Demographics Of Singapore 2020

Singapore is counted as one of the leading economies of the world currently. Whether it is business investments or employee turnover rates, the performance of the country has been commendable in the past decade. Naturally, the demographics of Singapore have also evolved over the years. The demographics of Singapore in 2020 are as follows:

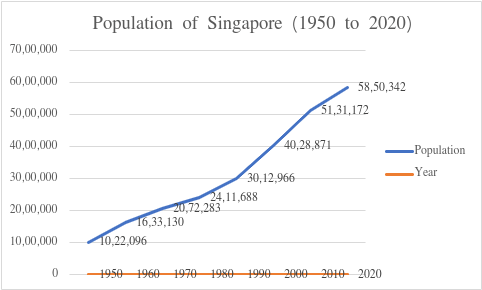

The Population of Singapore:

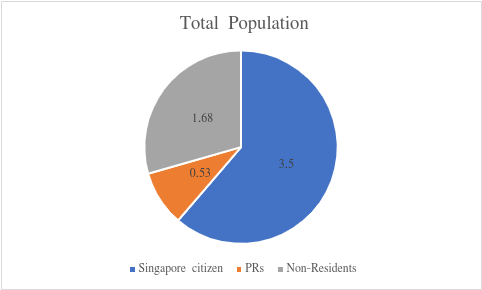

The population of Singapore is 5.87 million according to UN data. The country has seen a 0.79% growth in the population from 2019 to 2020. Although this growth is slower than the previous 0.81% jump, it is still significant for increasing the population density. So, much so that Singapore has now become the second most dense country in the world. The current population density in Singapore amounts to 8358 people/km2.

The population comprises an array of ethnicities which includes Chinese, Malays, Indians, and some others. The Chinese ethnicity forms the majority in the country with 74.2% of the Singaporean population being Chinese. Second to Chinese ethnicity is the Malays group that amounts to 13.2% and next comes the Indian population living in Singapore that forms 9.2% of Singaporeans. The rest of the ethnicity group comprises 3.2% migrants of the USA and European origin.

Urban vs Rural Population:

As the country has seen a shift into an increase in population density, almost the entire population of Singapore has turned urban. Singapore has seen urbanization between the period of 1955 until 2020. The major cause behind this aggressive urbanization is the rise in employment opportunities that come with industrialization in the country. A major spike in rural population came in 2010 where now the urban population stands tall at nearly 6 million and rural being around 60,000.

Language:

There are various languages spoken by the citizens of the country such as Malay, Mandarin, English, Tamil, and bits of Bengali or Hindi. The national language of Singapore is Malay while its official language is English to maintain uniformity in the ethnic groups.

Local Currency in Singapore:

The Singaporean dollar functions as the national as well as local currency in Singapore.

Education and Employment:

Singapore has a literacy rate of 97.5% and an estimated 15.8% of Singaporeans had a diploma by the end of 2019. Owing to the government reforms and stringent policies, the unemployment rates have lowered by 2% on average.

Indians living in Singapore:

Although the proportion of Indians in Singapore is small it is still significant to the population as a whole where it makes 9.2% of the total. The Indians living in the country belong to a mix of religions such as Hinduism, Sikhism, Muslim as well as Christians. The Indians have backgrounds such as Tamil, Punjabi, or Bengali in terms of language and dialect.

India finds a fair share of NRIs in Singapore that not only contribute overseas but also have an increased interest in investing in their homeland. This has brought the sport of NRI Real Estate investments from Singapore NRIs in India.

As per the recent statistics, around 9% of the total Indians residing in Singapore are permanent citizens of the country while 25% of these individuals have acquired a university degree from the country. It suffices to say that the proportion of Indians in Singapore is sure to witness an upward trajectory in the coming years of urbanization and commercialization.

Most Inhabited Singapore Cities by Indians:

The highest density of Indians can be traced around Sungei Road, Jalan Besar, and Serangoon road that is known as ‘little India’ and flourishes with the majority of the Indian population of Singapore. Recently, Indians have also branched out into other areas of the city and have established a niche in the Indian community.

Can Singapore Based NRI Invest in India?

At the advent of the 21st Century, investments peaked the interests of many. Consequently, NRIs have also poured capital in the form of investment in India.

NRIs from Singapore have also shown interest in investing in Indian assets and build good capital either for their retirement savings or any preparation for financial asset creation. There has been an increase in the involvement of Singaporean NRIs as investors in Indian funds or Indian real estate. It is now quite easy for NRIs to invest in India after the regulations of FEMA.

How can Singapore Based NRI acquire Real Estate in India?

The Singapore-based NRIs can acquire real-estate in India by means such as:

- Inherited land

- As gift

- Agricultural land

- Plantation land

- Farmhouse

It is important to note here that FEMA doesn’t allow the buying and selling of Agricultural or Plantation land as real-estate.

Investing in Real Estate: NRI investment in Indian real estate is a clever financial move as it provides long-term profits to the investor.

Purchase of the property: FEMA allows NRIs to sell or purchase a real estate property in India. The NRIs can do so through NRE/NRO/FCNR accounts that are accepted for transactions.

Sale of the property: There are certain TDS imposed on NRIs selling real-estate property in India. This tax varies with the time of sale and type of gains viz long-term or short-term capital gains. If the NRI tries to sell the property within 2 years of making the purchase then the tax imposed is 30% owing to the short-term gains.

When NRIs sell the property after 2 years of purchasing a tax of 20% is levied on the long-term capital gains. The NRIs can also go for a tax exemption on residential real-estate either by going for a capital gains bond or through Section 54 and Section 54EC.

Age Limit: The Income-tax slab rates also vary with NRI’s age and for those under the age of 60 years, the taxation is 20%-30% depending on the type of property and bank whereas the individuals above 60 years of age do not have to pay any TDS on property sale or purchase.

Investment Options Available For NRI In India

Investment for NRI

Nowadays, almost all of the investment options are available to both NRIs as well as residents combined. This has expanded India’s GDP by an estimated 3% and has also contributed to the health of the economy.

The investment options for NRIs in India is as follows:

- Mutual Funds: One of the most popular investment options for NRIs is an investment in mutual funds. NRIs from Singapore can invest in mutual funds easily under FEMA regulations. The return rates on mutual funds are promising in India that go up to 16% on the large-cap equity funds. The taxation on mutual funds is slightly different for NRIs and Indian citizens. The taxes are levied on short-term gains amounting to around 30% for the first 3 years and 20% afterward. The ELSS or Equity Linked Savings Scheme is a popular mutual fund investment scheme that also provides NRIs some tax benefits on their capital gains.

- Equity: NRIs are eligible to invest in the stock market of India. They can do so by creating a PIS account that accounts for their investment portfolio. The Indian stock market provides great returns in a long-term time frame but is also a more volatile investment when compared to Fixed Deposits or PPFs.

- Real Estate: Perhaps, the most popular NRI investment option in India, the real estate investments are becoming the apple of every NRI’s eye. They invest in real estate to establish a financial asset in the country while they continue to work abroad. Recently, the Indian Government has also allowed NRIs eligibility to avail of home loans to purchase a real estate property. The NRI real estate investments have yielded 10.2% returns for the financial year 2018-19.

- National Pension Scheme: Although National Pension Scheme (NPS) are lesser-known forms of NRI investments, they still prove to be beneficial for NRIs as retirement savings. The government also allows NRIs to open an eNPS account that requires a PAN or Aadhaar card. The returns on NPS are dependent on the age of NRI where NRIs under the age of 60 years receive 80% of the annualized investment sum with a withdrawal limit of 20% and the NRIs above the age of 60 years receive 40% of the paid investment as an annualized sum with a 60% limit.

- Unit-Linked Insurance Plans: Such investment strategies are more popular among the residents but some NRIs also opt for ULIPs investment that helps in diversifying the NRI’s investment portfolio.

- Government Securities: A recent addition to the list of NRI investment options in India is that of Government securities. NRIs can go for T-bills or Government bonds as a means of investment either on a non-repatriable or repatriable basis.

