India’s Economic Growth in Commercial Real Estate Investments

- Over the years, real estate has been vital for India’s economic expansion. After the agriculture sector, the real estate industry in India generates the second-highest amount of employment.

- Long and short-term rises in non-resident Indian (NRI) investment were also anticipated for this sector.

- Recent years have seen a great deal of growth and development in the nation, which has made the commercial real estate industry an attractive place to invest.

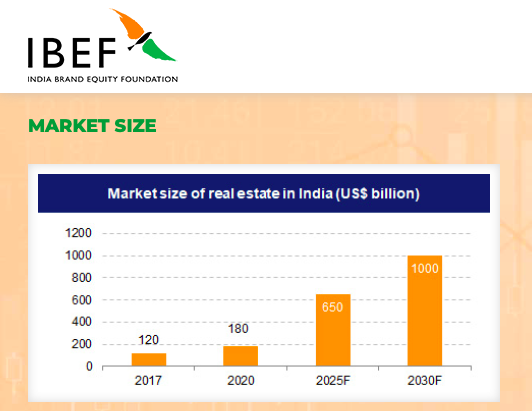

Market Size of Real Estate in India

- The value of the real estate market is expected to increase from Rs. 12,000 crore (US$ 1.72 billion) in 2019 to Rs. 65,000 crore (US$ 9.30 billion) by 2040. India’s real estate market is predicted to grow from US$ 200 billion in 2021 to US$ 1 trillion by 2030, and by 2025, and will account for 13% of the nation’s GDP.

- By 2047, the real estate industry in India is predicted to grow to a value of US$ 5.8 trillion, accounting for 15.5% of the country’s GDP, up from its current 7.3% share.

- The Real Estate Investment Trust (REIT) platform has received approval from the Securities and Exchange Board of India (SEBI), enabling a wide range of investors to participate in the Indian real estate market. In the upcoming years, it would generate an opportunity in the Indian market valued at Rs. 1.25 trillion (US$ 19.65 billion).

Factors fueling CRE

An ideal climate for the expansion of commercial real estate in India has been created due to several factors like:

Rapid Urbanisation

Recent reports indicate that India has experienced a record-breaking rate of urbanisation, with the country’s population expected to soar to 600 million by 2030. This is creating an enormous demand for housing, commercial space, and infrastructure, which is driving the Indian commercial real estate market towards remarkable growth.

Foreign Direct Investment (FDI)

Significant investments have been made in the commercial real estate sector by foreign investors drawn to India by its FDI policies that are more lenient and its ease of doing business. This inflow of foreign money fosters economic expansion and makes the environment favourable for building projects.

Attractive returns

The attractive returns on commercial real estate investments in India have been an incentive for both domestic and international investors. The rental yields, capital appreciation, and long-term growth potential make commercial real estate an attractive asset class. This has resulted in increased interest and investments in the sector.

Tech and Startup Boom

India’s emergence as a global technology hub has led to a surge in tech startups and multinational corporations setting up shop in the country. This tech-driven growth has translated into a heightened demand for modern office spaces and tech parks, providing construction owners with a golden opportunity.

Flexible Workspaces

The gig economy and the growth of remote work have increased demand for flexible workspaces. The growing popularity of co-working spaces and shared office spaces has given construction owners a new opportunity to create flexible, cooperative spaces.

Recently, Assetmonk introduced “The Landing,” an innovative Co-Living Ecosystem situated at GMR Hyderabad Airport, one of the busiest airports in India, as a long-term real estate investment opportunity.

Demographic advantage

India’s young and dynamic population is a significant driver of economic growth. The rising middle class and their increased purchasing power have led to the growth of organized retail and services sectors. This, in turn, has created demand for shopping malls, commercial complexes, and office spaces, making commercial real estate investments highly attractive.

Growing service industry

India’s service industry, including IT/ITeS, banking, finance, and insurance, has been witnessing significant growth. This growth has led to an increased demand for office spaces and commercial complexes. The expansion of multinational corporations and start-ups in India has further fueled the demand for commercial real estate investments.

