- As we slow dance into 2024, India real estate market has been on the up and up. Traditional real estate investments have been flourishing, in addition to alternative investment which is totally reshaping how the Indian real estate sector works.

- As per a report from ANAROCK research, housing sales in India touched unseen heights in the first 3 quarters of 2023. Residential real estate sales touched new highs in a number of Indian cities: Mumbai, Delhi NCR, Hyderabad, Chennai, Bengaluru, and so on.

- As per a Concorde report on the future of real estate india market is projected to grow at a mouthwatering CAGR rate of 9.2% from 2023 to 2028. Furthermore, the real estate sector is anticipated to contribute 13 percent to the total GDP of the country by 2025.

- The future of real estate market in india looks very promising indeed, and in this article we’ll take a look at real estate trends in india that investors can witness in the near future in Indian real estate.

A Closer Look at India Real Estate Market Trends

Residential Sector: Strong & Steady

- The heartbeat of the Indian real estate industry sector lies with the steadily growing middle class which keeps its cities alive and bustling. Demand for residential properties in urban & suburban areas is growing, mainly due to factors such as steady economic growth and urbanisation.

- 2023 also saw the completion of many new large scale residential projects, which has further increased demand and the development of new growth spots.

- As per JLL’s Home Purchase Affordability Index, it is anticipated that affordability for the residential sector will improve in 2024. A significant reduction of about 60-80 basis points in the repo rates will elevate the affordability of home purchases, making it an opportune time to invest in the housing sector.

Commercial Real Estate in 2024

Co-Working Spaces

- In the aftermath of the pandemic, there has been a surge in the search for shared and adaptable workspaces, which has ignited the commercial real estate market in india.

- Businesses are shifting towards flexible hybrid working models, and the demand for flexible commercial office properties that can be used as hubs of collaboration and creation has increased.

- These commercial coworking spaces have redefined conventional work environments and have fostered a spirit of networking and harmony among the companies who occupy them; further captivating investors looking to maximise potential in the commercial real estate boom in India.

Commercial Subleasing

- Commercial subleasing is one of the biggest ways in unlocking value from commercial real estate: You lease commercial space from a primary landlord which is the further sublet to the subtenant, allowing for flexible office arrangements and additional sources of monthly income.

- The increasing demand for shared workspaces reflects a changing office culture and creates opportunities for astute investment strategies.

India Real Estate Market Trends

| Market Sector | Key Insights |

| Residential Sector | Predicted to constitute over 50% of the Asia Pacific region’s middle class by 2024. – Record-breaking housing sales in H1 2023: approximately 2.29 lakh units, over 63% of total 2022 sales. |

| Commercial Sector | CBRE forecasts a rise in India’s commercial real estate project count from 37% (2022-23) to over 40% (2023-24). – Robust growth in major cities (Mumbai, Delhi, Bengaluru) driven by IT, e-commerce, startups. |

| Real Estate Growth in Tier 2 & Tier 3 Cities | Rising real estate investment in metro cities prompts focus on tier-2 and tier-3 cities (e.g., Pune, Hyderabad, Kochi, Chandigarh). – These cities offer a mix of affordability and growth potential due to government initiatives and infrastructural projects. |

Fractional Ownership: Redefining Ownership of Commercial Property

- As we’ve seen, real estate has been, and continues to remain an integral sector for long term investment among Indian investors and NRIs.

- The market is appreciated for its portfolio diversification, mitigating risk, and maximising potential to attain long-term capital apreciation.

- Alternative investment models have a crucial role in the future of indian real estate industry: These investments, such as Real Estate Investment Trusts (REITs), fractional ownership, and commercial leasing, have taken over the sector by storm and are seeing a rapid ascent in the industry.

How Fractional Ownership is Transforming the Market

- Fractional ownership has emerged as a revolutionary alternative investment option in the last couple of years, allowing multiple investors to own high end commercial properties.