- Certificate of Deposit: NRIs can also build an investment corpus through Certificate of Deposits and the current statistics suggest that NRIs have contributed $1.49 billion in the form of these deposits and bonds. These serve as a good short-term investment source with a period of 3 months to 1 year.

Investment Options Available For NRI In Singapore

There’s a reason behind Singapore becoming a thriving economy in the world. The country has established good capital assets and a tremendous cashflow that contributes to GDP. All these factors make Singapore a dream investment hub. The investment options offered by Singapore include:

- Singapore Government Bonds: The Singapore Government Bonds are a lucrative long-term investment option ranging from 2 years to 30 years of investment. The investment yield on these bonds ranges between 0.28% per annum for 2 years and 1.09% per annum for 30 years. For an individual looking to invest in Singapore Government Bonds, the minimum investment required is S$1000.

- Singapore Mutual Funds: The Singapore Mutual Funds also serve as an important investment option in the country and these options are available throughout Singapore. These investments prove to be beneficial for both the fund manager and advisors. The performance of such funds varies 0.8% for 3 months returns and 6.25% for year-round investments.

- Real Estate: The Real-estate investments in Singapore have seen a 2.67% rise from 2018. This rise was primarily seen in the regions Outside Central Region (OCR) and RCR. The growth has been highest for residential real-estate with housing units increasing by 29.4% in the country during 2019. This has led to an increase in rental and housing investments.

- Structured Deposits: Investment in fixed deposits or unit deposits has recently gained momentum in Singapore especially for investors with a low risk-bearing appetite. There are three sources of structured deposits in Singapore namely DBS, UOB, and OCBC where interest rates vary from 0.25% to 1.55% and the minimum investment sum is S$1000.

- Exchange-Traded Funds: Singapore is well-known for its exchange-traded funds and the global market for such funds is expected to double by 2023. Singapore offers a variety of ETFs such as Bond ETFs like ABF Singapore Index Fund, Commodity ETFs like SPDR Gold Shares, Sector-Specific ETFs, Country specific ETFs like SPDR STI funds. The investors can invest in ETFs through a brokerage account or Robo advisor.

Interest Rates on Investment Options in Singapore

- The interest Rate on Treasury Bills: The individuals can invest in Singapore Government Securities for a 6-month or 1 year period. The interest rates for 6-months of investment are around 0.19% of the median yield while for 1 year the interest rates were 0.27% in July of 2020. The Singapore Govt. has generated S$2-4 billion as returns for T-bills and SGS.

- Interest Rates on Government bonds: Interest rates of Singapore Government bonds is 0.28%, 0.52%, 0.88%, 1.03%, 1.09% for the 2 years, 5 years, 10 years, 15 years, and 30 years term respectively.

- Interest Rates on Savings Bonds: The interest rates of Singapore Savings bonds are 0.24% to 0.88% per annum.

- Interest Rates on FD: The Singapore Fixed Deposits are available with DBS at an interest rate of 0.85% to 1.15%, UOB offers an interest rate of 0.7% to 1.15% and OCBC has an interest rate of 0.25% to 1.55% depending on the term of FD.

- The interest Rate on Saving Plans: Singapore Saving Plans are provided by UOB at an interest rate of 0.75% per annum and Maybank Save up provides a 1.03% interest rate per annum.

How Investing In India Is A Profitable Investment Than Investing In Singapore by Singapore NRI

A genuine dilemma for NRI investors is the choice of investing in their homeland or the city of their residence. For Singapore based NRIs the choice is simplified due to the profits of investing in India that include:

Economy Overview-

Indian economy is on the turf of development and has transitioned from a closed economy to an open-market one. It has seen growth since 1997 ranging from approximately 7% for every single year until today. Currently, India has a GDP of 65% that is 7 times more than Singapore, and an exports rate of $301.9 billion. The prime sectors withholding the nation’s economy include information technology, telecommunication, jewelry, and pharmaceuticals.

Moving on to Singapore’s economic front, the country is among the world’s largest economies currently and serves a GDP of $274.7 billion. The country has a free-market type of economy and is dependent on per capita GDP, exports, trades, electronics, and pharmaceuticals. The major attractions for investors are the magnificent infrastructure and advanced technology.

Business Environment-

As India is a developing economy, the business environment is a bit lackluster where it is difficult to venture into new businesses. Singapore on the other hand has been ranked at No.2 according to World Bank Ease of doing Business Report 2017. The country is miles ahead of the Indian business environment whether it is credit scores, construction permits, business establishment, or enforcing contracts. What India lacks in the business environment, covers the field of workforce and labor. The population demographic in India comprises a majority of individuals that are under the age of 25 years. Thus, it holds immense potential for the business workforce.

Documents Required-

Singapore: The process of business investment in Singapore offers two options one for new business and another for a GIP fund. The documents required include:

- Application form for PR investors

- An investment plan proposal

- The investment or program undertaking form is given by the authority

- Entry permit to Singapore

- Supportive documents demanded by the investing institution

India: When an NRI candidate decides to invest in India, he/she is required to present the documents:

- Identification proof

- Passport of NRI candidate

- Proof of their Indian residence (if any)

- Proof of their residence abroad

Immigration requirements-

In India:

There are two categories of visas for working in India viz; an Employment visa that is valid for 5 years and a Business visa that allows NRIs to visit India anytime in 6 months.

In Singapore:

For investing or working in Singapore there is an Employment Pass issued under the Government and used by Foreign professionals, executives and managers. The individuals possessing an employment pass is required to draw a minimum amount of S$3,600 as salary. There is also a provision for an EntrePass for the individuals who wish to start a new business in Singapore.

Income Tax For NRIs

Income Tax-

Singapore: There is no double taxation in Singapore and the tax slabs for personal income is around 22%. The country follows a one-tier taxation system.

India: The tax rates on an individual’s income go up to 30% and the tax on investment dividends is 15%.

Corporate Tax-

Singapore: A corporate tax of 17% is levied on companies operating in Singapore.

India: The companies and business organizations operating in India have to incur a tax of 25% at a flat rate along with an additional surcharge amounting to 5% over the company’s annual turnover when it exceeds Rs.1 crores.

Tax Exemptions-

Singapore: Singapore offers a complete tax exemption for a new company’s initial 3 years of operation. This is applicable for the corporation’s income ranging up to S$100,000.

India: The NRIs investing in India receive more tax exemptions than those in Singapore that can be availed on both short-term as well as long-term capital gains. The investment companies in India also allow a degree of exemptions on dividends or venture-capital enterprises.

Investment Procedure for Singapore NRI Real Estate In India

Complete Investment Procedure For Investing in Indian Real Estate

Whether in the country of residence or abroad, a person who is buying a property has to solve many legal issues before finally getting the keys to their dream home in their hand.

Furthermore, an NRI must be mindful of all the legal aspects revolving around the property’s purchase. They should have complete knowledge of the foreign investment laws and the laws in the country of residence.

When acquiring a property in a foreign country or one’s own country, many investment and liability risks are present. The most important thing that one needs to be mindful of is the law of any land regarding the buying or selling the property in that particular country. Let’s look at some legal aspects involved while dealing with real estate investments to make a financially sound decision.

Government’s Approval:

When a person needs to invest in real estate, whether in a foreign country or the country of residence, they need to obtain official permission or approval from the relevant government. However, it depends on country to country, whether government approval is necessary or not. For example, while buying a property in France, government approval is mandatory.

On the other hand, resident Indians can acquire property abroad through gift or inheritance from someone who isn’t a resident Indian. However, Indian law permits an NRI to hold any immovable property outside India.

Ultimately, every country’s rules and regulations are crucial, so it is imperative to have perfect knowledge beforehand.

Stamp Duty Tax and other Taxes

After getting the necessary approval, the next step is to understand what kind of taxes one has to pay and what will apply to them when buying a property abroad. Usually, paying tax is a hassle. But upon understanding them, it usually clears a lot of confusion.

One needs to understand five taxes relating to property investment. They are as follows –

- Stamp Duty Tax

This tax is the first and an indirect tax. It’s put on the property one purchases based on the price paid for the property.

- Council Tax

This tax is the second indirect tax. The local authorities levy this tax, and the rate depends upon the purchase price, the location, and the value of the purchased property.

