- Maximize your investment returns by understanding the key role of the Internal Rate of Return (IRR). Our in-depth blog post explores IRR’s significance in evaluating opportunities and boosting your portfolio’s growth potential.

- Let’s say you are shown two real estate deals, the first with an 17% IRR and the other with an 6% IRR. Does a deal with a higher IRR always translate into a better deal? Is IRR the only measure that matters?

- The property’s long-term yield can be determined using indicators like the Internal Rate of Return (IRR). It is a reliable and good concept for real estate investors to be familiar with.

- You will undoubtedly gain an understanding of what IRR is and how to calculate it for commercial real estate investments after reading this article.

What Is the Internal Rate of Return (IRR)?

- Before starting any new project or making any investments, A cost-profit analysis is a natural step. A possible investment’s return is calculated using the internal rate of return, or IRR.

- The calculation is referred to as internal because it does not account for outside variables like inflation and the cost of capital. Investors can compare the profitability of various investments or capital expenditures with the use of internal rate of return (IRR), which is expressed as a percentage. When all else is equal, a higher internal rate of return (IRR) investment is preferred over a lower one.

- Any project or investment has a margin or a required rate of return (RRR) that makes the undertaking worth considering. However, that is not the sole criterion used to make these choices. A thorough consideration of numerous additional quantitative and qualitative factors is made prior to making an investment decision.

Why Internal Rate of Return Is Important

- Investors can determine an investment’s expected profitability with the use of IRR. An investment might be said to have a 10% IRR, for example. This means that over the course of its life, an investment will yield an annual rate of return of 10%.

- In particular, IRR is a discount rate that results in a net present value (NPV) of zero when applied to projected cash flows from an investment.

How to Calculate IRR

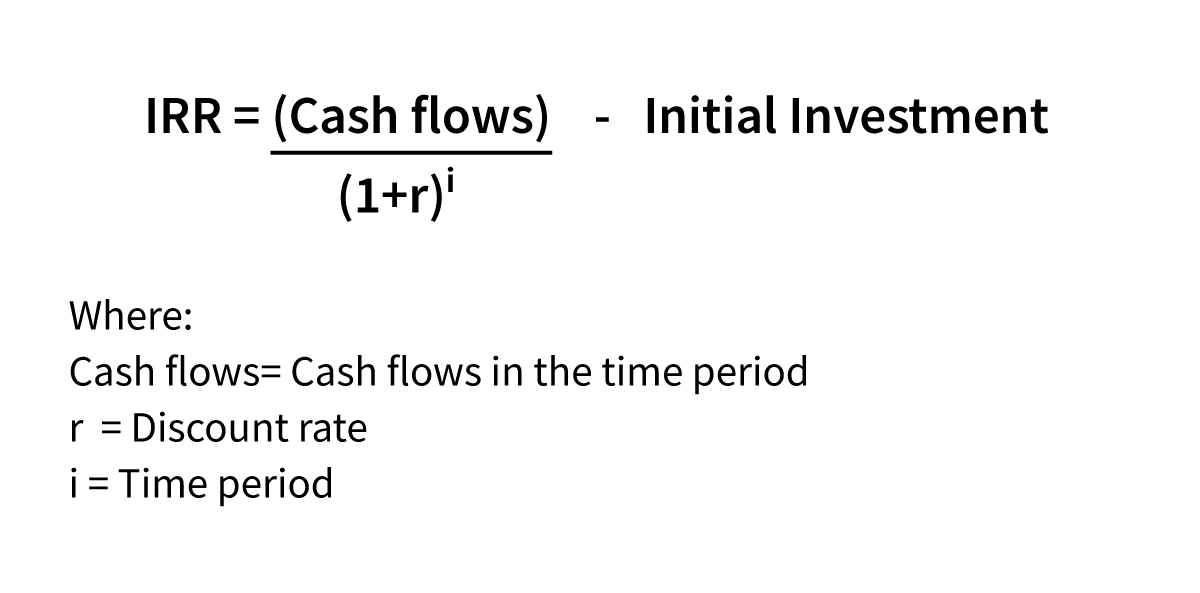

- As a real estate investor, it’s important to know how to determine the internal rate of return and the steps associated with it. Although there isn’t a set formula for estimating IRR, the formula finds the discount rate by setting the NPV (Net Present Value) to zero.

- The internal rate of return is calculated using the same formula as the net present value. An analyst cannot use analytical methods to derive the IRR; instead, they must rely on the trial and error method.

- IRR can also be calculated using a variety of software programmes, such as Microsoft Excel, with automation. A financial function in Excel is a calculator for internal rate of return using cash flows at regular intervals.

The ideal rate of return is defined as the point at which the present value of future cash flows and the cost of the investment equal each other. A project is profitable if it can accomplish this. In simpler terms, the project is appealing because, at this rate, the cash outflows and the present value of the inflows are equal.

Interpreting IRR

IRR at the end of it all is still based on speculation. It may not match up with actual profitability. It just shows the likely profit if all other factors in the financial modelling and analysis of an investment go as planned.

Analysts can get a general sense of which investments or projects might be better than others by focusing only on the internal rate of return (IRR) without delving deeply into other financial aspects. IRR, when paired with NPV, can offer valuable information about a project’s or investment’s long-term viability.

Benefits of IRR in Real Estate Analysis

- Evaluation of Profitability:

By taking the time value of money into account, the internal rate of return helps in estimating the possible return on investment (ROI). By taking into account the amount and timing of cash flows, it enables investors to evaluate a real estate project’s profitability.

