Here’s everything you need to know about the Goods and Services Tax regime and how it will affect you financially.

The Goods and Services Tax, or GST, on flats and apartments, is one of the several taxes that buyers must pay when purchasing a property. Even though the GST regime has been in place for four years, many changes have been made in the GST tax structure in a short period.

Read Also: How to Calculate GST on Real Estate Property Purchase?

GST Rates in Real Estate

Since its inception, the government has considerably decreased the GST rate on property purchases to imitate demand amid a prolonged slump. According to analysts, this might reduce the buyers’ pay-out by 4% to 6% on the whole purchase.

| Property type | GST rate till March 2019 | GST rate from April 2019 |

| Affordable housing* | 8% with ITC | 1% without ITC |

| Non-affordable housing | 12% with ITC | 5% without ITC |

While the new tax rate without the input tax credit (ITC) would apply to all new projects, builders were given a one-time option to choose between the old and new rates for their ongoing projects until May 20, 2019. This deal was only available for projects that were still unfinished as of March 31, 2019. The government decided after the developer community expressed worries about tax liabilities in the absence of ITC.

GST calculation on affordable property

Here’s how to calculate GST on the purchase of a flat in the affordable housing sector before and after the rate adjustment on April 1, 2019:

| Affordable housing | GST on affordable housing before April 1, 2019 | GST on affordable housing after April 1, 2019 |

| Property cost per sq ft | Rs 3,500 | Rs 3,500 |

| GST rate on flat purchase | 8% | 1% |

| GST | Rs 280 | Rs 35 |

| ITC benefit for a material cost of Rs 1,500 at 18% | Rs 270 | Not applicable |

| Total | Rs 3,510 | Rs 3,553 |

Impact of GST on luxury property

Buyers of luxury houses will save more under the new GST rates than they would have previously. Here’s an example of how to compute GST on a luxury unit purchase:

| Luxury housing | Before April 1, 2019 | After April 1, 2019 |

| Property cost per sq ft | Rs 7,000 | Rs 7,000 |

| GST rate on flat purchase | 12% | 5% |

| GST | Rs 840 | Rs 350 |

| ITC benefit for a material cost of Rs 13,000 at an average of 15% | Rs 126 | Not applicable |

| Total | Rs 7,714 | Rs 7,350 |

GST on government housing schemes

The administration has stated that government-led major housing projects aimed at the average man will be subject to only 1% GST under the new regime. Among these housing plans are the Jawaharlal Nehru National Urban Renewal Mission, the Rajiv Awas Yojana, the Pradhan Mantri Awas Yojana, and state government housing programs.

Also Read: Buying A Property? Don’t Get Scammed By These GST Myths

GST on construction services

While real estate in India is not directly subject to the GST regime, certain activities and services in the sector are taxable under the new rule. The following are the rates at which related activities in the construction sector are taxed in India under the GST regime:

| An under-construction home bought under the PMAY Credit-Linked Subsidy Scheme (CLSS) | 8% |

| An under-construction home bought without the subsidy | 12% |

| Works contract for affordable housing | 12% |

GST rate on construction and building materials

The Goods and Services Tax (GST) applies to real estate in India through labor contracts, as well as building and construction activity, because all components utilized in development work are subject to GST. Simply expressed, the new regime applies to the Indian construction industry, which continues to receive high rates of taxation through a combination of levies placed on the purchase of various building construction supplies.

GST on maintenance charges for housing societies

Flat owners must pay 18% GST on residential property if they pay at least Rs 7,500 in maintenance fees to their housing society. Housing societies or residents’ welfare associations (RWAs) that collect Rs 7,500 per month per unit must also pay an 18% tax on the whole amount. Housing societies with annual revenue of less than Rs 20 lakhs, on the other hand, are free from paying the GST. For the GST to be applied, both conditions must be met: each member must pay more than Rs 7,500 per month in maintenance fees, and the RWA’s annual turnover must be greater than Rs 20 lakhs.

The government has also stated that if the charges surpass Rs 7,500 per month per member, the full sum is taxable. For example, if the monthly maintenance rates are Rs 9,000 per member, the 18% GST on flats is charged on the total sum of Rs 9,000, not on Rs 1,500. (Rs 9,000-Rs 7,500). In addition, owners who own many apartments in the same housing society will be taxed separately for each unit.

