tempting chance to earn attractive returns.

What makes this opportunity even more appealing is its accessibility, as individuals can commence investing in this product with a minimum amount of just Rs. 10 lakhs.

This low entry threshold ensures that a wide range of investors can participate and benefit from this exceptional investment opportunity.

Related Articles

- Best Investment Options in India to get Higher Returns

- Alternative Investment Options In India

- Best Passive Income Ideas In India

Best AIF funds in India FAQS

Q1. How to invest in alternative investment funds in India?

A. To begin investing in AIFs, an individual investor must have a minimum investment corpus of Rs. 1 crore. You must also present proof of your ID, PAN, and income.

Q2. How is AIF different from mutual funds?

A. Alternative Investment Funds offer a higher degree of flexibility than mutual funds as they invest in unlisted shares and also use shorting and leverage.

Q3. What is an Alternative investment fund?

A. Alternative investment funds are investment schemes that distribute their capital among financial instruments other than conventional investment options. They include angel funds, commodities, real estate, venture capital, private equity, etc.

Listen to the article

Listen to the article