In the last few decades, India has seen massive development in the industrial sector which has boosted its economy tremendously. The growing GDP of the country has attracted the attention of foreign direct inverters or FDIs which has also arrested the interest of NRIs to consider India a perfect destination for investment. Many NRIs have some questions in mind that whether staying abroad debars them from investing in India or what can be some of the best returns for NRI investment in India. NRIs have various options available in the Indian market for making investment. Before considering various investment options let’s check why such investments are essential.

Why Should NRIs Invest in India?

Retirement Planning

One of the most important aspects of financial planning is preparing for retirement. Planning for old age should start as soon as a person starts earning. One needs to have a diversified portfolio to ensure a good post-retirement life. Those planning to settle in India after their retirement, should have some assets and a proper planning for the post retirement earnings.

Higher Returns

Investing at the right time can generate higher funds. There are many policies in which investing earlier generates greater returns. The interest rate increases with time. A higher interest rate with short term investment can be risky as compared to long term investment. Managing one’s investment is also necessary to generate higher returns and reduce the risk.

Sending Corpus to Family

Although one’s earnings can be enough for one’s immediate family, when it comes to other members in the family one may require additional income or one may require money for unexpected expenditures. In such cases, investments are a boon. There are so many investment options available which also allow a person to withdraw money as per his/her convenience or provide monthly income. These will help in getting an additional income which can be reinvested again.

Building Assets

For building financial wealth, investments are essential. For example, an NRI can purchase a property which itself is an asset and can rent it out further. The rental income generated can be reinvested in any fixed deposits which will not only increase one’s corpus but also help save tax. One can also get a loan on the property. Since secured loans have lower interest rates thus loans become cheaper. Let’s take a look at the amount of NRI investment in India in the past few years.

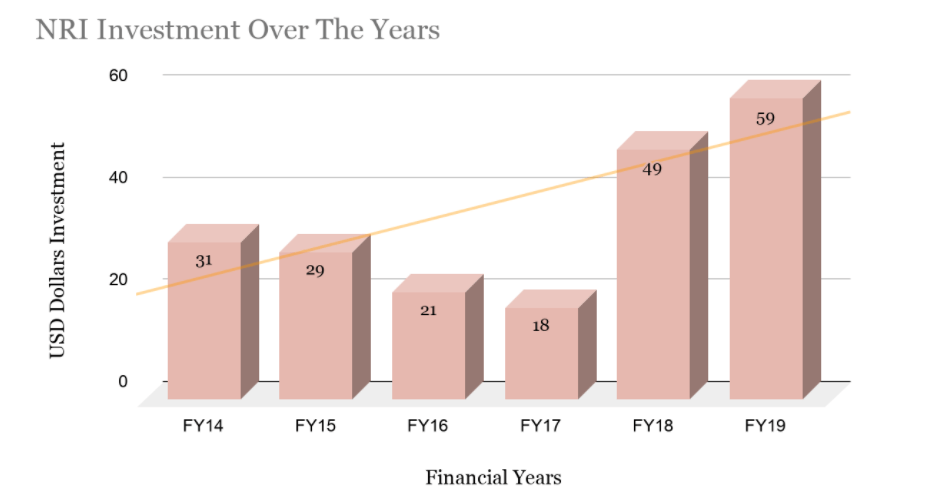

NRI Investment in India Over The Past Few Years

As we can see from the trendline, NRI investment has been increasing over the years.

Sourcre – https://www.acuite.in/nri-deposits.htm

Best Returns for NRI Investment in India

Real Estate

Real Estate investment has been one of the most preferred options in India. This investment is ideal for those with long term investment goals with steady returns. If the property is at the right location then one can also rent the property. This further adds to the income. For buying and selling properties, one must have an NRE, NRO, or FCNR account.

In real estates, the risk is quite low and the returns are very high. Plus, the rates of properties keep increasing with time. There are many ways through which one can opt for real estate investment. One can buy residential, commercial properties or even real estate mutual funds. Further, commercial real estate funds help in generating greater corpus as compared to real estate ones. One can invest in shops and offices. An important thing to note is one is only allowed to invest in residential and commercial properties but not agricultural land.

Documents Required for NRI Investment in Real Estate

- Overseas Citizen of India (OCI) Card or Indian Passport

- Allotment letter

- Address proof

- Building plan that is approved

- Attorney certificate of power

- PAN Card

- Sale deed

- Tax returns

Fixed Deposit Bank Accounts

Fixed Deposit Investment is a very common form of NRI investment in India. In a fixed deposit, the investor deposits a fixed amount of money on which interest is earned for a specific period as chosen by the NRI. But one cannot withdraw the money before the period is over. Once the tenure ends, the principle along with the interest is paid out. It is the safest option of investment.

Documents Required for FD Investment-

- Passports

- Address Proofs

- PAN Card

Mutual Funds

Mutual funds are equity-linked market shares that are subject to market risks. It is one of the risky investment options yet offers one of the best returns. They offer higher interest rates as compared to FDs. One can choose their risk profile and financial goals and invest according to them. One needs an NRO or NRE account to invest in mutual funds.

Documents Required for FD Investment-

- Passports

- Address Proofs

- PAN Card

- Bank Account

- NRO or NRE account

With various investment options, NRIs can reap the benefits from their investments in India. One can build a strong and robust portfolio by investing in Real Estate. NRIs can also invest in the Fixed Deposits that are the safest investment option as they safeguard the investment and ensure steady returns through interest pay-outs. NRIs also get to invest in Mutual Funds that are subjected to market risks. Owing to the risk the interest rates are higher than FDs which prove to be profitable.

Among all the investment options, Real Estate has the best to offer you both in terms of returns and protecting the investor’s interests. In real estate, NRIs’ investment is backed by a physical that appreciates with time. Want to invest in Real Estate? Assetmonk is an online real estate platform. You can invest in Real Estate with just a click away. We list out highly curated assets that undergo thorough due-diligence on our platform. Through various products like Growth, Growth Plus, and Yield, we strive hard to meet every customer’s obligations and aspirations. Click here to know about investment opportunities.

Best Returns for NRI FAQ’s:

What are three different types of fixed deposits?

There are mainly three different types of fixed deposits are:-

- Non-Resident External Account (NRE)

- Non-Resident Ordinary Account (NRO)

- Foreign Currency Non-Resident (FCNR)

What are the benefits of an NRE account?

The benefits of NRE account is:-

- Anytime account access

- Beneficial interest rates

- Easy money transfer

- Joint holders allowed

- Low cost

- Low balance required

What are some of the Government Securities to invest in?

Some Government Security Bond to invest in are:-

- Capital index bonds

- Fixed rate government bonds

- Floating rate government bonds

Yes, NRO accounts are taxable at 30%.

Who is considered to be an NRI as per government rules?

As per government rules, a person is considered to an NRI if he/she is:-

- A person who has not stayed in India for a period of 245 days in the previous financial year

- Or has not lived in India for a period of 60 days in a particular year

- Or, someone who has not been in India for 365 days in a stretch for the past 4 hours.

For investment in direct equity, what are the accounts required?

For investment in direct equity, the accounts required are:-

- A NRO or NRE saving account for PIS purposes.

- A dematerialized account which stores the equity purchased in electronic form.

- A SEBI trading account created by a registered broker.

Yes, NRIs can invest in NPS.