- Income Tax

This tax is the third and a direct tax. When a person purchases a property, and if its value rises enough to earn some income, such payment is a taxable investment income. However, if the person is occupying the purchased property, then the tax doesn’t concern them.

- Capital Gains Tax

Again, this tax is a direct tax. When a person sells the property and earns some money from the sale, they need to pay a capital gains tax. However, NRIs are exempt from this tax.

- Inheritance Tax

This tax again is a direct tax. Any resident Indian with property or assets that are not within their resident country needs to pay this tax. However, NRI need not worry about paying this tax.

Finally, the first two taxes that are the Stamp Duty Tax and the Council Tax, are mandatory and a bit on a higher side. Two out of three direct taxes are not a concern for the NRI buyers. It is always beneficial to be familiar with any laws and taxes before going in for any real estate investment.

Complications Regarding Taxes

The tax brings along complications. Such complications may occur in overseas countries where a person wants to acquire the property.

The following are the complications that one faces while buying a property abroad –

- To obtain necessary tax registrations

- To file tax returns

- To pay the property taxes

Suppose if a person is earning a rental income, they need to accept all the country’s tax laws where they have an investment and their country of residence. In simple words, any income from an overseas property investment will be treated as income from property in India.

Secondly, tax considerations are vital when considering any investment in overseas property. If a person sells a property in India and wants to purchase another property from the sale proceeds in a foreign country, they will be liable for tax within India.

Additionally, selling, leasing, or transferring any purchased foreign property will create a tax liability in India and the foreign country. Thus, one has to understand the tax implications in both countries.

Necessary Tax Registrations

After understanding all the tax implications, a person, to avoid the double taxation problem, should manage the liability of taxes with proper knowledge aided by a lawyer to resolve any legal issues. Simultaneously, one should know that some countries have signed a unique treaty called the Double Tax Avoidance Agreement (DTAA) with India. This agreement offers two options for avoiding double taxation –

- The income of the NRIs will be taxable either in India or in the country of their residence.

- India will deduct any amount that is equal to its income tax in the country of their residence.

Also, one needs to know that for making an overseas real estate investment, an individual does not require any special permissions from the FEMA (Foreign Exchange Management Act ) and the RBI (Reserve Bank of India) except for the following three situations –

- If the purchase of the property is in the joint name with a non-resident relative

- If a person using the funds from RFC (Resident Foreign Currency) to finance the property

- If the purchase of the property is through LRS (Liberalised Remittance Scheme)

Property Taxes

Tax for NRIs selling their property in India

- Long term capital gains are taxable at the rate of 20%

- Short term capital gains are taxable as per the income tax slab

Here one should know that the capital gain is the difference between the acquisition price and the sale price minus any expenses incurred while making the sale, for example, stamp duty, brokerage, registration charges, etc.

Tax Deducted at Source (TDS)

When a resident Indian buys any property from an NRI, they deduct TDS at 20% if the property has been held for two years and above as against 30% is the property is sold in less than two years. The deduction includes a TDS plus surcharge, health, and education cess.

Guideline for LTCG TDS rates w.e.f. 2018 -19 –

| Property value | Tax Details |

| Less than INR 50 Lacs | 20.8% including cess and surcharge |

| Between INR 50 Lacs to INR 1 CR | 22.88% |

| Above INR 1 CR | 23.92% |

| Above 2 CR | 25% |

| Above 5 CR | 37% |

KYC Documents Required for Singapore NRI For Real Estate Investment in India

The following are the documents along with the KYC form that is required for the Singapore NRIs for real estate investment in India –

KYC Form

An NRI needs to submit the KYC form and all the necessary details duly filled immediately to the SEBI registered. The NRIs can send the documents by courier/post to the intermediate.

Documents for NRI or POI

NRIs must furnish the following documents:

- Copy of Indian passport and visa

- In case an Indian passport is unavailable-

- PIO (Persons of Indian Origin) card if they hold a foreign passport

- OCI (Overseas Citizen of India) card if their parents are citizens of India

- Work permit or employment contract or appointment letter of their current country of residence

- Latest certificate of salary or Payslips for the last six months

- Latest income tax returns

- Bank statement of NRE and NRO accounts for the last one year

- Bureau report of the current country of residence

- Power of attorney as per the format provided by the bank (in case if they are not in India for the execution of the transaction of purchase)

- PAN Card that is mandatory for property transactions.

- Tax returns

- Address proof

- Sale deed

- Allotment letter

- Approved building plan & occupation certificate

- Encumbrance certificate

- In case of NRIs belonging to the Merchant Navy, then they should submit a mariner’s declaration or a certified copy of CDC – Continuous Discharge Certificate

Attestation of NRIs or PIOs (Person of Origin)

The NRIs need to attest all the above documents by authorized officials of the overseas branches of the scheduled commercial banks that are registered in India, court magistrate, judge, public notaries, or the Indian embassy or consulate hey general in the country of their residence.

In Personal Verification (IPV)

IPV is mandatory for the KYC process as per SEBI rules. Intermediate should conduct the IPV of the NRIs or PIOs. Also, the NRIs need to submit all the documents or proofs in the English language.

Taxation Laws for Singapore NRIs For Real Estate Investments

There has been a recent trend of Singapore NRIs investing in real estate in India. However, they do face specific tax implications while purchasing or selling any property in India. Let us delve deeper into the details of taxation for Singapore NRIs.

Tax implications for an NRI Purchasing a Property in India

An NRI is rightly given the benefit of tax related to buying a property similar to a resident Indian. They can claim a deduction of Rs. 1 Lac under Section 80C of the income tax.

Additionally, on buying a house on loan, the NRIs have no upper limit towards a claim or a deduction for home loan interest, unlike the resident Indians who can claim a deduction of only up to Rs.1.5 lakh.

Like their Indian counterparts, NRIs are eligible to avail of other deductions such as registration charges, stamp duty, municipal taxes that are payable during the year, and the flat rate of 30% of the rent (which excludes municipal taxes) for maintenance.

However, if the NRIs buy a property worth more than Rs.50 Lacs, they shall bear a TDS at the rate of 1%. They can apply for a tax exemption from wealth tax if the property purchased is vacant and declared ‘self-occupied.’ Another way to apply for tax exemption from wealth tax is to rent out the property for at least 300 days a year. Here, a point needs a consideration that this rule applies to the first property only, and for all the other subsequent vacant properties, the NRIs will have to pay the tax at a rate of 1% of the value (net of outstanding loans) more than Rs. 30 Lacs.

For NRI investments to be taxable depends upon whether India has signed a DTAA (Double Taxation Avoidance Agreement) with the NRI’s country of residence. If that is the case, then the NRIs don’t have to pay the tax twice. However, they will pay tax on capital gains.

Equity Funds Taxed for NRIs:

Short Term Capital Gains at 15%.

Long Term Capital Gains more than INR 1 Lac at 10%

Debt Fund Taxed for NRIs:

Short Term Capital Gains at 30%

Long Term Capital Gains more than three years at 20%

Additional features of Taxation for NRIs from Singapore:

DTAA:Singapore and India have signed a unique tax treaty known as the Double Taxation Avoidance Agreement (DTAA) to avoid double taxation. The absence of this treaty invites double taxation for the individuals. Also, it means that the incorporated or formed companies, whether in India or Singapore, can impose tax rates in their respective countries on the same income. This treaty forbids any unfair income flow between the two countries while discouraging illicit commerce and trade being carried out.

According to this treaty, the income earned from the direct or indirect us age or the selling of any immovable property will be subjected to taxation in the property’s country of location. This earning includes real estate earning of the enterprise and any other income earned from the immovable property through its use for accomplishing any professional services.

Repatriation of funds: NRIs are allowed to repatriate or transfer their funds collected in India to abroad. For this purpose, they are required to submit a FORM 15CA and 15CB. The NRIs can repatriate S$ 1 million a year outside India.