RWAs (Resident Welfare Association), on the other hand, are eligible to claim ITC (Input Tax Credit) on taxes paid on capital goods (generators, water pumps, lawn furniture, and so on), goods (taps, pipes, other sanitary/hardware fittings, and so on), and input services such as repair and maintenance services.

GST on rent

Landlords are exempt from paying GST on real estate rental revenue if their properties are rented out for residential reasons. The GST regime, on the other hand, sees renting out residential property for commercial purposes as a supply of services, bringing rental revenue inside its jurisdiction. Under the new regime, an 18 percent GST on residential units is levied on such rental revenue if it surpasses Rs 20 lakhs per year. In this instance, landlords must also register to pay GST on their rental income. A GST of 18% is paid on the rental of commercial premises.

Also Read: GST on rental- Everything you should know!

According to the Gujarat Authority for Advance Ruling (AAR) for Goods and Services Tax (GST), landlords are not obligated to pay GST on electricity recovered from tenants because these charges are not included in the value of supply. The order was issued by the Gujarat AAR in response to a petition filed by Gujarat Narmada Valley Fertilizers & Chemicals. When a landlord incurs an expense while delivering a service to his tenants, he is not required to pay GST on the money he recovers from the renter under GST legislation. The legislation requires the landlord to pay the GST on the rent amount specified in the rental agreement.

The applicant has placed the onus on the lessee to pay the charges for the electric power utilized directly to the utility company. It cannot be stated that electricity charges are covered by Section 15(2)(c) of the CGST Act, 2017 because the rate for renting premises has been determined at a certain amount and the electricity charges are to be borne by the lessee under the conditions of the agreement.

However, it was emphasized that electricity prices would not be included in the value of rent for calculating the GST unless the rent agreement specifically stated that the renter would bear the electricity charges on actuals. This means that, in addition to paying the rent, the tenant must shoulder the power charges on actuals for the landlord to avoid paying GST on the electricity charges recovered from the tenant.

Also Read: Impact of GST on Rental Income

The energy charges collected by the landlord from the tenant at actuals based on sub-meter readings are covered by the amount recovered as a pure agent in respect of the lessor under Rule 33 of the CGST Rules, 2017. The judgment would only apply to the agreement under consideration, and the analogy of this decision would not be relevant to other sets of circumstances.

GST on Ready-to-move-in Houses

It is vital to highlight that the GST does not apply to the real estate sector. The applicable tax rate on a property building is levied under ‘work contracts.’ This is why a developer cannot levy GST on the sale of ready-to-move-in homes. After completion and receipt of the occupancy certificate, a property is designated as ready to move in and is no longer subject to the work contract. In a nutshell, the GST would be levied on the sale of under-construction properties that have yet to get their OCs. It is also worth noting that under the former regime, buyers had to pay service tax on the purchase of ready-to-move properties.

However, because the developer/owner paid GST as part of the purchase, he would eventually include this expense in the overall cost of the property. This essentially means that, while ready residences are exempt from GST, the buyer must still pay it.

GST on Land Transactions

Because the sale of land does not include the transfer of any goods or services, it is likewise exempt from the GST on construction services. Because the cost of land is an important element in determining property values, GST offers a standard abatement of 33 percent of the total contract value for taxable real estate transactions.

GST on plot

While the selling of plots is also exempt from the GST regime, any little construction on the plot would be subject to GST. In the event of the sale of such a plot, one-third of the plot’s value will be excluded, and GST will be levied on the remaining two-thirds of the land’s value.

GST & Its Impact on Indian Real Estate

At the time of the adoption of the GST on real estate in July 2017, the industry as a whole was experiencing a depression, owing mostly to demonetization and the implementation of the RERA (Real Estate Regulation and Development Act, 2016). However, demand and supply for real estate increased in early 2018, mostly due to the robust expansion of inexpensive and mid-income housing. However, housing prices were either static or rose somewhat across the country, while in bigger cities such as Delhi NCR, prices were reported to have declined by 2% as of Q3 2018.