- The flexibility & accessibility of this model are key factors that have facilitated its rapid growth in the industry, with the market for fractional ownership in India growing from Rs 1500 crore in 2019 to about Rs 4000 crore in 2023.

- According to a indian real estate market report by Knight Frank, the market for fractional ownership of commercial property is expected to reach USD 8. Billion by 2025: at an anticipated Compound Annual Growth Rate (CAGR) of 10.5%. High convenience of investment, reduced minimum entry barriers, mitigation of risk, are some factors behind the growing popularity of fractional ownership in India.

Assetmonk: Secure Alternative Real Estate Investments

- Assetmonk has been a catalyst for change in India’s real estate investment landscape, providing investors with novel opportunities to invest in trophy commercial real estate properties and giving high returns.

- By using technology to our advantage, and strategically scouting premium properties in key locations, Assetmonk empowers investors to diversify their portfolios with high potential real estate projects.

The Upswing of Indian Real Estate in 2024

Despite challenges presented by the global economy, the Indian real estate industry has demonstrated remarkable resilience and adaptability in 2023. The main focus is building adaptable and sustainable spaces for the commercial and residential sectors.

Despite growing geopolitical tensions, India is still a favorable place to invest, so the commercial segment is predicted to grow. Expanding operations by tech-enabled sectors in the nation will be the primary driver of demand growth.

India has emerged as the most favored location for global shared services, accounting for roughly 1,580 GCCs as of FY23. There were notable changes in the residential and commercial segments of the real estate india market. Cities’ residential markets expanded rapidly as a result of both new supply and rising demand.

Current Landscape of Indian Real Estate

In the real estate market in india market today, the industry is a shining example of determination, having outperformed all forecasts in 2023 with a strong showing.

Industry projections indicate that the real estate sector will account for 13% of India’s GDP by 2025 and that the market size is expected to exceed USD one trillion by 2030.