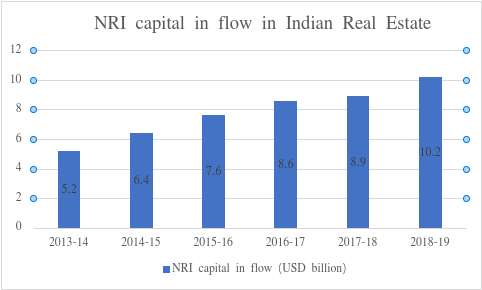

Best Cities for Singapore-based NRI To Invest In Indian Real Estate

The Indian real estate crosses a USD10 billion mark this year through NRI investments. According to a report on the trends of NRI investment in the Indian real estate sector compiled by 360 Realtors, NRI investment in India’s real estate segment has doubled from USD 5 billion in 2014 to USD 10.2 billion in 2018. This humongous growth is experienced mainly in India’s five cities, namely Mumbai, Bangalore, Pune, Noida, and Gurugram or Gurgaon.

What are the driving factors of this growth?

The following factors drive the positive growth in the investments in the Indian real estate market –

- Dwindling value of Indian rupee making the real estate market more affordable

- Regulations like RERA has increased the transparency of the whole process of buying a property

- A growing focus by the developers on the expatriate market.

- High yielding rental returns

- Capital Appreciation

A quarter of the country’s real estate investment comes from the NRIs of the US, UK, Singapore, and the Middle East. Around 70% of the sales are in retail sales from the expatriates who desire or plan to buy a home and settle in their homeland post-retirement. This deep down desire for stepping on the Indian soil for spending the rest of the lives also becomes one of the fundamental reasons for the NRI investments in the Indian real estate.

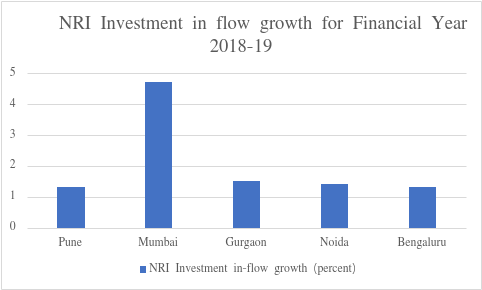

The following graph shows the NRI capital inflow in the real Indian real estate in US dollars billion –

Source: IndiaInfoline

City-wise growth demographics in NRI investments ($bn)

Mumbai continues to be the favourite NRI Investment destination in the country, with an investment of around 45 to 50% of the total NRI investment. Surprisingly, this investment comes from not only the NRI buyers originally hailing from Mumbai but also from the North and South of India, leading to increased growth of NRI investment in the Mumbai real estate by 74%. Again, Mumbai’s high preference is supported by attractive 3% yearly rental returns, followed by a high capital appreciation between 5% to 7% on a YoY basis.

On the other hand, IT hubs like Pune, Bangalore, and Gurugram or Gurgaon are emerging as the first choice of IT professionals working abroad and are planning to touch base. The capital inflow in these cities has almost doubled in the last five years.

Source: IndiaInfoline

Currently, Noida seems to be growing an unprecedented 350% growth since 2014, scraping up a tremendous USD1.4 Billion in real estate investments during the year 2018-19. Though attracting less than half of the investment as against Gurugram in 2014, Noida has skyrocketed the NRI investment in the real estate investment segment by becoming home to industries such as IT/ ITeS, publishing, and consulting. Its proximity to Delhi and Gurgaon, comparatively affordable prices, and the growing rentals is attracting interest in the city.

Let us now head on to some of India’s leading real estate markets that are creating a tsunami of NRI investments in India.

Mumbai Real Estate Market

Mumbai, a bustling city and India’s financial capital, is growing exponentially due to significant growth in its peripheral areas. The Mumbai Metropolitan Region is ranked as the largest real estate market in India compared to other regions. It has one of the highest rental yields in the commercial segment across the world.

Mumbai ranks third among 34 cities, including the global financial hubs like Hong Kong, New York, London, Singapore, and Beijing, as rated by Knight Frank in the Global Cities 2018 report. Mumbai generates approximately 6.2% of India’s GDP, with an approximate 30% of the country’s total FDI inflows.

It serves as a headquarters to 24 out of 58 Indian companies on the Fortune 2000 list for 2017. At the same time, 11 out of 22 banks have their head office or corporate office in Mumbai. The Mumbai Metropolitan region records a significant growth of around 33% in the prices of the property.

With such a strong background, Mumbai is the first choice for NRI real estate investment.

Pune Real Estate Market

When they look for real estate investment in India, the NRIs want a good quality of life, which they get in Pune. As against Mumbai or Bangalore, where people live a fast-paced life ideal for the youngsters, Pune provides a perfect blend of ease, comfort, and movability.

The young professionals love the city and are picking up this city to choose their future home. Pune is also in demand for those who are looking out for second homes or retirement homes. Being an education hub, there is also a greater demand for rental housing in Pune. The NRIs living in the UK have been favoring the Pune property market in recent times. For those in the IT service sector, Pune is the next best city to Hyderabad for settling down professionally and personally by having a home, according to a survey by Mercer’s quality of living.

Bangalore Real Estate Market

Bangalore – the Information Technology capital of India, is also one of the favorite start-up destinations. JLL, the property consultant, has named Bangalore one of the dynamic cities in the world. Bangalore provides an eclectic blend of continuously growing real estate, attractive property packages, ideal brokerage packages, and a thriving economic activity. Bangalore has got a culture of its own.

According to the recent trends, Bangalore shows a demand for the co-working space, which would only increase substantially in the future. NRIs who are looking to earn a handsome monthly income can invest in commercial real estate properties and turn them into a co-working space. Private estimates show that the yearly office rental yield is around 10% making Bangalore the best bet for real estate investment.

Recent data shows that the NRIs from the UAE are particularly favoring Bangalore’s property market. According to the Global Wealth Migration Report, the city, with its many industries, would lead to tremendous growth in the future.

Gurugram Real Estate Market

The real estate market in Gurugram or Gurgaon offers good returns on investments made.. Gurugram or Gurgaon offers best-in-class infrastructure, world-class commercial setup, and excellent connectivity to Greater Noida, Greater Noida-West, Ghaziabad, and Jewar its expanding Metro network.

Some of the area’s upcoming attractions are Jewar International Airport, an ambitious film city project, Dwarka Expressway, and a developing new Gurgaon. Golf Course Road and Extension are targeting a lot of activities from the builder community. So, one can expect many promising projects that are launching soon. All of these make Gurugram or Gurgaon an emerging hot real estate investment destination for the NRI investors who are looking towards earning higher rental yield and profitable future returns. Gurugram or Gurgaon is undoubtedly one of the biggest business hubs in northern India.

Noida Real Estate Market

The micro-markets of Noida and Greater Noida have a plethora of real estate investment options that are available for every budget. An attractive affordability quotient with many infrastructure projects in the pipeline makes Noida and Greater Noida a favorite amongst a lot of NRI property buyers. The Noida-Greater Noida Metro, along with a developing Greater Noida West, TechZone 4, Surajpur, and Sector CHI in Greater Noida, are witnessing a healthy infrastructural activity in recent times, turning it into an excellent long term investment option for the NRIs.

Chennai Real Estate Market

One of the least expensive real estate markets compared to the four metros in the country, Chennai offers an excellent real estate investment option to the NRI. The Economist Intelligence Unit’s Worldwide Cost of Living 2019 Index suggests that the Chennai real estate market is a value for money and includes being included in the world’s ten cheapest locations.

The capital of Tamil Nadu state, Chennai, has remained unaffected by many turbulent changes in the Indian property market during the last five years. The city has shown no dramatic changes in terms of pricing or new property launches. So, what is it that makes Chennai a hot favorite among real estate investors?

Due to its automobile industry’s resilience, which nicknames Chennai as the ‘Detroit of India’ along with a continuous demand for homes driven by an impressive industrial mix including automobile, technology, healthcare, and manufacturing sectors, keeps it going. Recent data shows that the NRIs living in the US are developing a keen interest in the Chennai property market. The Mercer survey of 2019 ranks Chennai as the safest Indian city.