Also Read: Latest GST Reforms in India for Homebuyers

However, such price drops were primarily due to oversupply rather than the impact of GST, as most developers did not pass on ITC benefits to home buyers. Even when ITC benefits were passed on to homebuyers, the price difference was insignificant.

According to recent research, the resale market was also significantly impacted, with prices falling by 15% to 20% in Delhi NCR. This is even though GST does not apply to resale properties. As a result, one can argue that the impact of GST cannot be adequately gauged at this time, and that only with additional time will a clearer image of the impact of GST on real estate emerge.

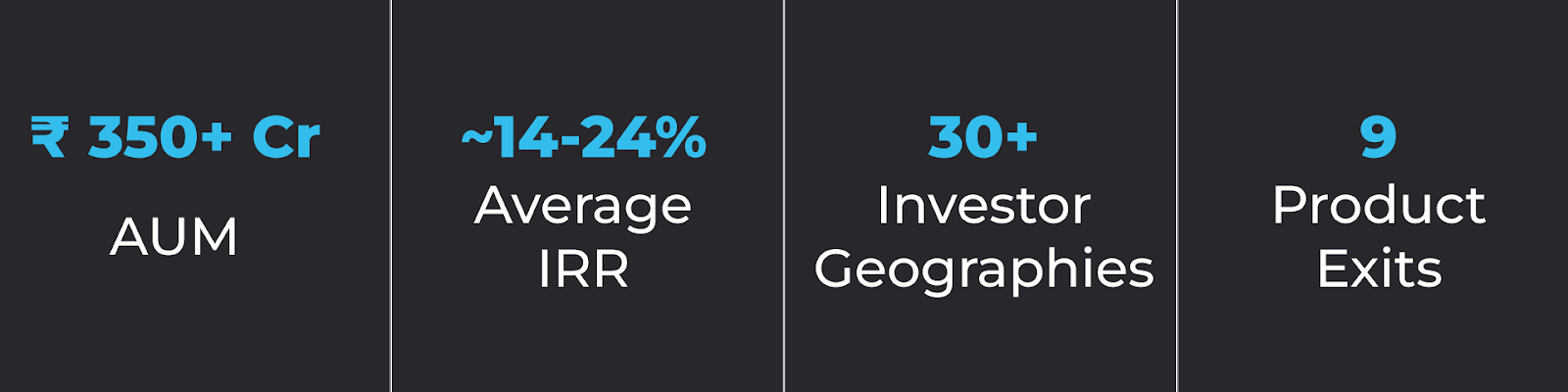

On a more positive note, according to prominent industry players and analysts, 2019 will be a better year for the Indian real estate market, with demand for both commercial and residential real estate likely to increase. Assetmonk is one of the leading WealthTech Platforms in India, offering real estate investment opportunities in cities such as Bangalore, Chennai, and Hyderabad with an IRR of 14-21%. Our products are classified to suit different income groups. Click on ‘Assetmonk’ to start your investment with us!

GST Rules for Real Estate Asset Categories FAQ’S

What are the different categories under GST?

There are four versions of GST: the Integrated Goods and Services Tax (IGST), the State Goods and Services Tax (SGST), the Central Goods and Services Tax (CGST), and the Union Territory Goods and Services Tax (UTGST) (UTGST). Each of them has a distinct taxing rate.

Is GST applicable to the real estate sector?

GST applies a single tax rate of 12% to homes under construction, although GST does not apply to completed or ready-to-sell properties, as was the case under previous law. As a result, customers will benefit from price reductions under GST.

How is GST calculated on the property?

Assume a builder sells an under-construction property to a buyer for Rs 100. To compute the GST on the building, the land value of Rs 33 will be deducted, and the GST on construction will apply only to the remaining Rs 77.

How does GST affect real estate?

The impact of the GST regime on the real estate sector is that under the GST regime, real estate developers can claim the Input Tax Credit (ITC) on building inputs such as labor, cement, bricks, and so on. The ITC was introduced to avoid the tax on tax positions. The GST tax will be credited back to the developers under ITS.

Listen to the article

Listen to the article