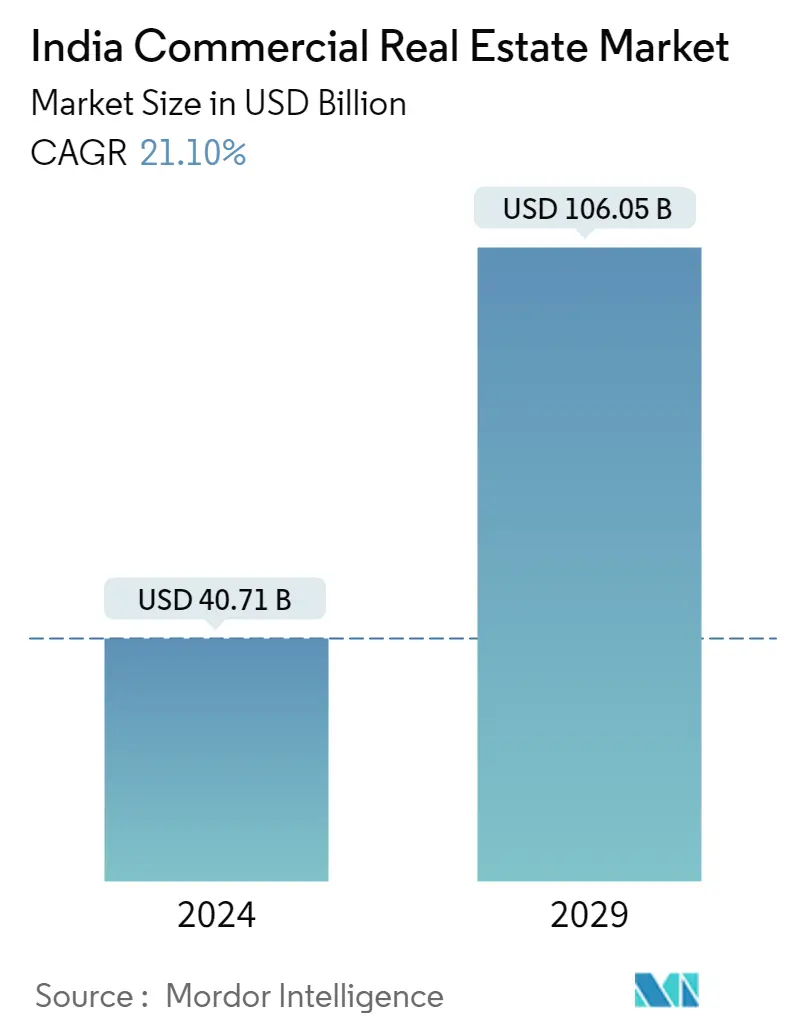

A recent indian real estate market report from Knight Frank India offers an accurate indication of the trajectory of property values, predicting a 5-7% price appreciation in the residential real estate market in 2024. While the size of the Indian commercial real estate market is projected to be USD 40.71 billion in 2024 and grow at a CAGR of 21.10% to reach USD 106.05 billion by 2029 as per reports by Mordor Intelligence.

High disposable incomes, thriving economic conditions, and a spike in NRI investment supporting positive market sentiment all contributed to the growth trend. Industry data shows that home sales have significantly increased, and property values have been rising steadily in a number of metro areas.

Emerging Trends

Here are a few of the emerging real estate trends in india that you should look out for:

PropTech

The rise of PropTech is particularly notable. Technology and real estate procedures coming together are revolutionising the industry, increasing productivity, and offering creative solutions for real estate deals.

According to recent data, there has been a notable surge in investments in PropTech, highlighting how important it is in influencing the direction of real estate.

Co-living and coworking spaces

Co-living and co-working spaces are becoming dynamic forces that are redefining how people think about living and working.

According to Colliers’ most recent report, “Future of Co-living in India,” the number of co-living beds in India is predicted to double by 2024, from 2,10,000 beds at the end of 2021 to 4,50,000 beds by the end of 2024.

Corporates and multinational corporations (MNCs) are flocking to co-working spaces in 2023, which have emerged as robust growth hubs, as the co-working sector has flourished and demand has increased significantly.

The data shows that changing lifestyle preferences and the gig economy are driving increased demand for adaptable, community-focused spaces.

With developers increasingly focusing on creating integrated spaces that meet both living and working requirements, this shift is expected to redefine the dynamics of the real estate market in india.

Tier 2 and 3 cities

There is a noticeable shift in the development focus, with Tier 2 and Tier 3 cities coming under increasing scrutiny.

According to JLL India, since January of last year, real estate developers have paid approximately Rs 5,000 crore to acquire 1,461 acres of land in Tier II and III cities in order to grow their enterprises. Plotted development is the intended use for the majority of the land parcels acquired in these cities.

Development has been pushed to Tier 2 and Tier 3 cities where there is a need for affordable space due to the increase in real estate prices in the major cities.

In order to access cheaper infrastructure, office spaces, warehouses, co-working spaces, retail, and other amenities, large corporations and industrial houses are also relocating to Tier 2 and Tier 3 cities.

The most recent indian real estate market report points out these cities’ potential for growth and investment opportunities, which are being driven by increasing urbanisation and infrastructure development. Expansion of real estate into the peripheries is becoming the new frontier as major urban centres get saturated.

Demand for Grade-A & Flexible Office Spaces

The office market is expected to expand in 2024 as more businesses enforce work-from-office policies. It is expected that businesses will grow and rent new office spaces as more workers return to the workplace. However, because of the uncertainty surrounding the global macroeconomic situation, businesses will be cautious when leasing.

With more big businesses adopting flexible spaces, the current inventory of flexible spaces, which is approximately 53.4 million square feet, is expected to surpass 81 million square feet in the next two years.

Additionally, it is anticipated that the office sector will prioritise sustainable designs and renewable energy sources as the world community steps up its efforts to combat climate change.