Finally…

Many of the leading real estate companies and developers feel that this is a perfect time for investment in the Indian real estate sector. A successful implementation of RERA, depreciating Indian Rupee at an all-time low, and a desire of the majority of the Indians staying abroad to come back home makes real estate investment for the NRI more lucrative and reassuring. Also, premium developers in India are now offering residential developments at par with the international standards, thus providing the NRI with the best of both worlds staying close to their family with no compromise on their lifestyle.

Rules for Singapore NRI Investment In Indian Real Estate

India is experiencing considerable growth in the NRI property investment in various parts of the country. These NRI property buyers reside mostly in the US, Singapore, UK, Canada, Middle East, and South Africa. The hot destinations for investment in residential and commercial properties are Bangalore, Pune, Chennai, Goa, and Ahmedabad. With newer policies and a more comfortable NRI investment process, the government is all set to attract more and more investments in real estate in India.

Here are some rules and guidelines that the NRI investors need to follow when investing in real estate in India:

-

Citizenship

If an NRI is holding an Indian passport, they don’t need any approvals to make any investment in real estate. Even under the general permission category, those people belonging to Indian origin or PIO do not require any government consent for investment in the property unless they’re the citizens of some of the neighboring countries like Nepal, Bhutan, Sri Lanka, Bangladesh, China, Afghanistan, and Pakistan.

-

Type of Property

The Indian real estate offers a wide range of options to the NRIs for investment. The options include residential, commercial, under-construction properties, and ready to move in flats. However, they’re not allowed to buy any farmhouse, agricultural land, and plantation property unless they receive it as a gift or through inheritance.

-

Method of Payment

While buying any property in India, the NRIs can make payments using normal banking channels for inward remittance. They can also execute the transaction using a non-resident external rupee (NRE) account or an ordinary non-resident rupee (NRO) account, or a foreign currency non-resident deposit account (FCNR) account. There’s no compulsion to pay in foreign currency cash or through cheque.

-

No rules Governing Inheritance

The RBI has no rules to govern any immovable properties that have been gifted or received by inheritance, crew inheritance by NRIs. Also, the RBI does not lay down any restrictions for leasing or renting the NRI’s property.

-

Eligibility for Loan

Just like any other Indian residents, NRIs are also eligible to apply for loans in India. NRI property buyers qualify for a loan up to 80% of the property value. The NRIs need to fund the balance amount on their own. In case of loan repayment, the NRIs must pay back the loan to the respective banks in Indian currency only.

-

Tax Payment

An NRI investor should know the three kinds of payments before making any investment in property in India. These charges include registration charges, stamp duty, and service tax, which are payable according to the Indian rules.

- The property tax varies according to the kind of property and its location.

- There are three kinds of slabs for the payment of stamp duty in India.

- If the owner of the property is a woman, then 4% of the value of the property.

- If the property is owned through joint ownership, then 5% of the value of the property.

- If the owner of the property is a man or a male, then 6% of the value of the property

- The registration fee is applicable as 1% on all the transactions of property

Foreign Exchange Management Act (FEMA)

Any monetary transaction crossing borders either coming into or going out from India is governed by FEMA foreign exchange management act 1999 came into effect after the FERA act’s nullification. From then on, FEMA regulates all foreign exchange transactions. Below given are the five most important FEMA regulations that the NRI investors best know –

-

Maintenance of Bank Account

On getting the status of an NRI, one needs to open individual bank accounts that are specially designed for NRIs. These include:

- An NRO account if they want to spend money they have earned abroad back to India.

- An NRE account for keeping income earned from repatriable or moveable assets, such as cash and securities.

- An FCNR (B) account that helps in storing money in foreign currencies. Both NRO and NRE are useful only for the Indian currency.

-

Financial Investment Options

NRIs are allowed an unlimited number of investments in repatriable or non-repatriable transactions. They cannot invest in small savings schemes or Public Provident Fund (PPF) to use the small savings by offering reasonable returns on investment combined with income tax benefits.

-

Acquisition and Transfer of Immovable Properties

All the NRIs and Persons of Indian Origin (PIO) (excluding people from Canada, Austrailia) can buy all types and kinds of commercial as well as residential real estate in India. The exceptions are as follows:

- Agricultural land

- Farm homes

- Plantation

-

Repatriation of Current and Immovable Assets

An NRI can send money from foreign repatriable assets such as rent from a property owned abroad back to India. The NRIs are restricted to repatriate the funds related to immovable properties or lands since they can only repatriate their original investment info foreign funds. Also, they cannot use the interest from the proceeds of these investments for remittance.

-

Income for Students

As per the Liberalized Remittance Scheme, the Indian NRI students can receive a maximum of USD 10 lakhs per year from their NROs or NREs, or any proceeds or profit gained from estates or properties. The NRI students can also receive an amount equal to USD 2.5 lakhs per year towards caring for close relations.

RBI Permissions Required

The Reserve Bank of India has issued general permissions to NRIs through a circular to buy any commercial or residential property in India. These NRI investors are not required to seek any specific permission from the RBI. They also need not send any communication or intimation regarding the purchase of property to the RBI.

Also, as per the available existing permissions, the NRI investors can purchase any number of commercial or residential properties with the consent and support of India’s income tax laws.

Suppose the NRI investors are unable to come to India. In that case, the documents regarding the property’s purchase can be looked into and executed by any person given a valid power of attorney.

An important point to be noted here is that the NRIs cannot purchase any agricultural land or plantation property, or even a farmhouse in India. If the NRIs want to buy the same, they will have to approach RBI for permitting them to do so after considering their circumstances.

Remittances of Funds

The NRIs, when investing in India, belong to various countries. There are some common queries that the NRI investors always face, and they are regarding the transfer and repatriation of the funds for investment. Let us have a detailed look at each query and try to solve it for the NRIs.

Transfer of NRI Funds

An NRI investor can transfer funds only from the Non-Resident Rupee (NRE) account or Non-Resident Ordinary Rupee (NRO) account. The transfer of funds can use normal banking channels like NEFT, RTGS, and IMPS.

An NRI can use only Indian currency for the transfer of funds. As per the RBI guidelines, an NRI cannot transfer funds in foreign currency directly as this can be considered an FDI and will come under the regulations of FDI or FEMA. Suppose the NRI investors want to transfer foreign currency. In that case, they need to convert that foreign currency into the Indian currency or its equivalent by asking the bank to do so before moving it to their investment accounts.

If the NRI investors cancel their investment, they will get a refund of the amount into the same NRE bank account from which they have transferred. In fact, as per the RBI’s Master Circular No. 4/2015-16 dt. 01/07/2015 (Master Circular on Acquisition and Transfer of Immovable Property in India by NRIs/PIOs/Foreign Nationals of Non-Indian Origin) the returns of purchase consideration for the property in case of cancellation will be done in the same NRE account with the condition that the NRI investor has made the original payment through that particular NRE account.

Remittance of Sale and Proceed

As per the RBI rules, the NRIs cannot deposit any income receivable in India into an NRE or foreign currency account. This ruling is that the amount from the NRE account is repatriable freely in foreign currencies. Therefore, all the income from rent and sale proceeds use the NRO account of the NRI investor.

The NRI investor can repatriate any proceeds from rent and sale up to USD 1 million (INR Rs. 7 CR) to their NRE account through the below-given steps –

Step 1- To get a certificate under Form 15CB from any chartered accountant practising in India to verify the amount of money being sent after confirming that the money has been acquired through legal sources and taxes have been paid thereon.

Step 2 – To fill an online Form 15CA with the tax Department.

Step 3 – To fill and submit the RBI Form A2.

Keynote – The Form 15CB is not necessary for an NRI to fill up if the remittance is not more than Rs. 5 Lacs.

Upon submitting these documents, the bank will transfer the funds from the domestic NRO account to the NRE account.

Loan Eligibility For Singapore Based NRI Investing in Real Estate

The following individuals are eligible for NRI home loans in India –

Eligible Profiles – Non-Resident Indian (NRI), Person of Indian origin (PIO), Overseas Citizen of India (OCI), except Citizens of Bangladesh, Pakistan, Sri Lanka, China, Afghanistan, Iran, Bhutan, or Nepal.

Eligible Age – The minimum age for an applicant is 24 years, while the maximum age limit is 60 years or the retirement age, whichever is earlier during the loan maturity.

