Sip vs one time investment

When it comes to investing, people usually choose one of two approaches: lump sum or regular investments. One must pay the full amount at once for one-time investments, while regular payments must be made by investors into SIPs.

For those with different and distinct financial objectives, these two investment strategies operate differently. They have advantages and disadvantages. The investment’s cash flow is the primary distinction between the two. Confused?

Read on to discover some of the key distinctions between a one-time investment and a systematic investment plan (SIP) if you are having trouble deciding which will work best for you.

Systematic Investment Plan (SIP)

An investor participates in Systematic Investment Plans (SIPs) by setting aside a certain amount of money on a regular basis. The investor’s bank account is immediately debited of this particular sum. Additionally, one can begin with a single SIP investment and proceed with recurring, periodic investments after that.

Advantages of SIP

- Investment discipline: Considering that the monthly SIP amount is automatically taken out of your bank account and put towards the mutual fund plan. Thus, It brings out the much-required discipline in investing.

- Offers Flexibility: A SIP allows you to modify the amount, halt, and withdraw any amount. A minimum investment amount in mutual funds (MFs) is INR 500.

- Mitigation of risk: SIPs reduce the average cost of investing because they give you more units during a down market. Long-term returns are higher as a result. Thus, rupee cost averaging has the least impact on SIP investments. Furthermore, investing in mutual funds through a systematic investment plan eliminates the need to worry about market volatility.

- Rupee cost averaging: The average cost of investing decreases because the investment is spread out over time. As a result, SIP investments in mutual funds are less impacted by market volatility.

One time Investment

With these investments, the investor can buy as many units as he wants all at once. Usually, this approach is chosen to generate additional wealth and liquidity. The timing of the market strategy is used in the lump sum method.

Advantages of Investing in One time investment

- Higher returns: In the long run, a one time investment yields greater returns. This is so that the investor can profit from market fluctuations as the entire amount is invested upfront.

- Lower costs: Compared to SIP investments, there is only one transaction, which helps save on transaction costs. There are also fewer investment management fees.

- Flexibility: Since the investor can select the investment period based on their financial objectives, a lumpsum investment offers greater flexibility in that regard.

- Ideal for long term: One-time investment plans are ideal for long-term investments as they offer a range of benefits such as capital growth from idle money, steady gains, high liquidity, and tax benefits.

Sip vs one time investment calculator

- The SIP vs One Time Investment Calculator is a tool that helps investors compare and evaluate the benefits and outcomes of investing through a Systematic Investment Plan (SIP) or making a one-time lump sum investment.

- This calculator takes into account various factors like investment amount, investment horizon, expected returns, and risk tolerance to provide a comprehensive analysis of both investment methods

- Here’s how the calculator can assist you:

- Comparative Returns: The calculator compares the projected returns and growth of your investments under both the SIP and one-time investment scenarios. This allows you to visualize the potential outcomes and make an informed decision.

- Risk Assessment: By factoring in your risk tolerance and investment horizon, the calculator helps you assess the level of risk associated with both options. This information is crucial in aligning your investment approach with your risk appetite.

- Flexibility Analysis: The calculator enables you to experiment with different investment amounts and tenures, allowing you to gauge how varying these parameters can impact your investment growth.

- The goal of the SIP vs One Time Investment Calculator is to provide investors with a clear understanding of the potential outcomes of both investment approaches, empowering them to make investment decisions aligned with their financial goals and risk preferences.

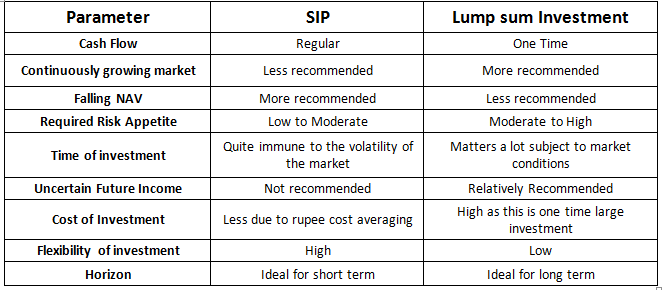

Difference between SIP vs one time investment:

Fractional Ownership: A lucrative investment opportunity

- In the Indian market, fractional ownership specifically in relation to real estate investment—has become increasingly popular. Because of this trend, the real estate industry is now more inclusive, thanks to fractional ownership structures.

- A shared ownership structure of commercial properties is referred to as fractional ownership in real estate. With this strategy, investors pool their money together to make investments.

- As an investor, you can invest in fractional ownership real estate through alternative investment platforms like Assetmonk with just Rs. 25 lakh.

- Retail investors have an excellent opportunity to receive a high return on their investment due to the high appreciation potential of commercial real estate. The real estate sector is rapidly digitizing, making it easy to track a fractional investment.

- Additionally, Investors can diversify their portfolio from traditional investment instruments such as Fixed Deposit (FD) or SIPs while earning high returns on their investments.

Bottom Line

Making a thoughtful decision about whether to invest in mutual funds using lump sum or systematic contributions is essential. An investor’s risk tolerance, financial objectives, and the length of the investment all influence their decision between the two. Additionally, it’s critical to diversify your holdings and avoid putting all of your money in one place.

Assetmonk recognizes that our investors have a variety of investment options in addition to real estate. Only outperforming real estate assets will make it onto our list after our professional asset management team compares them to other similar financial instruments, ensuring that investors receive higher returns as well as consistent monthly income. Only assets that meet our high-potential, secure-asset criteria will be accepted onto our platform.

Our primary expertise lies in offering individualized guidance and carefully curated fixed-income investment opportunities supported by real estate assets. We remain dedicated to our passion for guiding investors through this transformative journey and helping new and veteran investors realize the full potential of alternative investment in commercial real estate.

Listen to the article

Listen to the article