Sustainability

In the industry, sustainability is now a fundamental principle rather than a secondary one. A growing real estate trends in india in construction is using policy and tax benefits to incentivize eco-friendly construction practices.

According to a McKinsey report, the development and maintenance of the built environment is responsible for roughly 26% of greenhouse gas emissions and 37% of emissions related to combustion.

Additionally, real estate companies have started to consider sustainability as a necessary practice, including planning as many open and green spaces as possible, in light of the government’s ambitious plan to have India achieve net zero emissions by 2070. In addition to environmental concerns, the realisation that sustainability has the potential to yield substantial long-term returns is what is driving this shift.

Hence, Developers are matching their projects with sustainable practices to meet the growing demand for green buildings, as evidenced by the data. As India works towards its goals of having net zero emissions by 2070 and 50% reductions in carbon emissions by 2050, more eco-friendly construction and the use of sustainable materials are anticipated.

Why is investing in India’s real estate market an attractive option?

Asian markets, including India, are seeing a diversification of the depth of capital, with real estate emerging as a preferred sector for higher allocations. Real estate is a desirable investment due to India’s status as one of the world’s economies, expanding quickly due to private consumption and capital formation. Investors are looking into opportunities in various real estate categories, including data centers, office spaces, private credit, logistics, and residential properties.

Financial experts view real estate as a safe, long-term investment, and the industry’s future looks bright. Experts predict that the residential real estate market will rise to a three-year peak in 2024 while staying within reasonable bounds.

According to the JLL Home Purchase Affordability Index, the real estate market in india is expected to grow at the fastest rate in major cities like Chennai, Delhi NCR, and Mumbai.

Fractional Ownership: A Game-Changer in the Indian Real Estate Market

The high barrier to entry, ownership risk, and related responsibilities discouraged people from investing in large real estate in the past, but fractional ownership has drastically changed the real estate landscape in India.

In short, fractional ownership is the price of owning a costly asset divided into shares, with each owner owning a percentage of the asset and all related risks and obligations. Regarding real estate, it indicates that several investors jointly own shares of a valuable property in which they are each entitled to a certain percentage. This allows the investors to enjoy the rewards of their investment while reducing the risk of ownership and management of the entire property.

The collective asset value in the nation’s fractional ownership market increased from Rs 1,500 crore in 2019 to Rs 4,000 crore in 2023.

According to the indian real estate market report by TruBoard Partners, the fractional ownership market asset under management (AUM) is expected to grow at a compound annual growth rate (CAGR) of 25–30% in the next four to five years.

Fractional ownership has completely changed the game from the past, when real estate assets, especially luxury homes and commercial properties, were thought to be difficult investments for people on a tight budget.

By dividing the costs with other investors, investors can now easily access these properties even on a tight budget. By doing this, investors can minimise expenses and risks while still taking advantage of these spaces’ features and advantages.

Because fractional ownership has a lower initial investment than full ownership, it enables investors to build a more diverse portfolio and reduces the risk of owning a single property.

Assetmonk, an alternative investment platform, offers a fractional ownership model where investments are secured and start as low as 25 lakhs, offering investors a steady stream of rental income.

Conclusion

The future of India real estate is full of promise, and supported by consistent economic growth of the country, evolving market dynamics, and high demand for diverse real estate offerings.

Investors looking to venture in the real estate india, after gaining the required knowledge and experience can do so confidently; with Assetmonk as a reliable partner ready to guide you through the alternative real estate investment landscape in India.

Read More

What Are The New Opportunities in Commercial Real Estate?

Impact of Government Policies on Commercial Real Estate

Latest News

Indian real estate to be worth $1.5 trn by 2034 as demand soars

India’s real estate sector will be worth $1.5 trillion by 2034 as it grows three-fold from $482 billion now as residential and commercial demand grows, said a report on Friday.

Source : Business Standard12 April 2024

Listen to the article

Listen to the article