Real estate investing is an excellent way to diversify your portfolio and diversify your income sources. However, not everyone is interested in purchasing and flipping houses in order to rent them out, or in maintaining property and tenants. If you want to invest in real estate without the commitment or hassle of purchasing property, there are other ways to invest in real estate that offer just as consistent returns.

Investing in real estate may seem like a lucrative and alluring idea, but getting started in real estate investments is the toughest thing, owing to the reason that it requires a huge amount of capital. While it is easy to presume that the only way to invest in real estate is through direct property ownership, the fact is that there are several other real estate investment opportunities that do not actually involve property ownership yet offer enormous and stable cash flow.

With these investment options, investors can reap the benefits like rent from the estate’s tenants, capital appreciation, and get their portfolios diversified into an alternative, but tested asset class. And all of this, without having any ongoing responsibilities of building maintenance, being landlord, and many other obligations that property owners usually have.

This article will help you get knowledge over the parallel realm of real estate that deals with investing in real estate without buying a property.

What Are The Different Ways of Real Estate Investment?

It is now a trend to invest in real estate, not the traditional way but the conventional way that is without becoming the landlord. It has been futuristically predicted that the growth factor and prosperity in the real estate market will flourish immensely. Hence, it is the right time to invest in housing properties without dealing with landlord-related work and tenant issues.

Let us look at ways through which you can invest in real estate without buying a property.

1. Fractional ownership

Another investment platform is fractional ownership. It enables investors to buy a portion of a property so that they can get all the perks of owning a property without the upfront cost and any ongoing hassles. This concept is more suitable for prime assets in commercial real estate where the risks are really high and an individual investor may not be able to afford the entire property.

Investors can put in fractions of elite commercial properties and earn a steady rental yield and build long-term wealth. It is emerging as an investment avenue for the enthusiastic middle class and retail investors, an asset collection known chiefly for institutional investments. This model has been widespread in Europe and the US and is now picking up momentum in India as well.

2. Online investing platforms

Online real estate investment platforms collect money from many investors and invest on their behalf in opportunities that would otherwise be difficult or hugely expensive to find or have access to.

These investment platforms range widely in investment offerings, types of property, investment minimum amounts, and investor access offered. These online investment platforms either focus on a single property or a combination of residential and commercial properties. And more often, the investments that the investors make are part of crowdfunding, a way for others to be able to buy property without requiring venture capital.

However, this medium of investment is best for those investors who can afford to leave their investments uninterrupted for an extended period of time.

3. Flipping houses

Flipping houses involves purchasing a property, repairing and renovating it (if required), and reselling it for gain. Flipping houses is in most ways similar to wholesaling but the key difference is that in wholesaling, the investors don’t have to repair it. They can sell it right away for a profit considering the market conditions, demands, etc.

To get high profits, investors typically purchase properties that present a lower price than what the markets offer or buy from those owners who are in dire need of cash. After taking ownership of the property, the investors quickly start to search for prospective buyers by advertising their property.This way, they earn revenue in the form of a fee that is associated with the transaction, typically a certain percentage of the total property cost.

This field requires explicit knowledge of real estate asset types, their values, and the market. A skilled investor flips various properties without wasting any time and is always on the search for suitable properties to purchase.

4. Invest in a real estate focused corporation

There are numerous corporations that own and manage real estate without actually operating as a REIT. The difference is that they might pay a lower dividend than a REIT.

Companies of this sort include hotels, resorts, timeshare associations, CRE developers, etc. Make sure to conduct due diligence before purchasing stock in individual companies. This option can be a great one if the investor wants exposure to a particular type of real estate investment and has ample time to research all the details pertaining to the company and the investment.

5. Alternative Investment Funds (AIFs)

AIFs, basically invest in startups, nascent-stage venture funds, infrastructure funds, real estate, and more. According to the SEBI, AIFs are privately merged funds that can either be open-ended or close-ended, depending on the class.

Also Read: Smarter Ways To Invest and Earn Alternative Income

While AIFs are more profitable than mutual funds, they require a substantial minimum investment of INR 1 crore and as a result, are ideal for High Networth Investors(HNIs).