Eligible Work Experience – The applicant should be having a minimum overseas work experience of at least six months with a total work experience of two years.

Eligible Minimum Income –

For GCC Countries – AED 5000 – p.m. (or equivalent)

Other Countries & the USA – USD 3000 -p.m. (or equivalent)

For Merchant Navy – USD 2000 p.m. for nine months

The following table provides a list of the eligibility criteria for NRI home loans in India –

| Eligibility Criteria | Salaried or Self-Employed |

| Work Experience | Minimum 2 years of work experience in present company |

| Age Criteria | Minimum: 18 years Maximum: 60 years/retirement age |

| Loan Tenure | Up to 30 years |

| Loan Amount | Depends on the borrower’s profile |

| Interest Rate | 8.70% onwards |

| Prepayment Charges | Nil to a maximum of 2% |

| Late Payment Charges | 1% to 3% |

| Nationality | Indian |

| Resident Type | Non-Resident Indians (NRI) or Persons of Indian Origin (PIOs) |

Process of Applying for Home Loans in India

Owning a home is a dream for most of the NRIs. Nowadays, there are various home loan schemes now available to make the dream reality, especially for the NRIs. It has now become relatively easy for the NRIs to own a home in India as NRI home loans are readily available to fulfill certain conditions. Let’s look at the process of applying for the NRI home loans in India.

Points to Remember

Some of the essential points a Singapore NRI should keep in mind while applying for the home loan are the following –

The Requirement of Physical Presence –

The physical presence of an applicant is not required to apply for a loan. The applicant can appoint a relative as their attorney’s power for completing the loan procedure on their behalf.

Borrowing Limit –

The NRI applicant can borrow funds up to 80% of the property cost through a home loan. However, the eligibility depends upon the income and repayment capacity of the applicant. Moreover, there is no limit on the number of loans.

Penalty Charges –

If the applicant needs to pre-close a home loan, then there are no pre-pay or penalty charges to pre-close the loan at any point in time. It will not even damage the credit rating of the NRI applicant in India.

How long is the Loan Process going to be?

The entire loan process takes anywhere between 30 to 45 working days. It takes around three couriers to India and a couple of emails to complete the process entirely.

The loan process

Below given is a simple process for home application in Indian real estate a Singapore NRI –

Step 1

A person living in Singapore can courier the loan application and the cheque for the processing fee, and all the supporting documents. Alternatively, they can also apply online on a particular bank’s official website.

Step 2

The bank will study the documents, verify the employment, and calculate the NRI applicant’s eligibility. The bank will then issue a sanction letter stating the loan amount and the interest rate on offer, and all the other terms and conditions regarding the loan.

Step 3

The NRI applicant may submit the original property documents and a few other supporting papers or documents to the bank. The applicant may have to pay any other loan related applicable charges for getting the loan disbursement.

Singapore NRIs may need to submit the following essential documents to the bank or the lender for a hassle-free process:

- Copy of Full passport and work visa.

- A duly filled loan application form

- Employer ID card.

- Three recent passport size photographs.

- Valid work permit proof

- Copy of the contract of employment.

- To provide current overseas proof of residence, e.g., Agreement of house lease, bank statement, card statement, utility bill, etc.

- Salary slips of the past three months

- Statement for the last six months of salary account and NRE/NRO account

- A general power of attorney

- Last year ITR except for NRIs in Middle East nations and Merchant Navy Employees.

- Details of previous loan(s), if any.

- Property papers

NRI Home Loans

Sanctioning

Sanctioning of the loan depends on the bank’s verification process regarding the applicant’s documentary proof and the quantum of the loan that the bank can approve. The NRI loan applicant may be requested to visit the Indian embassy and all the necessary documentary proofs and may be asked questions regarding income, monthly expenses, job stability, age, etc., before the loan sanction. Upon satisfaction, the bank will provide a sanction letter stating the loan amount, loan tenure, interest rate, and other terms of the home loan.

Disbursement

Upon the sanction of the loan, the next process is the disbursement of the loan. There is no fixed time for the allocation of home loans. It may take around seven days to four weeks for the disbursement.

The following is the process for home loan disbursement –

Step 1 – Submission of the documents

Step 2 – A legal examination of all the documents

Step 3 – Details regarding the date and down payment amount

Step 4 – Verification of documents and property

Step 5 – Disbursement of home loan

Disbursement of home loans may either be in stages or full, depending upon the completion of the property’s construction. The loan agreement will be stating the disbursement schedule. However, the bank or the lender considers only the construction stage and not any payment timeline stipulation that the builder provides.

The following documents are to be submitted before the loan disbursement –

| Document | Checks & Controls |

| Loan Agreement and Annexures |

|

| National Automated Clearance House (NACH) mandate/ Standing Instruction (SI) form and Security Cheques (SPDC) |

|

| Loan Cover/ Insurance Details |

|

| Processing Fee / Equitable Mortgage cheques |

|

| Property Documents |

|

| For Balance Transfer / Takeover of loan from other bank / financial institution |

|

| Own Contribution Receipts |

|

| Sanction Letter |

|

| TDS |

|

| PSL Documents |

|

| Other Documents (to be collected if applicable) |

|

Maximum Loan Discounts

Among all the other factors, income and educational qualifications have an important role to play in deciding the maximum loan amount available to an NRI. Banks allow an advance of around 80% to 85% of the property value subject to the individual’s gross monthly income (GMI). Also, the maximum amount of loan granted lies between 36 to 40 times of an individual’s gross monthly income.

Some banks also provide loans by calculating a ratio of equated monthly installment (EMI) to the net monthly income (NMI), EMI / NMI. Interestingly, some banks depend on the place of residence as one of the criteria. Those residing in the US need to have a minimum annual salary of around 30,000 USD and 42,000 USD, while those living in the Middle East require a minimum yearly salary of about 36,000 Dhms to 48,000 Dhms. However, it is important to note that graduate NRIs only can avail of home loans in India.

Tenure of Loans

The tenure for home loans for an NRI is restricted against a resident getting a maximum tenure of 30 years with some banks. For an NRI, the tenure ranges around 5 to 15 years and any extension beyond the term of 15 years depends entirely upon the Bank’s discretion and exceptional reasons or cases only.

Rate of Interest

The banks usually charge the NRIs a higher rate of interest for home loans in India. It is because of the higher risk involved. The margin is generally around 0.25% to 0.50% more of the interest rate as against those provided to the resident Indians.

Repayment of Loan

The NRIs have to repay the loan only through non-resident external (NRE), or non-resident ordinary (NRO) accounts with payment or settlement from abroad. Also, they cannot use any other funds to repay these loans, and the repayment has to be done in Indian rupees only.

Some essential points that NRI should consider when applying for an NRI home loan

- If the NRI is self-employed, then the maximum tenure for the home loan available is 20 years against a salaried employee, which is 30 years.

- It is always advisable to get the loan’s approval first and thereby decide upon the property that the NRI wants to purchase. The savings should be able to give the individual sufficient financial support till the loan disbursement.

- The NRIs should not worry about the legal age of the property. The Bank will sanction the loan if the property is well maintained even though its residual age is 12 years.

A detailed list of documents to be submitted against a home loan or property loan application –

List of papers/ documents applicable to all applicants:

- Employer Identity Card

- Attested copy of valid Passport and visa.

- Address proof mentioning the current overseas address

- Copy of Continuous Discharge Certificate (CDC)-for applicants employed in the merchant navy.

- PIO Card issued by Government of India. (in case of PIOs)

- The attestation of documents done by FOs/Rep. Consulate or Overseas Notary Public or officials of Branch/ Offices or Indian Embassy/ Sourcing outfits based in India.

