An introspection on how much time is left for one’s retirement to plan it effectively and efficiently. Considering to invest in a real estate, pension, retirement plan, or any other policies to guarantee a stable and peaceful life after retirement is essential. Planning one’s retirement is not just an option but a requirement in current times. So we have put together some of the top Retirement plans for NRIs where an NRI can invest for optimal benefits.

Top Retirement plan for NRIs

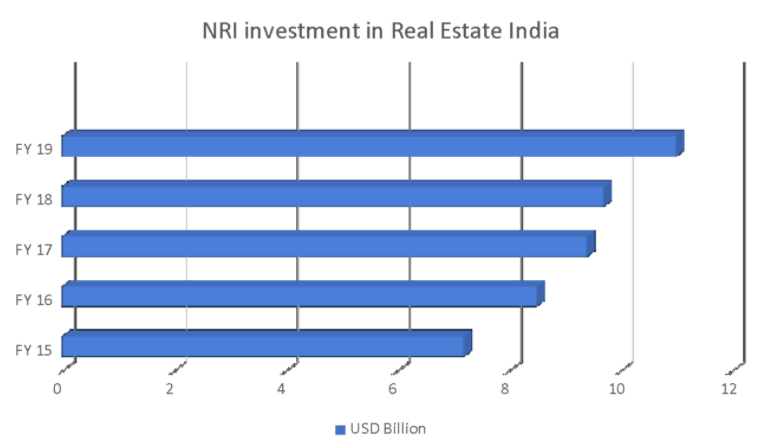

Real Estate:

The price of a property in Delhi, Gurgaon, Mumbai, etc., be it commercial or residential, is spiraling higher than ever, which might be the best time for all NRIs (Non-Resident Indians) to invest in the country. When it comes to tax benefits, these are quite similar to any other resident of India. Although NRIs could easily invest in commercial and residential properties, they cannot invest in farms, plantations, and agricultural lands. An NRI must be careful and watchful during investing in properties/ real estate because it is a little challenging to be away and be engaged in maintaining such matters. One could give a power of attorney to someone he/she trusts to manage the issues.

National Pension Scheme (NPS):

In the National Pension Scheme, there are no lower or upper limits to the amount/number of contributions made each year. The individual is free to manage the tenure/frequency and amount of contributions made.

New Pension System:

Any NRI in 18 to 60 years could also invest in the current NPS (New Pension System). For retirement, one would be needed to invest in an account of the Tier I level. The minimum contribution in this would start from 6,000 INR per annum. Withdrawal of such an account would not be possible as per the terms and conditions prescribed and subjected to modifications under the PFRDA (Pension Fund Regulatory & Development Authority).

Mutual Funds:

If one is planning to retire soon, it would be optimal if one considers both debt and equity and then opt for Investment in a pension fund. Investing in MIP (Monthly Income Policies) would be quite suitable for sustainability. These monthly income plan funds are debt oriented plans which generally invest up to 80% of its sum in the debt instruments and the remaining sum in the equity instruments. However, investing in a mutual fund would attract overall capital gains tax and is one of the best options for NRI Investment over a long period.

Exchange-Traded Funds:

ETFs are marketable securities that track stock elements. Being an NRI, one could invest in ETFs with a comparatively low transaction fee, and this is one of the least portfolio management to get exposure to Indian equities.

Gold:

Gold investment could be made in many formats such as gold bars, gold ETFs, gold mutual funds, gold deposit schemes, etc. Gold ETFs are comparatively more transparent in the pricing and could be purchased and sold quickly like any other company stock.

Source: https://www.indiainfoline.com

Top Tips on How NRI retirement Plan could be made future-ready in India:

- One should first estimate the retirement budget by figuring out the needs and requirements as accurately as possible.

- Then one should spend less compared to regular expenses. A penny saved is a penny earned, filling just the requirements and compromising a little bit on the needs.

- As there are many expenses that one will undertake being a retired person, it is advised not to underestimate the amount of future proof the personal finance plan needs to be.

- One should also keep the KYC documentation updated. The KYC (Know Your Customer), bank account, and PIS (Portfolio Investment Scheme) account, along with the Demat & trading accounts, are needed for a hassle-free investing plan.

