Fractional Ownership of Holiday Homes

- Owning a luxury second home in a beautiful picturesque location, away from the noise and hustle bustle of a metro city, isn’t that a dream for many? But this dream comes with its own reality checks: Large cheques of hefty expenses and maintenance, not to forget the cost of owning the luxury second home.

- Well, thanks to SEBI (Securities & Exchange Board of India) and fractional ownership, this dream has turned into reality for a large number of investors. In this blog post we’ll explore how the growth of fractional ownership coupled with SEBI’s new proposed framework impacts holiday homes in India.

Fractional Ownership: A Quick Review

- Fractional ownership is shared ownership model wherein multiple investors can collectively own a property. Fractional ownership of commercial real estate is growing in popularity, although fractional ownership of residential properties and luxury homes is also not far behind.

- Through this model, investors collectively share both the costs and benefits, and can profit off of high rental yields on the property and capital appreciation. In the context of luxury holiday homes, this means you can own a fraction of a vacation property & enjoy it for a specified period each year.

- And the market is growing. According to CBRE’s India Market Monitor 2023, the luxury residential market experienced a mouthwatering 151% year on year (YoY) sales increase in the first quarter of 2023.

- And as per data from Knight Frank, the market for fractional ownership properties in India is expected to grow by 65%, from $5.4 billion in 2020 to $8.9 billion in 2025, at an annualised rate of 10.5%.

SEBI’s Proposed Framework for Fractional Ownership

The Securities And Exchange Board of India has recently proposed a regulatory framework for fractional ownership in India, which is a game changer for the alternative real estate landscape. The regulatory body aims to increase transparency, accountability, and a legal backing to fractional ownership. This will ensure a more secure, regulated environment and also increase investor confidence.

SEBI’s Nod To Fractional Ownership

- In a board meeting held in November 2023, the Indian market regulator approved a number of amendments to SEBI (Real Estate Investment Trusts) Regulations 2014 (REIT Regulations).

- Here’s what this means for investors: Under the earlier 204 regulations, the minimum threshold for REITs was Rs 500 crore. Now, the minimum threshold has been reduced to Rs 50 crore. This change will allow a large number of investors to invest in smaller and medium sized REITs.

- What this has done is, it has incorporated fractional ownership under the existing SEBI Regulations (REIT Regulations). Now fractional ownership assets will be regulated like REITs, with a minimum asset value of Rs 50 crore.

Growing Market of Luxury Homes

- Now for the bombshell: As per a report by real estate consultancy firm CBRE, there was a 97% Year on Year (YoY)increase in the sale of luxury homes priced at Rs 4 crore or above in the first 3 quarters of 2023.

- The report further went on to state that a total of 9700 luxury second homes were sold in 2023 during that time period, almost double the 4700 units sold in the corresponding time period in 2022. This increase doesn’t just indicate an anomaly, there is a shift in real estate dynamics and rising investor interest in owning a second luxury property away from cities.

- High net worth individuals (HNIs), Non-resident Indians (NIRs), and investors looking to safeguard their portfolios are opting to invest in real estate equipped with smart technologies, away from air and noise pollution, and homes having luxurious and modern architectural designs. This has also contributed to the rise of fractional ownership of luxury second homes in India.

Fractional Ownership of Holiday Homes in India

- SEBI’s proposed regulations in the amendment is all set to make fractional ownership much more accessible to wider range of investors. Fractional ownership of holiday homes provides a unique opportunity to invest in high value properties in prime locations, without having to bear the burden of sole ownership, regular maintenance, and heavy expenses.

- When it comes to fractional ownership models, Assetmonk leads the line with a minimum investment ticket of 25 lakhs INR.

- With SEBI’s approval, investors can remain confident of regulatory oversight, and take advantage of the burgeoning fractional ownership sector in India and enter it at the right time.

- Whether you want a beach view Bungalow in south Goa, or a colonial era inspired house in the hills in Mussoorie, fractional ownership of luxury homes can make those aspirations a reality. This also hits true for investors looking to broaden their horizons and opt for real estate investments to diversify their portfolio.

Bottom Line

Fractional ownership has changed how the world looks at real estate investments. It is a paradigm shift, providing ease of access and potential for global growth through technological advancements. It’s a cornerstone of the modern diversified investment portfolio.

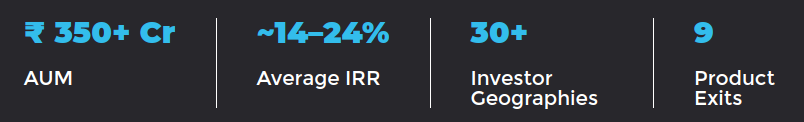

As the real estate sector in India grows, platforms that prioritise transparency, due diligence, and an overall good experience for investors will come to the front. At Assetmonk, we’ve embraced our role in shaping the future of fractional ownership in commercial real estate in India.

Fractional ownership of commercial real estate is all set to become a mainstream investment avenue. Investors who embrace this model stand to benefit from a more flexible and rewarding real estate investment experience in the years to come.

Assetmonk’s web based investment platform facilitates access to these opportunities. We also contribute to the evolution of the real estate sector, and are ready to guide investors in their fractional ownership journey.

Listen to the article

Listen to the article