- Loan Application: Completed loan application form duly filled with 3 Passport size photographs

- Identity Proof (Anyone): PAN/ Driver’s License/ Passport/Voter ID card

- Residence/ Address Proof (Anyone): Recent copy of Telephone Bill/ Water Bill/ Electricity Bill/ Piped Gas Bill or Driving License/Copy of Passport/ Aadhar Card

Property Papers:

- Permission for construction (where applicable)

- Registered Agreement for Sale (only for Maharashtra)/Allotment Letter/Stamped Agreement for Sale

- Occupancy Certificate (in case of ready to move property)

- Share Certificate (only for Maharashtra), Electricity Bill, Maintenance Bill, property tax receipt

- Approved Plan copy (Xerox Blueprint) & Registered Development agreement of the builder, Conveyance Deed (For New Property)

- Payment Receipts or bank A/C statement showing all the payments made to Builder/Seller

Account Statement:

- Bank account details for the previous 6 months overseas account showing salary and savings and Indian account if any.

- If any previous loan from other Banks/Lenders, then Loan A/C statement for the last 1 year

Income Proof for Salaried Applicant/ Co-applicant/ Guarantor:

- Valid work permit

- Employment contract – an English translation duly attested by employer/ consulate / our foreign office / Embassy in case it is in any other language

- Last three months’ salary certificate/slip

- Last six months’ Bank Statement showing salary credit

- Latest salary certificate /slip in original and copy of identity card issued by the current employer

- Duly acknowledged copy of last year’s Individual Tax Return except for NRIs/PIOs located in Middle East countries and employees in the Merchant Navy.

Income Proof for Non-Salaried Applicant/ Co-applicant/ Guarantor:

- Business address proof

- Proof of income in the case of self-employed professionals/businessmen.

- Last 2 years Audited/C.A. certified Balance Sheet and P&L accounts,

- Last 2 years Individual Tax Return except for NRI/PIO located in Middle East countries

- Last six months’ Bank Statement of overseas account in the name of the individual as well as company/unit.

Fees

Consolidated Processing Fee:

- 0.40% of the loan amount plus applicable GST subject to a minimum of Rs 10000/- and maximum of Rs 30000/- plus GST.

- However, for Builder Tie-Up cases wherever separate TIR and Valuation is not required: 0.40% of loan amount subject to a maximum recovery of Rs 10000/- plus applicable tax.

- And, if in case TIR and Valuation are required then normal charge as mentioned above will be applicable.

Post-Sanction**

- Stamp duty payable for Loan agreement & mortgage.

- Property insurance premium.

CERSAI Registration Fee of Rs 50 + GST up to Rs 5 Lakh limit; and Rs 100 + GST for limits above Rs 5 Lakh.

Account Opened By Singapore-Based NRI In India, Taxation Policy And Exemptions

Accounts That Can Be Opened by NRI Based in Singapore

Singapore-based NRIs looking forward to investing in India have some of the essential guidelines & rules that they need to follow to begin their investment.

Singapore-based NRIs to invest in India are supposed to open any one of the following accounts with an Indian bank depending on the need –

Non-Resident External Account (NRE Account)

This account may be in the form of current savings recurring or fixed deposit account with most a minimum of one year from creating the account. The NRIs must deposit only foreign currency in the NRE account. The account carries no upper limit on the transaction amount. The NRIs must open NRE account themselves and not through anybody holding a power of attorney on their behalf.

Non-Resident Ordinary Account (NRO Account)

This account may be in the form of a recurring, saving, current or fixed deposit account. Any person residing outside India may open an NRO account with an authorized bank or a dealer to transact money in the Indian currency. NRO account is useful to the NRIs to manage their income, which they earn in India. In an NRO account, the conversion of Indian rupees to a foreign currency occurs after the money is deposited. An NRI can be a joint owner of an NRO account with any other NRI or resident Indian, preferably a close relative.

Foreign Currency Non-Repatriable (FCNR Account)

NRIs can remit their earnings to an FCNR account in any of the six currencies such as the Canadian dollar, US dollar, Euro, Australian dollar, Yen, and Pound. FCNR or NRE account is useful to transfer the funds. The principal and interest do not accrue any tax in the FCNR account.

Comparison between NRO, NRE & FCNR account

To understand how the three accounts are different from each other and what are the issues that they solve for the Indians living abroad, let us compare NRE vs. NRO vs. FCNR accounts –

NRE vs. NRO vs. FCNR

| Particulars/Type Account | NRE | NRO | FCNR |

| Currency of Deposit | Foreign currency | Indian Rupee (INR) | Foreign Currency |

| Currency of Withdrawal | Indian Rupee | Indian Rupee | Foreign Currency |

| Taxable in India | Not taxable in India | Taxable in India (at 30%) | Not Taxable in India |

| Risk of Exchange Rate | Open to risk due to fluctuating foreign exchange rate | No involvement of foreign exchange risk | No involvement of foreign exchange risk |

| Repatriability or Transferability | Repatriable – Fully and freely | Repatriable Interest; transfer of principal amount has certain set limits.Repatriation up to USD 1 million is possible per financial year from this account. | Repatriable – Fully and freely |

| Earn Interest | Earn up to 4% p.a. interest rate on the savings account and up to 4.35% p.a. interest rate on the NRE deposits* | Earn up to 4% p.a. interest rate on the savings account and up to 5.5% p.a. interest rate on the NRO deposits |

|

*Please note that the interest rates are applicable as of April 2020 and are subject to change

Taxation Policy Singapore Based NRI Investment in Real Estate

When a Singapore-based NRI invests in real estate in India, they consider a fair offer from the buyer or seller and assume the tax liability. The tax liability on a property sale depends on how long the NRI has held the property.

If the NRI owns the property for more than two years, they incur a long-term capital gains tax which is about 20%. While if they own the property for less than two years, they may incur a short term gains tax that offers the normal income tax rates.

Tax Deducted at Source (TDS)

When a resident Indian buys any property from an NRI, they deduct TDS at 20% if the property has been held for two years and above as against 30% is the property is sold in less than two years. The deduction includes a TDS plus surcharge, health, and education cess.

Guideline for LTCG TDS rates w.e.f. 2018 -19 –

Property valueTax Details

| Less than INR 50 Lacs | 20.8% including cess and surcharge |

| Between INR 50 Lacs to INR 1 CR | 22.88% |

| Above INR 1 CR | 23.92% |

| Above 2 CR | 25% |

| Above 5 CR | 37% |

Keynote

For NRI investments to be taxable depends upon whether India has signed a DTAA (Double Taxation Avoidance Agreement) with the NRI’s country of residence. If that is the case, then the NRIs don’t have to pay the tax twice. However, they will pay tax on capital gains.

Equity Funds Taxed for NRIs:

Short Term Capital Gains at 15%.

Long Term Capital Gains more than INR 1 Lac at 10%

Debt Fund Taxed for NRIs:

Short Term Capital Gains at 30%

Long Term Capital Gains more than three years at 20%

TDS at a Lower Rate

An NRI can opt for a tax refund at the end of the year if the tax deducted at the source is over the tax liability. However, they can apply for a certificate to file at a lower TDS rate to avoid this tedious process. However, they need to remember that they must use it before executing the sale agreement. The assessing officer determines the TDS after calculating the capital gains, and they will get their refund immediately.

Exemptions for NRI in Singapore Investing in Real Estate

The NRIs can reinvest any capital gains made through the sale of a property in India to reduce the tax liabilities. If they invest the capital gains in purchasing another property within two years, then the profit earned from the sale proceeds has an exemption from the tax: section 54EC and Section 54 F help achieve that motive.

Exemptions Under Section 54EC

According to Section 54EC of the Income Tax Act, 1961, an NRI can invest the long-term capital gains to buy another property or invest in specific bonds issued by India’s Government. The Rural Electrification Corporation (REC) and National Highway Authority of India (NHAI) issue these bonds. These bonds can be put for redemption after a lock-in period of three to five years from their purchase to avail an exemption from the tax. However, one should buy these bonds in less than six months from the sale of the property in India. Additionally, one should know that Rs. 50 Lac is the maximum amount of investment in these bonds. Also, the benefit is available only if the investment is made in the specified long-term assets.

Exemptions Under Section 54F

Section 54F of the Indian Income Tax Act 1961 provides an exemption towards long-term capital gains other than residential property sales. To claim an exemption, as per section 54F, the NRIs have to purchase residential property within a year before the transfer date or two years post the date of transfer. NRIs can also construct one residential property within three years after transferring the capital asset. However, the new property to be useful for availing an exemption must be situated in India and should not go for sale before three years of its purchase or construction.