- People should not depend overtly on the bank, where all accounts are present. One could also talk to a professional wealth management firm or professional financial planner to understand specific investment opportunities and have an unbiased view of the plan.

Retirement Planning for Future

Some people think that Retirement Planning is something like having a property that could generate money in the long run. This could be one of the sources but not a primary option. The truth is, this is an old school mindset, as such money from rents would not be able to beat the inflation rate. So, one must ensure every factor and create future proof, inflation-proof, and secure personal finance plan. NRIs could invest in different kinds of asset classes to get the desired returns. NRIs should make sure to work with a professional financial planner to make things easy, smooth, and transparent.

NRI Retirement Planning doesn’t have to be a hassle. One could research well, invest in present trends, and enjoy long term blossoms. It would be a wonderful experience as one proceeds to plan for the next phases of one’s life. With the right mindset, stable approach, and optimal research, one could enter retirement ready, secure to move forward, and genuinely enjoy the next adventurous life events.

Every NRI must keep this in mind!

NRIs have to pay utmost attention to several factors such as the currency movements, any legal aspects of Investments In various options, may it be India or abroad, certain taxation matters in India or the country of residence. These all are necessary if one wishes to have a smooth transition to one’s retirement and fulfill all the retirement requirements, needs, and goals.

However, one would need the Know Your Customer (KYC) document along with a bank account and an account for investment in mutual funds in India. For investments in the equity or stock market, one would have to open a Portfolio Investment Scheme (PIS) account, a savings bank account. This should also include Demat and trading accounts. Also, one should keep in mind that intra-day trading would not be allowed for the NRIs.

Keeping the above points in mind, and because everything is pacing fast, one can access anything and everything at the fingertips.

Retirment Plan for NRI FAQ’s:

Can an NRI buy the Kisan Vikas Patra?

No, an NRI would not be allowed to invest in any of the small savings schemes, this includes Kisan Vikas Patra as well as the Post Office Monthly Income Scheme. Other than these, most of the other investment options which are available to resident Indians are also available to NRIs

At what age should one start the retirement plan?

The simplest answer is, as soon as one could. Ideally, one should start saving in his/her early or mid-20s, when one first leaves college and begin to earn a decent amount of money. This is because the earlier one starts to save, the more time the money has to grow, and the grace of compound Interest would play on the next level for such actions.

Is it better to rent a house in retirement or own it?

Though homes could be valuable assets on their own, they shouldn’t be purchased primarily for the cause of investment. Buying it offers stability, certain tax benefits, and a lot more perks. On the flipside Renting a house would provide more flexibility as well as liquidity, and one will spend less money & time on its maintenance.

NSC, called the National Saving Certificate, is a savings option that provides the benefit of Investing and tax savings. On the flip side, the Kisan Vikas Patra (KVP) does not give benefits of the tax deduction.

What is considered a good retirement plan?

There are 3 steps to an optimal retirement plan. First, the individual needs to exactly map out the requirements in the latter part of life. Then planning for saving up for the things that are needed but not required. And lastly taking action! Most people do plan out for their retirement but the action part is missing, the more early one takes the action and starts to invest the more exponential compound Interest one would receive in the future.

Is Gold ETF a Good form of Investment?

Because of the sudden hike in gold prices, one might have to face some liquidity issues in the physical gold market because of lower demand, However, Investment through gold ETF & Sovereign Bonds would be a good option as they offer higher liquidity.

Gold Exchange Traded Fund (ETF) is a great investment option if one wishes to diversify the portfolio or if one finds buying physical gold inconvenient. Any form of Gold is considered to be a safe asset, this means that the prices are usually not extremely volatile.

If one does have family members in India, one can easily invest in Sovereign Gold Bonds through them because an NRI is not allowed to invest in Indian Sovereign Gold Bonds according to the prevailing laws.

Can an NRI invest in gold ETF?

Yes, NRIs could invest in Gold ETFs. If they are purchasing it through the exchange, then they must have the PINS account. Investing in Gold ETFs would be preferable as it offers more liquidity than physics Gold.

Why is planning for retirement is so important?

Planning is very important as picturing the goals would motivate one and keep him/her focused. Retirement planning and how to reach the goals would help one to set realistic priorities and stay organized. Sometimes one needs to do things in a particular order, so it is necessary to know when and where to start.