- Comparison of Various Investments:

Investors can evaluate and rank investments according to their expected returns by determining the rates of different projects.

- Timing of Cash Flows is Incorporated:

IRR takes into account the timing of cash flows, in contrast to other metrics like net present value (NPV), which only looks at the total value of cash flows. This feature is especially important in real estate investments since cash flows there fluctuate greatly over a longer period of time.

Limitations of IRR in Real Estate Analysis

- Ambiguity in Reinvestment Assumptions:

The formula makes the assumption that project cash flows are reinvested at the estimated internal rate of return (IRR). Finding practical reinvestment opportunities with the exact same rate of return, however, can be difficult. The accuracy of the calculations may be impacted by this assumption, which might not fully reflect the potential for reinvestment.

- Ignoring Cash Flow Magnitude:

The timing of cash flows is the only consideration in the final IRR calculation result, which does not account for their absolute magnitude. Due to this restriction, projects with comparable IRRs may experience wildly separate cash flow amounts. As such, it might not offer a complete view of the viability or profitability of an investment in real estate.

- Timing Sensitivity to Cash Flow:

This method makes the assumption that all cash flows take place on specific dates and can be reinvested appropriately. Cash flows in real estate, however, are frequently unpredictable and subject to delays. Variations in the cash flow schedule can have an important impact on the calculated rate and may result in incorrect results.

IRR vs ROI

| Elements | IRR (Internal Rate of Return) | ROI (Return on Investment) |

| Measures | Profitability & potential return on an investment | Efficiency and profitability of an investment |

| Represents | The discount rate at which the NPV of cash flows from an investment becomes zero | The ratio of net profit to the cost of the investment |

| Features | Considers the time value of money by factoring in the timing & magnitude of cash inflows & outflows | Does not consider the time value of money or specific timing of cash flows |

| Use | Helps in comparing different investment opportunities and selecting the most attractive one | Useful for evaluating the performance of investments and determining their effectiveness |

| Results | Provides a single percentage value to assess the overall return on an investment | Provides a straightforward percentage value showing the return relative to the initial investment |

| Reflection | Reflects the compound annual growth rate of an investment over its holding period | Can be calculated for various time periods (monthly, quarterly, annually) to assess the investment’s performance over different periods |

What is a Good IRR?

- Generally, a good IRR for commercial real estate investments is one that surpasses the cost of capital, or in simpler terms, the return that investors could have earned from an alternative investment of similar risk profile. For commercial real estate investments specifically, a levered IRR within the range of 7% to 20% is often considered attractive.

- It’s important to evaluate the potential investment and keep in mind that an IRR isn’t always what it seems to be when figuring out what a good IRR is. For instance, even though a project has a high initial rate of return (IRR), the developer or sponsor may have deducted asset management fees before distributing funds, resulting in a lower net IRR for you as an investor.

- On the other hand, even in cases where distributions are made on a monthly or quarterly basis, an IRR may be underestimated because the industry standard is to calculate investment returns annually.

Navigating High IRR in Commercial Real Estate with Assetmonk

- Assetmonk, with its in-depth understanding of the real estate market, ensures that your investments are channelled into high growth potential assets. Our experienced team conducts meticulous due diligence, assessing each property’s fundamentals and market conditions, leading to investments that naturally exhibit a high IRR.

- The fractional ownership options offered by Assetmonk provide long-term retail investors looking to increase their exposure to the CRE market with a high potential earning yield of IRR 14 to 21% annually.

Conclusion

To sum up, for investors who want to maximise their profits and make well-informed decisions, knowing what internal rate of return (IRR) in real estate investing is important. IRR can help you figure out just how much of a return on investment you’ll receive. You can use it to determine which investments will yield the best returns.

Investors can evaluate real estate projects’ viability, compare various investment options, and determine profitability by using this metric. It is crucial to take into account this factor in addition to other financial indicators and factors that might affect the overall success of the investment.

A specialised platform for alternative investments, Assetmonk offers investors exceptional options that are backed by real estate.

These investment products offer our valued investors an impressive 17% IRR guarantee, along with asset-backed security and a simple exit strategy. These well chosen investment options from India’s developing private markets are overseen by a trustee who holds a SEBI registration. With a minimum investment of just 10 lakhs in our structured debt offerings in commercial real estate,you can enjoy the benefits of stress-free investing and rewardingly high returns.

FAQs

Q1. What’s Considered a Good IRR?

A. The project’s risk and the industry both affect a good internal rate of return. Greater IRR returns are necessary for higher-risk projects. A good internal rate of return (IRR) in real estate can range from 12% to 20%, dependent on risk.

Q2. What’s an IRR of 20% Mean?

A. When the net present value (NPV) of an investment is zero, the rate of return (IRR) calculated using projected discounted cash flows will be equal to the initial investment amount. This is the case when the IRR is 20%. In this instance, the cash flows’ IRR is 20% as a result of applying time value of money considerations. With a 20% IRR, the investment is breakeven.

Q3. What’s the Difference Between IRR and ROI?

A. Return on investment, or ROI, compares the initial investment to the cash flows generated over the course of the investment. The internal rate of return, or IRR, on the other hand, is an annualised return that is calculated by time-value of money discounting back cash flows annually. IRR is the rate where the net present value (NPV) is zero.

Listen to the article

Listen to the article