Moreover, the NRI should not own more than one residential property other than the new property within two years or construct within three years of any other residential house. If the NRIs invest the entire proceeding from the sale, they can get full exemption from the capital gains. Otherwise, a proportionate exemption is allowed.

Net Consideration Explained

To avail an exemption under section 54F of the Income Tax Act, the applicant needs to reinvest the ‘net consideration.’ The ‘net consideration’ under section 54F means the full value of the consideration received on account of the transfer of term capital assets reducing any expenditure that has been incurred exclusively towards the transfer.

Net Consideration = full value of concentration – expenditure

Unavailability of exemption according to section 54F –

As per section 54F, the exemption is not available to the NRIs under the following circumstances –

- The NRI applicant is already the owner of more than one residential property on the date of long term capital assets transfer.

- The NRI applicant purchases an additional residential property (other than the new residential property purchased or constructed for claiming an exemption as per section 54F) within a year from the date of transfer of the long term capital asset.

- The NRI applicant constructs an additional residential property (other than the new residential property purchased or built to claim an exemption under section 54F) within three years from the date of transfer of the long term capital asset.

Amount of Exemption Available under Section 54F –

Section 54F of the Income Tax Act provides exemption as under –

| Particulars | Amount of exemption |

| Investment of full net consideration | Exemption of the full amount of long-term capital gain |

| Investment of proportionate net consideration | Exemption =Long term capital gain x Amount of re-invested / Net consideration |

Singapore NRI Home Loan Application Process in India Real Estate

A Singapore NRI may be working abroad, but his yearning for his homeland may make him invest in India’s real estate. Whatever the reasons, when the question of investment arises, a person faces another problem of arranging the necessary fund.

Points to Remember

Some of the essential points a Singapore NRI should keep in mind while applying for the home loan are the following –

- The physical presence of an applicant is not required to apply for a loan. The applicant can appoint a relative as their attorney’s power for completing the loan procedure on their behalf.

- The NRI applicant can borrow funds up to 80% of the property cost through a home loan. However, the eligibility depends upon the income and repayment capacity of the applicant. Moreover, there is no limit on the number of loans.

- If the applicant needs to pre-close a home loan, then there are no pre-pay or penalty charges to pre-close the loan at any point in time. It will not even damage the credit rating of the NRI applicant in India.

- The entire loan process takes anywhere between 30 to 45 working days. It takes around three couriers to India and a couple of emails to complete the process entirely.

The loan Process

Below given is a simple process for home application in Indian real estate a Singapore NRI –

Step 1

A person living in Singapore can courier the loan application along with the cheque for the processing fee and all the supporting documents. Alternatively, they can also apply online on a particular bank’s official website.

Step 2

The bank will study the documents, verify the employment, and calculate the NRI applicant’s eligibility. The bank will then issue a sanction letter stating the loan amount and the interest rate on offer, and all the other terms and conditions regarding the loan.

Step 3

The NRI applicant may submit the original property documents and a few other supporting papers or documents to the bank. The applicant may have to pay any other loan related applicable charges for getting the loan disbursement.

Singapore NRIs may need to submit the following essential documents to the bank or the lender for a hassle-free process:

- Copy of Full passport and work visa.

- A duly filled form of the loan application.

- Employer ID card.

- Three recent passport size photographs.

- Valid work permit proof

- Copy of the contract of employment.

- Current overseas residential proof, e.g., Agreement of house lease, bank statement, card statement, utility bill, etc.

- Salary slips of the past three months

- Statement for the last six months of salary account and NRE/NRO account

- A general power of attorney

- Last year ITR except for NRIs in Middle East nations and Merchant Navy Employees.

- Details of previous loan(s), if any.

- Property papers

Repatriation of Funds

An NRI would always want to move the money from their NRI account to their country of residence at some point in time. The Repatriation of funds means just the same. It means the ability of funds that are transferable freely across countries by converting them into respective foreign currency.

Once a person becomes an NRI, they need to open an NRE, NRO, or FCNR-B account in India. NRO accounts are useful for India’s earned funds, while the NRE account is suitable for holding foreign income. When a person moves the money from an NRO account to the NRE account or an account in the country of residence, such a money movement is called Repatriation.

If you are an NRI, you will want to move money from your NRI accounts back to your home country at some point. Let us read more about whether you can send money back from all types of accounts and the documents you need.

What is Repatriable Income?

The income that qualifies to be Repatriable can be broadly classified into the following Income source categories –

- Monetary inheritance

- Income earned through Indian investments or sale of assets

- Funds that are held while moving abroad

- Fund through overseas remittances which are made to India for investment or other purposes

What kind of Funds and how much can a person repatriate?

| Kind of income | Limit of Repatriation |

| Current or recent income:It includes salary, investments, interest, profits from any business, or a proprietorship deposit in an NRE account | No limits |

| Movable assets:It includes balance held in an NRO account, via sale proceeds of assets in India that are acquired through inheritance, legacy, or under a settlement deed done by parents or any close relative | USD 1 million per financial year |

| Immovable assets:It includes sale proceeds from any residential property purchased in India according to the norms of FEMA, 1999 (FEMA does not allow the purchase of agricultural land or a farmhouse or a plantation to an NRI) | USD 1 million per financial year |

FEMA Rules that govern Repatriation

Every time al NRI repatriates the funds, there are specific income tax implications in India. Given below are the implications which an NRI should keep in mind –

- An NRI can cumulatively repatriate funds of the current income earned in any year or the same year or the subsequent years

- NRIs can repatriate or transfer funds from their NRE account freely with no limits

- An NRO account balance should contain dues that have been received legitimately in India and not through a fund transfer from another NRO account or through borrowing from other people

- In the case of holding a residential property, an NRI can repatriate the sale proceeds of two such properties

Can the NRIs cross the Repatriation limit?

Yes, the NRIs can repatriate the funds higher than the preset limits only after RBIs explicit approval. The situations in which an NRI may request to increase the permissible limit of Repatriation are children’s education, medical emergencies, or buying a property in the country of residence.

Final words on Repatriation

The NRIs can do the Repatriation process faster through an NRE account and without any limits. If sending the money back to the country of residence from an NRO account, the person needs to be aware of its limitations. Also, one must remember that the limit of the NRO account, USD 1 million is valid for a single financial year. It means that the balance amount of the transfer in case of a transfer lesser than this amount will not be useful in the next financial year.

What happens in case of a Sale or Purchase of Immovable Property by an NRI?

Suppose there’s a sale of immovable property other than agricultural land or a farmhouse. The authorized dealer can allow Repatriation of sale proceeds only after considering that a person selling or buying the property has followed all FEMA regulations. The property has been legally acquired at the time of sale. The Repatriable amount should not exceed the amount paid out of funds in the FCNR account or the NRE account or is received through any other banking channels. Also, as per section 6 (5) of FEMA, a person or their successors cannot send money earned from the sale proceeds of property outside India without prior permission from the RBI.

What happens when an NRI inherits an immovable property?

In the case of inheritance of immovable property, the NRIs must produce the documents of the property that is acquired through inheritance. If there is a sale of such property or if the property is rented out, then the proceeds from the same can be repatriated by the NRO account. However, the remittances cannot exceed the limit of USD 1 million in a financial year. The limit can exceed only with prior permission from the RBI. The NRIs have to present a NOC and a tax clearance certificate from the income tax authorities to remit the property inheritance proceeds through a deed of settlement by parents or close relatives.

The NRIs also have to obtain a certificate from the chartered accountant in India regarding the inherited property proceeds and submit it to the bank for transferring the money abroad. The certificate is known as ‘Form 15CB’. The tax authorities will have to file the ‘Form 15CA’ Both the procedures are done to validate the legality of the transfer of money abroad.

Pros and Cons of Singapore NRI Investing in Real Estate in India

If numbers mean anything, then the expatriate community accounts for 9% of Singapore’s total population. This community contributes to a total yearly investment of around one billion US dollars.

India and Singapore have been related for a long time leading to a profound settling of the Indian diaspora in a country with a population under six billion. Singapore is a country full of significant opportunities for some of the ex-pats.