Investing in real estate is a gamble, and it isn’t always a fun Las Vegas-style gamble. Any real estate investor needs a few “tools” in their “tool belt”: solid knowledge of their preferred real estate market, the ability to estimate remodel costs, and a firm grasp of basic financial concepts.

Knowing how to calculate Net Operating Income correctly is one of the most important calculations for real estate investors (NOI). This powerful calculation allows real estate investors to make quick financial decisions. Whether a novice or a veteran in the industry, every investor ultimately aims to increase the wealth over time through the investment. Taking informed investment decisions by analyzing the investment opportunities will help you maximize your returns. Analyzing the performance of the asset equips you with the estimation of the returns.

Real estate investors are benefited from several metrics that give hands-on information about the asset. NOI, Net Operating Income is one such performance indicator that investors use to analyze the returns of the assets they are ready to invest in.

NOI estimates the operating income on the property to give insight into the asset’s income generation capacity. It is an essential component used for other metrics like Cap rate to get a detailed assessment of asset performance.

What is Net Operating Income (NOI)?

Net Operating Income, or NOI, is a formula used by real estate professionals to quickly calculate the profitability of a specific investment. After deducting necessary operating expenses, NOI determines the revenue and profitability of an investment real estate property. The power of NOI is that it combines all of the necessary income and expenditures for each property into a single calculation. NOI represents the adequate income generated from the property. It is the income generated from the assets after deducting the operating costs. The goal of NOI is to provide investors with insight into a rental property’s true cash flow: how profitable it is (or isn’t), how much it costs to maintain the property, and the overall health of the investment.

Mathematically,

NOI = Gross Operating Income – Operating Expenses

where,

Gross Operating Income = ( Income generated from property – Vacancy and credit losses)

Income generated from property = Potential rental income + Other income from a property.

Potential Rental Income indicates the income generated by letting out a residential property. If the property undergoes any vacancy period, the total rent is estimated considering the prevailing market conditions.

Other income from the property is generated when the owner earns through complementary assets like parking, vending machines, etc.

Vacancy or credit losses are the losses incurred during the asset’s vacancy period or the dishonest tenants who owe you the rent.

Gross Operating income is the resultant of all the above, as shown in the equation.

How to calculate NOI?

Let us consider an example of a clear understanding. If you own a property that generates an annual rental income of Rs. 2,00,000, and the income through the parking lot is Rs.10,000 per annum. Due to unforeseen reasons, a vacancy for two months arises, which incurs a loss of Rs.40,000 for that year. Further, the operating expenses like maintenance, insurance, property taxes all sum up to Rs.50,000 per annum are incurred.

Note that before jumping into calculating Net Operating Income (NOI), you must calculate the income from the property and check for any vacancy losses that make the gross operating income. Now,

Gross Operating Income = 2,00,000 + 10,000 – 40,000

= 2,10,000 – 40,000

= 1,70,000

NOI = Gross Operating Income – Operating expenses

NOI = 1,70,000 – 50,000

NOI = Rs.1,20,000.

Note that the above example is for understanding purpose only and does not attribute to the market trends.

It is worth noting that many expenses come under Operating expenses and certain expenses that could be mistaken as operating expenses. Here is the list of the expenses that contribute to NOI.

What Are Expenses Considered in Calculating NOI?

As a thumb rule, the operating expenses are associated with the day-to-day running costs—the higher the operating expenses, the lower the NOI.

Property Maintenance

Every property over some time undergoes certain major and minor repairs like plumbing, electrical work, which incurs the costs classified as maintenance costs. You must consider them for the calculation of operating expenses.

Legal Fees

Suppose your property is subjected to any litigation. In that case, the costs incurred for the legal proceedings, like drafts and hiring an attorney, all come under legal fees included in the operating expenses.

Utilities Unpaid by Tenants

You can have the misfortune of having dishonest tenants who skip the bill for utilities like waste management. If paid by you, all the bills fall under the operating expenses, in turn affecting your NOI adversely.

Property Taxes

Property tax varies from municipality to municipality. You have to consider them under operating expenses as they impact your NOI.

Insurance costs

You may insure your property against any damage, and you should count the money spent on the insurance, even if it is annual or bi-annual. It affects your NOI calculation.

What Expenses Should be left out While Calculating NOI?