6. Real estate partnerships

It is one of the most common ways to invest in real estate, with each person taking over different responsibilities. Often, this can be opted as a way to buy property at a lower price. Individuals can set up terms such as – paying the debt or perhaps handling the down payment for the asset. Depending on the terms of the partnership, a person may be investing in real estate without actually putting too much hands-on work of owning property.

7. Invest in Real Estate Exchange Traded Fund – ETFs:

It is a collection of stocks or bonds in a single fund that is similar to mutual or index funds with the advantage of lower costs and broader diversification. Many ETFs are available in the market that provides ample exposure to the real estate market after considering all prospects and thorough research in the field.

8. Invest in Real Estate Mutual Funds:

Just like ETFs, you can also invest in mutual funds. Again, it comes with lower costs and huge benefits.

9. Invest in REITs:

People invest in REITs, as this is an added advantage to investing in real estate without acquiring the property. It helps in diversifying holdings and also supports non-correlation with any other type of equities. It also provides the right kind of exposure to the real estate industry without being a landlord. One needs to make sure that a consumer must always opt for publicly related REITs instead of going for non-traded REITs. A few factors to consider while investing in REITs are liquidity, fees, transparency, risk, and value.

Don’t miss: A Beginner’s Guide To Investing In REITs.

10. Invest in a Real Estate Focused Company:

Many companies are not actual REITs but own and manage real estate. The difference between both options is that the consumer needs to search and scrutinize various options before looking for the right company and a lower amount of dividend, which needs to be paid. These companies can be hotels, resorts, commercial real estate developers, etc. This requires a lot of time to research historical data, history, and other major details of the company.

11. Invest in Home Construction:

There are plenty of prospective options to invest in home building and investing in the construction site of the real estate industry, a smart move. It is forecasted that there will be a boom in household construction in the coming years.

12. Hire a Property Manager:

It is advisable to hire a property manager to do all the heavy work regarding managing the real estate business and to lead him to maximum exposure towards the real estate business. Property managers save a lot of time and effort from the investor and take care of the rental property like repairs, rent collection, vetting tenants, etc. They act as a medium of communication between the owner and the tenant, and it helps the investor to focus more on his profits and other personal and professional opportunities.

13. Invest in Real Estate Notes:

One of the best options for investment is not to buy a brick and mortar building; instead, the investor buys Real estate notes, which are profitable. These can be purchased from a bank also.

14. Hard Money Loans:

If the investor does not want to invest in real estate, he has a great option of providing hard loans and earns interest on it. The advantage is not to become a landlord but to be a creditor offering hard money loans to other investors in real estate. This golden opportunity also offers a high return on investment. These are direct loans, and it fetches him a minimum of 12% interest return on his money.

15. Invest in Online Platforms for Real Estate:

Online real estate investment platforms pool funds from multiple investors and invest on their behalf in opportunities that would otherwise be prohibitively expensive to pursue. These vary greatly in terms of investment offerings, property types, and investment minimums. The online platforms, which focus on both residential and commercial real estate, allow investors to invest in a single property or a diversified portfolio of real estate. The medium, on the other hand, is best suited for those who can afford to leave their investments unbroken for an extended period of time. There are many online websites like Assestmonk through which investors can involve themselves in the real estate industry with the least of chances to get physically involved in this business.

16. Investing in Wholesaling Houses:

It is similar to changing homes, but the owner is not with the investor, and he does not have to bear any maintenance cost. The only difficulty is to find the appropriate real estate property and to sell it for maximum profits.

17. Real Estate Crowdfunding:

You may have heard the term “crowdfunded real estate” but not fully comprehended what it meant. Here’s one way of looking at it: Assume that real estate developers decided to construct an apartment complex. They have two options: they can seek financing from a lender such as a bank, or they can turn to a group of individual investors. If they go with the individual investor option, that’s when you come into play. A large group of people invests in a specific project through real estate crowdfunding. As an investor, you will either fund or raise capital for a real estate project alongside other investors and real estate companies.

Because you can choose the property you want to invest in, the risks are low and the projected returns are high, up to 20%, especially if the property is in a high-growth residential area in a developing city.

Don’t miss : What Is Commercial Real Estate Crowdfunding In India?