Government initiatives

The government has placed a strong emphasis on improving India’s investment climate, infrastructure, and other factors that are driving up demand for commercial real estate.

Real estate industry transparency has been aided by reforms such as RERA. Construction business owners can take advantage of a liquid investment market by collaborating with REITs to maximise the value of their properties.

The goal of the Smart Cities Mission is to create tech-savvy, sustainable urban areas. Due to this initiative, there is now a greater need for contemporary infrastructure, which opens up opportunities for large-scale projects by construction owners.

What does the future hold?

- Given their long-term outlook, global capital is expected to persist in making investments through platforms or joint ventures across a range of asset classes.

- After three office REITs were successfully listed, India recently saw the launch of its first retail REIT. The REIT market is anticipated to see more public listings in the future, possibly involving industries like hotels and warehousing, as institutional players and local partners work together to aggregate more portfolios.

- Commercial offices may face difficulties if the world’s current headwinds continue, which could impact capital deployment as well as demand. Nonetheless, these difficulties are not unique to India and are probably going to affect everyone on the planet.

- Given India’s standing as a leading global technology hub and current developments, the nation appears to be in a good position to weather this and show more resilience.

The Rise of Fractional Ownership: A Pathway to Commercial Real Estate Investment in India

- One innovative investment strategy that has gained prominence in recent years is fractional ownership in real estate.

- This approach allows multiple investors to collectively own a share of a commercial property, providing an opportunity for individuals with smaller budgets to enter the lucrative real estate market.

- Fractional ownership in commercial real estate combines the benefits of property ownership with reduced financial barriers and shared responsibilities. Investors can have a percentage stake in high-value properties such as office buildings, retail spaces, or industrial complexes, receiving proportional returns on their investment.

- Assetmonk, an alternative investment platform, for example, offers a fractional ownership model where investments are secured and start as low as 25 lakhs.

- India’s economic growth has contributed to the popularity of fractional ownership models in commercial real estate.

- As the economy continues to expand and businesses flourish, the demand for commercial spaces, such as office complexes or retail centres, is on the rise. Fractional ownership allows investors to capitalize on this demand by sharing the financial risks and rewards associated with commercial property investments.

- Additionally, fractional ownership offers benefits beyond financial considerations. Investors can leverage the expertise of experienced property managers or real estate firms that handle the day-to-day operations, maintenance, and tenant management, ensuring a hassle-free investment experience.

Bottom Line

India’s robust economic growth has paved the way for lucrative opportunities in commercial real estate investments. As the country continues to thrive, both domestic and international investors can capitalize on this growth by diversifying their portfolios and exploring innovative strategies such as fractional ownership.

With its potential for reduced financial barriers and shared responsibilities, fractional ownership enables investors to participate in high-value commercial properties, accessing the benefits of real estate ownership that were once out of reach.

As India’s economy expands and the demand for commercial spaces increases, fractional ownership presents a flexible and accessible pathway for investors to tap into the thriving market and secure their stake in the country’s commercial real estate growth.

For those wishing to maximise their returns, Assetmonk offers premium tax-efficient investment options.

Assetmonk, a platform with an IRR of 14–21%, has a proven track record of providing potential real estate investors with outstanding investment opportunities. Contact us right now.

FAQs

Q1. What factors drive commercial real estate investments in India’s thriving economy?

A. India’s thriving economy is driven by factors such as increasing urbanization, a growing middle-class population, and expanding industries. These factors contribute to the rising demand for commercial spaces, attracting investors seeking to capitalize on the growth potential.

Additionally, government initiatives and policies supporting foreign direct investment (FDI) in the real estate sector further incentivize commercial real estate investments in India.

Q2. How can investors leverage India’s economic growth for successful commercial real estate investments?

A. To leverage India’s economic growth for successful commercial real estate investments, investors should conduct thorough research and due diligence. They should consider factors such as location, market trends, potential rental incomes, and growth projections.

Consulting with experienced professionals in the real estate industry can provide valuable insights and guidance. Additionally, exploring investment strategies like fractional ownership can offer flexibility and access to high-value commercial properties.

Listen to the article

Listen to the article