NOI does not include figures that can be deducted from future earnings and taxes. It also excludes large one-time expenses such as major repairs. Does this make sense? Certain numbers are excluded from NOI calculations because they do not support the net operating income goal (NOI).

The following expenses are not factored in a while, calculating NOI as they are classified as Capital expenditure. Capital expenditures are the costs incurred during the purchase of the property or maintaining it. Hence, capital expenditure is dissimilar to operating expenses as they are the costs that are incurred on the operations that affect daily life.

- Mortgage expenses

- Income taxes

- Debt services

- Property depreciation

- Tenant improvements

Interpretation of NOI

People associated with real estate investments, whether be investors or lenders, use NOI to determine the profitability of the properties and arrive at a conclusion accordingly.

You can get to know the performance of the asset from the NOI estimate. NOI lets you analyze the cash flows from the investment, which can be the factor in deciding to lend money for that particular investment. Positive cashflows ensure the loan’s repayment, while the negative or lower cash flows may invite uncertainties to the repayment.

Investors use the NOI to know the scale of the returns. If you invest in a property with positive NOI, you are going to reap benefits. If the value is negative, it is called Net Operating Losses.

Property choice is the core of the investment. It may gamble your money and bring your investment down to zero under deficiency in assessing the property. Hence, NOI plays a crucial role in decision making on your investment. As an investor, you can always rely on the NOI of the different properties to compare the cash flows that would be generated by them. You can prioritize the assets with higher NOI value.

You can also analyze your property trends every year. The drooping NOI figures act as your alarm to check the performance and manage the asset.

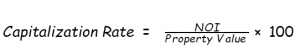

What is The Role of NOI in the Capitalization Rate?

NOI is a variable used to calculate the Capitalization rate. The capitalization rate, also known as Cap rate, demonstrates the returns earned through the investment. In simpler terms, it is the ratio of net operating income to the property value. The capitalization rate is expressed as a percentage and can be used to compare the earnings from the different real estate investments.

From the above equation, we can say that the Cap rate increases with the increase in NOI.

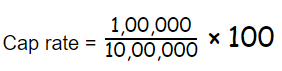

Let us consider calculating the Cap rate using NOI. For instance, if you have a residential property that generates Rs.1,00,000 per annum and the property value is estimated to stand at Rs.10,00,000, then,

= 10%

Pros and Cons of Net Operating Income

Pros

- NOI helps you to understand the cash flow of the asset. You can figure out if the property generates profits or losses by looking at the NOI.

- It helps the lenders understand the risk and potential of the assets that they choose. If your NOI is positive, it indicates a risk-free investment with returns, but the negative figures warn of the losses that the investment might incur.

- NOI tells the investors how much to expect from the property. It gives a realistic approach to investment returns.

- NOI’s gross operating income also considers the losses due to the vacant property making NOI a credible metric, unlike the cap rate, which neglects these losses.

Cons

- Asset management plays a significant role in determining the returns. You may find the NOI erroneous if you do not manage the asset properly, which depreciates with time.

- NOI calculation does not involve other variable costs like mortgage expenses and income taxes. So, it might overestimate your gains if you depend on NOI for your overall profits earned through the investment.

- Any change in the market trends affects your NOI figures. The inaccuracy of the market trends may become your pitfalls as it is difficult to predict the future rents.

It requires skill and knowledge to choose the right investment. You must analyze the property’s status and the demand in the market to avoid making an expensive mistake. Analyzing the property using metrics as NOI makes you an informed investor and helps you make wise choices.

Assetmonk is the online platform that helps you sort your investment in metropolises across India. Invest in the high yielding properties under the Growth, Growth Plus, and Yield categories of assets that we offer. You can enjoy a steady passive income by investing in small ticket sizes through fractional ownership. For further details, visit Assetmonk.

Net Operating Income (NOI) FAQ's:

NOI is Net Operating Income, which is an indicator used by the investors to know the property’s performance.

Mathematically,

NOI = Gross Operating Income – Operating expenses

NOI is used to calculate the other indicators in real estate like cap rate.

Cap rate = NOI / Property Value

Both investors and lenders use NOI. If the NOI is positive and high, lenders see it as evidence of loan repayment by the investors. The investors can estimate the cash flow from the NOI figures.

Listen to the article

Listen to the article