In case you aspire to be a part of the real estate sector but still want to stay away from the struggles of being a landlord, you can choose to try investing through any of the above-mentioned mediums. However, for complete amateurs, it is always advisable to get themselves well equipped with the necessary knowledge and do enough homework before venturing into this field of real estate investing without actually buying a property.

It is a trend these days that investors and real estate facilitators invest in commercial properties to maximize their income and returns on their investments. It is a highly lucrative business that invites heavy investment opportunities from the stakeholders and, in return, the opportunities to explore vast opportunities within the real estate market and fund other personal and professional businesses are much higher. Commercial real estate investment is quite different from residential real estate funding in which the investor has umpteen options to invest in and earn maximum profits.

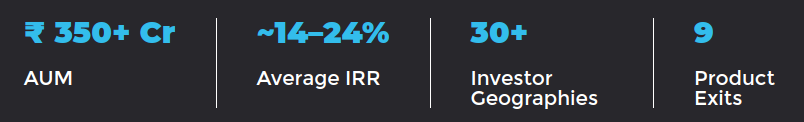

Assetmonk is a WealthTech platform that offers real estate investment options in major cities like Bangalore, Chennai, and Hyderabad, with IRR ranging from 14 to 21%.

CRE Investing Without Property FAQs:

Q1. How is it possible to invest in Real Estate Online without actually buying the property?

Many companies that have initiated this profitable investment to help investors buy and get involved in formed groups to finance real estate without getting actual ownership of the property. They let out funds and capital to invest into commercial real estate or residential properties and in return they receive regular cash flow and multiple distributions in return.

This kind of investing is quite similar to investing in REITs wherein the money is pooled in as cash from different investors who collectively take benefits of the singled-out platform from where they operate and function.

The cash pooled in and invested may be used for purchasing commercial real estate, apartments or buildings, warehouses, infrastructure and much more. Consequently, they derive the benefit of the dividends and multiple distributions of their investments which also converts into long term appreciation of the buildings that have been purchase using their capital, but no ownership was gained. This relieved them from the headache and fuss of the maintenance and upkeep pf the property.

Hard money loans are the best way to invest in properties and commercial real estate without taking he headache of keeping the ownership of the property. When a stakeholder has enough cash and capital to lend and he does not want the liability of being the landlord, all he has to do is to lend it to another investor who works on the property. This way the lender gains maximum exposure, a great ROI – Return on Investment thus saving on a lot of time, inconvenience and effort. Hard money loans are direct loans to a real estate investor and in return a handsome rate of interest is attained as a profit. Normally these loans are given out to people they know instead of lending a huge amount of money to strangers.

So, it is a great strategy to invest in property without attaining ownership of the same.

Q3. Is it a sound option to invest in Real Estate Notes?

Going by the experience of many investors, it is a sound option as the rate of profitability is quite high and the hassle of physically acquiring a property is nil. May have shared a positive response after purchasing real Estate notes from known and credible people and from banks at purchase prices which are much lower than what a retail investor would pay.

Q4. Why is it sometimes necessary for investors to hire property managers?

When the investors don’t have the time or patience to physically deal with real estate, it is better for them to hire professionals as property managers and acquire their expertise in managing their asset. The benefits of hiring a property manager are as follows:

- Experience and expertise

- They have the mindset of an investor and act like one

- They have incredible patience to deal with situations which the owner normally loses

- Aggressiveness and professionalism are the basic qualities

- Strong PR and communication skills make them apt for the job

- Their organizational and leadership qualities help in managing the entire hierarchy of employers

- They are quite flexible and tech savvy

ETFs are Exchange Traded Funds which are kinds of bonds or stocks purchased by the investors in leir of CRE purchases without ownership. REITs are Real estate Investment Trusts that invest in hotels, office buildings, manufacturing units etc.

Related Articles

How To Earn Passive Income From Real Estate Without Owning Any Property

There are methods to generate money in real estate without putting in a lot of effort. There are many ways to earn completely passive income from real estate.

5 Reasons To Invest In Office Spaces As Real Estate Investments In 2022

There are many ways present in real estate investments. Out of them office space investment is one of the best as it generates passive income every month. Here we are explaining the reasons to invest in office space in the year 2022.

Should Indians Invest In REITs With A Long Term Or Short Term Plan?

The dilemma is whether you should invest in REITs for capital appreciation or regular income. In India, the options are restricted – we know that worldwide, REITs meet both goals. This blog clearly explains whether Indians need to invest in REITs or not.

Exploring REITs? Here Are The 3 REITs Listed In India & How To Invest

Most would not have gone for REITs investing a decade or so. But, REITs have grown in appeal among institutional and ordinary investors, especially with the positive prospects surrounding future office space expansion.

Real Estate Crowdfunding: What is it And How It Works?

Real estate crowdfunding is often used to increase and diversify one’s financial holdings while maintaining an overall balanced portfolio of financial investments, including stocks, bonds, and other equity holdings, rather than as a major means of generating wealth.

Dividend Income or Passive Income From Real Estate – What’s Worth It?

This article mainly explains about the dividend and passive income that is generated from real estate investments. Read more to know about which type of income is best from investing in real estate properties.

Real Estate Investing – How Much Will The Sector Grow Till 2030?

There is no doubt that the real estate sector is growing like anything in India. After Covid 19 situation the industry is experiencing an increase in demand for many commercial and residential buildings. This blog gives us a clear idea of what real estate industry growth is going to be till 2030.

How To Calculate Yield For All Types Of Real Estate Investments In India

Rental yield may be measured in two ways: gross rental return and net rental return. The gross rental yield is the yearly rental revenue derived from the property valuation, excluding expenditures for property upkeep and taxes. It’s just the amount of money you make in rent each year.

Is Office Space Still A Worthy Real Estate Investment In The Work From Home World?

The market appears to be improving, with lease activity picking up in the top seven cities in 2021. Many offices already have opened, and many more are expected to start soon. As a result, this is an excellent moment to invest in commercial real estate.

What Drives The Price Of A Commercial Asset in Real Estate Investment?

A main real estate market driver is a primary force that positively impacts the market. If a market driver is available, there is a good chance that favorable market or industry trends will emerge. Values may rise, and demand may increase.

FEMA Regulations For NRI Real Estate Investments in 2022

This blog gives us a brief idea about the FEMA regulations that are required for NRI real estate investments in 2022.

What Is The Minimum Amount For Real Estate Investment Online In India

Nowadays small investors are coming forward to make profits with a minimum amount of investment in Indian real estate online. This blog gives them a clear idea of the various methods present in real estate investments.

How To Create A Tax-Smart Portfolio With NRI Real Estate Investments

These are the numerous investment opportunities available to NRIs in India. This article helps the NRIs to understand the different methods where they can be able to create tax-smart portfolio with their investments.

India Among The Top Flexible and Cost Efficient Office Locations in the World: Report

The rise of India as a startup powerhouse has also boosted the demand for flexible spaces. They’ve reimagined their products and repositioned themselves to be more relevant in today’s changing environment.

What Makes Real Estate Investment In India The Most Profitable Investments For NRIs?

There are different types of real estate investments present in India which can make NRI investments profitable within a short span of time. This blog gives you clear info on how the investments are being Profitable for NRIs.

JLL reports India real estate garnered $943 million in investments worth in Q1 2022

JLL India has reported that the Indian real estate sector has attracted investments of worth $943 million in Q1 2022 which is 41 percent more compared to the previous quarter.

10 Real Estate Investing Terms To Understand Before Talking To An Agent

Real estate investing may be expensive. However, if you do it correctly, you might earn a sizeable chunk of passive income from rental as the property appreciates. That is why it is critical to comprehend the main terminology of real estate investment.

RBI Rules & Permissions For NRI Investments In India Real Estate

The RBI provides guidelines from time to time outlining the legislation and granting broad authority to NRIs to acquire certain immovable assets in India without needing additional approval from the RBI.

Navigating Marketing Volatility In Real Estate Investment Via Fractional Ownership

Financial markets enjoyed a wild journey in 2022, with sharp ups and downs in stock and cryptocurrency valuations. While real estate with fractional ownership has always been a solid basis in every good portfolio

The Right Way To Measure The Performance Of A Real Estate Investment

This article gives an overview of real estate performance measurement. Property valuation is more difficult than other types of asset appraisal because it lacks specific published values.

Listen to the article

Listen to the article